|

Greetings,

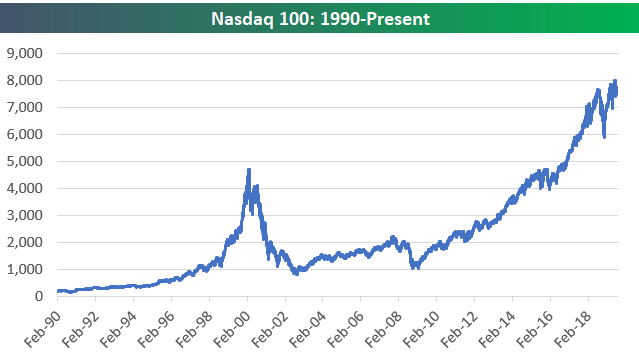

Just a quick late summer note to keep you up to date with some of our thoughts and observations. While some of you are off fighting wildfires, watering lawns and gardens, or hanging out at the beach, we’ve stayed put through this summer of the virus, making investment changes as we see opportunity or risk. The stock market has rallied off of the March lows and is now officially in a new bull market, with the S&P 500 having hit a new all-time high. This has been the fastest recovery in history following such a decline; following the fastest drop ever from an all-time high into a bear market. That said, this has not been a broad market rally, with multiple sectors still languishing just a few percentage points above their lows. These are generally businesses awaiting word on when the COVID recession will end, triggering increased product demand and a clearer path to safety. Financials, Retail, Energy, Real Estate and Utilities, often stalwarts of the economy (and great dividend payers) are either in bear market terrain or are noticeably lagging the indexes. The driving force behind the new records has been primarily big tech; not just any tech, but BIG tech. These firms (Microsoft, Apple, Alphabet, Amazon, and Facebook), represent only 1% of the S&P 500 by count, but about 25% by value; and this increases as they continue to get media and buyer’s attention. This is the largest bias towards outsized firms ever. It’s understandable with current circumstances that all five of these giants have and will continue to reap outsized rewards due to our dependence on e-communication and e-commerce. We could not run Cairn without the products that Microsoft and Apple provide. That being said, it’s quite possible that (some of) these leaders are too far ahead for their own good, as momentum can push the markets far past fundamental support. Traditional value metrics are beyond stretched, investor behavior indicators are flashing warning signs that should be noticed, and at this point greed should be taking a back seat to caution as we have more months of recession ahead. Another, less publicized area of risk is in the bond markets, particularly with low to medium quality corporate debt. Defaults are rising, and this probably will continue for some time into the future. In some parts of the country municipal bonds pose a risk. I think that we’re well positioned here, with very little exposure to at risk debt. Our Oregon munis are primarily covered by property taxes and have so far proven to be resilient. We’ve taken all of this under consideration while making our investment choices and will continue to do so. If you have a desire to discuss any of this, or any other concerns that you may have, please give us a call, and either Patrick or I will be happy to have that chat. Here’s to a few more weeks of sun and then a glorious fall. Your Cairn Team Greetings, It's Patrick here following up on Tim’s post from last week, explaining in more detail how we view the current investment landscape. From an economic perspective, the slowdown in activity has been nothing like any of us have seen during our lifetimes. The contraction and number of job losses was last witnessed during the great depression. Reading through various reports makes you realize how traumatizing the virus has been to most Americans. If one just looked at the S&P 500, you would think that everything is the old status quo and that we had just a minor correction. The disconnect between what “main street” is going through and what the stock market is going through is a head scratcher to say the least. I wrote about valuations and bear market experiences in our last quarterly letter so I will not spend a lot of time rehashing the topic again, except to say large cap U.S. stocks are still trading at lofty valuations and that the current market experience we see is still typical of historical bear market experiences. We will change our view when the data warrants it, but for the time being caution is still a primary objective. The silver lining to this environment is that there are pockets of the market that have had a worse experience than the S&P 500, and that is where we are finding opportunity to put cash to work. For instance, small cap stocks (companies that have a lower market capitalization) are trading at valuation discounts that we have not seen in over 20 years. When analyzing the data, other periods of such wide divergence have generally led to higher returns for small cap equities over large cap. Many of the individual companies we invest in have much smaller market caps than the S&P 500, so this should benefit the portfolio going forward. Additionally, select industrial, consumer discretionary, technology, and health care names have experienced much larger declines during the recent market selloff, creating some opportunities for investors that do their homework (like us). Tim touched on the absolute outperformance of the technology sector versus the rest of the market. The companies that have benefited most from employees having to work from home have seen their share prices levitated to truly astounding levels. Looking at the last time we saw this level of outperformance we can see the narrative is similar between our current environment and the one back in 1999. The story was, “Technology and the internet are going to change the world forever, so revenue growth is all that matters.” Which was true, but it did not stop large tech from losing over 70% of its value. Now the narrative is “Tech companies can weather this recession because of workers staying from home and their capital requirements are low.” This is also true, but the price investors are willing to pay for future growth of these companies seems to be excessive here (chart below). Though the economy is most likely going to get worse before it gets better, we as investors, must look through the noise and use a historical perspective when looking for opportunities. There are areas of the markets that offer compelling risk/reward tradeoffs and we are taking advantage of them. However, the data does not indicate that portfolio positioning should be tilted towards maximum risk. Still holding a higher amount of safe assets (cash, T-Bills, etc.) makes sense until broader valuations improve. Thank you again for your continued support during this trying time in our economy.

Please drop me a note if you care to discuss anything in greater detail. Best regards, The Cairn Team Greetings,

It’s been a month since our Quarterly Newsletter went out, and I thought that you might appreciate an update on our office situation and some thoughts on the COVID economy. Our office remains closed to visitors, and I expect this to continue through the end of May, probably longer. We are getting reasonably adept at online meetings through WebEx, so if you feel the need for a catchup discussion that requires more than a phone call, please, let us know and we’ll set something up. Patricia continues to report into the office every day, handling incoming calls, deliveries, and various office tasks. I’m here 2 to 4 days a week, trying to reduce my chances of getting infected, but remaining otherwise effective. The rest of the team works remotely. Remote work is interesting, and I think very different than most of us imagined. The ability to make a call, trade securities, do research, etc. is essentially as good as it always was. There are some challenges with reviewing items by multiple team members; all surmountable. The real difference is the lack of easy, casual interactions that help stimulate thoughts and redirect energy. I’ve likened this to “dancing without music.” There is nothing stopping one from taking the first step, but conversely, nothing provides a cue to start either. It takes some getting used to. Equity markets are up considerably since the last time I wrote. I can’t say that this offends me in any way, but it does seem a bit optimistic as most of the bad news in the form of poor quarterly earnings, dividend reductions, companies pulling guidance, high unemployment, and a GDP reading indicating a deep recession has not yet been heard. At this point much remains to be known, as most indications signal that the shutdown will reverberate for quite a while into the future. A big bright spot has been technology stocks, which, as a group, are up for the year. This reflects a number of factors, not the least being our obvious dependence on technology to get through times like this. It does make one wonder ultimately where this goes; how much further can they go up without having their own 21st century tech bubble. Overall, valuation is still a concern, as US large cap stocks are close to levels seen only a few short months ago. I’ve asked Patrick to discuss this in a separate post that you’ll see soon. He’ll detail our thoughts on what to expect and what we are doing as we go through this exceptional Spring. Until we meet again, I wish you and yours well. The Cairn Team As health and economic events continue to evolve at a brisk pace we are adapting our business practices to better keep our employees and clients safe, accommodate school closures, etc., while continuing to operate at a level required by you and these fast moving markets.

Beginning today, we will transition to remote work with a system in place to collect and process incoming mail and to transfer incoming calls out to the team. We all have access to our Cairn systems, and can trade, move money, access files, and otherwise serve your needs. During this unprecedented time, we will not be holding in-office meetings unless circumstances are exceptional. Hoping that you and yours remain well. The Cairn Team I wish that I could reach out and have a solid ten minute conversation with each and every investor with their money entrusted to Cairn. Unable to do that effectively, you deserve a few thoughts from us directly to supplement what you’re reading or hearing in the news.

Suddenly, things seem very different with the NBA suspending the season, travel from Europe restricted, and Tom Hanks infected and quarantined. In my prior message I put forward the idea that our collective reactions to the Coronavirus could have a large impact on the economy and our investments, and we took action to sell some long held positions in preparation. So now here we are. At this point stocks are no longer being bought and sold on fundamentals, and the prices we’re seeing are the result of massive liquidations based on fear. We’ve seen this movie before, with the current twist being that we can more clearly see what is driving the panic. While there are firms facing an existential threat, like the cruise lines and some smaller shale oil producers, a majority of the companies that we own are able to handle weeks or even months long disruptions to the free movement of people and goods, and will eventually move on from here. I do not like the prices being offered for our companies right now and I’m very reluctant to sell into this environment unless funds are needed immediately. There are some companies we are wanting to shed, but not on a day that smells of panic like today. We do also have our eye on some stocks that we may wish to buy at a newly reduced price. Looking forward, I believe that the federal government has a huge role to play in protecting our economy and our health. That role may be to provide some kind of relief to debt laden oil producers and transportation companies, payroll stimulus, or even providing temporary liquidity to financial markets. Unlike any crisis that we’ve seen in my lifetime, this one seems to have an expiration date as the virus works through its process and modern medicine eventually puts and end to the spread within the next year. The oil price war could end soon and suddenly with a few phone calls, or our government could take steps to protect our domestic energy production to combat the actions of “State Players” overseas. Regarding Cairn’s preparations for possible transit restrictions or a personal illness, we are able to access all of our trading and information systems remotely, and if need be can redirect our incoming calls to any phone that we wish. I hope it does not come to that, but it’s good to be prepared. The best course today is to look after our own health and that of those we’re responsible for and let this run its course. We’ll continue to look for opportunities to adjust our holdings as it makes sense. Regards, The Cairn Team Hi everyone,

This was quite a week in financial markets, so I wanted to add some color to Tim’s message from earlier in the week. Though we continue to have limited information on the Coronavirus, there no doubt will be an impact on business activity, consumer behavior, and investor psychology. Economic and market effects aside, we truly hope that containment and detection efforts continue to strengthen so more lives are not affected. Based on short-term market sentiment, over the last two weeks, the stock market went from being extremely complacent to pessimistic. On a short-term basis the market is very oversold. That does not mean it can’t get more oversold, but a short-term bounce could be likely. Our actions will be driven by what the data tells us, not by emotion. We will continue to sell or trim companies that exhibit high valuations, declining price momentum, and underwhelming fundamentals. We are also ready to purchase companies that offer the opposite and this recent sell off will help to provide some opportunities. As always, risk management is high on our priority list, but we must remain open to taking advantage of opportunities that present themselves. Enjoy the weekend and let us know if you have any questions or concerns. Best regards, Patrick & The Cairn Team Greetings,

Unless you’ve been sequestered as a juror or have otherwise been off the grid, it’s likely you’ve heard that the coronavirus, or more accurately the various responses to the virus, have been impacting the global economy and hence the prices of your investments. It appears more likely each passing day that this will become a global pandemic, but much like our own body’s immune system, our collective reactions may cause more harm than the disease itself. While there’s much to learn about this new virus, it looks like the fatality rate is about 2% overall, with healthy populations faring better. While every death is regrettable, this disease’s impact is likely fleeting, without permanent structural changes to societies, families, or workforces. For some time, we’ve been tracking the progress of the US and world economies and noted many signs that we are in a mature stage of the growth cycle, with every indication being that while some major economies (US & China) are still growing, the rate is slowing. This is normal and expected after the long recovery from the bottoms of 2009, but it’s been recently exacerbated by the tariff battles. The various, and mostly rational, responses to the spread of the coronavirus are hampering international trade and will further suppress growth around the world, possibly pushing more economies into recession. The US economy is on better footing than most with strong employment, a huge internal consumer market, and access to most other markets on the planet. It’s generally a nice place to live too. We’ll note though, that stocks are expensive, and a little healthy doubt about where things are headed may just be the catalyst to help them get cheaper. We’ve been preparing for this by reducing equity exposure, selling stocks we view as too expensive, buying more income producing positions, and applying strict valuation criteria in our buy decisions. Our focus on risk management will not spare us from all the whims of the market, but it should bring you some comfort that wherever things go from here, you’ll have a reasonable experience. I’ll add that the stock market has been quite robust, so much so that even after the selloff of the past few days the S&P 500 Index is within 6% of all-time highs, and at the price it was in early December. I welcome your comments and concerns, so please feel free to call, stop by, or reply to this message. Thank you for your continued trust. Your Cairn Team |

RSS Feed

RSS Feed