|

Greetings from the Northwest. Summer sunshine is warming us up in the West. It feels so good! The last few days have been the hot type, where individual bones in your spine feel like they are melting out the last of the ice and chill of winter. The stock market has also been hot for a while. But not all parts or sectors have been feeling the heat. Frustratingly, the hottest sectors and companies are also the most richly valued companies and hence not attractive to us as value or momentum investments. The purchase prices of our investments are of paramount importance to us. Time can heal a lot of investment wounds, but it is most difficult to recover from overpaying. I hope the world is laughing with me when I ask, “Have you noticed the volcano of crazy, off-the-cuff, wacko ideas and plans that are being trotted out, run around the test globe and then re-evaluated?” Probably the biggest, loudest worries are coming from trade-war concerns. This has fired up volatility in currencies and stock markets around the planet. There is a lot of noise about potential longer term effects from tariffs and trade wars on U.S. companies and in particular industrial manufacturing. Please remember that manufacturing is only about 12% of GDP and we are in the 1st inning of a potentially long, hot, and politicized season. Patrick and Tim are both itching to add to this quarter’s letter, so I shall go back to the dugout. Tim's Part

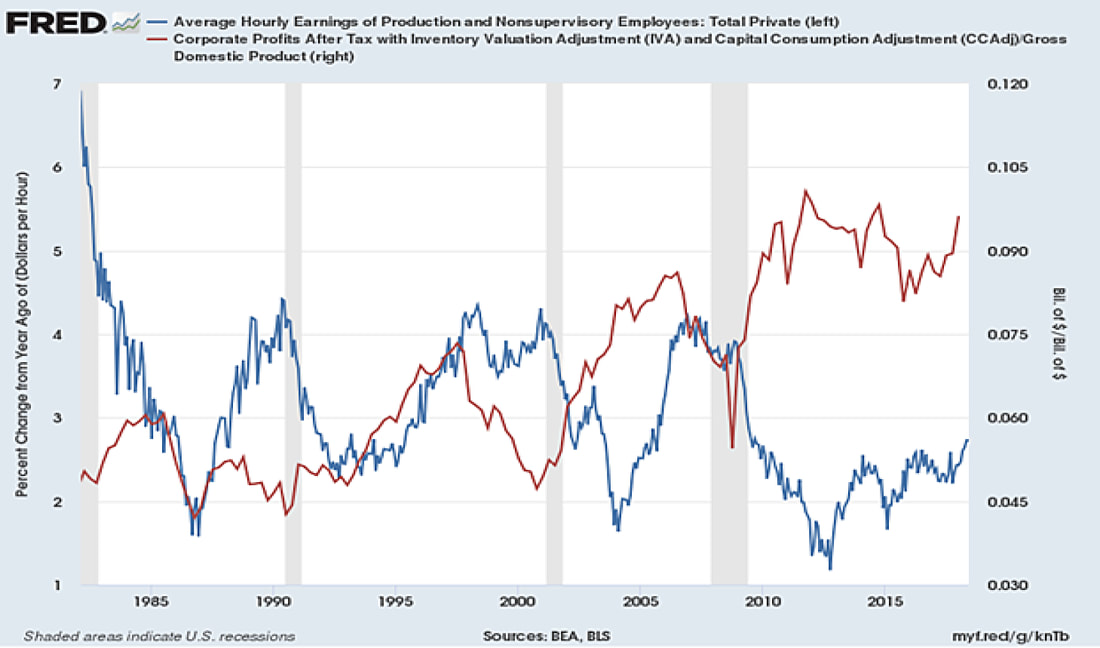

The proposed DOL Fiduciary Rule, scheduled for implementation last year, was delayed numerous times before being terminated through court action in June. The courts determined that the Department of Labor had overreached its authority and that the topics addressed are better dealt with by the SEC, which in most other ways is responsible for the regulation of investment advisors. What was this “DOL Fiduciary Rule” and why is this topic important? The growth of the employer sponsored retirement plan, such as the 401(k), has been tremendous over the last 35 years, with combined assets now above $6 trillion. These employer sponsored plans are now the primary tool for retirement savings, with fewer than 2% of Americans being enrolled in a traditional pension plan. The financial security of our next generation of retirees depends heavily on the success of these newer plans. This explosive growth has attracted much attention from the financial industry, which provides the investment platforms for these plans and for the various “Individual Retirement Accounts” or IRAs. Holding these assets, managing them, and providing advice on them is good business, and a core profit center for almost any investment oriented financial institution (Fidelity, Vanguard, Cairn, etc.). For decades the employer sponsored plans have been tightly regulated by ERISA (Employee Retirement Income Security Act). IRAs and the transfer of assets from employer plans into IRAs (rollovers) are not generally subject to ERISA. Some business models in the industry are intently focused upon this rollover process, and, like all great business opportunities, sometimes the interests of the consumer get overshadowed by the interests of the service and product providers, particularly without specifically designed legislation. The DOL rule set out to fix this by making everyone involved in the process a“Fiduciary,” someone who must be true to the consumer and put the consumer’s interests first. This has caused major shifts in the industry, as firms were forced to evaluate their business models to determine how they were at risk of violating the new rule, how to eliminate conflicts of interest, and how to implement the prescribed procedures that came with this rule. An example of this is that Vanguard stepped away from advising clients on IRA assets. How could they maintain fiduciary standing when advising clients to purchase Vanguard funds? With the funds themselves being Vanguard’s primary business, they quickly and preemptively made the decision to stop advising. For Cairn and other fee-only investment advisers, the DOL Fiduciary Rule had a much lower impact as we already were, are, and will continue, to act as a fiduciary. For us the change was the implementation of some required documentation that detailed why a rollover or IRA transfer was appropriate in each circumstance. The DOL rule is dead, but the genie is out of the bottle, with many firms continuing to implement planned changes with the expectation that the SEC will soon roll out their own rules with a similar goal of improved consumer protection. What may be different is a more nuanced approach by a more informed SEC that recognizes the difference between commission-based brokers and insurance agents, and the fee-only advisers who are already acting as fiduciaries. Time will tell. For now you can be assured that we will continue to act and advise in your best interests as we wait for the regulators to sort things out. Patrick's PartLast fall I wrote about inflation and how the slow growth in average hourly earnings was not matching the inflation worries that were being discussed by market pundits. Recently, with the passage of individual and corporate tax law reform, growth of average hourly wages has started to pick up. The chart below shows a measure of corporate profit margins (red line) and the year-over-year change in average hourly earnings (blue line). As you can see, these two lines tend to move in opposite directions; the higher wage growth tends to be, the lower corporate profits tend to be. Inherently this makes sense, although many factors determine overall corporate profitability. The salaries paid to employees are a large fixed cost. Contrast this expense with, for instance, the cost of raw materials, which can be adjusted based on short term dislocations between supply and demand. The takeaway from this chart is that higher wages should depress corporate profit margins, which are already sitting close to an all-time high. The possible retreat in profit margins due to higher wage costs is currently not being priced in by market participants (let alone higher input costs if large tariffs take place). As we continue to navigate a market that is on the expensive side, we continue to watch for other indicators that could change the corporate landscape. Rising wages are one data point we are keeping a close eye on. Our investment discipline helps combat these possible pressures as we consistently look for market leaders that have the ability to pass on higher costs to their end customer, regardless of the type of industry. We firmly believe that risk management is of high importance as we get to the later innings of the market and business cycle. However, we are still finding opportunities in the marketplace, and we will take advantage of them if the price is right. Please feel free to reach out to me with any questions regarding this or any topic. As I’m fond of saying, please come on by when you are near. The coffee pot is always on.

Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. How many of you have taken a trip to one of the fabled movie lots in California or elsewhere across the country? Movie lots where fabulous, action-packed scenes have kept us all at the edge of our seats. Well, that’s where I feel we’ve been. I can see and feel, almost taste, the dust in the clapboard buildings. The peeling paint, a couple of window panes broken out. Maybe a curtain flapping in the breeze through the broken window. I can smell dust, maybe I can smell the livery stable, maybe I can smell a little coal smoke, maybe someone cooking. And here we are on a quiet Easter weekend and April Fools’ Day, when out of the East, with the sun to his back, comes a wild cowboy with pistols in both hands. The bullets begin flying and I start dancing, I jump up to avoid a bullet hitting my ankle, I dodge to the left, I dodge to the right, I keep on dancing as the bullets fly around me. Breaking another window, splintering some other wood boards, and of course punching a couple of holes in that classic water trough near the livery. This is what the last few months have felt like, unplanned, and very unsettling. It may be that disruption is the way to get people focused on the issues that our country needs to address. But, my gosh, it is difficult for the markets and investors to have a sense of stability with all of the disruptive, High Noon activity. Over the years many of you have heard me say that I don’t worry too much about the markets overall. What I care about are the individual companies that we own. Companies where folks are making decisions daily on how to make their business more profitable, more appropriate, and more relevant. These are the things that I’m focused on, and it may be that the business environment is changing in a positive way. Earnings, dividends, backlog of work not yet done, promising future new technologies: These are important to me as we wrap our thoughts around what we as investors should own. In the past I’ve talked about our wall of worry. I’m not going to do that. From time to time I’ve talked about interest rates. I’m not going to do that either. But I do think there is a change in the way businesses are being managed from a tax perspective, and how we need to think about taxes and the way we own our investments. How we as investors are going to act and how it may have an effect on our returns. Patrick is going to take an important part of the message today and reflect upon the changes that we see in the way companies are aligning with new tax rules and with increasing interest rates. I would encourage you to call up and schedule a time to come and see us. If you haven’t had a chance to talk with Patrick and/or Tim lately, it’s a great thing to do. Any of us are happy to sit down and review your world and your investments. Patrick has been with us nearly three years and has a wonderful handle on so many of the companies we invest in.

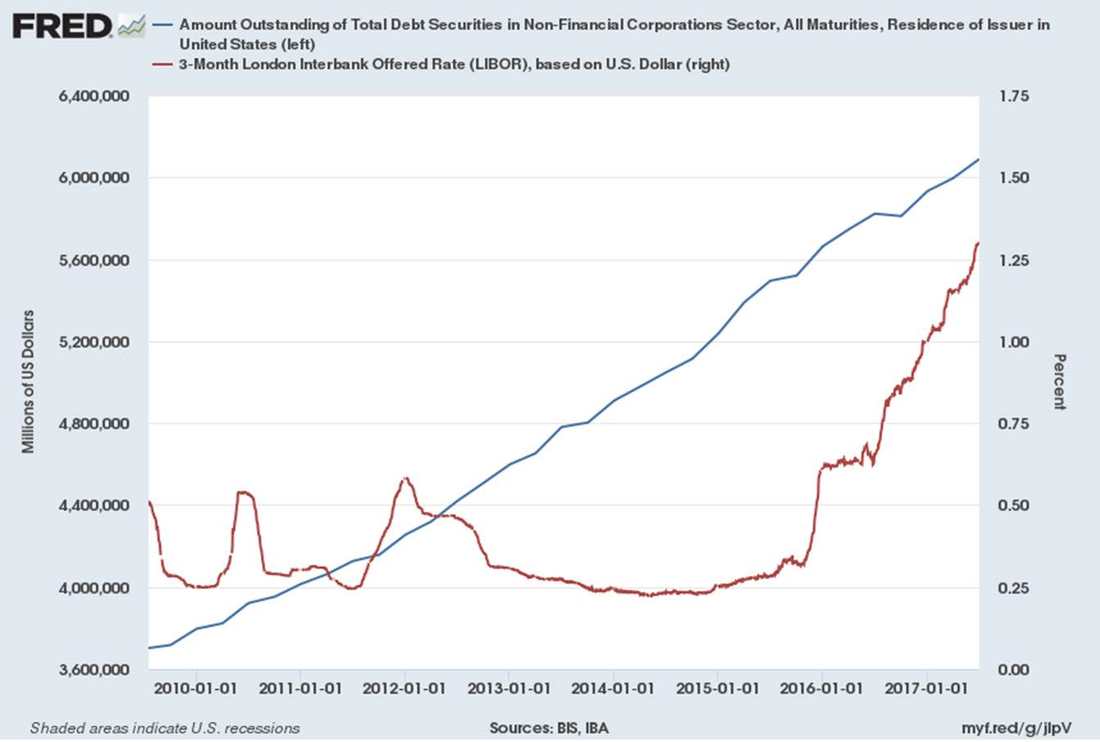

Many of you have heard me talk with enthusiasm when it comes to my belief that the economy will continue to march along, sometimes at a bustling rate and sometimes slower. Currently we are at a fairly brisk rate, and that’s a “good thing” for investors. So, as I often do, while driving down the road and see other people in their cars, or if I’m in the office and look out and see other office windows or other business doors, I remember that behind every single one of those cars, businesses, or offices is somebody just like you and me, trying to figure out how to put some more money in their wallets for all of the things that they would like to do in their lives. It’s a very compelling economic growth story. As we see businesses hiring more, we are enthusiastic about an ongoing improving and growing economy. That being said, we all know that if there is one thing that causes jittery markets, it is uncertainty, and right now we have a lot of uncertainty. Patrick's PartSo much for the low volatility that investors have become accustomed to over the previous couple of years. The first quarter saw markets rise to an all-time high by the end of January, only to finish the quarter in negative territory. The S&P 500 Index finished down 0.76% for the quarter while developed international stocks fared a bit worse, -2.2%. Emerging market equities fared the best of the major asset classes, returning over 2.4%. Bonds were also mixed as yields were quite volatile, reflecting consistent economic growth while the U.S. Fed continues on its interest rate hike path. As we have written previously, we view broad U.S. stock indices as richly valued and that view has not changed during the quarter. Finding bargains in this environment is challenging but we remain vigilant in our search for quality investments selling at compelling prices, while decreasing our exposure to companies that have become more fully valued. As Jim mentioned, I am going to discuss some of the changes that companies will be facing regarding tax rates and the rising costs of borrowing. Last quarter we briefly touched on the changes in tax law that focused on individuals. There was also a broad overhaul to the corporate tax structure that many companies are still trying to dissect three months after the fact. The two primary changes that are being talked about the most are the lowering of corporate tax rates from a high of 35% down to a flat rate of 21%, and the changes to the deductibility of interest expense on corporate debt. The latter change is not talked about as frequently, but could be of more importance in the years to come. We spent a lot of time in early 2017 identifying companies that could benefit the most from a lower corporate tax rate. That benefited portfolios later in the year, as companies with high effective tax rates were strong performers in the back half of 2017. Companies that benefited the most had similar qualities: low debt and a large proportion of U.S. revenues. The use of funds that companies are netting, resulting from lower tax, is still not completely clear, so it will be interesting to hear executives speak about their plans during upcoming earnings announcements. While an increase in productive spending (research, capital equipment, employee training and technology enhancements) would be welcome news, we remain skeptical, as historically tax savings have been used to increase executive compensation and share buybacks. Also, the increased chatter of trade tariffs/wars and possible effects on corporate profits could weigh on the benefits that were perceived from lower corporate tax rates. A very important part of the tax law change surrounds the deductibility of interest expenses for corporations. Historically, the interest expense on the debt issued by companies was fully tax deductible. Over the last 10 years, this allowed these firms to access the bond market at historically low interest rates and have the interest expense be tax deductible (what a deal!). Under the new tax law only part of the interest expense is tax deductible (up to 30% of operating earnings before depreciation). Companies that have large amounts of debt or increasing interest expenses are now more susceptible to lower profits. We feel this is a risk that is currently underappreciated by equity markets. As the chart below shows, corporate America has taken on large amounts of debt over this past cycle, rising from roughly $3.6 trillion to over $6 trillion. This is at a time when the costs of corporate debt have started to rise (indicated by the red line, 3 month LIBOR). See chart below. As interest rates have begun rising in the corporate market, this creates a headwind surrounding balance sheet strength, financial flexibility, and corporate profitability going forward. While we continue to look for attractive investments, these potential headwinds will be considered. We always strive to invest in companies we feel are financially healthy. Financial health and cash flow strength could separate the winners from the losers as we reach the later innings of the market cycle. Where we cannot find these suitable investments, we are comfortable being patient to protect against downside risks. We will get past this tariff noise. We’re going to continue to keep our eyes open and try to dance around those surprising puffs of dry dust that are poofing up near our feet. Please remember that any time you are in town we’d love to see you. Don’t hesitate to come on in. The coffee pot is always on.

Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. Greetings from the Northwest. The essence of these reports from Cairn to you, our investors, should be primarily focused on you, the investment results and some sort of a gaze into the future, and thinking about how that future might affect the way we handle our investments. This time I’m going to start with a more personal note. Lara and I had a chance to meet up with our son, Tygh, who is an exchange student from OSU Forestry Engineering Program to the École Supérieure Du Bois in Nantes, France, focusing on International Timber Trade. Well, that’s a tongue twister of a sentence. We had a wonderful opportunity to spend Christmas and the New Year abroad. It was an unusual time to be out of the office as we went from one year to the next. Especially when there was so much news about potential, and eventually real, tax law changes. Patrick is going to pick up most of the load, describing some of these changes for us. Tim is going to update us on the phenomenon known as Bitcoin. And in general we’re going to be focusing on some of the things that we find particularly important at Cairn to keep all of our investment energy going in the correct direction. Our trip involved mostly France, although we had a wonderful few days in Iceland on the way over, and a few days in Amsterdam on the way back. We focused on a couple of locations with longer stays on the Brittany Coast and in Paris, renting an apartment in both places and doing most of the meal prep and grocery shopping ourselves. We had an opportunity to sort of sink into and enjoy France. The overarching condition that must be communicated to our investors is that there is a tremendous amount of economic horsepower happening in Europe. It is busy. Even in the winter there are lots of people spending lots of money. Loads of construction plus many products being invented and manufactured. They are absolutely determined to create new and interesting results in the way of transportation, education, banking, and healthcare. Over the last couple of years our investments have shifted to more exposure in European companies than in the past. I am extremely pleased to be in that situation, especially since it helps us move toward companies that are comparatively less expensive than some of their counterparts in the USA. Thank you for putting up with the anecdotal research that we carried out whilst being consumers in a foreign land. It is the place to be and we should look forward to enjoying international investing results. Only one of these tasks was accomplished (barely), yet the equity markets marched to all-time highs. US stocks, measured by the S&P 500, returned 21.83% with international markets faring a bit better. We feel two acronyms can describe why investor euphoria continued in 2017 despite high valuations and continued geopolitical concerns: FOMO — “Fear of Missing Out” and TINA — “There is No Alternative.” Record low bond yields and paltry interest rates on safe haven investments have caused investors to reach for yield, raising already high risky assets, due to their fear of missing out and lack of an alternative to earn a satisfactory return. TINA can explain the most recent American Association of Individual Investors (AAII) poll where household allocation to stocks reached over 68%. This high allocation to stocks has not occurred since the late ‘90s, so clearly investors are feeling the need to reach for risk as fixed income and cash rates remain low. In our view, FOMO is the reason that many companies with little to no profits and high cash burns (Tesla and Netflix come to mind) trade at current prices. Other reasons given by financial pundits and talking heads on TV for the continued rise in equity prices are mostly noise and do not hold much water when analyzing the data. Ignoring the noise, FOMO and TINA, while sticking to our disciplined process, allow us to find ideas and investments that still offer attractive risk/reward traits. The silver lining is that not all companies are treated equally by investor euphoria, so we are still able to sift through the investment landscape and find bargains that the investment public has ignored. As an example, throughout the year we were focused on companies that had effective high tax rates that could benefit from tax reform. Many of these companies meeting that criteria are being cast aside over what we believe are excessive worries of competition and market share erosion. We are pleased with how our portfolios have done in spite of our conservative bias, as we continue to view the US market as expensive. We will continue to be vigilant in finding opportunities without losing sight of the fact that risks are higher than normal and preservation of capital is of equal importance while this nine year bull market matures. During the last week of December a new tax law was signed by the President. While there are many changes that are still being analyzed by tax experts, we want to touch on a few that we find meaningful.

Again, these are just some of the changes that were signed into law. For any detailed questions on how the new tax law affects you, your professional tax preparer will have the answers. I’m going to pass it over to Tim so he can talk about something much more exciting: BITCOIN! Enjoy. Tim's PartBitcoin? Lately we’ve had a number of our investors ask about Bitcoin (big sigh). It seems to be in the news daily, whether it’s up, down or both. While there are many sources that can provide a deeper plunge into the inner workings of Crypto-currencies and Block Chain Technology, we’ll take a moment and give our perspective on this phenomenon. Bitcoin as a currency — Not so much The reason it was created was to provide a secure and cheaply transferred currency useful to people and businesses worldwide. Despite its promise as a medium of exchange free from central banks and banking industry controls, it is not currently viable as currency for the ordinary human. Some reasons for this: Bitcoin is treated as any transaction that involves Bitcoin a tax may be due. Just as selling appreciated stock to buy a car will result in a 1099 for the capital gains, a “sale” of Bitcoin occurs during the conversion to dollars to facilitate the purchase of goods or services, which could result in a taxable event. Imagine getting a 1099 for the purchase of a sandwich! This is of course not happening, but it’s one of the novel effects that will need to be dealt with. In relation to the US dollar and other currencies, the value of Bitcoin is extremely volatile. Until prices of goods and services are quoted in Bitcoin across the globe, a conversion to traditional currency (i.e., US$, Euro, etc.) must happen in order to finalize transactions. This makes it unlikely that Bitcoin will be appropriate for widespread public use any time soon. Another issue for Bitcoin is that “depository” accounts used to hold it have been frequent targets for cyber theft; in some cases entire brokerage firms have been emptied of their Bitcoin. Normal monetary controls, developed over decades of experience, do not yet exist with Bitcoin; a fundamental benefit to some is a fundamental risk to others (think bearer bonds). VISA just cancelled a pilot program of Crypto-currency payment cards for some of these very reasons. Bitcoin as an investment — Hmmm In the sense that one can pay dollars for Bitcoin, and have more or fewer dollars at a future point in time, Bitcoin can be considered an investment, or at least has some features of investing. There is no way of measuring the value or potential value of Bitcoin in relation to the dollars one might invest, except by the market price at any given moment. There’s no productive enterprise being owned that may pay a dividend or rent, and otherwise have a widely agreed upon intrinsic value, as an investment in real estate, stocks or bonds would have. While Bitcoin holds promise for a future with a universal currency, it is unlike gold or other precious metals, which have held value to humans and governments for thousands of years and are unlikely to see this erode. Bitcoin and other Crypto-currencies are very new and it’s possible that they are but a transient experiment leading to something more permanent and useful in the future, in which case they will be worthless. We’ll see. If you decide to jump in Buy only what you can afford to lose! Enjoy the experience and learn from it. Don’t use the kids’ college fund! As we go forward, and I have an opportunity to speak with you on the phone or in person, I’d be excited to give you a little more information on the places we explored abroad. Two adventures stick out as really remarkable: One was a fantastic storm on the Brittany Coast of France and then several days following, hiking the rocky, craggy, storm-ravaged coast line. Very, very beautiful and quite stimulating. Second, and without any particular planning, somehow we ended up at the top of the Eiffel Tower on Christmas Eve. That was a blast, absolutely gorgeous wonderful experience, chilly, people packed, fun. I look forward to seeing you throughout 2018, and until then…

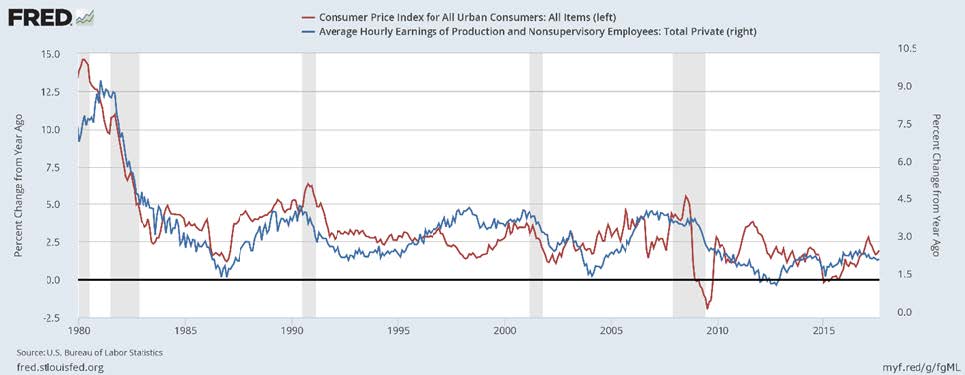

Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. Greetings from the Northwest. Often I begin these letters reflecting upon those topics we have hanging on our wall of worry. It would appear, during this particular period of time, that the wall of worry is not that worrisome. At a very local level the recent forest fires that clouded our skies and challenged our transportation are diminishing. It’s wonderful to have some rain and it’s even better that we’ve been soaked with several inches of it. Over this last weekend, I took a trip up the Columbia River Gorge, traveling up the Washington side and coming down the Oregon side to see the extent of the Eagle Creek Fire. Yes, lots of terrible damage, but it really looks as if (like so many times before) the forest, the views, and the beauty will return. Instead of a wall of worry, we have a wall of a-lot-of-things-going-on. It’s a very exciting time at Cairn; many of you have been into the office over the last year and have experienced our new technology-bristling conference room and of course the espresso machine. In person and over the phone many of you have gotten to know Morgaine, who came to us not very long ago with a different kind of background, as a scholar of Ancient Mediterranean History, looking for a temporary job to rebuild her finances and head back to the Mediterranean and continue her education. Well, the time has come. Sadly for us, she is leaving. But, happily for us, Jesyca will be taking her place. Jesyca is a recent graduate of University of Colorado Boulder, and has moved to Portland to enjoy the vibe and the Northwest. She will be the person many of you will get to know on the phone or as you visit the office. Additionally, she will be helping Theresa with many of the tasks that happen in our office on a daily, weekly, monthly basis. Jesyca is one of the 110 new Portlanders who arrive each day to our fair city. Welcome to Portland, Jesyca! From a long list of important topics, there are several that are really worth focusing on this quarter. Number one, while we’re all interested and worried about the global economy, it has become clearer as the months roll by that the fear people had of debt after the recent “Great Recession” seems to be subsiding, and we are now becoming more comfortable with the increasing global debt. That’s typically not a good thing, but the expansion of our economy and economies globally seems to be taking it in stride. Number two, the Equifax security leak is a tremendous problem. We’ve taken a look at this and would encourage all of our readers to read the blog post Morgaine and Jesyca compiled on the current options to protect your personal private information. I believe it is important we all take this situation seriously and do everything we can to keep our personal data as safe as possible. The third topic that I’m confident will be fascinating to watch over the next months is the proposed changes to our tax laws. This could cause everybody to really think about the question: “What do you want your government to do for you?” And after you’ve made the list of what you want our Government to do, how do you finance it? So hang on and let’s get ready for some really interesting conversations about taxing ourselves so we can pay for what we want our Government to do. I’m going to pass this over to Patrick, and I think Theresa has an important message to deliver to us as well. I look forward to the next time we meet or speak and I look forward to a wonderful fall with a lot of delight in living in the Northwest. Patrick's PartGlobal equities shook off a number of negative geopolitical headlines during the quarter. U.S. stocks rose 4.50%, while international stocks continued to outperform, rising 4.80%. Fixed income continued to defy the worry of rising interest rates as the U.S. 10 year Treasury yield remained at a low 2.32%. Economic growth around the world has shown better signs of life through the first 9 months of the year, which brings me to my topic for the quarter: Is the pick-up in GDP growth inflationary, and how will interest rates be affected? I’m not going to touch on the stock market, as our opinion has not changed from last quarter’s letter that U.S. indices, like the S&P 500, are becoming expensive. However, we continue to find value in individual companies, though not at the same level as a couple of years ago, so patience is warranted. Over the last 10 months the Fed has started the slow process of normalizing interest rates and reducing the size of their balance sheet. Since December 2016, there have been three 0.25% interest rate hikes. These increases have brought the fed funds rate to 1% - 1.25%. Historically, the Fed has raised interest rates in an attempt to cool down an overheating economy and to put the brakes on inflation. One indicator that we look at to take a reading on the health of the economy is the change in employee earnings versus inflation. The chart below shows the year-over-year change in inflation (red line, measured by CPI) and the year-over-year change in average hourly earnings for employees (blue line). As you can see, historically there has been a very tight relationship between the two. Actually, year-over-year changes in average hourly earnings tend to lead changes in inflation. As the bottom right of this chart shows, the growth of average hourly earnings peaked in 2016 and has been steadily declining since. This is in contrast to the pick-up in inflation that has taken place since 2015. This matters when taking a look at Fed policy going forward and how future interest rate increases could affect the economy. If inflation is set to decline in line with what hourly earnings growth is telling us, then the Fed will have some very tough decisions about how quickly to raise interest rates going forward. Overall, the pick-up in GDP growth does not look to be inflationary at this point. If that is the case, monetary policy risks will remain high as the Fed will have to weigh continued normalization of interest rates against the risk of slowing down the economy. These are just some of the many data points we look at when thinking about your investment portfolios. Please email or call if you want to discuss any of these topics in more detail. Theresa's PartOften fall is a time to regroup and get organized. Maybe even catch up on some neglected chores. When you have a change of address, please contact me. I would like to coordinate the address change for you at both Cairn and the custodian. Not having a current address on file can cause information delays, and can eventually cause restrictions on your accounts. I will need your signature to change your address at the custodian. You may contact me directly via phone 503.241.4901 or email. Thank you Theresa. Please take me up on my standing offer to swing by for some local joe. The pot is always on. Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. P.S. Our website relaunch was a great success. The first 20 people responded to the challenge within two hours! Many more over the next several days! We sent coffee cards to all who responded, even after the first 20. I haven’t told Tim the grand total because it will bust the marketing budget. Thanks for participating.

Greetings from the Northwest. It’s the July 4th weekend and I’m not where I thought I was going to be. A couple of weeks ago I was having a conversation with a fellow who mentioned he knew someone who had a tractor for sale in Spokane, WA. My wife’s family has a filbert orchard and a tractor can be a darn handy tool. Especially if it’s a lightly used, well cared for, 12 year old tractor. So here I am piloting my pickup and trailer through the Columbia River Gorge and central Washington desert. I was enjoying an ice cold Starbucks coffee when I zipped right past the State of Washington’s first commercial hemp growing operation outside of Moses Lake. Commerce is flowering in the Columbia Basin. The person I’m going to see about the tractor lives a little north of Spokane, which is nearly a 350 mile drive one way. And it’s hot. I’ve always enjoyed Spokane; over the years it’s been such a hotbed of economic activity, mining, banking, logging, farming, technology and recreation. In general it is a really interesting area to recreate in as well as to have a business. So after many hours, I pulled into a wonderful family’s farm, and after serious negotiations I loaded and hauled a new used tractor back to the Willamette Valley. These kinds of trips typically stretch a little longer because I like to meander and see interesting things along the way. I deviated from the highway route near the Tri-Cities of Pasco, Kennewick and Richland. With a pelican as my guide, I crossed over the Columbia River on the recognizable cable bridge, officially named the Ed Hendler Bridge, into downtown Kennewick.  Ed Hendler Bridge, Kennewick, WA. Photo by: Lara P Ed Hendler Bridge, Kennewick, WA. Photo by: Lara P The Fourth of July also brings an extraordinary event to Portland each year, The Blues Festival. Being there in person is of course fantastic, but this particular weekend I’ll take my jazz by radio. I always enjoy hearing Booker T play “Green Onions” and many others. The Blues Festival celebrated its 30th anniversary, and while it’s possible more Portlanders know about 30 years with the blues, we won’t forget that this is also Cairn Investment Group’s 10th anniversary. Tim and I and our team have been extraordinarily pleased to be connected to the wonderful group of investors who make up Cairn Investment Group. Over the last ten years Cairn has evolved considerably. It is exciting to see the growth in our research capacity, allowing us to dive even deeper into the valuations of our investments. Patrick will be covering the details of projects we’ve been working on the last few months. Tim is going to cover some of the components of our relationship with you. Patrick's PartThe broader markets continued their positive momentum during the second quarter, with US stocks rising over 3% and international stocks faring a bit better, rising over 5%. When you look underneath the hood that drove returns in large cap US stocks, the companies that have been carrying the load (Apple, Amazon, Facebook, Google) started to lose some of their luster, all suffering negative returns during the month of June. This has started to benefit active management and value-conscious strategies, as many of the names that have been carrying the broader market have risen to price levels that we consider to be far above fair value. This brings me to my topic for this quarter: Where are valuations for the broad market? And how does our approach differ from simply investing in indices? Many clients have voiced concern over the last year that they feel markets are “expensive” and are mostly wanting a return “of” capital more than a return “on” capital. We manage all our clients’ wealth with a “return of capital” being the building block of our philosophy while achieving a reasonable “return on capital.” We share the view with these clients that the broad US markets are above fair value. Below is a chart that maps the total market cap of US stocks measured against US GDP. This is the so-called “Buffet Indicator” and, as you can see, it has risen to historically high levels. We have talked in the past about the potential risks of index investing in the US, and this indicator shows some of the risks going forward in blindly investing in indices that are potentially filled with overvalued stocks. Our philosophy is built around constructing equities portfolios that demonstrate high quality companies at attractive prices, and then being patient while our thesis plays out. We continue to find attractive long term investments even as US markets reach historic highs. We have found some opportunities in the health care and consumer markets. We feel that the markets have unfairly priced-in many negative events that probably won’t happen (i.e. the Amazon taking over the world effect). For patient, research-oriented investors, like ourselves, this creates opportunities to invest in well managed companies at historically low valuations. As Jim has said many times in the past, “We do not own the stock market.” Not owning the whole stock market when valuations are at high levels can do wonders to protect against loss when volatility rears its head again. So while the markets might be expensive, rest assured: Our goal is that your portfolios are not. Thank you for your continued interest and, as always, feel free to reach out to me with any questions. Tim's PartWhen you began your relationship with Cairn, one of the processes that you went through with us was to fill out and discuss an Investor Profile; it’s a document that we use to learn about you, your goals, and your attitudes about money and investments. This document is important because it leads directly to the investment choices that we make on your behalf, so it makes sense that it be accurate and up to date. Much has changed in the world since we opened our doors ten years ago. We’ve been from economic boom to bust to a slow cooker boom again. We’ve seen three US Presidents, the advent of the iPhone, a significant re-mapping of the Portland food scene, and, of course, we’re all ten years older. If you feel that your circumstances have changed enough to warrant a reassessment of your profile, please let us know. We welcome a chance to revisit this and learn what’s new in your life. Come on by for a cup of hot or iced coffee when you have a moment. We’d like to show off the techniques we are applying.

Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. Greetings from the Northwest. I know that all of you as our wonderful investors have now torn open your report to read the ever stimulating and maybe even exotic newsletter. But, before we get to the volatility, changeability, and shifting sands of investments, I thought we would reflect for just a second about the weather we’ve had. This poem was handed to me by a gentlemen from a northwest family that has been with us for a long time. And for the first one of those family members who recalls this and contacts us, we’ll give you an opportunity to submit yet another poem for next quarter. We had a terrific 2016. We followed with a solid first quarter of 2017. Now we’re looking forward to really intriguing investment challenges and finding solutions that work for our portfolios. Many of you have heard me drone on about the things we’re going to pin on our wall of worry. So forget about it. Know that the wall of worry is there and we’re paying attention to it. We might speculate on the direction of interest rates from time to time, or the push and pull of politics, but as you have heard me say many times, we’re not investing in the market, we’re investing in individual companies. As simple as it may sound, the relative valuation of the purchase price almost always decides whether or not, over time, you’ll have a profitable enterprise, a profitable investment. Now we’re going to shift over to Patrick and let him carry the news, illuminating some of our thoughts on current investments and the selections we have been making. Patrick Mason, CFP :: Investment AnalystIn last quarter’s newsletter we briefly touched on our prediction surrounding the potential market reaction to the U.S. presidential election. We were confident that changes don’t happen in a vacuum nor overnight, and so far that is turning out to be the case from a policy perspective. The initial investor enthusiasm surrounding the possibility of large infrastructure spending and tax reform has waned, as the reality of the sheer size of these projects proves to be more difficult to implement than originally thought. From an investment prospective, the slower pace of policy changes creates an interesting environment. The sectors and companies thought to be the biggest beneficiaries of potential policy changes are experiencing investor euphoria and a herd mentality, causing certain sectors to provide minimal appreciation potential at current prices. When much of the current market movement is based on high expectation, thoughtful and disciplined valuation analysis becomes even more important. On the bright side, this also creates opportunities to invest in select companies that have not been the recipients of investor euphoria. As always, we are focused on risk management and protecting against permanent loss of capital. It is easy to be enticed to shift focus to the short term in a market based on euphoric expectations; yet now, more than ever, is a time to focus on long-term opportunities to grow wealth. In this environment we will continue to find high quality companies at attractive prices, while selling companies that we believe have become overpriced. Thank you for your continued trust and support. Please call or stop by if you ever want to discuss anything in more detail. Patrick, thank you very much. Now we’ll shift to Tim in his other role here as Chief Compliance Officer. You may have heard on the news, or seen in the newspaper, that one of the big topics of this year is the word “Fiduciary.” Tim will give you a summary of how we embrace this, how it affects us as a firm and our thinking, and what benefit it has for you as our investors. Tim Mosier :: Principal and Chief Compliance OfficerYou may have heard about a new rule in the works from the Department of Labor known as the “DOL Fiduciary Rule.” This rule, proposed by the Department of Labor under the Obama administration, would require that Investment Advisors, Brokers, Insurance Agents, and anyone else providing investment advice for a fee or commission, must act in the best interest of the investor when dealing with certain retirement accounts, in financial terms, as a “Fiduciary.” At this point you might ask: “You mean they haven’t always acted in the investor’s best interest?” The answer is: maybe. The investment industry has many ways that it supports individual investors. Much of the industry, most easily identifiable as “brokers” who earn a commission on trades and insurance product sales, is held to a standard that says investments and advice must be “suitable” for the investor; not in the best interest, but suitable. This can mean that sometimes the advice is given biased towards the advisor’s interest rather than the investor’s. Another, smaller part of the investment industry consists of Registered Investment Advisers, (notice the “e” instead of an “o” in advisers) like Cairn Investment Group, who must, and always have, acted as Fiduciaries. The new rule would push much of the industry in our direction. It comes with new documentation requirements to help investors better understand the choices they face when rolling over or transferring retirement assets between accounts or custodians. Because we at Cairn have already accepted the mantle of a Fiduciary, the changes in our processes will be modest: new language in our advisory agreements, making it clearer that we are a fiduciary, and a cost comparison worksheet to help investors make better decisions. The brokerage firms that are not primarily in a Fiduciary model will be forced to make difficult choices regarding the services they provide and to whom. The new administration has delayed the enforcement date until mid-June, and there is indication that it may be withdrawn completely if the courts allow. It is our plan to fully comply with the new documentation requirements regardless. Thank you, Tim. We’ve had some changes at Cairn recently. All of them seem to be working out well. Number one, we took over a little more space in our building and have shifted some office spaces around. Patrick has settled into the old conference room, making it his office while the additional space has been remodeled into a new conference room – it’s pretty zippy. We’re still trying to figure out how to run the technology. I might resort to dragging in a tripod paper holder otherwise known as an easel and just write and draw the “old-fashioned” way. But the rest of the folks seem to be catching on quickly; we’re excited about the technology we’ve added, the space, and the way the office seems to flow. It’s good. Additionally, Brie, who was with us and so wonderful at so many things, resigned at the end of January. We have added a new terrific person. As a bit of an intro, I think that many of you will recognize and have some memories of Theresa Benjamin. Theresa worked with Dad and me at Charter Investment Group from 1992 – 1995, she then took what seems to be kind of a reasonable path, met a guy, got married, moved to a different state and, life being what it is, she’s back in the northwest and has rejoined us. Theresa is learning fast all the complexity and the care and feeding of our business. Thank you, Theresa, we’re happy to have you here. That being said, as our investors dial in to the office, it’s likely that Morgaine will be picking up the phone.

If you are near, don’t hesitate to swing by. We would love to have you come by the office and meet Theresa, and, as you know, the coffee pot (or in this case the espresso machine) is always raring to go. Thanks for your support. We look forward to a successful 2017. Happy Trails, Jim Parr, Principal |

RSS Feed

RSS Feed