|

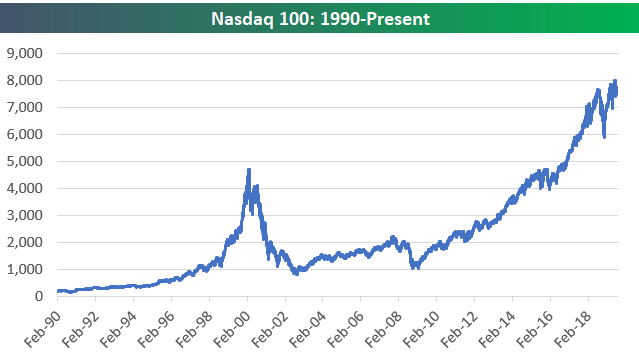

Greetings, It's Patrick here following up on Tim’s post from last week, explaining in more detail how we view the current investment landscape. From an economic perspective, the slowdown in activity has been nothing like any of us have seen during our lifetimes. The contraction and number of job losses was last witnessed during the great depression. Reading through various reports makes you realize how traumatizing the virus has been to most Americans. If one just looked at the S&P 500, you would think that everything is the old status quo and that we had just a minor correction. The disconnect between what “main street” is going through and what the stock market is going through is a head scratcher to say the least. I wrote about valuations and bear market experiences in our last quarterly letter so I will not spend a lot of time rehashing the topic again, except to say large cap U.S. stocks are still trading at lofty valuations and that the current market experience we see is still typical of historical bear market experiences. We will change our view when the data warrants it, but for the time being caution is still a primary objective. The silver lining to this environment is that there are pockets of the market that have had a worse experience than the S&P 500, and that is where we are finding opportunity to put cash to work. For instance, small cap stocks (companies that have a lower market capitalization) are trading at valuation discounts that we have not seen in over 20 years. When analyzing the data, other periods of such wide divergence have generally led to higher returns for small cap equities over large cap. Many of the individual companies we invest in have much smaller market caps than the S&P 500, so this should benefit the portfolio going forward. Additionally, select industrial, consumer discretionary, technology, and health care names have experienced much larger declines during the recent market selloff, creating some opportunities for investors that do their homework (like us). Tim touched on the absolute outperformance of the technology sector versus the rest of the market. The companies that have benefited most from employees having to work from home have seen their share prices levitated to truly astounding levels. Looking at the last time we saw this level of outperformance we can see the narrative is similar between our current environment and the one back in 1999. The story was, “Technology and the internet are going to change the world forever, so revenue growth is all that matters.” Which was true, but it did not stop large tech from losing over 70% of its value. Now the narrative is “Tech companies can weather this recession because of workers staying from home and their capital requirements are low.” This is also true, but the price investors are willing to pay for future growth of these companies seems to be excessive here (chart below). Though the economy is most likely going to get worse before it gets better, we as investors, must look through the noise and use a historical perspective when looking for opportunities. There are areas of the markets that offer compelling risk/reward tradeoffs and we are taking advantage of them. However, the data does not indicate that portfolio positioning should be tilted towards maximum risk. Still holding a higher amount of safe assets (cash, T-Bills, etc.) makes sense until broader valuations improve. Thank you again for your continued support during this trying time in our economy.

Please drop me a note if you care to discuss anything in greater detail. Best regards, The Cairn Team Comments are closed.

|

RSS Feed

RSS Feed