|

Passed in December 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act included several provisions designed to address a wide variety of retirement planning topics. Considered one of the most comprehensive pieces of legislation affecting retirement savings, it contained several reforms designed to make saving for retirement simpler and more accessible for everyone. The SECURE 2.0 Act was signed into law in late 2022, bringing several additional changes related to retirement and savings not included in the original legislation. These changes, too, were aimed at encouraging more workers to save for retirement. While not a comprehensive list, below are the takeaways we feel are the most noteworthy. 1. Required Minimum DistributionsTo comply with IRS mandated tax rules, a required minimum distribution – often referred to as a “RMD” – is the amount that must be withdrawn from a qualified retirement account or IRA each year. The SECURE 2.0 Act raised the RMD age to 73, starting in 2023 and to 75, starting in 2033. Previously, the penalty for failing to satisfy the minimum distribution was 50% of the amount not taken. That penalty is now reduced down to 25%, and further to 10% if corrected within two years. Roth 401(k)’s, unlike Roth IRA’s, are currently subject to the same RMD rules as traditional qualified retirement accounts. However, beginning in 2024, Roth 401(k)’s will no longer have minimum distribution requirements. 2. Retirement Plan “Catch Up” ContributionsCurrently, individuals who have reached age 50 or older are permitted to make catch-up contributions into their employer sponsored retirement plan. The catch-up limit for 2023 is $7,500 and is indexed annually for inflation. Traditionally, plans offered the option to designate these contributions as pre-tax and/or after-tax Roth. Under SECURE 2.0, for participants with income over $145,000, all catch-up contributions need to be made to after-tax Roth accounts starting in 2024. Additionally, beginning in 2025, the catch-up contribution limit for those aged 60-63 will increase to the greater of (1) $10,000 or (2) 150% of the standard catch-up contribution limit. 3. 529 Plan Withdrawals It’s not uncommon for investors with 529 plans to have account balances remaining even after college expenses are paid in full. Under current law, a withdrawal for anything other than qualified education expenses may be subject to ordinary income tax and a 10% penalty. SECURE 2.0 changed the rules surrounding 529 plan withdrawals, allowing owners to roll over excess balances from a 529 into a Roth IRA. The following guidelines must be meet for the rollover to be considered valid:

4. Automatic EnrollmentWith fewer companies offering pension benefits, the responsibility to save for retirement largely falls on individual workers. Those that don’t contribute will find themselves falling behind. Beginning in 2025, all 401(k) and 403(b) plans established on or after December 29th, 2022, will be required to automatically enroll their employees into those plans at a minimum contribution rate of 3%, but not more than 10%. The contributions must increase by 1% each subsequent year until the participant has a contribution rate of at least 10%, but not more than 15%. As an employee, you still have the option of changing your contribution rate or opting out of the plan altogether. 5. Retirement Plan PortabilityCurrent law enables employers to initiate mandatory distributions from terminated employee’s retirement plans after a 30-60 day waiting period, without the owner’s consent. If no action is taken, and the balance is between $1,000 - $5,000, the account can be automatically rolled into an IRA. Accounts with less than $1,000 can be paid out by check. SECURE 2.0 permits plan service providers to offer plan “portability”, meaning that account balances, rather than being cashed out, will transfer to the employee’s new retirement plan automatically when they change jobs. 6. Emergency SavingsThe emergency savings provisions in SECURE 2.0 are designed to make it easier for participants to set aside funds for unforeseen emergency expenses. Beginning in 2024, plans are now eligible to offer non-highly compensated employees the option of establishing an emergency savings account as part of their retirement plan. Contributions will be after-tax and capped at $2,500. Distributions can be taken anytime, and the first four withdrawals must be free from any fees. In addition, employers may also offer a tax – and penalty free emergency withdrawal of up to $1,000 per year. Withdrawals taken under this provision must be repaid within three years. 7. Student Loan MatchUnder current rules, an employer is only allowed to match a participant’s pre-tax deferral or after-tax contribution into their retirement plan. SECURE 2.0 allows employers to make matching contributions on behalf of employees making student loan payments, even if they are not contributing anything to the plan. Beginning in 2024, employers are authorized to match those loan repayment amounts. To qualify for the match, the following guidelines must be met:

If you have any questions regarding the SECURE 2.0 Act, or what impact it may have on your financial plan, our team of advisors at Cairn Investment Group are available to assist. Contact us anytime for a complimentary consultation.

We are proud to announce that our own Patrick Mason has been selected as a panelist at the 2023 Private Wealth Pacific Northwest Forum being held in Portland on March 8, 2023. The Private Wealth Pacific Northwest Forum was developed as an education-focused, in person event for allocators and asset managers. The purpose of this meeting is to facilitate the dissemination of actionable investor content, coupled with supporting the continued development of the private wealth investment industry in the Northwest region. Patrick will have the opportunity to present his views on current and future market opportunities and strategies with other professional money managers. Patrick Mason, Chief Investment OfficerPatrick is responsible for portfolio management, investment and economic analysis at Cairn Investment Group. He also plays a pivotal role in communicating Cairn’s investment philosophy to clients and prospects. His discerning and knowledgeable demeanor hallmarks any encounter with him. Patrick holds a degree in Economics, is a Certified Financial Planner, and a member of the CFA Society of Portland. He previously held portfolio management and financial planning positions with a local investment management firm, Charles Schwab, and TIAA-CREF prior to joining Cairn Investment Group during his investment career that began in 2002.

With the abundance of financial information now accessible online, the interest in Roth conversions has increased substantially in recent years, and for good reason. Roth IRAs are largely considered to be one of the most appealing retirement savings vehicles available. Coupled with declining tax rates and a proliferation of newly retired baby boomers – an estimated 29 million in 2020 – more and more people are left wondering, “Does a Roth conversion make sense for me?” Roth conversions, unlike contributions, can be done by almost anyone. While the basics of a Roth conversion are understood by many, determining when, if, and how much to convert is often a complicated question to answer. Before deciding if a Roth conversion is right for you, it’s important first to understand the differences between the types of IRAs, the types of conversions, and the pros and cons. TRADITIONAL IRAS VS. ROTH IRATraditional IRA

Roth IRA

TYPES OF CONVERSIONSRoth IRA ConversionA Roth IRA conversion is the process of moving funds from a traditional, SEP, or Simple IRA – or a defined contribution plan like a 401(k) – into a Roth IRA. Anyone can convert eligible IRA assets to a Roth, regardless of income. Income tax is owed on the conversion in the year you convert. Assuming the contributions you made to the IRA account were deductible, you’ll owe income tax on every dollar. If the contributions were non-deductible, you’ll owe income tax only on your earnings. There’s no requirement on the amount of dollars you can convert each year, you can choose to do partial conversions of any amount. Backdoor Roth ConversionA backdoor Roth conversion is a strategy used by high-income earners to circumvent the income limits that apply to Roth IRA contributions. This strategy is possible because there are no income thresholds limiting who can make non-deductible traditional IRA contributions or Roth conversions. Whether or not you can make the maximum Roth IRA contribution annually depends on your tax filing status and modified adjusted gross income (MAGI). For ’23, as a single filer, you may contribute up to the annual limit if your MAGI is less than $153,000. As a joint filer, your MAGI must be less than $228,000 to contribute the maximum amount allowed. A backdoor Roth conversion is a process whereby you establish a traditional IRA account (or contribute to an existing account), make a non-deductible contribution, and then convert it to a Roth. Calculating the taxes on a back door conversion is further complicated by the pro-rata taxation rules. The pro-rata rule influences the taxation, calculating liability proportionally to the fraction of after-tax vs. before-tax contributions. Let’s look at two examples to help demonstrate the difference between these two circumstances. Example 1: Paul earns over $228,000 per year as a joint filer, participates in his employers 401(k), and would like to make a Roth IRA contribution. Because his income is over the threshold, he cannot make a direct contribution. As an alternative he opens a Traditional IRA, makes a non-deductible contribution, and then converts those funds into a Roth IRA. Because his contribution was after-tax and non-deductible – and because he does not have other pre-tax IRA accounts – no taxes are due on the principal amount converted. Any earnings on the deposit would be subject to income tax at the time of conversion. If this is done is succession, earnings will be negligible. Example 2 (pro-rate rule): Paul earns over $228,000 per year as a joint filer, participates in his employers 401(k), and would like to make a Roth IRA contribution but has a Traditional IRA that was funded with strictly deductible/pre-tax contributions. Again, because his income is over the threshold, he cannot make a direct contribution. He can, however, contribute to his existing Traditional IRA and then convert those funds to a Roth IRA. The tax consequences of this transaction will be much different because of the pro rata rule. The pro rata rule prevents you from converting only the after-tax funds, it must be proportionate to the fraction of pre vs. post tax contributions. Let’s say Paul has a $100,000 Traditional IRA balance, $7,500 of which came from a non-deductible contribution (’23 maximum allowed for those over 50). If Paul chooses to convert the $7,500 contribution, he will need to calculate how much of the conversion will be subject to taxes; the steps are as follows:

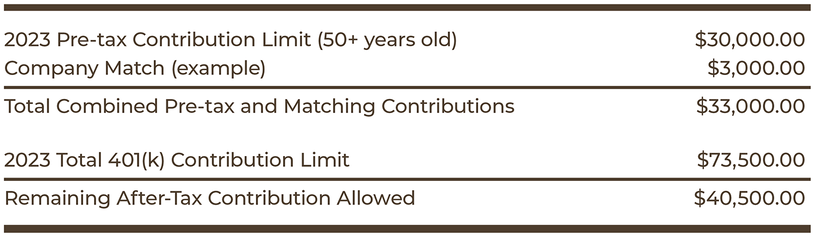

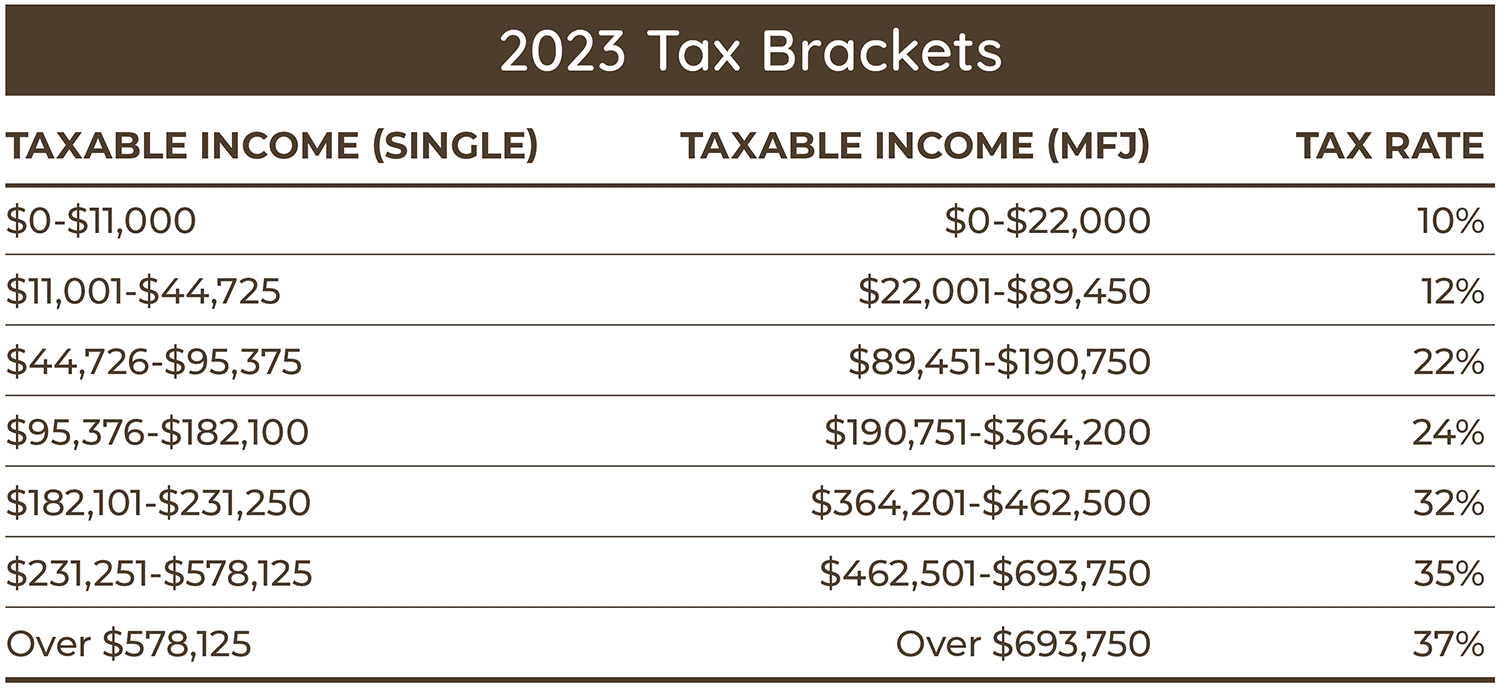

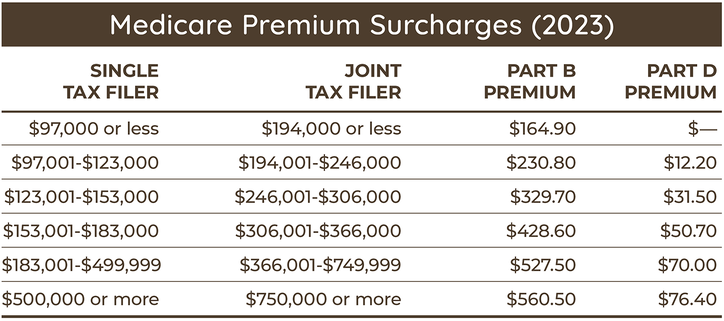

Mega Backdoor Roth ConversionA mega backdoor Roth conversion is a specific type of backdoor conversion where you contribute after-tax dollars to a 401(k) that you hold with your employer and then immediately roll those contributions into a Roth IRA or Roth 401(k). This strategy is only made possible if your companies plan document allows after-tax contributions and has an in-service withdrawal provision. For ’23, the pre-tax annual contribution limit for employer sponsored retirement plans is $22,500. Individuals above the age of 50 are eligible for a “catch-up” contribution, bringing the total to $30,000. However, if your plan allows after-tax contributions, the combined pre- and post-tax limit is much higher. In that instance, total employee and employer contributions of up to $66,000, or $73,500 for employees who are 50 or older, are allowed (for ’23). The after-tax dollars would then rollover, or convert, into a Roth IRA or Roth 401(k). The principal amount is not taxable; however, any earnings will be considered pre-tax and subject to taxation at the time of the conversion. Example: Paul works for XYZ Co. and contributes to their 401(k) plan. XYZ Co’s plan documents allow after-tax contributions and In-Plan Roth conversions. To carry out the Mega backdoor Roth strategy, Paul must follow these three steps (see chart below for a detailed breakdown): (1) max out individual contributions to the 401(k), (2) make after-tax, non-Roth contributions up to the annual maximum (combined employee & employer), and (3) elect an in-plan Roth 401(k) conversion of the “remaining after-tax contribution allowed.” Alternatively, if the plan does not have a Roth 401(k) component, after-tax contributions can be moved into a Roth IRA, assuming plan the documents allow for in-service non-hardship withdrawals. PROSTax-free WithdrawalsIf you have met the five-year rule and are at least age 59 ½, Roth IRA withdrawals are completely tax-free. Tax-free withdrawals offer tremendous advantages in retirement, particularly in years when you have higher than normal income or want to realize capital gains without triggering additional tax liabilities. Minimum Required DistributionsUnlike traditional IRAs, 401(k)’s etc., Roth IRAs do not have distribution requirements beginning at age 72. You can continue letting the funds grow tax-free for as long as you’d like. Minimum distributions can increase your income significantly later in life, especially when considering other means tested benefits, such as Medicare premiums and social security. The ability to leave Roth funds intact, without a withdrawal requirement, is a major advantage over other retirement vehicles. Tax DiversificationHaving a wide variety of account types in retirement provides you with the ability to pull funds in the most tax efficient manner possible. Maintaining diversity among IRAs, Roth IRAs, and Non-qualified (taxable), helps contribute to that efficiency. Example: For tax year ’23, the marginal income tax brackets are as follows: Paul, who is retired, has total taxable income of $89,450 filing jointly (after adjusting for deductions), putting him at the tail end of the 12% marginal income tax bracket. Any additional income he realizes this year, will put him in the 22% marginal income bracket. He has done a very good job of saving for retirement, but never contributed or converted funds to a Roth IRA. All of his retirement savings accumulated in 401(k) and traditional IRA accounts. Let’s say, for example, that Paul booked a vacation to spend some time with his family in Hawaii, at a total cost of $10,000. When he withdraws funds from the IRA to pay for the trip, he’ll pay tax on that distribution at a rate of 22%, nearly a 50% increase from his previous bracket. Because his only source of funds is IRA and 401(k) assets, he has no other option. If he had Roth IRA and/or non-qualified taxable assets to withdraw from, he would have much more control over his tax liability. The option of pulling assets from those account types could have saved him $2,200 in additional federal income taxes ($10,000 * 22%). Maintaining a Roth IRA account in retirement can help prevent a situation like this. Beneficiaries / Estate PlanningRoth IRAs are a particularly valuable estate planning tool. When inheriting a Roth, you are granted the same tax advantages as the original owner. Distributions are tax free, provided it’s been 5 years since the original account owner established the account (each conversion has its own 5-year requirement). The SECURE Act, which was passed in December 2019, changed the inherited IRA distribution rules. For those deaths that occurred in ’20 or later, non-spouse beneficiaries must establish an inherited Roth IRA account and withdraw the entire balance within a 10-year period or take a lump sum distribution. The new law also created a category of beneficiaries called “eligible designated beneficiaries”, who are still permitted to stretch distributions over their life expectancy. As a non-spouse beneficiary, you must fall into one the of the following categories to qualify; (1) a minor child of the decedent (only applicable until the minor reaches the age of majority) (2) disabled persons (3) chronically ill (4) not more than 10 years younger than the deceased and (5) certain types of trusts. Spousal beneficiaries can treat the account as their own, stretch distributions over their lifetime, deplete the account over a 10-year period or take a lump sum distribution. CONSIncreases Ordinary IncomeAny amount you choose to convert will increase your ordinary income, which may push you into a higher marginal tax bracket. Conversions only make sense if the converted funds are taxed at a rate that is lower than what you expect to pay in the future. Without proper planning, it’s possible to pay more lifetime taxes with a Roth conversion than without. Conversions are IrrevocableMany things can prompt your desire to reverse a conversion. Two of the more common reasons for doing so are: (1) poor investment performance and (2) underestimating your tax liability and/or marginal bracket. Remember, the amount you convert from an IRA to a Roth IRA, under most circumstances, is fully taxable. If you perform a conversion and subsequently loose money on the investments, you may want to reverse that transaction, in hopes of reconverting when the account has a lower balance to reduce the overall tax liability. Alternatively, you may underestimate your tax liability when planning for a conversion. Let’s say for example you convert $30,000 in October and then receive an unexpected bonus in December, pushing you into a higher marginal income tax bracket prior to year-end. Your total anticipated income, after receiving the bonus, may cause you to reconsider the prior conversion. Prior to 2018, you could have “recharacterized” the conversion, meaning you could move the converted funds back to the traditional IRA, eliminating taxes that would have otherwise been owed. Under current law, Roth conversions are irreversible. Once your conversion is complete, nothing can be done to reverse it. Ordinary Income Tax Ripple EffectIt’s important to understand the interrelationship that exists between ordinary income, capital gains, social security and other taxes and surcharges; including net investment income tax and Medicare premium surcharges. Long-term capital gains stack on top of ordinary income, so an increase in ordinary income can trigger additional capital gains taxes. Ordinary income also plays a factor when calculating “provisional income,” which is used to determine how much, if any, of your social security benefit will be subject to tax. Lastly, more ordinary income can trigger Medicare premium surcharges and/or net investment income tax. Beginning in ’07, government began reducing the subsidy for high-income individuals, causing them to pay higher monthly amounts for Part B and Part D Medicare premiums. These surcharges are referred to as “Income-Related Monthly Adjustment Amounts,” or IRMAA, which is determined by income on your tax return from two years prior. See the chart below for a breakdown of these surcharges based on income: Net investment income tax is a 3.8% surtax paid in addition to regular income taxes. The surtax applies only if you have net investment income – capital gains and dividends, interest and annuity payments, passive business income and/or rents – and MAGI over a certain amount; $200,000 filing single and $250,000 filing jointly. The surtax applies to your net investment income or the portion of your MAGI that excess the threshold – whichever is less. For example, if you have $40,000 in net investment income and your MAGI goes over the threshold by $60,000, you’ll owe the 3.8% surtax. But you’ll owe only on the $40,000 since it’s the lower of the two amounts. Total tax would be $1,520 ($40,000 x 3.8%). The rules and tax implications of converting any amount from a traditional IRA to a Roth IRA – or as a backdoor or mega backdoor conversion – are very complex. We strongly recommend you consult with a tax advisor and/or financial planning professional to help properly determine if a conversion is right for you before executing any of the strategies discussed herein.

The decision to convert to a Roth should be made in the context of a comprehensive financial plan. If you have additional questions or would like to explore any of these strategies further, our team of advisors at Cairn Investment Group are available to assist. Contact us anytime for a complimentary consultation. It’s hard to believe we’re on the precipice of yet another new year but, here we are. Temperatures are dropping, family get-togethers are being organized and, pretty soon, coffee shops will be filled with the familiar echoes of holiday music. Before the hustle and bustle of the holiday season takes over entirely, it’s important to take a moment and make several year-end planning items a priority. Below is a checklist of eleven items you should examine, which can help secure your financial plan as we transition into the new year:

The U.S. tax system is complicated. Understanding the intricacies of the tax code and how different sources of income – including social security and capital gains – interact with one another can be intimidating, especially when transitioning into retirement. Our “Taxes in Retirement” webinar will address these topics and more while providing information on the tools available to help you proactively create tax-efficient strategies and avoid common tax pitfalls.

View the webinar here. Greetings,

With the situation in Ukraine now overlaying other risks already present in our financial systems, I’d like to give our perspective on possible outcomes for our clients and what we are doing to work our way through this. An outright war was almost unthinkable just a few months ago, and yet here we are. I won’t comment much on the war itself, as you are all able to read the reports as well as I can. My gut aches thinking about the fear, misery, and death that’s being inflicted on such large urban populations, and for their sake, I hope that this can end sooner than later. Much like my comments on COVID back in early 2020, I suggest that the actions that our government and its allies take will be the major driver in how our investments fare through this. That’s not to suggest that a wider conflict would not have impacts that transcend all that we’re dealing with, but for now, the choice to impose economic sanctions, likened to economic warfare by Putin, is what will drive the numbers we read in the following weeks and months. A quick list of the top risks to your investments:

I’m sure that I missed a few, but any of these is by itself a cause for caution. On the bright side, American companies are still pushing forward out of COVID; many have aggressive hiring and expansion plans, and lots of government stimulus money remains to be spent. The dollar is strong, and the USA looks like a beacon of stability that continues to attract foreign interest and investment. Believing all of that, what are we doing differently? We have a process that focuses on risk management, and in general it’s a good form to stick with a process until there’s evidence that it’s not working. The good news is that it seems to be. It’s led us to own companies and asset classes with solid fundamentals and good prospects, and to buy them when they’re a good deal, sell them when they’re not, and hold them when they are working. Some experience hiccups, but most don’t, and we find that in these tough times it’s a successful strategy to protect and grow. Our bond holdings align with our thoughts on the rate markets and are characterized by low-duration, high-quality offerings. If you read Patrick’s part in recent newsletters (Q2:2021 and Q3:2021), you can get an in-depth review of our approach. I hope this provides a little clarity. Of course, I welcome any of your calls to discuss this and any other topic on your mind. Best Regards, Tim Mosier I am pleased to announce that Mark Farrelly, CFP®, CDFA® (Certified Divorce Financial Analyst), has joined Cairn Investment Group as Senior Advisor and Director of Financial Planning. Mark’s expertise in specialized Financial Planning promises to elevate our game significantly in the coming years. Check out his bio here.

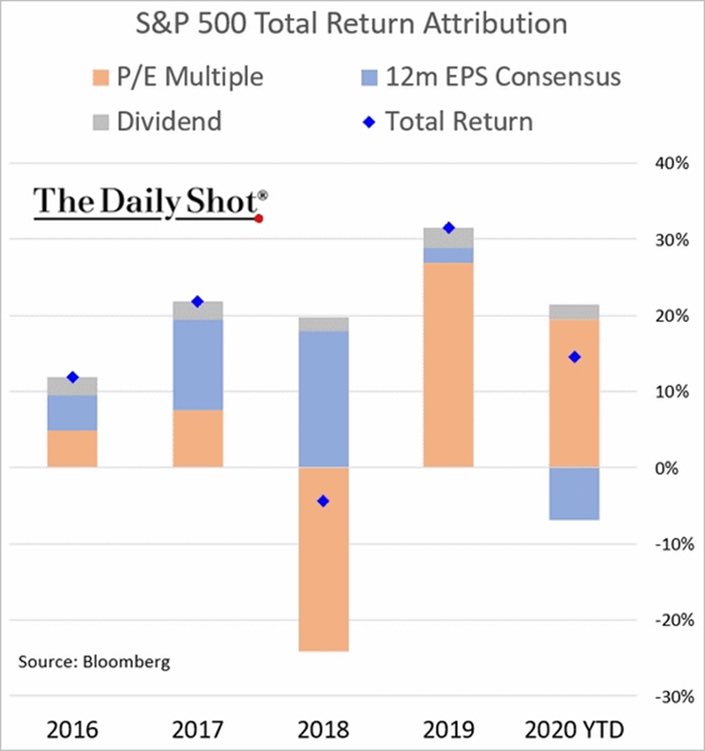

Mark will continue working with many of his long-term clients as primary advisor and will also collaborate with Patrick and I to fine tune our planning processes, so that we may begin applying those techniques to all of our clients. In the unfortunate event that you or someone you care about must work through the financial aspects of a divorce, Mark can provide very specific guidance that can be quite beneficial. Mark resides in Northern California, and will continue to work as a satellite office. I hope many of you will get a chance to meet him over time and get to know what a great resource he is to our clients and to our organization. —Tim and the Cairn Team A lot has happened since our last note! The virus is running rampant, but the election is behind us and multiple vaccines appear to be effective and on the way. The markets have interpreted the sum of these events to be positive and we’ve seen an amazing uptick in November, with broad participation across sectors, companies, and asset classes, lifting our account values. The shift of interest towards stocks that may benefit from a “re-opening” is notable and we own many of these. In our third quarter letter, we discussed the risks we are witnessing in large-cap technology stocks, the opportunities in small-cap stocks relative to large-cap stocks, and value versus growth stocks. In November it seems other market participants have started paying attention to the large valuation gaps of these two groups with small cap stocks having its third best relative performance month versus the S&P 500 in the last 20 years, and value stocks having their best absolute performance month in over 20 years. Although it is still too early to call this a permanent change in trend, it is encouraging to witness more broad participation across the market instead of only a handful of overly expensive companies producing the majority of returns. We are pleased with the recovery that markets have staged, but we cannot forget about the risks that are still present. We have written about valuations at length, and especially valuations surrounding large cap US stocks. With the recent run up, valuations for the S&P 500 stand at highs last witnessed in the year 2000 and right before the great depression. Economic activity and Company earnings, though improving, are still mired in recession from our battles with COVID-19, with company earnings showing a -6.3% decline from the previous year during the third quarter. Analysts estimate that earnings are not expected to reach their 2019 levels until the start of 2022. We know the market is a forward indicator but basing today's price on the hope of an earnings recovery in 2022 shows how much optimism is built into this equity market. As you can see from the chart below, the return of the S&P 500 to date, is comprised almost entirely by multiple expansion (investors paying more for an undetermined amount of future earnings). A risky proposition in our view. We are very excited about the possibilities of vaccines being distributed as we start the new year. I think everyone is ready to get back to a more “normal” way of life, and many of our equity positions are being held at the right price to benefit from further recovery, or expectation of it. However, we must always remain focused on what is already reflected in current prices so that we can understand the risks and opportunities that the markets are presenting. The good news is we are still finding some opportunities. Walking this tightrope, we still hold extra cash and fixed income in the portfolios to protect against the market going through another bout of pessimism.

We hope you and your families have a safe and happy holiday season. Thank you for your continued trust and please reach out if you want to discuss any topic in greater detail. Your Cairn Team So, what happens to the markets on November 3rd? It’s likely to be noisy with the first moves being quite reactionary. Focusing too much on this event, even if the outcome is ugly, is not a great use of one’s time. Here are the things that we think will cause more substantial moves in the next several months: 1. StimulusThis may be the reason why anybody has a stock portfolio that’s not down significantly in 2020. Without it we’d be in a real mess. Most financial experts and politicians believe that another stimulus package is necessary for the nation to avoid a worsening financial and social crisis. This view is shared, through differing lenses, by both political parties, so I think we’ll have more stimulus. It’ll be bigger if the Democrats win the White House and the Senate; potentially a $3T deal with aid to the States and Municipalities. Republicans will likely want to stick with something like the $1.9T offer we saw earlier this month. Either one will help. The outcome of the election may impact the timeline for additional stimulus. Mixed scenarios, like a Biden win and a Republican Senate, or a Trump win and a Democratic Senate would add some twists, but I believe they will still result in a new package. The longer the process takes, the more nervous the markets will be. 2. Stock ValuationsMany of the stocks that have driven the indices higher are at extreme valuations by historical norms. No one says they can’t go higher, but it’s likely that there will be a reckoning, and some have a long way to fall before they’ll become a good buy. On the bright side, many individual stocks are offered at more reasonable valuations and may find some upside with stimulus and a solution to the health crisis. 3. Vaccine or CureNot much to say here other than when it happens it will be a good thing. We’ll be able to begin building our post-COVID economy and maybe find a new group of winning companies. This will be very helpful to “main street.”

Looking out past the above topics, we must address another collection of challenges, too long to go into much here, but I’ll list a few: All of that stimulus comes at the cost of massive debt. How we deal with this over the next decade will determine how we fare as a nation and as investors. It’s looking more and more like we are swallowing the Magic Pill of “Modern Monetary Theory” leaving little choice but to have faith inflation and interest rates will be tamed over time. This will impact our long-term growth prospects, potentially in a negative way. Taxes are likely to change; sooner if Mr. Biden is elected and the Senate falls to the Democrats this year. You can look up Biden’s thoughts on taxation on his campaign website. It mostly focuses on high earners, the wealthy, and corporations. This will change spending behaviors in unanticipated ways and is likely to slow growth to some degree. It’s also likely that all working Americans will see a tax increase in the future as we deal with the aftermath of additional debt generated by COVID and fiscal spending. Financial markets face many challenges, but we also believe that they present opportunities. For instance, as we mentioned in our most recent quarterly letter, valuation spreads between value to growth stocks, and small cap to large cap stocks has reached historic highs. So even with the broad markets being priced to perfection, investors that are willing to do their homework (like us) can find opportunities in companies and asset classes that have not participated to the extent as the “glamour” stocks have. Our disciplined process and focus on risk management will allow us to navigate the equity markets, no matter the victor of next week’s election. Humbly yours, the Cairn Team

|

RSS Feed

RSS Feed