|

Greetings from the Northwest! July is upon us, and the forecast here is for some very Summery days ahead with temps in the mid-nineties. With that, we’re coming into what has traditionally been a slower season for security markets and many businesses, with folks nationwide taking advantage of the good weather to travel or enjoy their homes and families. At Cairn, the incoming calls have dropped off quite a bit, and are most likely to be about pulling a little cash for home improvements or travel. As usual, we’re cycling through a few staff vacations here, but will always have someone available to take your call and move funds or make a trade if the markets and banks are open. Despite the predictable lull in business activity, this year has some underlying circumstances that make it unique and interesting. For one, it’s an election year. I hardly go for an hour without someone pointing this out. With each passing week the intensity of the media storm on this topic is increasing, with no respite likely until late in the year. Many people worry about the possible election outcomes and how their lives, finances, investments and the future health of the nation could be affected. Our job is to see to it that no matter what happens in November, our clients’ investments survive the experience, and, if possible, thrive. On our side is the fact that election years tend to be good for the stock market; this is not intuitive, but historically the markets have advanced, regardless of who wins. Since 1960, only 3 of 16 elections have coincided with a down market. We’ve also got a bit of a tailwind with our positions in fixed income and cash, both of which are paying much higher rates than just a couple of years ago; and the fixed income is better positioned to act in its traditional role as a counterbalance to stocks and is less subject to interest rate shocks going forward. Every year, and every election year, is different, and many other realities are in play. Inflation has subsided but is not yet back where the Fed, and most of us, want it to be; mortgage rates are high relative to the past decade or so, and with house prices as high as they are, this has put the market for existing homes in quite a bind. People simply cannot afford to buy an equivalent house if they choose to sell the one that they’re in. This chart (below) illustrates the difference between the average rate of existing mortgages (loans outstanding) and the current rates. This has resulted in fewer existing homes for sale and has greatly benefited new home builders, who can offer homes at just the right price point, along with preferential financing. A possible longer-term outcome will be a sideways or down market for several years as folks just stay put, and when they do move, they can afford less of a home. Other things in play include massive public debt at much higher interest costs, a thinly supported stock market and generally high valuations. On the bright side, people seem to be going about their lives and spending money, and the US economy still shines above all others. One last thing before I hand this to Patrick for an in-depth discussion: Please remember that we have your back when it comes to financial planning of pretty much any sort, with broad expertise, multiple certifications, and best in class tools; we can work with you, at no additional cost, to develop and implement a plan for your future needs. Contact anyone at Cairn to get started. Now on to Patrick: Patrick's PartEquity markets had a mixed 2nd quarter as US stocks continue to be led by just a few select large technology companies. The table below summarizes the returns of the major indices for the quarter. As you can observe from the table above, outside of the S&P 500 and Nasdaq, most major indices were negative, which might not be intuitive given the media’s regular mentioning that stocks are hitting all-time highs. The previous few quarters, I have written about inflation, Fed rate cut decisions, investor sentiment, and equity valuations. I am not going to touch on the economic backdrop, which remains mixed, but focus this letter solely on what is driving equity market returns, what that could mean moving forward, and how we are navigating this challenging environment. As we go through the charts below, the major takeaway will be waning market participation (breadth) being masked by a few large tech companies despite lofty or extreme valuations. The chart above takes the equal weight version of the S&P 500 and divides that into the traditional (market cap weighted) version of the S&P 500. When the line is moving down, fewer stocks are driving the returns of the S&P 500 which is generally not a healthy market environment. Historically, sustained bull markets are accompanied by broad participation across sectors and asset classes. The current level of this ratio is at a 16-year low, and as you can also see from the chart, prolonged downturns in this ratio have preceded some nasty bear markets in the past in 2000, 2007 and 2020. As the market continues to make new highs, fewer companies are trading above their respective 200 day moving averages, which signals more companies’ prices are entering a downtrend than an uptrend. As we have witnessed in other reflection points in the market. With the tech sector growing to over 30% of the S&P 500’s weighting, similar to 1999, it is even more glaring when you compare the price performance of the S&P 500 Equal Weight Index versus the S&P 500 Information Technology Sector Index. Year-to-date performance of the different S&P 500 sectors confirms that most sectors are showing mid-single digit gains. The same can be said when looking at asset class performance. Investors piling into mutual funds or passive ETFs that follow or overweight these popular sectors are taking on much more risk than they probably realize. I think of it as momentum chasing with little regard to the price being paid for the underlying fundamentals. Recently in the Wall Street Journal, a chief investment officer of a well-known brokerage firm was quoted as saying, “Tech allows you to play defense and offense at the same time.” I find this difficult to believe. Tech has a trailing p/e ratio of 43x, a forward p/e of 34x, a combined price to sales ratio of over 13x, and we are late in a cycle with euphoria at very high levels for that given sector. Valuations in the US are also reaching extremes when you compare them to the rest of the world. The chart above shows the S&P 500 price / sales ratio divided into the rest of the world’s price / sales ratio. There have only been a few times over the last 27 years when we have reached this level of relative overvaluation. SummaryEquity market returns have been largely positive this year and over the last twelve months; but the outsized returns that are being shown in select indices are being driven by just a handful of names that are trading at historically high valuations. We feel this brings a high amount of risk to chasing those names as well as to the broader market. Speculators seem to believe that no price is too high and that they will be able to time the exit from the party before everyone else rushes for the door. This is almost impossible to accomplish on a consistent basis. As investors, we believe in understanding the price we are paying for the underlying fundamentals of the business and asset class, then paying a price we believe is below the value of what the market is offering it for. This does two things: It provides more downside protection than buying overpriced assets if the market falters, or we end up being wrong (which happens occasionally), and it produces a long-term return sufficient to meet your goals. Ignoring the noise and focusing on process is essential for navigating expensive equity markets. Currently, we are still invested below our long-term equity targets across all asset allocation strategies. We are still finding some limited opportunities, but the data guides us to still have a higher-than-normal cash balance. When the facts change, rest assured, we will change our mind and will have the flexibility to deploy cash without having to sell other assets that have declined in value. Thank you again for your continued support and trust. I intend my section of the newsletter to be informative and to give you a glimpse into what we are looking at daily. Please feel free to reach out to me if you want to discuss any topic in more detail. —Patrick Mason Thanks, Patrick! As always, a well thought out analysis of some important factors affecting our markets.

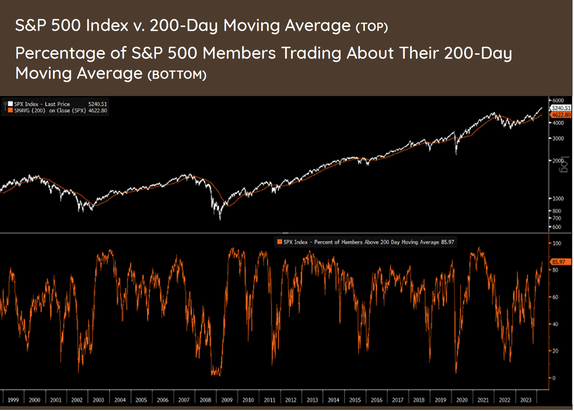

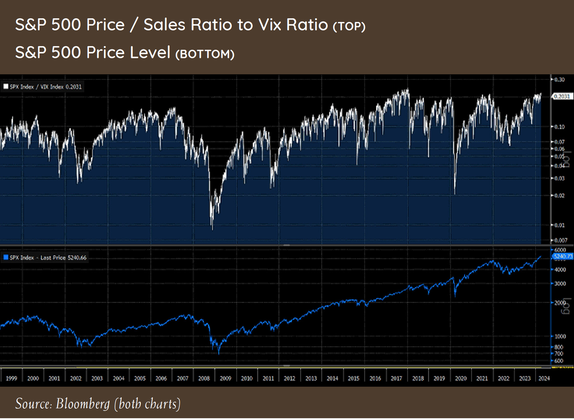

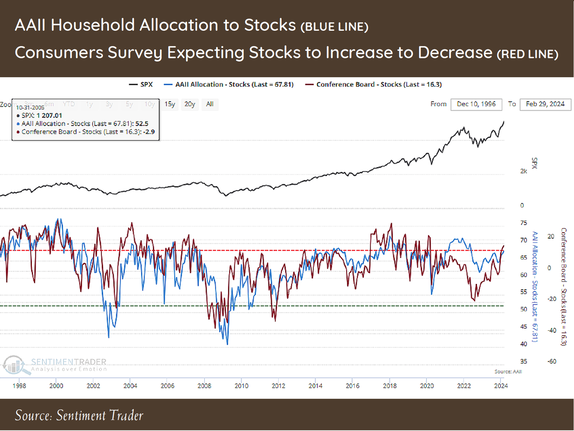

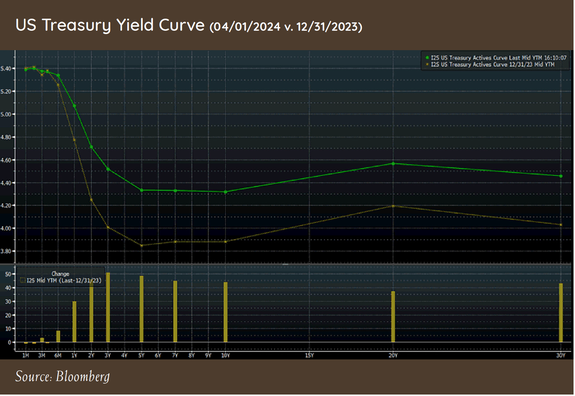

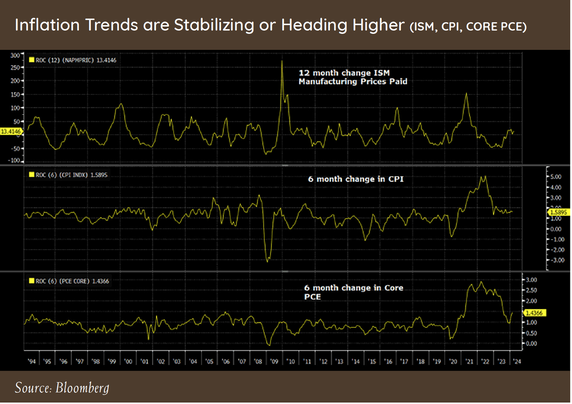

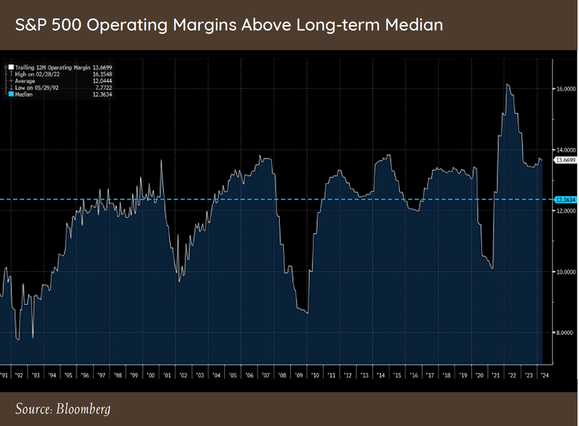

I hope everyone has a safe and fun summer. If you’d like to come in to review your accounts or your long-term plans, please give Stefanie a call, and she’ll get you scheduled with your advisor. Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest! Well, it’s been quite a first quarter for 2024! Against a backdrop of multi-faceted turmoil, the US economy has been strong enough to avoid a recession, despite last year’s spike in interest rates and enduring inflation. Apparently, consumers are still spending, even if it means getting deeper into debt, which may indicate a sense of optimism about their prospects, or it could be a house of cards ready to fall. We’ll see. Stock market indexes outperformed most expectations, but still, we saw that the broader market was not as enthusiastic as the few market leaders, although this last month saw that broader market catch up a bit; a healthy move. The “Magnificent Seven” is now the “Fab Four,” with Apple and Tesla in particular underperforming of late. A much-desired outcome for the Fed and most investors is the elusive “soft landing” whereby a major economic shift occurs (in this case, raising the Fed rates), without driving the economy into recession. I think it’s arguable that they’ve achieved that goal, recognizing that we never actually land anywhere; the merry-go-round never stops, and someday, due to some set of circumstances, we will experience a recession. Inflation is not yet in the bag either. We can’t yet predict the combined effect of having the Suez Canal route compromised and the upper Chesapeake out of service at the same time. I’ve heard it argued that we’ve been experiencing a “rolling” recession, with economic sectors taking their turn getting hit, then recovering, with the net result that overall, we never dip below the line. I can believe that. We’ve moved past the bank scare we were talking about last year at this time, but it may not all be over, especially for regional banks that have lent heavily into the commercial real estate market. I probably don’t have to tell you much about the state of that market for you to understand the risk presented. We have little to no exposure there, so hopefully whatever transpires won’t spread much beyond that sector. We’re happy to welcome Spring, and with the better weather, more of you are wanting to come in for an in-person meeting! I highly encourage it. Just give us a week or two’s notice and we can be prepared. Before moving on to Patrick’s well thought out dissection of the financial world, I’ll mention that we now have the ability to actively manage your 401(k)s and similar assets that cannot be brought into Schwab at this time. We’re utilizing a software service by Pontera that allows us access to almost any employer retirement plan. The advantages to you are our ability to coordinate those investments with your overall strategy and relieve you of the need to stay on top of rebalancing and allocation changes. Dan, Mark, or Patrick can explain how to set this up if it makes sense for you. With that, here’s Patrick: Patrick's PartEquity markets continued the upward trend that started in November last year, with most stock indexes posting mid to upper single digit gains for the quarter. The combination of better than anticipated economic data and the continued hope that the Fed will lower interest rates at some point this year added fuel to already overheated equity market prices. Last quarter, I wrote at length about the expensiveness of most US stocks and the effects on future returns. Suffice to say, with the performance of most markets being positive so far this year, our concerns surrounding high valuations have not changed. The current rally we are witnessing in the S&P 500 has created the following conditions: the price is more than 13% above its 200-day moving average, with more than 85% of members trading about their own 200-day moving average, the Price / Sales ratio (valuation) to the VIX (complacency) at multi-year highs (h/t John Hussman), and household allocations to stocks and their feelings about future prospects at extreme levels. The charts on the right show these conditions going back to 1998. As you can see, this does not always signal a market correction, but it has been a precursor to some of the larger drawdowns we have seen over the last 25 years. So, if there is one word I could use to describe the environment in the short term it would be “Exhausted.” One silver lining during the quarter is that participation improved in February and March, meaning that the market was not being driven by just a small group of stocks, as we witnessed over much of 2023. It is too early to tell if this is a change in trend, but it would be a much healthier environment in which to take more risk if participation wasn’t as ragged, even when considering current high valuations. Inflation and Interest RatesTo start the year, capital markets were pricing in close to seven rate cuts from the Fed, based on belief that inflation has been controlled, so restrictive monetary policy was not needed. I mentioned that I thought that was overly optimistic, based on what the inflation data was signaling. Over the last three months, inflation data has come in higher than what markets were estimating. This has changed expectations for rate cuts to come down to under three this year, with cuts not anticipated to begin until later in the year. The bond market has taken notice, as the long end of the US treasury curve has moved higher in anticipation of interest rates staying higher for longer. The current trend in inflation data being released might make even three cuts overly optimistic. The trend in CPI, Core PCE (Personal Consumption), and the prices paid component of the ISM manufacturing survey, all point to inflation being stickier and more permanent than what the market was anticipating starting the year. If inflation does become more embedded in the economy, the effects would be widespread across capital markets. Operating margins for the S&P 500 have maintained a high level, despite higher inflation, on the belief that inflation would moderate, and input costs and end prices would come back down. Inflation remaining sticky is going to test companies’ ability to continue to suppress wages and push higher prices down to the consumer. If the consumer is unable or unwilling to absorb continuously higher prices, margins will compress to more normal levels. Our job is to navigate this challenging environment and build portfolios that protect against the risks we observe, while earning a return to meet long term goals. To help protect our portfolios against margin compression and inflation risk, our analysis of companies looks at the ability of a company to maintain pricing power and the ability to adjust cost structures based on changing market dynamics. We also run scenario analysis on the operating performance of a company to make sure the price we are paying has a wide margin of safety built in. When looking at other asset classes to complement the portfolio companies we own, our understanding of market history and valuations provides the framework to take advantage of opportunities and avoid unnecessary risks when prices do not reflect economic reality. I look forward to the day when we talk about the breadth of opportunities and how the cash positions in the portfolio are being deployed to take advantage of them. In the meantime, we continue to have a neutral stance, and hold more cash than normal due to high valuations, euphoric sentiment, and ragged market participation. When the data changes, we will change our mind. Thank you for your continued trust and please do not hesitate to reach out to me to discuss any topic in greater detail. —Patrick Mason Thanks, Patrick!

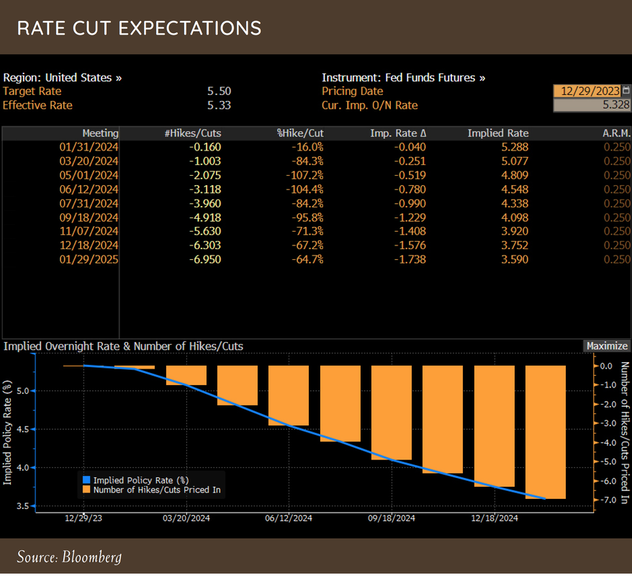

Have a safe and happy spring! Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest! As we welcome the new year, let’s briefly consider how exceptional 2023 has been. Thanks to strong El Niño conditions in the Pacific, the drought in California has been quenched, Washington has a state new record Mahimahi (a tropical fish often associated with Hawaii), and at this point no snow so far in the western Oregon or Washington valleys. It’s been warm and wet. Things were equally warm with securities markets, leaving many well-known economists, fund managers, and writers trying to dissect exactly why the year ended so much better than most predicted. Remember that the bank crisis (yes, that was in 2023), rapidly rising rates, high security valuations, inflation, global tensions, and a slowing world economy would combine to pummel stock prices? It didn’t happen; instead, we finished a year that provided solid gains in many asset classes. Some of the showy numbers, like the NASDAQ’s 54% gain, or the S&P’s 26%, were somewhat deceptive, in that they were driven to a huge extent by a very small number of headline stocks, and the NASDAQ’s eye-popping gains came on the heels of an equally bad selloff in 2022, so it’s pretty much where it was two years ago. Can it continue? Sure, but many of the concerns about overvaluation, a slowing economy, higher rates, etc., are still valid, even more so now. Much of this stock price enthusiasm was encouraged by the belief that the Fed will begin easing rates soon. They may not. I don’t think they should. The Fed has managed to take us from zero rates to something more in line with historical averages, and in so doing regained a useful tool to help us through times of crisis. We are not in crisis and haven’t been for a couple of years, yet governments at all levels have been spending like the end was nigh: another possible cause of the flourishing markets, and something that is unlikely to continue. The world’s supply chains are mostly back up to speed and shouldn’t be a significant driver of inflation going forward. When the seemingly endless flow of unfunded government payouts and backdoor bailouts ends, things are likely to become more challenging for consumers and smaller businesses. I look forward to Patrick’s more nuanced take on some of these topics. Here at home, we were honored by a long-time client and his daughter, to be presented with a digital rendition of a cairn photo that we now have hanging in our Vancouver office. Sarah Haftorson is the amazing, upcoming, digital artist who created the picture you see below. You can find out more about her and the process she employs at sarahhaftorson.com. By the time you read this, Cairn will have two new members of the ownership team: Mark Farrelly, and Cherie King, further enhancing our stability and our ability to serve our clients into the future. Congratulations, Mark and Cherie! Now on to Patrick: Patrick's PartThe 4th quarter of the year topped off a solid 2023 for broader equity markets with the S&P 500 rising over 11% for the quarter and over 26% for the year. Small Cap and International stocks also returned a respectable 16% and 18%, respectively. Bonds started the year poorly, with interest rates continuing to rise for the majority of the year, but the drop in rates that took place in the final two months saw their return move into positive territory at 5.5%. Up until the end of October, equity market performance could be characterized by the “Magnificent 7 (Apple, Microsoft, Meta, Alphabet, Tesla, Nvidia, and Amazon)” and then everyone else. The chart on the right shows the performance of the Mag 7 versus other broad indices. We have talked a lot about the lack of participation during this bear market rally that started at the end of 2022 and how unhealthy such an environment is for markets. So, if there is one silver lining to the recent rally that started on 10.27.23, it is that it has been very broad across numerous asset classes and sectors. The reason I say “one silver lining” is that the recent exuberance in equities is being driven mostly by investors’ hope that the Fed will return to a time of extremely low interest rates and that the inflation war has been won. That exuberance is not driven by drastically improving fundamentals. When you look at the data, the S&P 500 rose 16.21% from 10.27.23-12.31.23, while the S&P 500’s Price / Sales valuation multiple rose 20.19%. Euphoria is indeed alive and well, thanks to the Fed signaling a pivot in monetary policy. To end the year, the futures market is pricing in almost seven rate cuts in 2024. As you can see in the chart below, there are only eight Fed meetings during the year, so the market is assuming one rate cut starting in March and for every meeting that follows during a time when Core CPI is double the Fed’s long term 2.0% target. Not to say that cannot happen, but equity markets had better be careful what they wish for. If the Fed is cutting rates seven times in 2024, then my bet is that something alarming happened in the economy, causing the need to stimulate growth, which would not be a good thing for equity markets. This makes the biggest risks heading into this year – outside of extremely high valuations (touched on next) – that interest rates and inflation will stay HIGHER than the market is anticipating. During times of excitement and euphoria, investors tend to forget that valuations and the price you pay for the value of an investment are the main determiners of your long-term return, not the story being pitched at the time. We wrote about Cisco Systems last quarter, as many investors remember the Tech Wreck in the late 90’s, but this type of behavior has been happening for decades. In the 1970’s a story was being told about the Nifty Fifty stocks that is quite like the story being told about the Mag 7 now. It didn’t matter what price you paid for these darlings because they were innovators and would be around for many years to come. IBM is a perfect example of the narrative being presented. Yes, IBM was changing the computing world with growth rates that would match their innovation and impact on technology. In fact, IBM’s revenues grew from $6.88 billion in 1968 to over $34 billion in 1982 (close to 500%). In 1968 Business Week wrote about the exciting growth of IBM and how it compared to other companies:

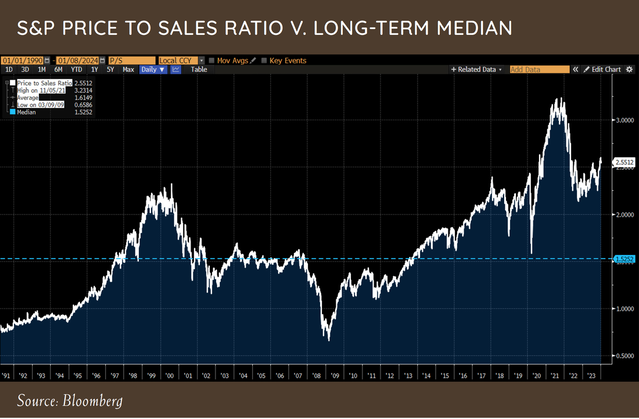

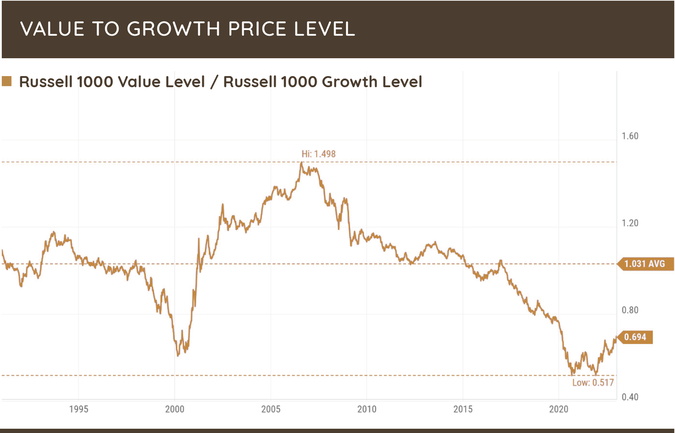

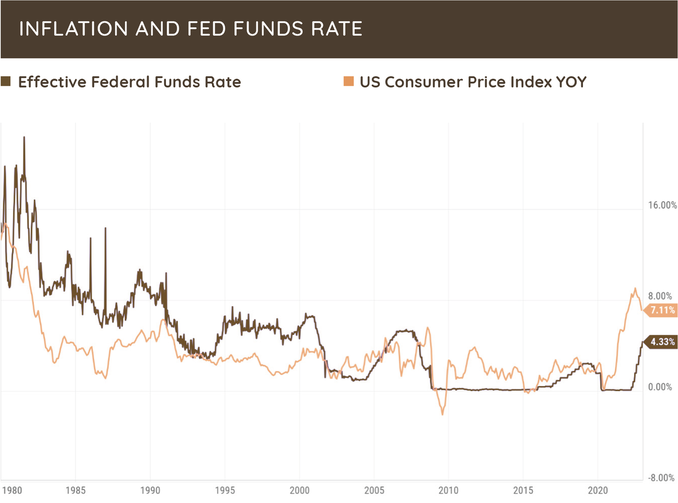

From the start of 1968, shareholders were rewarded with a price decline over 5% during the coming fourteen-year period, right in line with the S&P 500. Whether it is a company or an asset class, negative returns can be realized over a long-term investment horizon if you pay too dear a price.As Mark Twain is said to have opined, “History doesn’t repeat itself, but it often rhymes.” Currently, equity valuations are high, with the S&P 500 index price-to-revenue multiple higher than at any point in history outside of late 2021 and 70% above its long-term median. With high valuations and euphoric expectations about future growth and interest rates, risk of loss is higher than normal. A disciplined investment process with a focus on risk management will be paramount in navigating the years ahead. This is not to say there are not opportunities. Today, we still own high-quality companies that are trading at reasonable valuations; we combine those investments with asset classes we feel offer attractive valuations over the intermediate term. Fixed income is much more compelling than it was a few years ago, but we are still holding most of our allocation in short maturity debt based on the risks we discussed above. We also hold a large portion of the portfolio in cash via money markets, since the interest rate is high and it provides us with the optionality to invest in other long-term investments when prices are attractive. Our conservative positioning will not last forever. Market environments will change, and we will be ready to deploy our higher cash balances when valuations are lower or euphoria in the market has dissipated. Thank you for your continued trust and please do not hesitate to contact me directly if you have any questions or want to discuss any topics in more detail. —Patrick Mason Thanks, Patrick. As always, we’re open to discussing any and all of these topics, and would enjoy having you in the office to discuss your investments and plans. The coffee is always hot and free.

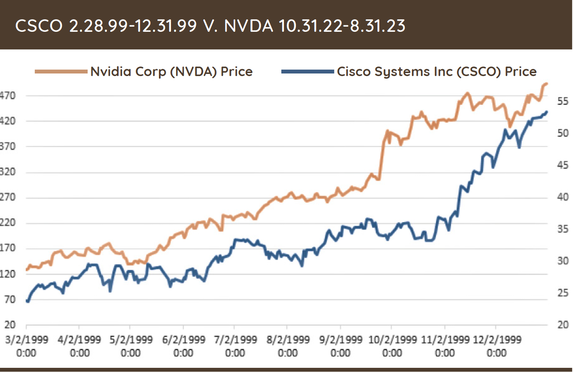

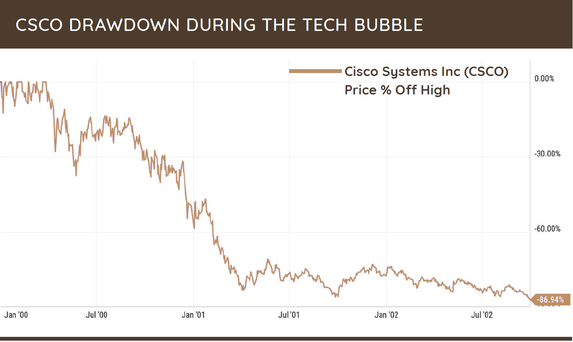

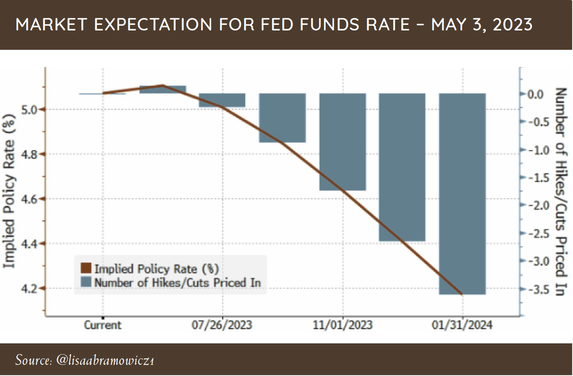

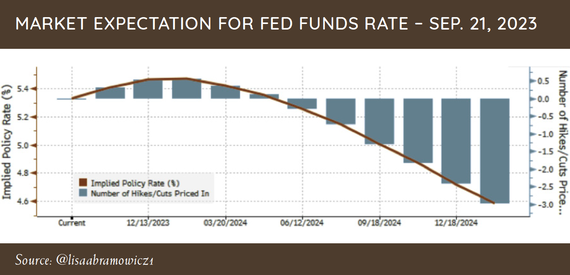

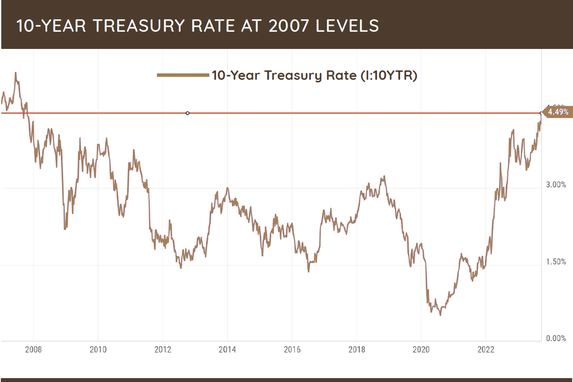

Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest! How quickly things get back to normal; the weather, I mean, not the economy. As I begin writing this it’s a blustery and wet fall day that serves to remind me that all things, good or bad, must eventually come to an end. Of interest to us all is where our economy is headed, something that will be determined by our collective adaptations to the higher interest rates and just how badly the embedded cost increases of the past years will affect the spending power of the middle class. While employment seems to be hanging on, many effects of the higher rates are just now being felt and are already sending out warning signals. Credit card delinquencies and defaults have risen to levels not seen since the “Great Recession,” and that can only be interpreted as a sign of consumer stress. If employment weakens, expect things to get even worse. Much of this stress is the result of the sticky inflation that has already happened. According to Mark Zandi, Chief Economist at Moody’s Analytics: “To be sure, the high inflation of the past 2+ years has done lots of economic damage. Due to the high inflation, the typical household spent $202 more in a July than they did a year ago to buy the same goods and services. And they spent $709 more than they did 2 years ago.” As employers are forced to increase wages, it’s likely that earnings will suffer. Another effect of the higher rates, not well understood by the general public, is the relationship between interest rates and growth expectations of stocks. Patrick has hit on this in the past, and it’s now being manifested in the price of the high growth stocks that drive the Nasdaq. I’ll leave it to Patrick to take a deeper dive into some of these topics. Let’s see what Patrick has to say: Patrick's PartThe third quarter saw the return of volatility across capital markets, with most asset classes posting negative returns. Large cap stocks, measured by the S&P 500, were down 3.7%, with bonds not fairing much better, falling 1.99%. The first half of the year, investor enthusiasm was rivaling periods we saw during market highs of 2021, as pundits pushed the narrative that inflation was being controlled and the Fed could soon start cutting interest rates. Growth and big cap tech stocks were the biggest beneficiaries of this, since the artificial intelligence (AI) story has become a popular investment theme. The excitement surrounding AI is reminiscent of the 1999-2000 time frame when any company attached to the internet was being awarded a very lofty multiple. I have written about the disconnect between a good story and a good investment, most recently in March of 2021. As with any good story, there are some partial truths that make the excitement surrounding the growth in a new technology sound compelling, which then awards select companies lofty valuations. In 1999, the partial truth and narrative focused on how impactful and beneficial the internet would be to society, and to company profits. Companies like Cisco were set to profit greatly from the internet’s increasing importance since they developed networking hardware and software. In fact, from fiscal years 1999-2001, Cisco’s revenue grew at a very impressive 83%. Now, one might think that the high growth in revenue would have equated to a soaring stock price to match that growth. In truth, during that same period, Cisco’s stock went on to lose over 80% of its value as even the company’s high growth rate could not match the even higher expectations that investors had placed on the company. Witnessing investors bid up a company like Nvidia to over 30x revenues shows that investors have very short memories about market history and the effects that high valuations can have on future returns. In fact, looking at Cisco’s share price movement during the last 10 months of 1999 is very similar to what we have seen with the share price of Nvidia over the previous 10 months. This is not a prediction of what is going to happen with the share price of Nvidia. They could very well grow into the high valuation the market has placed on them. However, a good company or story does not always equal a good investment, as Cisco and many other wonderful technology companies showed investors during the tech bubble. The last three months have seen investor sentiment shift from euphoric levels to a more cautious outlook for capital markets. The primary drivers of the market’s performance over the last three months have been the bond market and monetary policy. Market participants are coming to the realization that interest rates are more than likely to remain higher for a prolonged period, which can affect many different asset classes and investments. The chart below shows as recently as May 3rd, futures markets were pricing in rate cuts for the September Fed meeting that just took place, with rate cuts continuing until the Fed Funds rate was at 4.25% in January. Fast forward to September 21st: the futures market is now pricing in an additional rate hike this year with rate cuts not taking place until June of 2024. This has also corresponded with the rate on the 10-year treasury jumping to 4.49%, a level not seen since 2007 before the financial crisis. What I find interesting about the positive performance in stocks for this year is that many pundits were justifying rising stock prices on the belief that the Fed will change course and start to cut interest rates during the year. With the market now anticipating higher interest rates for longer, and rates might not be lowered until the middle of next year, the types of equities and bonds that will generate attractive risk adjusted returns could shift. The effects of higher interest rates on fixed income instruments, all things being equal, is straightforward. As interest rates rise, the value of a bond goes down to compensate for the new higher level of interest rates. To combat that interest rate risk in fixed income portfolios, we focus on short maturity, high quality bonds which exhibit less price movement during rising interest rate environments. The effects on equities are not as intuitive. In our March 2021 letter, I wrote about how different companies can be affected by higher inflation which generally leads to higher interest rates: If inflationary pressures and concerns become a reality, the tool kit used over that last cycle (investing in high revenue growth, low current earnings U.S. companies, combined with long dated bonds), will not have the same level of success that investors have become accustomed to. The bullet points below explain the intuition:

One could almost replace the word inflation with interest rates, and come to the same conclusion, so the bullet points above hold up well during the environment we find ourselves in now – of high interest rates and sticky inflation – for the simple reason of how to value a future stream of earnings. So, the one bullet point I would add now is:

Our approach has always been to buy companies and asset classes that are being offered at a low valuation, which helps combat the risk that higher interest rates can have on the present value of a company. Most equity markets remain quite expensive historically, so building a portfolio that can weather higher interest rates and valuation risk is paramount to being successful in the years ahead. The benefit of managing risk in the current environment, versus environments during the last 16 years, is that cash rates remain high. This allows us to earn a competitive return in money markets and treasury bills while we patiently wait for a more compelling investment environment that properly compensates investors for taking an elevated level of equity risk. As always, we will change our outlook and positioning, based on what the data and facts tell us. Thank you for your continued trust and support, and please don’t hesitate to reach out to me with any questions. —Patrick Mason

Hoping everyone is well, and that this new season brings new and exciting adventures.

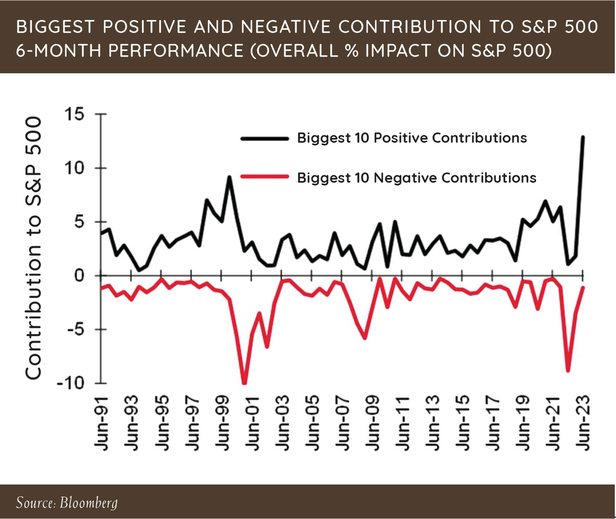

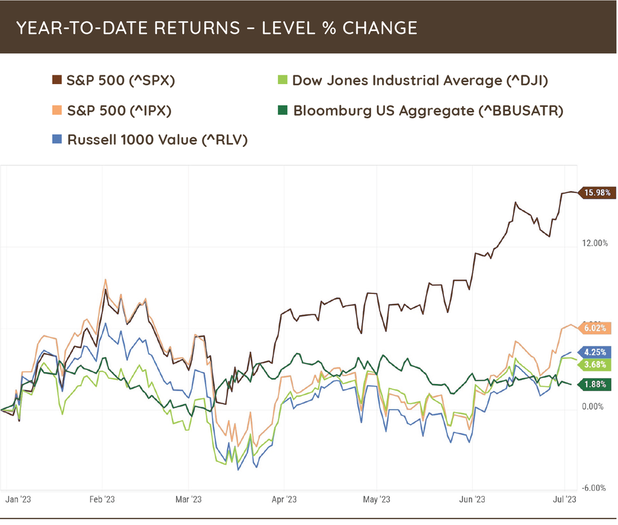

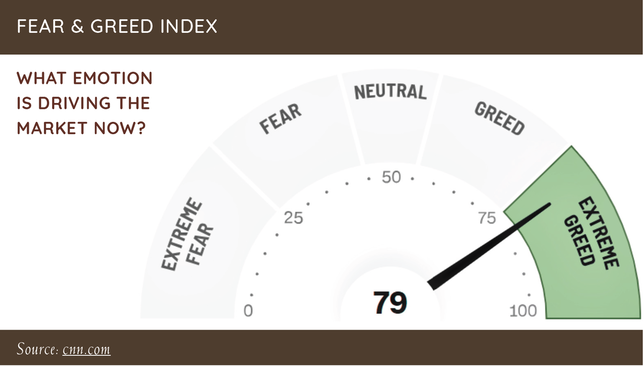

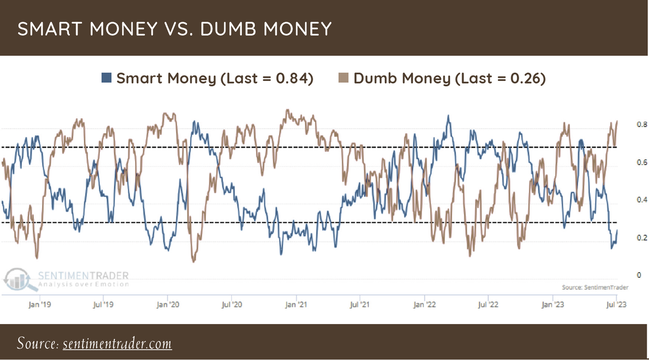

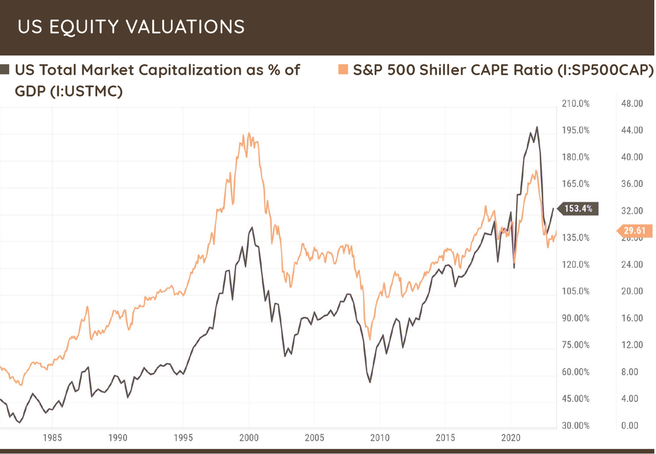

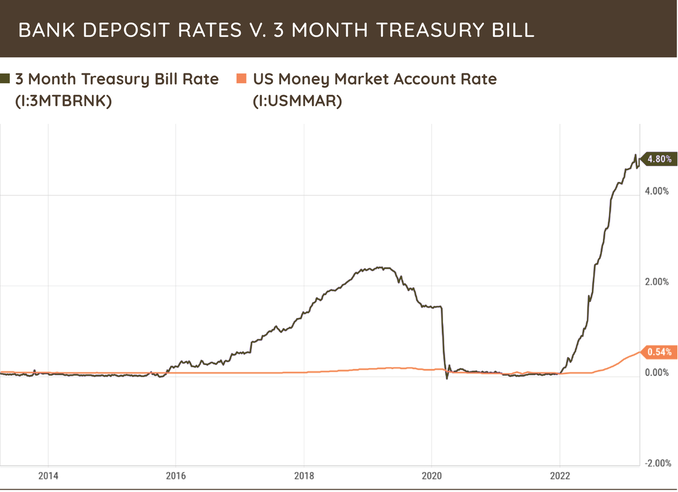

Tim Mosier, President, Cairn Investment Group, Inc. Greetings from the Northwest! What a difference 12 weeks makes in the weather! We’ve got a great start to the summer this year, not having to suffer through the typical June downpours before a sudden seasonal shift to dry and hot; we’re already there and my lawn is suffering. Sometimes it’s nice to have simple problems like that. Our friends in California are getting some great weather, too, but still dealing with an immense amount of water leaking out of the mountains. On a recent drive down the back side of the Sierra Nevada, I was delayed several times by flooding over US 395, and those mountains were still covered in snow. Every quarter I like to give a few thoughts on what I see as big picture issues that escape the casual viewer due to the “forest for the trees” effect, before handing things over to Patrick for his deeper dive into the current market conditions. Frankly, I’m having a tough time finding something to discuss this quarter, mainly because so much has not changed, and you deserve not to read my opinion for the third time on a topic! There are many macro issues in play, yet resolution for most has been slow. So, instead, I’ll turn inward a bit. First, I’ll remind everyone of our upcoming move. We’ll be out of the current location at the end of the day on July 13, the end of this week, and up and running on Monday, July 17 at our new headquarter location in Vancouver. Meetings that week can be scheduled at either the Vancouver location, or at our branch office in Portland. Remember that the Portland office is available by appointment only. Another exciting development is that Cairn can now manage your 401K and other employer sponsored retirement plans. If you have a desire for professional management of your retirement assets, let us know and we can discuss how this works and what advantages this may bring to your financial outlook. Finally, I’ll mention our expanding focus on financial planning. It’s something we’ve always done on demand but was not originally a core feature of our business. Times change and so have we. We have two Certified Financial Planners (CFP®) on staff, and we utilize the most comprehensive planning software available, allowing us to provide accurate and informative projections that reveal the key decisions that you must make as you make your way through life. This service has no additional cost to you, so if you feel like now is the time, let us know. With that I’ll hand things over to Patrick: Patrick's PartWith all the noise surrounding the economy, interest rates, and inflation, one could be forgiven for thinking that equity markets would be suffering. Instead, the S&P 500 has experienced a stellar first half. We have written at length regarding valuations, and risks facing current equity markets, and our opinion has not changed as nothing in the data has meaningfully shifted. In fact, today’s environment is similar to the one we wrote about a couple years ago when US equity markets were being driven by a few select companies. The two charts below show 6-month return contributions for the S&P 500 going back to 1991, and the year-to-date returns of some broadly followed indexes. Leadership has never been so narrow as it is right now, which is not the hallmark of a healthy market. The top 10 stocks in the S&P 500 now make up over 30% of the index compared to 17% in 2015. Investors throwing money into this bloated index are making a huge bet that market dynamics are forever changed. Enthusiasm for the most popular stocks is also evident in sentiment indicators, with both the CNN Fear & Greed Index and Sentimentrader’s Smart Money showing extreme optimism. This type of frothy sentiment has historically been a contrarian indicator when combined with high valuations. Outside of late 2021 and the tech crisis, valuations have never been higher. The silver lining in this challenging environment is the fact that we are still finding some attractive companies and asset classes that present compelling long-term value. And as the interest rate environment has shifted over the last 15 months, we are able to earn a return on cash while we patiently wait for a more attractive investment environment. Thank you for your continued trust. Please reach out to me if you have any questions or want to discuss any topic in more detail. —Patrick Mason Thanks, Patrick! With that, I’ll wish you all a wonderful summer full of family and travel.

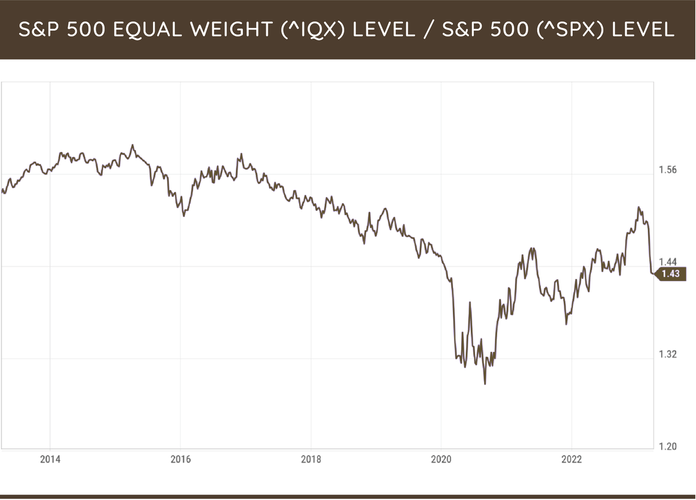

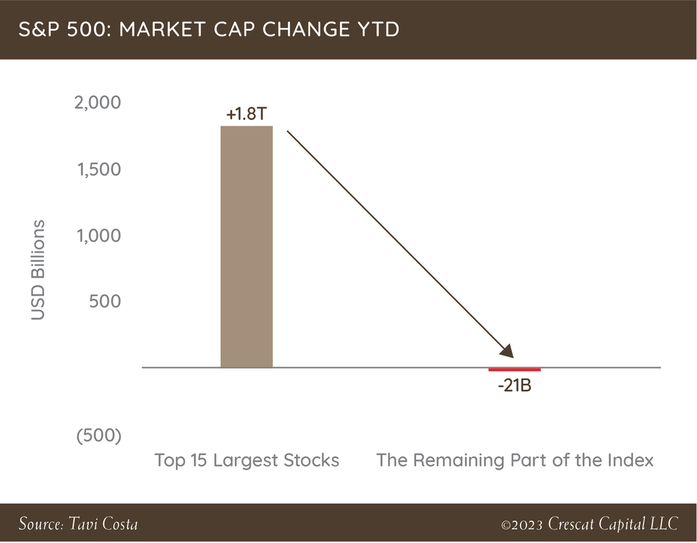

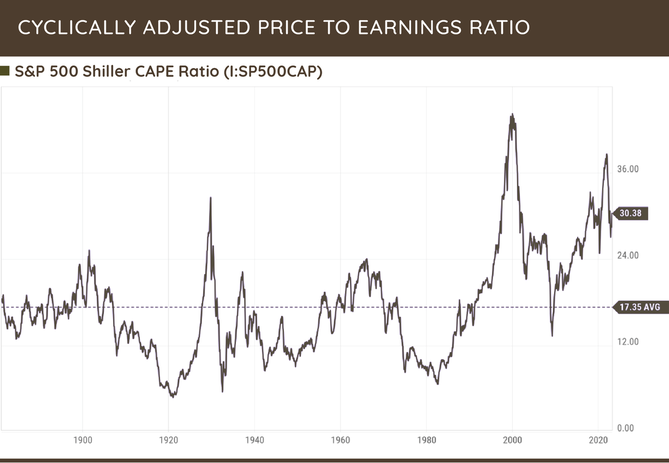

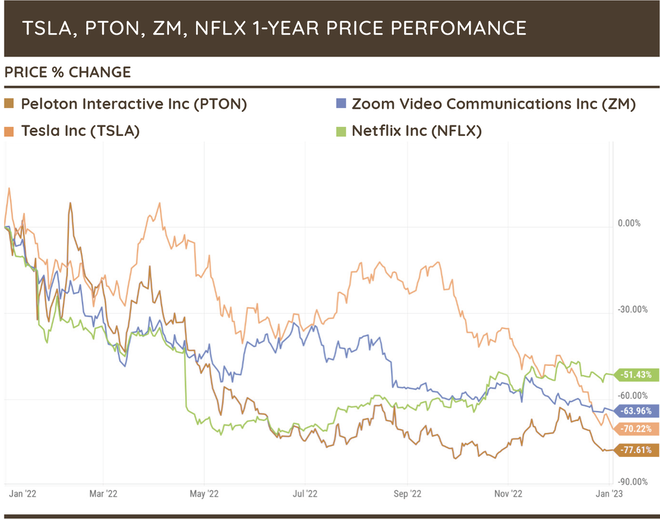

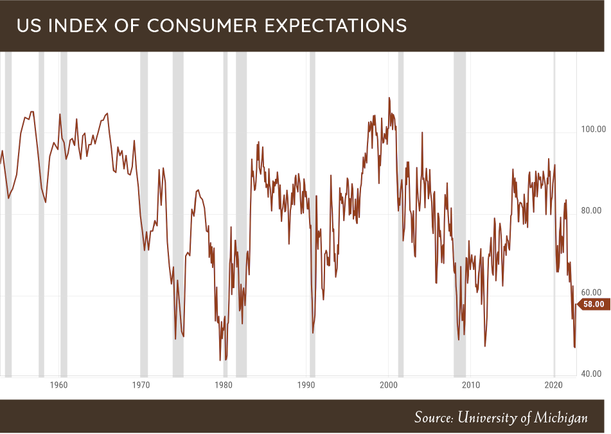

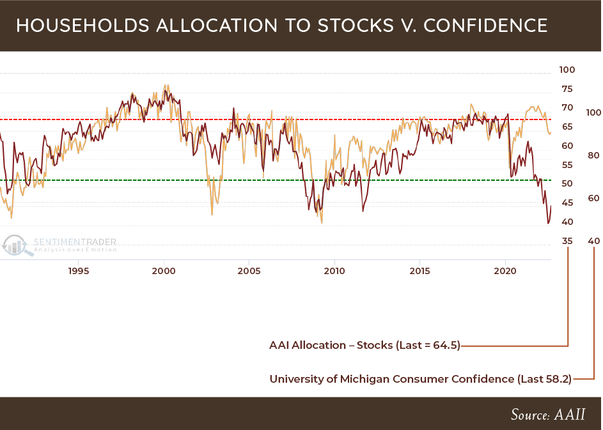

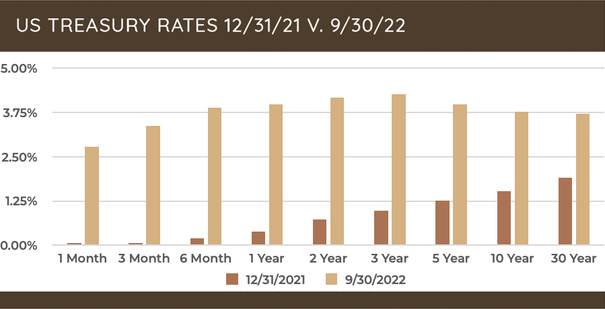

Tim Mosier, President, Cairn Investment Group, Inc. Greetings from the Northwest! I’ve heard that it’s finally Spring. I’d like to see some evidence before I believe it! All of us on the West Coast would welcome a change from the cold and rain. Attempting just that, I recently spent a few days at Disneyland with my granddaughters and rarely have I been so wet, and that’s from the perspective of a Northwesterner. I’m glad to be back in the dry, warm office. Speaking of the office, Cairn continues to grow! I’m happy to announce that Dan Poe, recently of Ameriprise, has joined us an Investment Advisor in Portland. His bio will be up soon on our website. With Dan, we’ll have four Advisors with the firm, and be better able to serve the diverse needs of our clients. I’m really looking forward to having his help in answering your many questions and making sure that our investment strategy is in sync with your needs. While the world roils around us, we feel that it’s vital to make these investments in people to assure our future. It’s been an interesting first quarter for 2023. While much has changed, like finding out that some big banks weren’t really solvent, much has not changed so much. Fundamentally, we’re still in a time of higher inflation, rising interest rates, and resilient employment. The same political and economic issues are being fought about in Washington. The major market indices are near historic highs, measured as either price or valuation. Since we have little exposure to the banking sector, and none at all to the banks considered at risk, our general outlook and plans remain steady. I’m sure that Patrick will expand on this. The recent bank implosions are worth discussing briefly, because they caused disruption in the financial markets, and many of you have been concerned about the safety of your money. Banks fail when the FDIC says they fail. Sometimes it seems unfair and too preemptive, but everyone in that game knows the rules. Insufficient liquidity, the inability to meet depositors’ withdrawal needs, is the measuring stick. You can get there by facing too many withdrawals too quickly, or by making poor investment choices. They usually find a way of coinciding. The failed banks all played a part in their own demise by poor investment management relative to their obligations to depositors, and also by being a bit too successful at winning jumbo-sized clients who can demand huge withdrawals in a flash, which they did. The vast majority of banks do not have these issues, and the largest, considered too big to fail, get easy liquidity from the US government as they need it. While 90% of bank deposits are FDIC insured across the country, Silicon Valley Bank operated with about 10% of its deposits insured. So hopefully, on that topic, we can relax a bit and realize it’s just part of the process of burning off excesses from our long bull market. At the height of the scare, the list of at-risk banks seemed to explode, and even included Schwab for a while. The metrics being cited were very one-dimensional and failed to recognize how well Schwab had consistently met the FDIC’s liquidity requirements, and how many billions of dollars Schwab has in reserve through the totality of its business. The company thought to be somewhat at risk, Schwab Bank, is just part of the overall Charles Schwab & Co., which includes the security broker dealer that custodies your assets. Only your Bank Deposit funds, also known as “sweep” funds, are connected to the Schwab Bank. These are insured up to $250,000 by the FDIC per account beneficiary. Schwab’s typical client has several types of accounts and is focused on overall wealth management much more than on banking. Almost half of these assets are managed by an advisor like Cairn, adding a layer of care and commitment that is unlike a typical bank. There is a nicely written piece on the Schwab website, in case you want to see some greater details on this. If you need to know more about this, just give us a call. Let’s see what Patrick has to say. Patrick's PartAll the turmoil in the banking sector, to date, has not rattled capital markets, with Large Cap stocks returning 7.50%, small cap 2.74%, international stocks 8.47% and bonds 2.96%. Headlines surrounding what the Fed might or might not do regarding interest rate hikes, combined with cracks materializing across regional banks, made for lots of volatility. At the end of the day, investors’ risk appetites remained strong despite these headwinds. There has been quite a bit written in the financial news about what has unfolded across the regional bank landscape. I won’t bore you with the small details, but the failure of Silicon Valley Bank was a byproduct of the Fed leaving interest rates artificially low for TOO long, not that the Fed started raising interest rates aggressively. Once interest rates, rightfully, started to rise, banks that had taken on too much risk investing in longer dated bonds exposed their balance sheet and solvency to risks most investors didn’t see coming. When deposit rates are close to zero, while T-Bills and money markets yield north of 4%, it can expose risks for banks that had invested customer deposits in long dated bonds. Technological advances have allowed clients to move cash balances quickly, and at banks that focused their deposit base on large clients with balances above FDIC limits (SVB, First Republic, etc.), a bank run can happen. I applaud the FDIC for how they have handled the situation, to date. Stepping in swiftly and backing all deposits, regardless of FDIC insurance limits, while wiping out equity and debt holders, is how bank failures should work. As Tim mentioned, we have very little exposure to the banking sector, and that is a byproduct of our process and our investment discipline. Over the last couple of years, I have mentioned that although valuations have been elevated for US stocks, one of the silver linings has been broad price participation. This means that returns were not being driven by a narrow list of names like markets witnessed from 2017 to early 2020. The chart below measures the S&P 500 equal weight v. the S&P 500. We have seen a steep reversal in market participation this year. The reversal has been so sharp, as this chart from Tavi Costa of Crescast Capital shows, the largest 15 stocks in the S&P 500 have generated 100% of the returns to start the year. The rebound in stocks to start the year has done nothing to alleviate the issue of lofty valuations for the S&P 500. Even with the index down close to 8% over the last year, valuations still sit at close to all-time highs. As a reminder, long-term returns, generated by stocks, are comprised of three variables: earnings growth, dividend yield, and change in valuation. To get to the 10% historical average return in US stocks that investors are beaten over the head with, you start with: earnings growth of 6% historically, plus a dividend yield of 2%, which puts you at 8%. To make up the 2% difference, multiple expansion needs to take place. Given that we are already sitting at historically high multiples, that seems to be unlikely. I would argue the path of least resistance is to have multiples contract, meaning that valuations will be a drag on returns for US stocks. It is just math. The combination of high valuations, poor market participation, and a market that is still in a downtrend does not strike us as an environment where taking excessive risk will be rewarded. The bright side is that our investment universe is not limited to the S&P 500; and, being value managers, we are always focused on the price we are paying for an investment and whether that provides an adequate margin of safety before putting your capital at risk. We are still finding some attractively valued investments in US stocks, though the opportunities are limited. We find international equities to be more attractive and we look for opportunities to continue to add to that asset class when appropriate. Thank you for your continued trust. Please drop me a line if you want to discuss any topic in greater detail. —Patrick Mason Greetings from the Northwest! It’s a new year, and, I hope, a happy one! I had to check the calendar to believe that it’s been three years now since I took the helm from Jim and began writing the opening lines of these newsletters, and what a three years it’s been! It’s a matter of fact that none of us truly knows what the future holds, but I must say, “How could I have known” that Covid would shut down the economy in just a matter of weeks, tanking the stock market with it, and that massive government aid and a taste for speculation would propel markets to new highs while the pandemic still raged? In that first newsletter we were already expressing concern that markets were pricey and that risk-taking behavior was higher than warranted. Patrick shared the CNN Money Fear & Greed Index, with the indicator firmly planted in the “Extreme Greed” quadrant. I did not track that meter much over the next year, but it must have been quite dynamic as the events unfolded. As I write this, it is firmly in the “Fear” quadrant. We know now, that in fact, many assets were overpriced, and some hard lessons were learned by those who chased performance or went all in on the “highflyers.” I’m glad that I never participated in the Crypto Craze and both Patrick and I gave consistent advice against it. That’s just a foundational part of who we are and how we think, rather than some precognition or other talent. Our beliefs and our processes have served us well as the market has deflated off its highs this year and will continue to provide a buffer against what may come. Speaking of which, I see 2023 as a year of reckoning with number of issues, not all financial in nature. A new burst of economic growth is unlikely to happen until inflation is back to reasonable levels. We’ll all have to live with new higher interest rates and adapt our personal economic decisions around them. So too, our political leaders will need to grapple with this, as the cost of funding their unprecedented spending is no longer free. The war in Ukraine needs to get resolved in favor of Ukraine for many reasons; one is that the adoption of Ukraine into the European community and the rebuilding that will follow may well be “the thing” that launches our next recovery. The opposite outcome is too bleak to consider. With that I’ll hand things over to Patrick for a more specific and detailed examination of your investment prospects. Patrick's PartWhat a difference a year makes. As Tim mentioned, at the start of 2022 investors were trumpeting the strong stock market returns and accommodative fiscal and monetary policy that 2021 witnessed. Although 2021 had ended well, we discussed in our 4th quarter letter that inflation pressures were starting to alter consumer sentiment, which could have a profound impact on corporate profits and valuations. Well, here we are a year later, and valuations have slightly improved, with the S&P 500 having fallen over 18%, whereas international stocks measured by the MSCI EAFE fared slightly better, declining by over 14%. Negative performance in the bond market is what caught most investors by surprise, with the Bloomberg US Aggregate declining more than 13%. Seeing both stocks and bonds decline at the same time is not something most investors are used to experiencing, leaving the unprepared asking, “Where can I hide?” Thankfully, we at Cairn were prepared for what had transpired and were able to avoid many of the large drawdowns in stocks and bonds. Our disciplined process is built around finding unrecognized value in companies and asset classes, and then making sure we are compensated enough for the risks that could unfold. If we are not finding opportunities, we are more than willing to hold cash, which was one of the best performing asset classes in 2022! Many of you have expressed concerns in the past about holding cash, since interest rates were at very low levels. My response was always two-pronged: First, cash gives you instant optionality to do something different without having to sell something in your portfolio that you might not want to sell. Second, cash is the BEST short-term inflation hedge. As inflation and short-term rates start to rise, your cash rate adjusts and the nominal value of your cash does not go down, unlike stocks and bonds. Many of the Covid darlings that rewarded investors in 2020 and 2021 saw their share prices drop by 50-80% in the last year as interest rates increased and concerns about future growth took center stage. We have discussed this many times in the past, that the price paid for an asset is the largest determiner of your future return. Growth investors learned this lesson in real time. The chart below shows the one-year price performance of four of the Covid darlings; Tesla, Netflix, Zoom Video, and Peloton Interactive. Equal weight ownership of these companies would have produced a return of -64% in 2022. I have nothing against any of these four companies (I love my Peloton); I just use them as an example that large losses can be realized by paying too high a price for even disruptive and innovative companies. In fact, of these four companies, only Tesla has had a positive price performance over the last 3 years. Large losses destroy compounding much faster than the benefit of a large unrealized gain. Our disciplined value philosophy also served us relatively well during 2022. I must admit, my patience was put to the test from 2014-2021 as value underperformed growth by a wide margin, prompting many headlines stating that value was dead. Though one year does not signal a complete shift in trend, I am happy to hear that argument going silent. As the chart below shows, value stocks have outperformed growth stocks by over 30% from their lows of November 2021. If history is any guide, we are still in the early stages of this outperformance, especially given the current inflation and interest rate backdrop. Concerning inflation and interest rates, as we have said many times, we are not in the business of predicting the direction of inflation and interest rates but will observe where we are now to make decisions. Our view based on the current data is that inflation will continue to come down from its peak levels witnessed in the fall. Many pressures that caused the spike in inflation will inevitably roll off as the months go on. The Fed has stated that they intend to keep short-term rates higher than inflation for longer than what capital markets might expect. We will see. Historically, the Fed has changed their tune as soon as financial stress gets too painful. The strong performance of stocks during the 4th quarter seems to point to the “hope” that the Fed will have to reverse course sooner than later. But as a reminder, the Fed has never cut rates when inflation is above the Fed Funds Rate. And looking at the chart below, we still have a way to go. As we enter a new year, our portfolio positioning remains defensive as risks are still tilted towards the downside. If we get a more material retreat in valuations or price behavior improves, we will be more than happy to put some of our excess cash to work. From an asset class perspective, we still have a positive intermediate term view on international stocks, though that was not materially helpful during 2022. With the strength in the US Dollar starting to subside, international equities could provide a nice tailwind in the future as valuations are much more attractive than broad US stocks. Thank you again for your continued trust and support. I’m always happy to discuss any of these topics in more detail, so drop me a line anytime. —Patrick Mason  Thank you, Patrick. You may have noticed that a smiling new face has been added to our team in the form of Stefanie Schneider. Hopefully, more of you will make it into the office as the season turns, and have a chance to introduce yourself. Remember, the coffee is always hot and free. Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. I can hardly believe that it’s been a year since I wrote of frosty mornings and fall colors! This year it’s summerlike temperatures, sunglasses, and tinder dry vegetation. I’m afraid that the eventual but certain surrender to Autumn may be more abrupt than usual. It’s been a rough investing season so far. I’m not sure I know why the stock market likes to pick the fall to make its most dramatic downside moves, but if September is a gauge, we’re probably in for some more pain before the bargain shopping kicks into gear to turn things around. We’ve done much to protect your assets from the most painful moves, as Patrick will point out, and we’ll continue to look for opportunities to reduce risk or pick up a bargain when we can. For most of you, staying the course will yield the best result, but if your needs and circumstances have changed, please let us know so that we can re-evaluate our plan. Here’s a topic that we’ve never really touched on before, and it has nothing to do with making you more money: In times like this it’s common to allow negative sentiment to seep into our decision making and knock us out of our normal patterns in many unexpected ways. While we’re all experiencing what’s likely a temporary reduction in our wealth, many of the organizations that provide for those in need, protect the environment, or otherwise do the hard work that most of us cannot do ourselves, still need our help, and they often find that getting the funds to do so is a bit tougher in times like this. I suggest that we continue to remember the causes that are dear to us, even when our own fortunes may be somewhat less. With that, I’ll hand things over to Patrick, who will again school us on the numerical realities of investing. Patrick's PartIt is understandable to hear investors’ comments about never having seen a market environment like the one we are living through now, having never witnessed both US stocks and bonds decline for 3 quarters in a row (h/t Liz Ann Sonders). High inflation, and the Fed’s response by raising interest rates at an unprecedented pace, have caused a shift in investor sentiment and risk-taking behavior across numerous asset classes. We have observed a quick reversal in how households and investors are feeling about their future, with the consumer expectations index hovering in recessionary territory. Though households are feeling pessimistic about the future, it seems like most investors have been conditioned over the years to expect that the Fed will always have their back, so even though pessimism is high, it seems like a fake pessimism. Although we are still in a bear market, and households are as pessimistic about the current economic environment as they have been in 30 years, very few are acting like it. The chart below shows household allocations to stocks still sitting at close to 65%, which is much higher than previous bear market lows where consumer confidence currently sits. So even though valuations have come down from their extremes (though still not cheap) and sentiment is low, the fact is that household allocations to stocks remain elevated, and we haven’t seen the signs of capitulation that signal that this bear market is over. In our first quarter letter we suggested that TINA (There is No Alternative) might be a thing of the past, as interest rates were starting to move higher. I think market pundits are going to have to come up with a new acronym, now that interest rates have risen substantially this year. The chart below shows US treasury bond rates at the start of the year and what the corresponding rates are now. Needless to say, there are now compelling opportunities to earn interest in more conservative assets, which we have not seen since 2007. Another observation looking at this chart that has been caused by aggressive Fed policy is this: I don’t know how something doesn’t break with rates rising as quickly as they have across the entire yield curve. Treasury rates are the starting place for the pricing of many other financial products across capital markets (just look at the current 30-year mortgage rate of 6.70%). Time will tell if the Fed will/can remain so vigilant in fighting inflation if higher rates start to have more broad consequences across the economy and capital markets. We have spoken many times over the years about the risks that have been present in markets due to high valuation combined with overly optimistic sentiment. We are not seeing those risks become a reality. We have preached risk management and protecting against the full brunt of market losses when bull market cycles inevitably turn. Though portfolios are down this year, holding extra cash and focusing on attractively valued companies and asset classes have helped us not participate in the full brunt of equity market losses. In our fixed income portfolios, we have focused on high quality, shorter maturity bonds which have also held up well compared to the broader fixed income market. Even though we are still cautious in thinking that the worst is behind us, we are now finding opportunities in companies and asset classes that were not present a year ago. Having extra cash in portfolios accomplishes two important goals during this period. First, it helps protect the portfolio when both stocks and bonds are not performing well. Second, it allows us to take advantage of opportunities without having to sell other assets that might be at depressed prices. So even though we still view risk as being elevated, we have the flexibility to shift gears when the time comes. We appreciate your continued trust and are always open to discuss any topic or concern in more detail if needed. —Patrick Mason Thanks, Patrick. If any of this feels like it needs a better explanation, please give us a call.

Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. It looks like this year’s take on summer has arrived, and we’re seeing a noticeable surge in the number of people mingling, dining out, shopping, and pursuing their outdoor passions, despite the higher costs that have been lightening wallets. The basic human need to live our lives and move beyond the virus is driving this burst of social activity. We’ll see how long this can survive in the face of the higher prices we’re experiencing. I’m sure glad I don’t have air travel planned any time soon, as that appears to be an unpredictable and expensive mess. So here we are, officially in a bear market, having just completed the worst first half experienced in our stock markets since the 1970s, with more clouds in the distance, as historically, the second half is the rougher. We’re probably in a recession, but a strange one. The economy is trying to burst forth from our COVID-induced lull, while at the same time the Fed is dousing the flames of the stimulus bonfire; and there’s a war and a lingering virus. The stock market has been overpriced for some time, so it’s not surprising to see a pull back, and Patrick will point out that overall, it’s still not cheap, despite some huge drawdowns in the more speculative asset classes. Housing is due for a correction of sorts, and it’s probably in the early stages of one. Depending on who you talk to and where you get your news, you could get the impression that the sky is falling and that we’re in a complete and total market meltdown. To be sure, it has been tough to find shelter in this storm, but I find comfort in our process, imperfect as it may be, believing that we’ll come out of this better than the broader markets, and well prepped for whatever’s next. Your actual experiences will vary, but I believe that what you have seen so far with your investments is distinctly less frightening than the shrill alarms being heard on many media outlets. On another, somewhat related note, I’m proud and excited to share with you that Cairn Investment Group was honored this last month as one of Oregon’s fastest growing private companies by the Portland Business Journal, the result of much hard work by the entire team. With that, on to Patrick and some specific and useful thoughts: Patrick's PartEquity and fixed income markets continued their march lower during the 2nd quarter, as investors continued to absorb rising inflation, tighter monetary policy, corporate profit margin pressures, and still high equity valuations. There were very few places for investors to hide during the first half of the year as large cap stocks, measured by the S&P 500, are down -19.96% and the Bloomberg US Aggregate Bond Index down -10.35%. I pointed to this as a risk in our Q1 2021 letter:

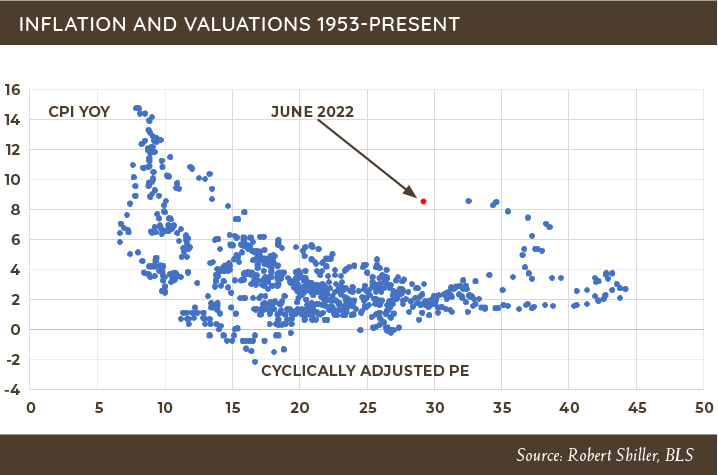

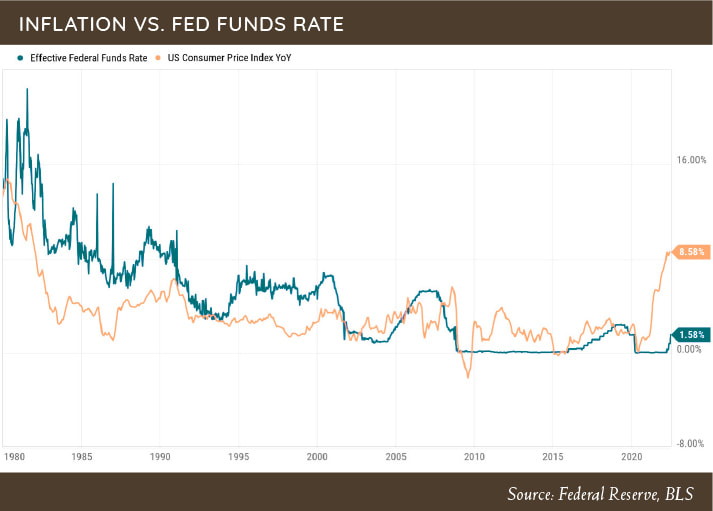

As we’ve discussed with many of you during meetings and reviews, stocks are not a very good inflation hedge when they are combined with high valuations. It’s only after valuations return to a more reasonable level that stocks offer a good hedge against inflation. The actual best hedge (short-term) against inflation is cash, which is why we have been holding a higher-than-normal cash allocation in portfolios for the last 18 months. The chart below shows inflation (vertical scale) and valuations (horizontal scale). As it illustrates, generally when you have 8.5% inflation, valuations are much lower than where they currently stand. So even though valuations have fallen from their historical extremes that investors were witnessing to start the year, they are still well above normal given the current inflationary backdrop. To combat the steady rise in inflationary pressures the economy has been experiencing, the Fed has become more aggressive in raising interest rates and tightening financial conditions. During their June meeting they raised the fed funds rate by 0.75% and have been hinting that another 0.75% hike might take place in July. As the chart below indicates, historically, when inflation is over 8% the fed funds rate is higher, not lower, than the inflation rate. So, if inflation stays high, then the fed has a way to go in raising rates. The biggest argument that we hear about why the Fed should slow their pace of interest rate hikes is the problem with the toolkit the Fed has to cool inflation. The options available are useful in decreasing the demand side of the inflation, not the supply side. Lyn Alden, of Alden Investment Strategy, said it best in her most recent monthly newsletter:

By raising interest rates, the Fed is in essence trying to raise unemployment and cool consumer demand. These actions could slow inflation for a period of time but, unfortunately, the price paid might be an economy that goes into recession. We are not in the business of predicting recessions, but we do have to be aware of the environment we are in and manage through it appropriately. With that said, we have a hard time believing that if the Fed continues down its current path, a soft landing they are hoping for is the most likely outcome. Through all the negativity there are some silver linings. Though the S&P 500 is down over 20% from its highs, many companies and asset classes have fared far worse. Many of the high-flying growth stocks that helped fuel the market bubble we were in, are now trading like beaten up value stocks. Overall, portfolios continue to hold higher than normal cash positions and are defensively positioned based on what the data is showing us. This provides us plenty of flexibility to change course when opportunities present themselves across the investment landscape. Combined with our cash allocation, we continue to hold a portfolio consisting of high quality, value-oriented stocks and bonds across asset classes that can weather market turbulence and provide the ability for capital appreciation, once the market environment eventually changes course. Thank you again for your continued trust and feel free to reach out to me to discuss any topics in greater detail. —Patrick Mason Thanks Patrick.

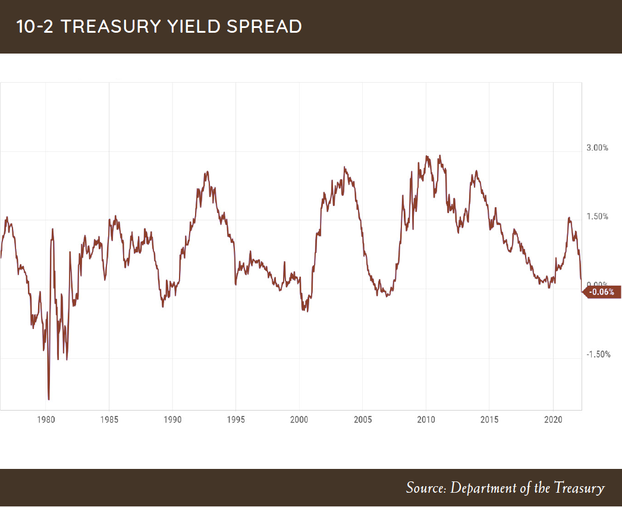

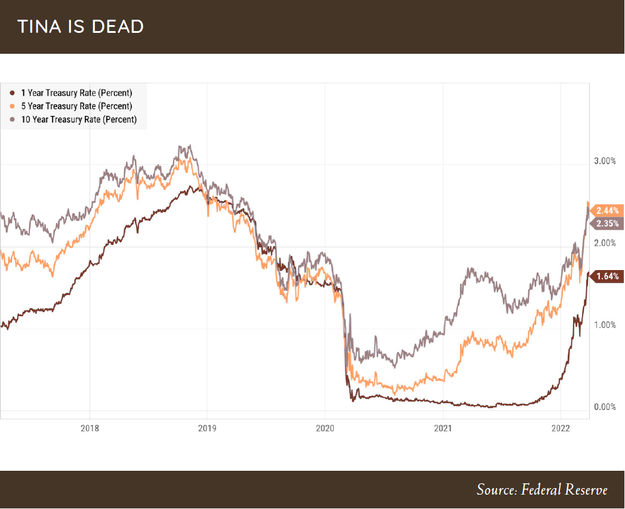

Here’s a reminder that the office is open, the coffee is fresh and hot, so please, don’t be shy about requesting an appointment or giving us a ring. Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. To say that there have been a lot of moving parts, in capital markets and economy, would be an understatement. Though equity and fixed income markets both finished down for the quarter, March provided some reprieve. Having both stocks and treasury bonds decline at the same time is a rare phenomenon. Over the last 100 years, it has happened four times during a calendar year. I guess we will see how the next nine months go. Many of the headlines being written, and market pundits’ comments, have been blaming the volatility that we have been witnessing in stocks on geopolitical concerns. While we are appalled at the conflict in Ukraine, we continue to believe the main drivers of equity and fixed income price movements are inflation, interest rates, and monetary policy. We have written about these topics many times over the last couple of years, and our opinion, based on data, has not changed. Inflation is here, and it is not going away anytime soon. Interest rates, and the Fed’s reaction to inflation, have been behind the curve; so now monetary policy makers are forced to play catch-up by raising rates into a slowing economy. A term that you might start to hear more over the next few quarters will most likely be “Stagflation.” Stagflation is the ugly combination of high inflation and declining economic activity, which the US has not witnessed since the 1970s. As I spoke about last quarter, rising inflation has affected consumer expectations about their future and that continues to show up in the data. The bond market has also started to take notice as the US treasury bond yield curve is the most inverted since the financial crisis. The yield curve has a strong track record of predicting a slowdown in economic activity. There will be plenty of talk about how “this time is different.” We would take those arguments with a huge grain of salt. We are not predicting, just observing the conditions and responding appropriately. If the environment changes, we will change our mind. On a positive note, there have been arguments over the last couple of years justifying the strong performance in equity markets as being driven by having no other alternative (TINA) due to interest rates being at historic lows. With the recent jump in treasury bond yields, this is no longer the case. Investors now have some options to earn income in relatively safe investments, which should impact decision-making at some point. This positive development will allow investors options for investing and provide competition for capital, which is beneficial to determine fair prices for many different asset classes. Overall, we have been pleased how portfolios have reacted during this shift in market behavior. Having a value bias during this rising interest rate environment has been helpful, as we have talked about previously. We continue to focus our equity allocation on companies and asset classes that generate consistent free cash flow, have resilient operating performance, and returns on capital that trade at attractive valuations. The main detractor to performance has been our allocation to international stocks. We continue to view international equities to be much more attractively valued than US stocks, so we are willing to be patient. Bonds have not been spared the volatility in capital markets. We manage your fixed income to be short-term in maturity and with lower credit risk than the broader bond market. Our focus on risk management, the willingness to hold cash, and be patient provides your portfolio flexibilities that are well positioned to navigate this challenging market environment. Thank you again for your continued trust. I have had many great talks with you over the last few months and continue to invite a conversation on anything you find needs further discussion. —Patrick Mason |

RSS Feed

RSS Feed