|

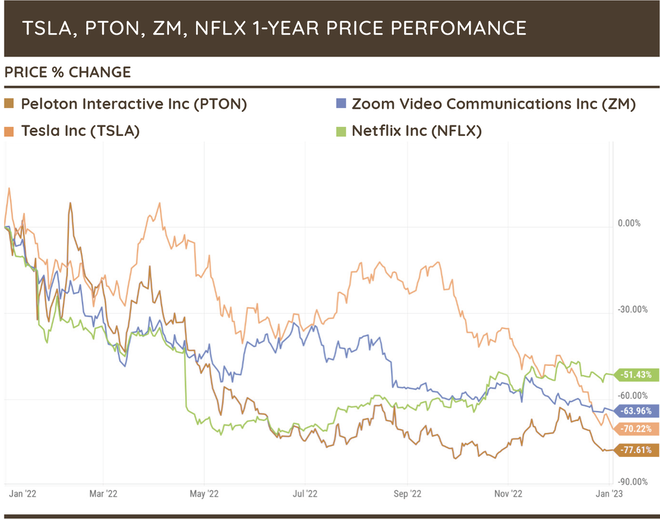

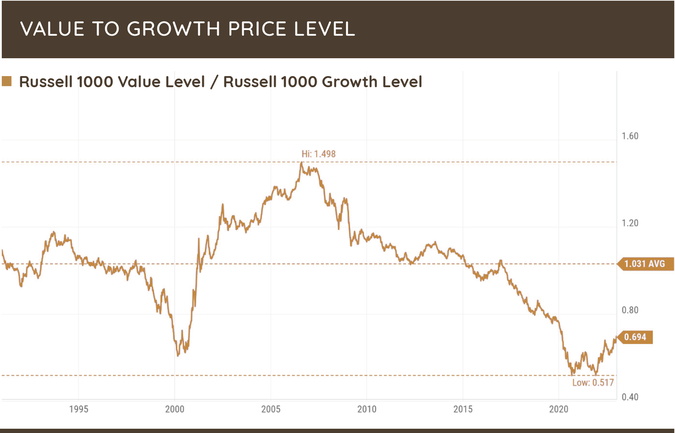

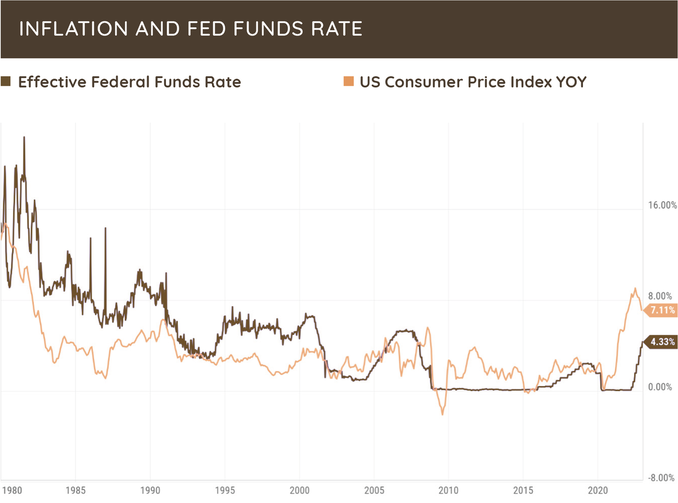

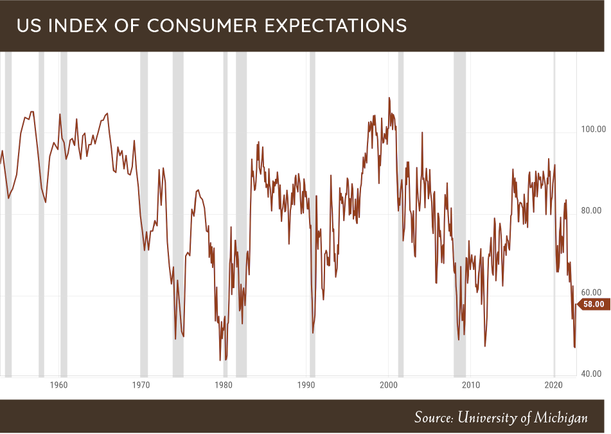

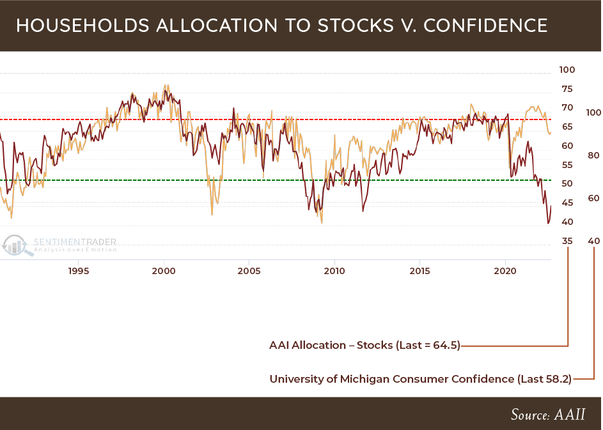

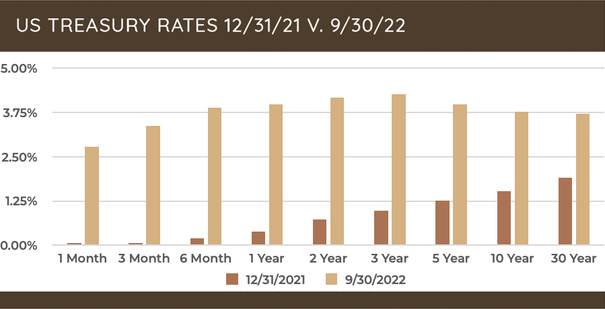

Greetings from the Northwest! It’s a new year, and, I hope, a happy one! I had to check the calendar to believe that it’s been three years now since I took the helm from Jim and began writing the opening lines of these newsletters, and what a three years it’s been! It’s a matter of fact that none of us truly knows what the future holds, but I must say, “How could I have known” that Covid would shut down the economy in just a matter of weeks, tanking the stock market with it, and that massive government aid and a taste for speculation would propel markets to new highs while the pandemic still raged? In that first newsletter we were already expressing concern that markets were pricey and that risk-taking behavior was higher than warranted. Patrick shared the CNN Money Fear & Greed Index, with the indicator firmly planted in the “Extreme Greed” quadrant. I did not track that meter much over the next year, but it must have been quite dynamic as the events unfolded. As I write this, it is firmly in the “Fear” quadrant. We know now, that in fact, many assets were overpriced, and some hard lessons were learned by those who chased performance or went all in on the “highflyers.” I’m glad that I never participated in the Crypto Craze and both Patrick and I gave consistent advice against it. That’s just a foundational part of who we are and how we think, rather than some precognition or other talent. Our beliefs and our processes have served us well as the market has deflated off its highs this year and will continue to provide a buffer against what may come. Speaking of which, I see 2023 as a year of reckoning with number of issues, not all financial in nature. A new burst of economic growth is unlikely to happen until inflation is back to reasonable levels. We’ll all have to live with new higher interest rates and adapt our personal economic decisions around them. So too, our political leaders will need to grapple with this, as the cost of funding their unprecedented spending is no longer free. The war in Ukraine needs to get resolved in favor of Ukraine for many reasons; one is that the adoption of Ukraine into the European community and the rebuilding that will follow may well be “the thing” that launches our next recovery. The opposite outcome is too bleak to consider. With that I’ll hand things over to Patrick for a more specific and detailed examination of your investment prospects. Patrick's PartWhat a difference a year makes. As Tim mentioned, at the start of 2022 investors were trumpeting the strong stock market returns and accommodative fiscal and monetary policy that 2021 witnessed. Although 2021 had ended well, we discussed in our 4th quarter letter that inflation pressures were starting to alter consumer sentiment, which could have a profound impact on corporate profits and valuations. Well, here we are a year later, and valuations have slightly improved, with the S&P 500 having fallen over 18%, whereas international stocks measured by the MSCI EAFE fared slightly better, declining by over 14%. Negative performance in the bond market is what caught most investors by surprise, with the Bloomberg US Aggregate declining more than 13%. Seeing both stocks and bonds decline at the same time is not something most investors are used to experiencing, leaving the unprepared asking, “Where can I hide?” Thankfully, we at Cairn were prepared for what had transpired and were able to avoid many of the large drawdowns in stocks and bonds. Our disciplined process is built around finding unrecognized value in companies and asset classes, and then making sure we are compensated enough for the risks that could unfold. If we are not finding opportunities, we are more than willing to hold cash, which was one of the best performing asset classes in 2022! Many of you have expressed concerns in the past about holding cash, since interest rates were at very low levels. My response was always two-pronged: First, cash gives you instant optionality to do something different without having to sell something in your portfolio that you might not want to sell. Second, cash is the BEST short-term inflation hedge. As inflation and short-term rates start to rise, your cash rate adjusts and the nominal value of your cash does not go down, unlike stocks and bonds. Many of the Covid darlings that rewarded investors in 2020 and 2021 saw their share prices drop by 50-80% in the last year as interest rates increased and concerns about future growth took center stage. We have discussed this many times in the past, that the price paid for an asset is the largest determiner of your future return. Growth investors learned this lesson in real time. The chart below shows the one-year price performance of four of the Covid darlings; Tesla, Netflix, Zoom Video, and Peloton Interactive. Equal weight ownership of these companies would have produced a return of -64% in 2022. I have nothing against any of these four companies (I love my Peloton); I just use them as an example that large losses can be realized by paying too high a price for even disruptive and innovative companies. In fact, of these four companies, only Tesla has had a positive price performance over the last 3 years. Large losses destroy compounding much faster than the benefit of a large unrealized gain. Our disciplined value philosophy also served us relatively well during 2022. I must admit, my patience was put to the test from 2014-2021 as value underperformed growth by a wide margin, prompting many headlines stating that value was dead. Though one year does not signal a complete shift in trend, I am happy to hear that argument going silent. As the chart below shows, value stocks have outperformed growth stocks by over 30% from their lows of November 2021. If history is any guide, we are still in the early stages of this outperformance, especially given the current inflation and interest rate backdrop. Concerning inflation and interest rates, as we have said many times, we are not in the business of predicting the direction of inflation and interest rates but will observe where we are now to make decisions. Our view based on the current data is that inflation will continue to come down from its peak levels witnessed in the fall. Many pressures that caused the spike in inflation will inevitably roll off as the months go on. The Fed has stated that they intend to keep short-term rates higher than inflation for longer than what capital markets might expect. We will see. Historically, the Fed has changed their tune as soon as financial stress gets too painful. The strong performance of stocks during the 4th quarter seems to point to the “hope” that the Fed will have to reverse course sooner than later. But as a reminder, the Fed has never cut rates when inflation is above the Fed Funds Rate. And looking at the chart below, we still have a way to go. As we enter a new year, our portfolio positioning remains defensive as risks are still tilted towards the downside. If we get a more material retreat in valuations or price behavior improves, we will be more than happy to put some of our excess cash to work. From an asset class perspective, we still have a positive intermediate term view on international stocks, though that was not materially helpful during 2022. With the strength in the US Dollar starting to subside, international equities could provide a nice tailwind in the future as valuations are much more attractive than broad US stocks. Thank you again for your continued trust and support. I’m always happy to discuss any of these topics in more detail, so drop me a line anytime. —Patrick Mason  Thank you, Patrick. You may have noticed that a smiling new face has been added to our team in the form of Stefanie Schneider. Hopefully, more of you will make it into the office as the season turns, and have a chance to introduce yourself. Remember, the coffee is always hot and free. Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. I can hardly believe that it’s been a year since I wrote of frosty mornings and fall colors! This year it’s summerlike temperatures, sunglasses, and tinder dry vegetation. I’m afraid that the eventual but certain surrender to Autumn may be more abrupt than usual. It’s been a rough investing season so far. I’m not sure I know why the stock market likes to pick the fall to make its most dramatic downside moves, but if September is a gauge, we’re probably in for some more pain before the bargain shopping kicks into gear to turn things around. We’ve done much to protect your assets from the most painful moves, as Patrick will point out, and we’ll continue to look for opportunities to reduce risk or pick up a bargain when we can. For most of you, staying the course will yield the best result, but if your needs and circumstances have changed, please let us know so that we can re-evaluate our plan. Here’s a topic that we’ve never really touched on before, and it has nothing to do with making you more money: In times like this it’s common to allow negative sentiment to seep into our decision making and knock us out of our normal patterns in many unexpected ways. While we’re all experiencing what’s likely a temporary reduction in our wealth, many of the organizations that provide for those in need, protect the environment, or otherwise do the hard work that most of us cannot do ourselves, still need our help, and they often find that getting the funds to do so is a bit tougher in times like this. I suggest that we continue to remember the causes that are dear to us, even when our own fortunes may be somewhat less. With that, I’ll hand things over to Patrick, who will again school us on the numerical realities of investing. Patrick's PartIt is understandable to hear investors’ comments about never having seen a market environment like the one we are living through now, having never witnessed both US stocks and bonds decline for 3 quarters in a row (h/t Liz Ann Sonders). High inflation, and the Fed’s response by raising interest rates at an unprecedented pace, have caused a shift in investor sentiment and risk-taking behavior across numerous asset classes. We have observed a quick reversal in how households and investors are feeling about their future, with the consumer expectations index hovering in recessionary territory. Though households are feeling pessimistic about the future, it seems like most investors have been conditioned over the years to expect that the Fed will always have their back, so even though pessimism is high, it seems like a fake pessimism. Although we are still in a bear market, and households are as pessimistic about the current economic environment as they have been in 30 years, very few are acting like it. The chart below shows household allocations to stocks still sitting at close to 65%, which is much higher than previous bear market lows where consumer confidence currently sits. So even though valuations have come down from their extremes (though still not cheap) and sentiment is low, the fact is that household allocations to stocks remain elevated, and we haven’t seen the signs of capitulation that signal that this bear market is over. In our first quarter letter we suggested that TINA (There is No Alternative) might be a thing of the past, as interest rates were starting to move higher. I think market pundits are going to have to come up with a new acronym, now that interest rates have risen substantially this year. The chart below shows US treasury bond rates at the start of the year and what the corresponding rates are now. Needless to say, there are now compelling opportunities to earn interest in more conservative assets, which we have not seen since 2007. Another observation looking at this chart that has been caused by aggressive Fed policy is this: I don’t know how something doesn’t break with rates rising as quickly as they have across the entire yield curve. Treasury rates are the starting place for the pricing of many other financial products across capital markets (just look at the current 30-year mortgage rate of 6.70%). Time will tell if the Fed will/can remain so vigilant in fighting inflation if higher rates start to have more broad consequences across the economy and capital markets. We have spoken many times over the years about the risks that have been present in markets due to high valuation combined with overly optimistic sentiment. We are not seeing those risks become a reality. We have preached risk management and protecting against the full brunt of market losses when bull market cycles inevitably turn. Though portfolios are down this year, holding extra cash and focusing on attractively valued companies and asset classes have helped us not participate in the full brunt of equity market losses. In our fixed income portfolios, we have focused on high quality, shorter maturity bonds which have also held up well compared to the broader fixed income market. Even though we are still cautious in thinking that the worst is behind us, we are now finding opportunities in companies and asset classes that were not present a year ago. Having extra cash in portfolios accomplishes two important goals during this period. First, it helps protect the portfolio when both stocks and bonds are not performing well. Second, it allows us to take advantage of opportunities without having to sell other assets that might be at depressed prices. So even though we still view risk as being elevated, we have the flexibility to shift gears when the time comes. We appreciate your continued trust and are always open to discuss any topic or concern in more detail if needed. —Patrick Mason Thanks, Patrick. If any of this feels like it needs a better explanation, please give us a call.

Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. It looks like this year’s take on summer has arrived, and we’re seeing a noticeable surge in the number of people mingling, dining out, shopping, and pursuing their outdoor passions, despite the higher costs that have been lightening wallets. The basic human need to live our lives and move beyond the virus is driving this burst of social activity. We’ll see how long this can survive in the face of the higher prices we’re experiencing. I’m sure glad I don’t have air travel planned any time soon, as that appears to be an unpredictable and expensive mess. So here we are, officially in a bear market, having just completed the worst first half experienced in our stock markets since the 1970s, with more clouds in the distance, as historically, the second half is the rougher. We’re probably in a recession, but a strange one. The economy is trying to burst forth from our COVID-induced lull, while at the same time the Fed is dousing the flames of the stimulus bonfire; and there’s a war and a lingering virus. The stock market has been overpriced for some time, so it’s not surprising to see a pull back, and Patrick will point out that overall, it’s still not cheap, despite some huge drawdowns in the more speculative asset classes. Housing is due for a correction of sorts, and it’s probably in the early stages of one. Depending on who you talk to and where you get your news, you could get the impression that the sky is falling and that we’re in a complete and total market meltdown. To be sure, it has been tough to find shelter in this storm, but I find comfort in our process, imperfect as it may be, believing that we’ll come out of this better than the broader markets, and well prepped for whatever’s next. Your actual experiences will vary, but I believe that what you have seen so far with your investments is distinctly less frightening than the shrill alarms being heard on many media outlets. On another, somewhat related note, I’m proud and excited to share with you that Cairn Investment Group was honored this last month as one of Oregon’s fastest growing private companies by the Portland Business Journal, the result of much hard work by the entire team. With that, on to Patrick and some specific and useful thoughts: Patrick's PartEquity and fixed income markets continued their march lower during the 2nd quarter, as investors continued to absorb rising inflation, tighter monetary policy, corporate profit margin pressures, and still high equity valuations. There were very few places for investors to hide during the first half of the year as large cap stocks, measured by the S&P 500, are down -19.96% and the Bloomberg US Aggregate Bond Index down -10.35%. I pointed to this as a risk in our Q1 2021 letter:

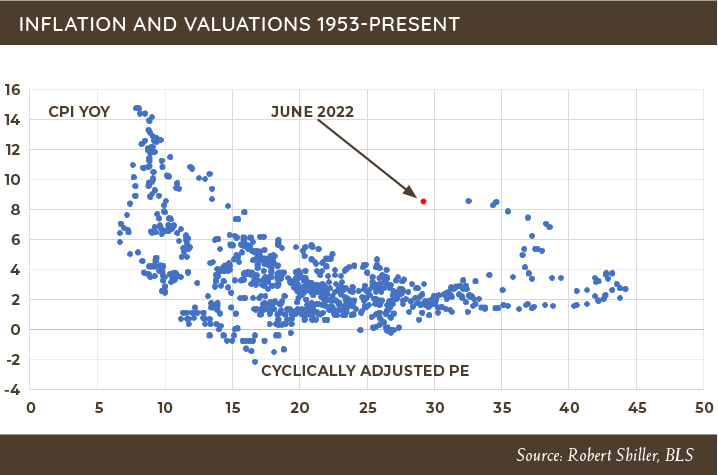

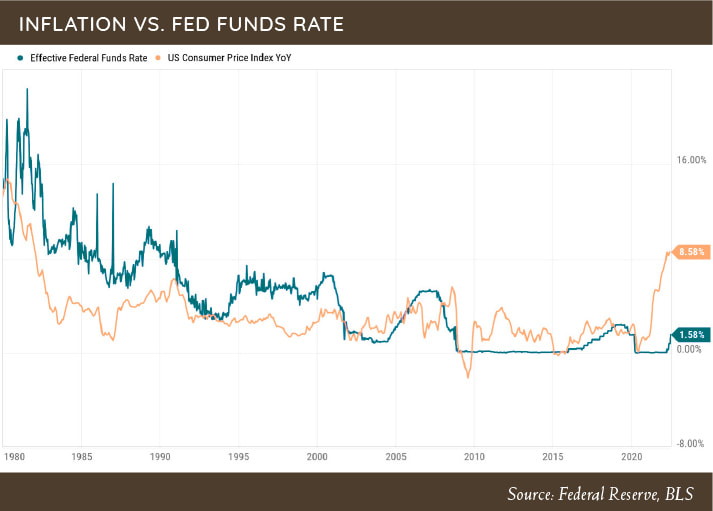

As we’ve discussed with many of you during meetings and reviews, stocks are not a very good inflation hedge when they are combined with high valuations. It’s only after valuations return to a more reasonable level that stocks offer a good hedge against inflation. The actual best hedge (short-term) against inflation is cash, which is why we have been holding a higher-than-normal cash allocation in portfolios for the last 18 months. The chart below shows inflation (vertical scale) and valuations (horizontal scale). As it illustrates, generally when you have 8.5% inflation, valuations are much lower than where they currently stand. So even though valuations have fallen from their historical extremes that investors were witnessing to start the year, they are still well above normal given the current inflationary backdrop. To combat the steady rise in inflationary pressures the economy has been experiencing, the Fed has become more aggressive in raising interest rates and tightening financial conditions. During their June meeting they raised the fed funds rate by 0.75% and have been hinting that another 0.75% hike might take place in July. As the chart below indicates, historically, when inflation is over 8% the fed funds rate is higher, not lower, than the inflation rate. So, if inflation stays high, then the fed has a way to go in raising rates. The biggest argument that we hear about why the Fed should slow their pace of interest rate hikes is the problem with the toolkit the Fed has to cool inflation. The options available are useful in decreasing the demand side of the inflation, not the supply side. Lyn Alden, of Alden Investment Strategy, said it best in her most recent monthly newsletter:

By raising interest rates, the Fed is in essence trying to raise unemployment and cool consumer demand. These actions could slow inflation for a period of time but, unfortunately, the price paid might be an economy that goes into recession. We are not in the business of predicting recessions, but we do have to be aware of the environment we are in and manage through it appropriately. With that said, we have a hard time believing that if the Fed continues down its current path, a soft landing they are hoping for is the most likely outcome. Through all the negativity there are some silver linings. Though the S&P 500 is down over 20% from its highs, many companies and asset classes have fared far worse. Many of the high-flying growth stocks that helped fuel the market bubble we were in, are now trading like beaten up value stocks. Overall, portfolios continue to hold higher than normal cash positions and are defensively positioned based on what the data is showing us. This provides us plenty of flexibility to change course when opportunities present themselves across the investment landscape. Combined with our cash allocation, we continue to hold a portfolio consisting of high quality, value-oriented stocks and bonds across asset classes that can weather market turbulence and provide the ability for capital appreciation, once the market environment eventually changes course. Thank you again for your continued trust and feel free to reach out to me to discuss any topics in greater detail. —Patrick Mason Thanks Patrick.

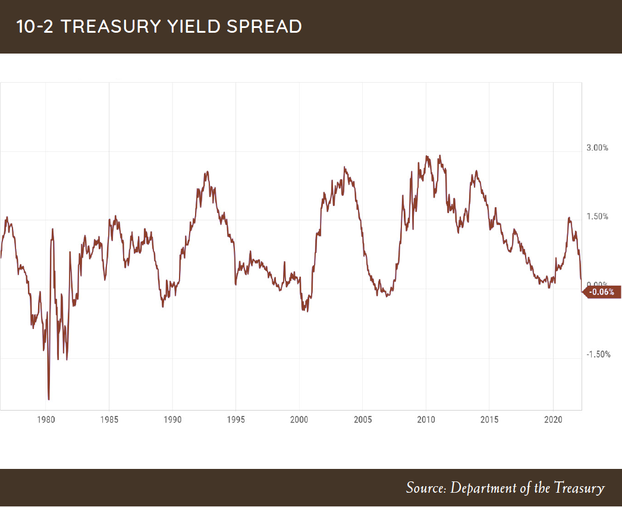

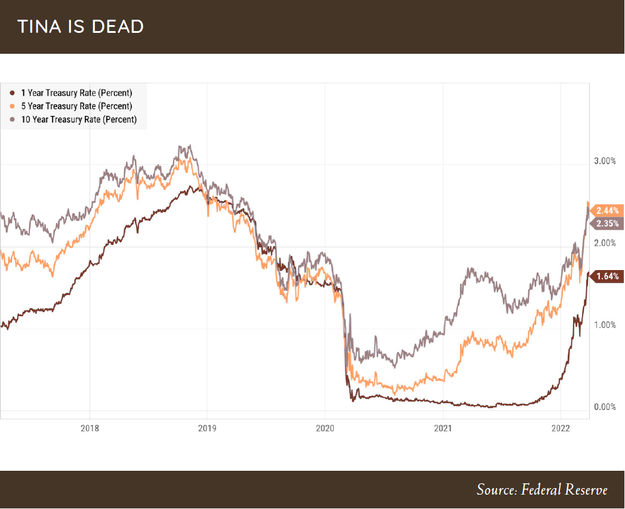

Here’s a reminder that the office is open, the coffee is fresh and hot, so please, don’t be shy about requesting an appointment or giving us a ring. Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. To say that there have been a lot of moving parts, in capital markets and economy, would be an understatement. Though equity and fixed income markets both finished down for the quarter, March provided some reprieve. Having both stocks and treasury bonds decline at the same time is a rare phenomenon. Over the last 100 years, it has happened four times during a calendar year. I guess we will see how the next nine months go. Many of the headlines being written, and market pundits’ comments, have been blaming the volatility that we have been witnessing in stocks on geopolitical concerns. While we are appalled at the conflict in Ukraine, we continue to believe the main drivers of equity and fixed income price movements are inflation, interest rates, and monetary policy. We have written about these topics many times over the last couple of years, and our opinion, based on data, has not changed. Inflation is here, and it is not going away anytime soon. Interest rates, and the Fed’s reaction to inflation, have been behind the curve; so now monetary policy makers are forced to play catch-up by raising rates into a slowing economy. A term that you might start to hear more over the next few quarters will most likely be “Stagflation.” Stagflation is the ugly combination of high inflation and declining economic activity, which the US has not witnessed since the 1970s. As I spoke about last quarter, rising inflation has affected consumer expectations about their future and that continues to show up in the data. The bond market has also started to take notice as the US treasury bond yield curve is the most inverted since the financial crisis. The yield curve has a strong track record of predicting a slowdown in economic activity. There will be plenty of talk about how “this time is different.” We would take those arguments with a huge grain of salt. We are not predicting, just observing the conditions and responding appropriately. If the environment changes, we will change our mind. On a positive note, there have been arguments over the last couple of years justifying the strong performance in equity markets as being driven by having no other alternative (TINA) due to interest rates being at historic lows. With the recent jump in treasury bond yields, this is no longer the case. Investors now have some options to earn income in relatively safe investments, which should impact decision-making at some point. This positive development will allow investors options for investing and provide competition for capital, which is beneficial to determine fair prices for many different asset classes. Overall, we have been pleased how portfolios have reacted during this shift in market behavior. Having a value bias during this rising interest rate environment has been helpful, as we have talked about previously. We continue to focus our equity allocation on companies and asset classes that generate consistent free cash flow, have resilient operating performance, and returns on capital that trade at attractive valuations. The main detractor to performance has been our allocation to international stocks. We continue to view international equities to be much more attractively valued than US stocks, so we are willing to be patient. Bonds have not been spared the volatility in capital markets. We manage your fixed income to be short-term in maturity and with lower credit risk than the broader bond market. Our focus on risk management, the willingness to hold cash, and be patient provides your portfolio flexibilities that are well positioned to navigate this challenging market environment. Thank you again for your continued trust. I have had many great talks with you over the last few months and continue to invite a conversation on anything you find needs further discussion. —Patrick Mason |

RSS Feed

RSS Feed