|

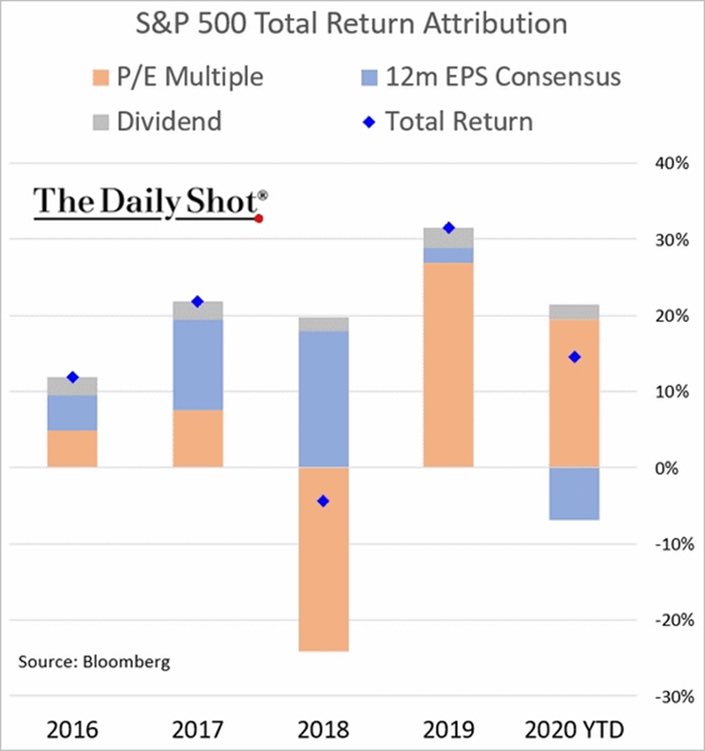

A lot has happened since our last note! The virus is running rampant, but the election is behind us and multiple vaccines appear to be effective and on the way. The markets have interpreted the sum of these events to be positive and we’ve seen an amazing uptick in November, with broad participation across sectors, companies, and asset classes, lifting our account values. The shift of interest towards stocks that may benefit from a “re-opening” is notable and we own many of these. In our third quarter letter, we discussed the risks we are witnessing in large-cap technology stocks, the opportunities in small-cap stocks relative to large-cap stocks, and value versus growth stocks. In November it seems other market participants have started paying attention to the large valuation gaps of these two groups with small cap stocks having its third best relative performance month versus the S&P 500 in the last 20 years, and value stocks having their best absolute performance month in over 20 years. Although it is still too early to call this a permanent change in trend, it is encouraging to witness more broad participation across the market instead of only a handful of overly expensive companies producing the majority of returns. We are pleased with the recovery that markets have staged, but we cannot forget about the risks that are still present. We have written about valuations at length, and especially valuations surrounding large cap US stocks. With the recent run up, valuations for the S&P 500 stand at highs last witnessed in the year 2000 and right before the great depression. Economic activity and Company earnings, though improving, are still mired in recession from our battles with COVID-19, with company earnings showing a -6.3% decline from the previous year during the third quarter. Analysts estimate that earnings are not expected to reach their 2019 levels until the start of 2022. We know the market is a forward indicator but basing today's price on the hope of an earnings recovery in 2022 shows how much optimism is built into this equity market. As you can see from the chart below, the return of the S&P 500 to date, is comprised almost entirely by multiple expansion (investors paying more for an undetermined amount of future earnings). A risky proposition in our view. We are very excited about the possibilities of vaccines being distributed as we start the new year. I think everyone is ready to get back to a more “normal” way of life, and many of our equity positions are being held at the right price to benefit from further recovery, or expectation of it. However, we must always remain focused on what is already reflected in current prices so that we can understand the risks and opportunities that the markets are presenting. The good news is we are still finding some opportunities. Walking this tightrope, we still hold extra cash and fixed income in the portfolios to protect against the market going through another bout of pessimism.

We hope you and your families have a safe and happy holiday season. Thank you for your continued trust and please reach out if you want to discuss any topic in greater detail. Your Cairn Team Comments are closed.

|

RSS Feed

RSS Feed