|

Greetings from the Northwest. Our second quarter report is always a little chaotic to produce, since the Fourth of July holiday generally jumps right into the middle of the progress. The distraction of summer, and all that this Fourth brings with it, can cause your diligent advisors to be found yearning for the sizzling BBQ burger or the thirst-quenching relief of an ice-cold beer. This Fourth of July holiday was marked by distinctly cool weather that made the 32nd Waterfront Blues Festival, held along the bank of the Willamette River, quite tolerable in the warming afternoons all 4 days. If the afternoons were filled with blues, the morning of Sunday was exploding with excitement as the U.S. women’s national team took the soccer World Cup for the fourth time!! Being distracted from the business world for a bit was a nice relief from the growing number of global economic woes filling the airwaves recently. The most significant topic of today may be the announcement that Deutsche Bank is retreating from its global expansion and laying off 18,000 people. Oops. Closer to home, in the American oil patch, things are slowing down as well. “Hoping for a gusher, driller came up short.” It’s a common refrain heard in so many words about many business ventures these days. There are so many situations in business now that are good, but not quite great:

I’m sounding like a deflated firework and Patrick is itching to report on the current economic trends, so over to Patrick while I go squeeze our lemons into lemonade. Patrick's PartThe second quarter witnessed investors tossing tariff risks and economic growth concerns aside to focus on the possibility of the Federal Reserve cutting interest rates in the coming months. After bouts of volatility during the 4th quarter of 2018 and again in May, large company U.S. stocks closed near an all-time high. During this time, investors have experienced quite a change in economic growth expectations and monetary policy implementation. Just one year ago, the U.S. Fed was forecasting 2019 GDP growth to be 2.4% and 2020 growth to be 2.4%. When they released their most recent projections on June 19, those figures dropped to 2.1% and 2.0%, respectively. Looking at corresponding interest rate projections, previous forecasts were calling for a rise in the fed funds rate (short term interest rates) to 3.4% in 2020. The current forecast is predicting that interest rates will fall to 2.1%. What a difference a year makes. This flip-flop in policy has been a large component of falling interest rates across the bond market (prices rise) and the tailwind we have witnessed for U.S. stocks in the short term. As Danielle DiMartino Booth, former Federal Reserve Bank of Dallas Advisor and founder of Quill Intelligence, recently said, “We are having a recession party” when describing how positively the stock market is reacting to much slower growth that could result in easier monetary policy. As the S&P 500 index (large company stocks) trades close to an all-time high, while small cap and international stocks do not, we like to check underneath the hood to see what is really driving these recent returns. One question I looked at recently was, “Are all stocks carrying their weight and rising together or are just a few winners saving the day?” Examining this allows us to determine the overall health of the equity market. The breadth of participation signals how broad or shallow a market rally can be, which we find useful during the late innings of a cycle. One of the ways we analyze this is to look at the return contribution of the top names of the S&P 500. Recently, I ran comparison of the return contribution of the top 4 (largest) companies during 2013 and the contribution of the top 4 companies over the last 12 months. For the majority of 2013, we witnessed a broad based contribution and participation from U.S. stocks across the board. Which makes it a good comparison point. Here is the story the data tells: 2013:

Last 12 months:

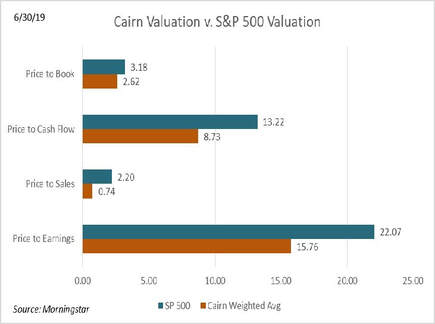

In essence, 2013 was a year where there was broad participation with many names of the index carrying the weight. Over the last 12 months you cannot say the same thing. A little more than 10% of the index is making up almost a quarter of the return. This indicates that the largest, and most popular, names have been carrying the load and the majority of companies have not been keeping up. I will leave it to you what you draw from this observation, but just a hint: It’s not sustainable in the long run. Cairn’s approach is not just following the crowd by investing more and more dollars into overly expensive companies. Our process of uncovering suitable investments is disciplined and consistent. As we stated in our September 2018 letter: “Through our quarterly letters and individual meetings we have discussed our process for uncovering successful investments, our current view of U.S. stocks, and how we are managing assets concurrent with that view. First, we are always on the lookout for industry leading companies that generate significant cash flows, with balance sheets that can provide financial flexibility. The final, and what we believe is the most important, piece is paying a price for a company that is significantly lower than what our analysis says the business is worth. We use a combination of cash flow analysis and the historical operating performance of the business to identify suitable investments, avoiding ones for which we would be paying too high a price, therefore limiting appreciation potential.” As the chart below illustrates, your portfolios trade at a significant discount to the S&P 500 by many different valuation metrics. Lastly, here is just a small subset of the companies we own across portfolios we manage. We thought it would be of interest.

As we head toward the second half of the year, we will continue to look for opportunities, realizing that risk management remains paramount as we reach the late stage of both this economic and market cycle. If you’re interested in reading more about individual companies that we’ve researched, check out the Company Spotlights or give us a call and Jim, Tim or I will be happy to provide more information. Thank you, Patrick.

As I’m fond of saying at the close of our quarterly letters, swing on by for a cup-o-joe. The coffee pot is always on. I’d like to add a personal note to all, about how thrilling it is to see our children grow. This event found me walking daughter Lindsey down the outdoor aisle in Wyoming as she accepted Aaron’s hand. Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed