|

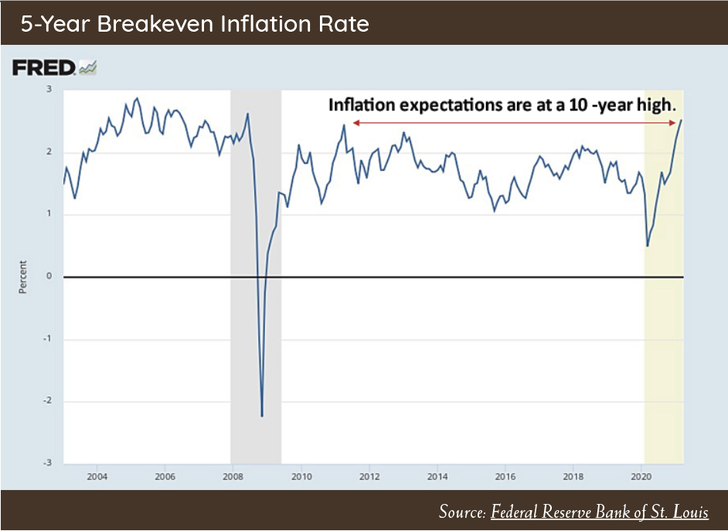

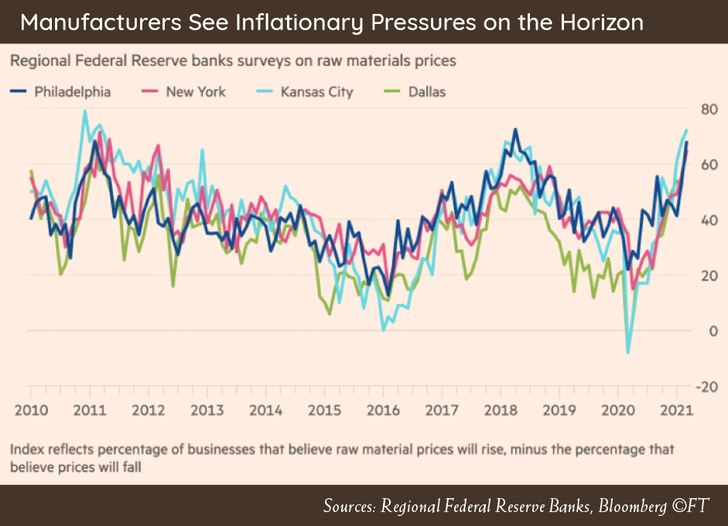

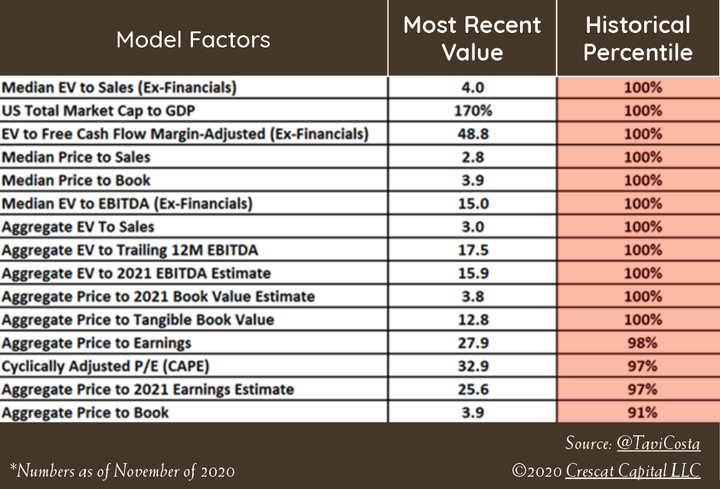

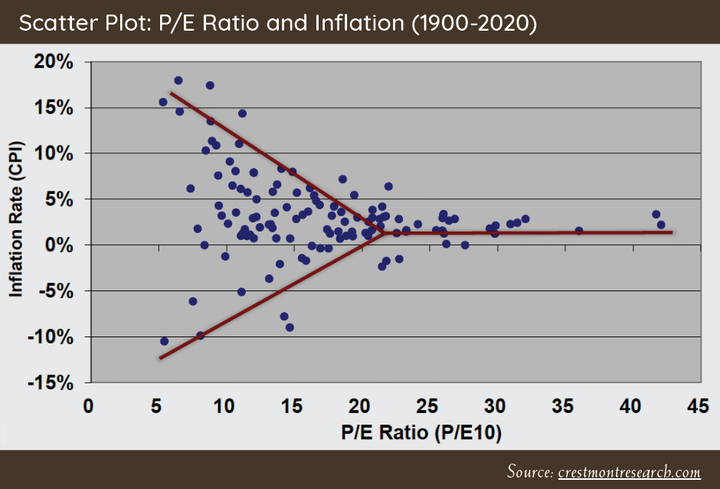

Greetings from the Northwest. Can you believe that it’s been over a year living with this pandemic, and no clear end in sight? And yet, here we are with financial markets and home prices at all-time highs, leading to a large divergence in fortunes between those who own assets, and those who don’t. We all know that it’s been particularly hard on those whose livelihood depends upon up-close and personal interactions with other humans. Let’s all hope that the stimulus and a well-managed re-opening of the economy relieve much of this burden for them. I believe that almost everyone reading this falls into the category of “those who own assets,” and have seen their personal worth increase during one of the most disruptive events in modern history. What has happened and what is happening globally should be considered as seminal, an inflection point in history heading towards something new and unknown. One can sense that big changes are afoot, and on many fronts. Indications are that after decades hiding in his bottle, the inflation genie is likely to reappear, fueled by massive government spending, and rising wealth from gains on many types of assets. Interest rates, on a downward path for the better part of 40 years and an entire career for most financial professionals, are very likely to rise in concert with inflation. Both of these have direct implications for asset prices and your investments. In his part, Patrick will give you our thoughts on this and what we plan to do about it. On the positive side are the emergence of medical and vaccine technologies that promise to improve our response to future outbreaks. One hopes that governments, too, will have learned and adapted to better handle them. Companies globally are adapting to the idea of more worker autonomy and a more dispersed and mobile workforce. What implications can we imagine for urban centers and commercial real estate? How far will or can this administration go in changing the direction of U.S. policy and practice on a broad array of American interests? It’s working with a clear mandate to pull us through the current crisis, but without such a clear mandate on many of the other issues that we face. How much further in debt will we go, and what will be the impact on our taxes? Will the world see a separation of supply chains and economies divided between the U.S. and China? How far will China’s economic and political rise take it? Will Russia’s global meddling (while its home economy is in shambles) lead to something worse or get checked in the future? Will the European Union come out of the crisis stronger or weaker after its chaotic response to COVID? The way that these and many other issues play out will have lasting effects on our investments and our personal lives. They don’t come with a playbook or a probable outcome, so we’ll adapt as we see them evolve. With that, here’s Patrick with some practical, measurable observations and what we are doing about them. Patrick's PartThrough small bouts of volatility, equity markets continued their forward march during the first quarter. Stocks, measured by the S&P 500, returned 6.17%, while the real drag on capital markets during the quarter took place in fixed income, with Long Dated Treasury bonds dropping 13.92%. The recent negative returns generated in bonds due to rising interest rates have caused a lot of chatter across the investment community. This is a topic we find of high importance as we manage your wealth moving forward. Some might say, “Wait, Patrick; interest rates rose a couple years ago, and bonds did okay.” Or “I don’t own many bonds in my portfolio, so what will this have to do with equity markets?” My simple response: “A lot!” The source of rising rates will have a profound effect on equity markets and returns realized across different investment styles over the coming market cycle. The source is very important, because, unlike 2018 when rates were rising due to the Fed reversing QE, the current narrative and concern of rising rates are not being driven by the Fed tightening monetary policy. Fed officials have been clear that they have no intention of reversing their current course for at least a couple of years. As the two charts below indicate, we are seeing interest rates rise today because market participants, investors, and business managers are becoming concerned that inflation is starting to heat up. This could be for a myriad of reasons, but the most likely culprits are large government spending, combined with strong economic growth, and extremely accommodative monetary policy. If inflationary pressures and concerns become a reality, the tool kit used over that last cycle (investing in high revenue growth, low current earnings U.S. companies, combined with long dated bonds), will not have the same level of success that investors have become accustomed to. The bullet points below explain the intuition:

As with most things in financial markets, not everything is black and white, so there will be certain areas of the marketplace we will continue to focus on, to find opportunities to combat the threat of higher inflation. First, as we have written about many times in the past, value stocks vs. growth stocks still trade at a large historical discount. The benefit of value stocks over their growth counterpart in a rising inflationary environment is that many of the cash flows and earnings of traditional value companies are realized in the present (think of Costco). So even if inflation is rising, the future value of earnings is not as impaired as in growth companies that realize their earnings many years into the future. Second, companies that have a strong competitive advantage with the ability to pass rising costs on to their customers and consumers should weather inflationary periods with less disruption to profits. Lastly, having exposure to equity markets outside the U.S. will be essential, as the relative value of international stocks is much more attractive, and higher inflation domestically generally comes with a lower value for the U.S. dollar. A lower value of the U.S. dollar versus other currencies is historically a positive to foreign equity markets. The benefit of our process is that it is built around understanding the value of what we are paying for something, while comparing that to the risks that could be present. Our disciplined approach will only act as another layer of safety during this potentially changing investment landscape. When risks are high, and opportunity is low, we will remain flexible but defensive for when the pendulum eventually swings in the other direction. Currently, we view risks as being high but not so high that defense is the only strategy. This positions our portfolios to hold slightly more cash than normal, while we are actively taking advantage of investments we feel offer compelling return potential during this challenging market environment. As always, thank you for your continued trust, and please reach out if you would like to discuss any topic in greater detail.

Thanks, Patrick!

In case you’ve missed the website and LinkedIn updates, Cairn has added a key member to the team in the last month. Mark Farrelly CFP®, CDFA® has joined us as Senior Advisor and Director of Financial Planning. It’s exciting to bring on someone as experienced and talented as Mark, who’s been in the business for almost 20 years, specializing in providing detailed and comprehensive financial advice. Mark and Patrick have worked together earlier in their careers, and already have a deep level of trust and respect for the other’s skill set and work ethic, setting up a promising integration of Mark and Cairn. Mark operates out of Northern California and will continue to work remotely. Over time Mark will help us in improving and codifying our financial planning practices, providing a better experience for all of our clients. Welcome, Mark! As restrictions ease, I hope to see many of you back in the office. In the meantime, we’re happy to provide help by any means that works for you, including Zoom or WebEx meetings. Tim Mosier, President Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed