|

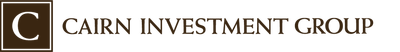

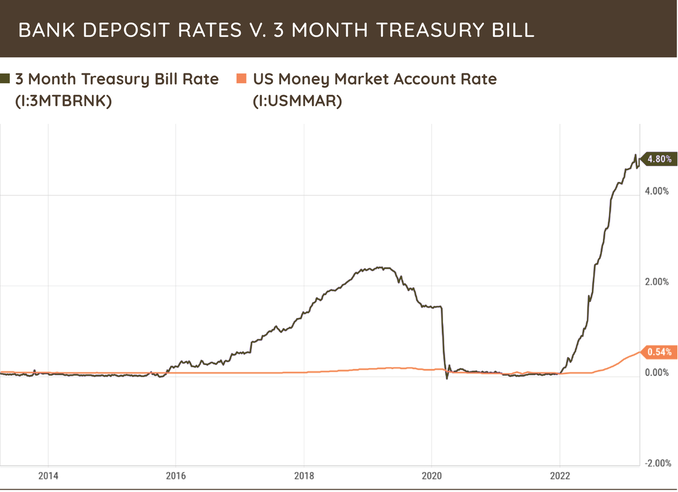

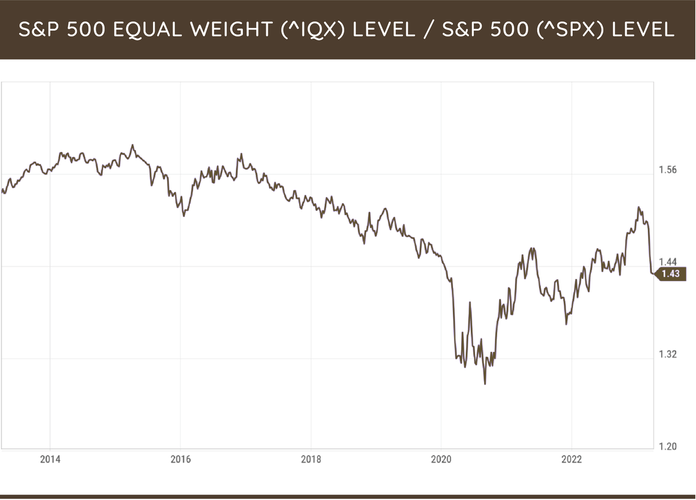

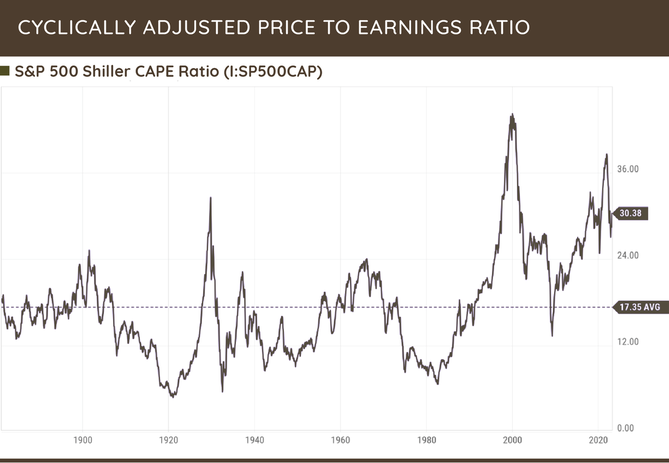

Greetings from the Northwest! I’ve heard that it’s finally Spring. I’d like to see some evidence before I believe it! All of us on the West Coast would welcome a change from the cold and rain. Attempting just that, I recently spent a few days at Disneyland with my granddaughters and rarely have I been so wet, and that’s from the perspective of a Northwesterner. I’m glad to be back in the dry, warm office. Speaking of the office, Cairn continues to grow! I’m happy to announce that Dan Poe, recently of Ameriprise, has joined us an Investment Advisor in Portland. His bio will be up soon on our website. With Dan, we’ll have four Advisors with the firm, and be better able to serve the diverse needs of our clients. I’m really looking forward to having his help in answering your many questions and making sure that our investment strategy is in sync with your needs. While the world roils around us, we feel that it’s vital to make these investments in people to assure our future. It’s been an interesting first quarter for 2023. While much has changed, like finding out that some big banks weren’t really solvent, much has not changed so much. Fundamentally, we’re still in a time of higher inflation, rising interest rates, and resilient employment. The same political and economic issues are being fought about in Washington. The major market indices are near historic highs, measured as either price or valuation. Since we have little exposure to the banking sector, and none at all to the banks considered at risk, our general outlook and plans remain steady. I’m sure that Patrick will expand on this. The recent bank implosions are worth discussing briefly, because they caused disruption in the financial markets, and many of you have been concerned about the safety of your money. Banks fail when the FDIC says they fail. Sometimes it seems unfair and too preemptive, but everyone in that game knows the rules. Insufficient liquidity, the inability to meet depositors’ withdrawal needs, is the measuring stick. You can get there by facing too many withdrawals too quickly, or by making poor investment choices. They usually find a way of coinciding. The failed banks all played a part in their own demise by poor investment management relative to their obligations to depositors, and also by being a bit too successful at winning jumbo-sized clients who can demand huge withdrawals in a flash, which they did. The vast majority of banks do not have these issues, and the largest, considered too big to fail, get easy liquidity from the US government as they need it. While 90% of bank deposits are FDIC insured across the country, Silicon Valley Bank operated with about 10% of its deposits insured. So hopefully, on that topic, we can relax a bit and realize it’s just part of the process of burning off excesses from our long bull market. At the height of the scare, the list of at-risk banks seemed to explode, and even included Schwab for a while. The metrics being cited were very one-dimensional and failed to recognize how well Schwab had consistently met the FDIC’s liquidity requirements, and how many billions of dollars Schwab has in reserve through the totality of its business. The company thought to be somewhat at risk, Schwab Bank, is just part of the overall Charles Schwab & Co., which includes the security broker dealer that custodies your assets. Only your Bank Deposit funds, also known as “sweep” funds, are connected to the Schwab Bank. These are insured up to $250,000 by the FDIC per account beneficiary. Schwab’s typical client has several types of accounts and is focused on overall wealth management much more than on banking. Almost half of these assets are managed by an advisor like Cairn, adding a layer of care and commitment that is unlike a typical bank. There is a nicely written piece on the Schwab website, in case you want to see some greater details on this. If you need to know more about this, just give us a call. Let’s see what Patrick has to say. Patrick's PartAll the turmoil in the banking sector, to date, has not rattled capital markets, with Large Cap stocks returning 7.50%, small cap 2.74%, international stocks 8.47% and bonds 2.96%. Headlines surrounding what the Fed might or might not do regarding interest rate hikes, combined with cracks materializing across regional banks, made for lots of volatility. At the end of the day, investors’ risk appetites remained strong despite these headwinds. There has been quite a bit written in the financial news about what has unfolded across the regional bank landscape. I won’t bore you with the small details, but the failure of Silicon Valley Bank was a byproduct of the Fed leaving interest rates artificially low for TOO long, not that the Fed started raising interest rates aggressively. Once interest rates, rightfully, started to rise, banks that had taken on too much risk investing in longer dated bonds exposed their balance sheet and solvency to risks most investors didn’t see coming. When deposit rates are close to zero, while T-Bills and money markets yield north of 4%, it can expose risks for banks that had invested customer deposits in long dated bonds. Technological advances have allowed clients to move cash balances quickly, and at banks that focused their deposit base on large clients with balances above FDIC limits (SVB, First Republic, etc.), a bank run can happen. I applaud the FDIC for how they have handled the situation, to date. Stepping in swiftly and backing all deposits, regardless of FDIC insurance limits, while wiping out equity and debt holders, is how bank failures should work. As Tim mentioned, we have very little exposure to the banking sector, and that is a byproduct of our process and our investment discipline. Over the last couple of years, I have mentioned that although valuations have been elevated for US stocks, one of the silver linings has been broad price participation. This means that returns were not being driven by a narrow list of names like markets witnessed from 2017 to early 2020. The chart below measures the S&P 500 equal weight v. the S&P 500. We have seen a steep reversal in market participation this year. The reversal has been so sharp, as this chart from Tavi Costa of Crescast Capital shows, the largest 15 stocks in the S&P 500 have generated 100% of the returns to start the year. The rebound in stocks to start the year has done nothing to alleviate the issue of lofty valuations for the S&P 500. Even with the index down close to 8% over the last year, valuations still sit at close to all-time highs. As a reminder, long-term returns, generated by stocks, are comprised of three variables: earnings growth, dividend yield, and change in valuation. To get to the 10% historical average return in US stocks that investors are beaten over the head with, you start with: earnings growth of 6% historically, plus a dividend yield of 2%, which puts you at 8%. To make up the 2% difference, multiple expansion needs to take place. Given that we are already sitting at historically high multiples, that seems to be unlikely. I would argue the path of least resistance is to have multiples contract, meaning that valuations will be a drag on returns for US stocks. It is just math. The combination of high valuations, poor market participation, and a market that is still in a downtrend does not strike us as an environment where taking excessive risk will be rewarded. The bright side is that our investment universe is not limited to the S&P 500; and, being value managers, we are always focused on the price we are paying for an investment and whether that provides an adequate margin of safety before putting your capital at risk. We are still finding some attractively valued investments in US stocks, though the opportunities are limited. We find international equities to be more attractive and we look for opportunities to continue to add to that asset class when appropriate. Thank you for your continued trust. Please drop me a line if you want to discuss any topic in greater detail. —Patrick Mason Comments are closed.

|

RSS Feed

RSS Feed