|

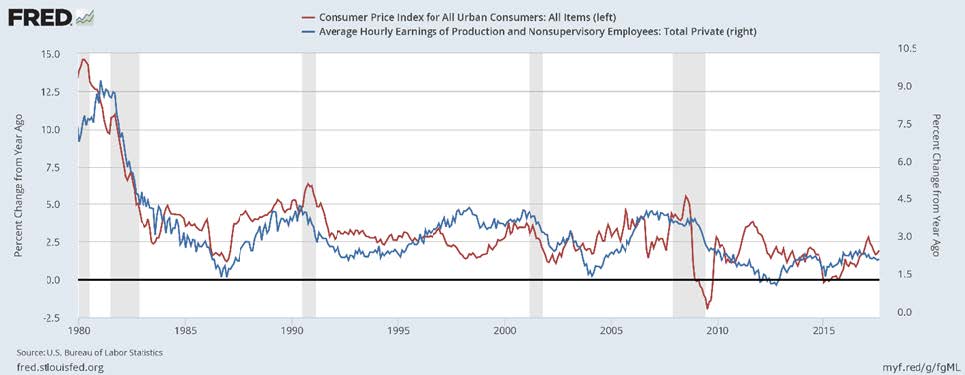

Greetings from the Northwest. Often I begin these letters reflecting upon those topics we have hanging on our wall of worry. It would appear, during this particular period of time, that the wall of worry is not that worrisome. At a very local level the recent forest fires that clouded our skies and challenged our transportation are diminishing. It’s wonderful to have some rain and it’s even better that we’ve been soaked with several inches of it. Over this last weekend, I took a trip up the Columbia River Gorge, traveling up the Washington side and coming down the Oregon side to see the extent of the Eagle Creek Fire. Yes, lots of terrible damage, but it really looks as if (like so many times before) the forest, the views, and the beauty will return. Instead of a wall of worry, we have a wall of a-lot-of-things-going-on. It’s a very exciting time at Cairn; many of you have been into the office over the last year and have experienced our new technology-bristling conference room and of course the espresso machine. In person and over the phone many of you have gotten to know Morgaine, who came to us not very long ago with a different kind of background, as a scholar of Ancient Mediterranean History, looking for a temporary job to rebuild her finances and head back to the Mediterranean and continue her education. Well, the time has come. Sadly for us, she is leaving. But, happily for us, Jesyca will be taking her place. Jesyca is a recent graduate of University of Colorado Boulder, and has moved to Portland to enjoy the vibe and the Northwest. She will be the person many of you will get to know on the phone or as you visit the office. Additionally, she will be helping Theresa with many of the tasks that happen in our office on a daily, weekly, monthly basis. Jesyca is one of the 110 new Portlanders who arrive each day to our fair city. Welcome to Portland, Jesyca! From a long list of important topics, there are several that are really worth focusing on this quarter. Number one, while we’re all interested and worried about the global economy, it has become clearer as the months roll by that the fear people had of debt after the recent “Great Recession” seems to be subsiding, and we are now becoming more comfortable with the increasing global debt. That’s typically not a good thing, but the expansion of our economy and economies globally seems to be taking it in stride. Number two, the Equifax security leak is a tremendous problem. We’ve taken a look at this and would encourage all of our readers to read the blog post Morgaine and Jesyca compiled on the current options to protect your personal private information. I believe it is important we all take this situation seriously and do everything we can to keep our personal data as safe as possible. The third topic that I’m confident will be fascinating to watch over the next months is the proposed changes to our tax laws. This could cause everybody to really think about the question: “What do you want your government to do for you?” And after you’ve made the list of what you want our Government to do, how do you finance it? So hang on and let’s get ready for some really interesting conversations about taxing ourselves so we can pay for what we want our Government to do. I’m going to pass this over to Patrick, and I think Theresa has an important message to deliver to us as well. I look forward to the next time we meet or speak and I look forward to a wonderful fall with a lot of delight in living in the Northwest. Patrick's PartGlobal equities shook off a number of negative geopolitical headlines during the quarter. U.S. stocks rose 4.50%, while international stocks continued to outperform, rising 4.80%. Fixed income continued to defy the worry of rising interest rates as the U.S. 10 year Treasury yield remained at a low 2.32%. Economic growth around the world has shown better signs of life through the first 9 months of the year, which brings me to my topic for the quarter: Is the pick-up in GDP growth inflationary, and how will interest rates be affected? I’m not going to touch on the stock market, as our opinion has not changed from last quarter’s letter that U.S. indices, like the S&P 500, are becoming expensive. However, we continue to find value in individual companies, though not at the same level as a couple of years ago, so patience is warranted. Over the last 10 months the Fed has started the slow process of normalizing interest rates and reducing the size of their balance sheet. Since December 2016, there have been three 0.25% interest rate hikes. These increases have brought the fed funds rate to 1% - 1.25%. Historically, the Fed has raised interest rates in an attempt to cool down an overheating economy and to put the brakes on inflation. One indicator that we look at to take a reading on the health of the economy is the change in employee earnings versus inflation. The chart below shows the year-over-year change in inflation (red line, measured by CPI) and the year-over-year change in average hourly earnings for employees (blue line). As you can see, historically there has been a very tight relationship between the two. Actually, year-over-year changes in average hourly earnings tend to lead changes in inflation. As the bottom right of this chart shows, the growth of average hourly earnings peaked in 2016 and has been steadily declining since. This is in contrast to the pick-up in inflation that has taken place since 2015. This matters when taking a look at Fed policy going forward and how future interest rate increases could affect the economy. If inflation is set to decline in line with what hourly earnings growth is telling us, then the Fed will have some very tough decisions about how quickly to raise interest rates going forward. Overall, the pick-up in GDP growth does not look to be inflationary at this point. If that is the case, monetary policy risks will remain high as the Fed will have to weigh continued normalization of interest rates against the risk of slowing down the economy. These are just some of the many data points we look at when thinking about your investment portfolios. Please email or call if you want to discuss any of these topics in more detail. Theresa's PartOften fall is a time to regroup and get organized. Maybe even catch up on some neglected chores. When you have a change of address, please contact me. I would like to coordinate the address change for you at both Cairn and the custodian. Not having a current address on file can cause information delays, and can eventually cause restrictions on your accounts. I will need your signature to change your address at the custodian. You may contact me directly via phone 503.241.4901 or email. Thank you Theresa. Please take me up on my standing offer to swing by for some local joe. The pot is always on. Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. P.S. Our website relaunch was a great success. The first 20 people responded to the challenge within two hours! Many more over the next several days! We sent coffee cards to all who responded, even after the first 20. I haven’t told Tim the grand total because it will bust the marketing budget. Thanks for participating.

Comments are closed.

|

RSS Feed

RSS Feed