|

There is no Frigate like a Book :: To take us Lands away Nor any Coursers like a Page :: Of prancing Poetry —Emily Dickinson Greetings from the Northwest. During past market cycles I had a chance to read company reports, newspapers, and periodicals. Visit with company executives and their business to business trading partners. Reflect on business and industry segments and then pin it all up on my “wall of worry” and look at it. The process was a little like adding a new chapter to an ongoing story each quarter. Everything must continue to evolve. Well, welcome to the crazy-fast times. It is not as common as it once was to read a book. The tales of far-off lands now arrive as fast as the next news cycle, which is terrifying. It’s hard to find time to reflect on the good or the generous and the joy of a poem. And why would we when we can be entertained and amazed at the silly, greedy, and stupid behavior of so many prancing world leaders? Let’s take a moment of our precious time and focus on the real monster in the room. Uncertainty. It has often been said that the “market” likes good news, dislikes bad news and absolutely hates uncertainty. We should add that investors don’t like volatility. Uncertainty creates volatility, which causes investors to become restless. Restless about what? Patrick has been doing some thought-provoking work looking into the comings and goings of recessions. Yes, I’ve said it. Recession. We will have them. Patrick’s work is helping shed light on the recession monster and what we should be doing now… or not. Patrick's PartEquity returns during the quarter were mixed, with large-cap U.S. stocks posting a slight gain of 1.7%, while small-cap U.S. stocks, international developed stocks, and emerging market stocks posted slight losses of -2.3%, -0.79%, -4.75% respectively. Volatility has started to pick back up again, as markets grapple with a combination of trade tensions, changes in monetary policy, and slowing global growth. During the year we spend a lot of time with our clients discussing what is going on in their lives, the ongoing management of their wealth, and how we view this ever-changing market environment. We learn a great deal from these discussions. Though the economy has been strong over the last few years, in recent months we have observed recessionary fears rising amongst the public and the folks we talk with. It’s easy to see why, as the news chatters regularly about when the next recession will happen. This has largely been driven by the consistent yield curve inversion. As of August 31, 2019, the New York Federal Reserve Bank’s Recession Probability Indicator, based on the yield curve, has moved to a 37% chance of recession within the next 12 months, up from 14.5% a year ago. In April, I wrote about the lag times after the yield curve inverts and the inconsistent message that an inversion sends (read about it here). However, there are more data points in recent months revealing that the economic recovery is showing signs of stalling. We take evidence as it comes and do not attempt to predict the likelihood of when the next recession will start. At this time, the data we analyze does not point to immediate recession. Where we have been focusing our efforts is in analyzing what the most likely market experience would be if we entered a recession in the near term. Our conclusions are as follows:

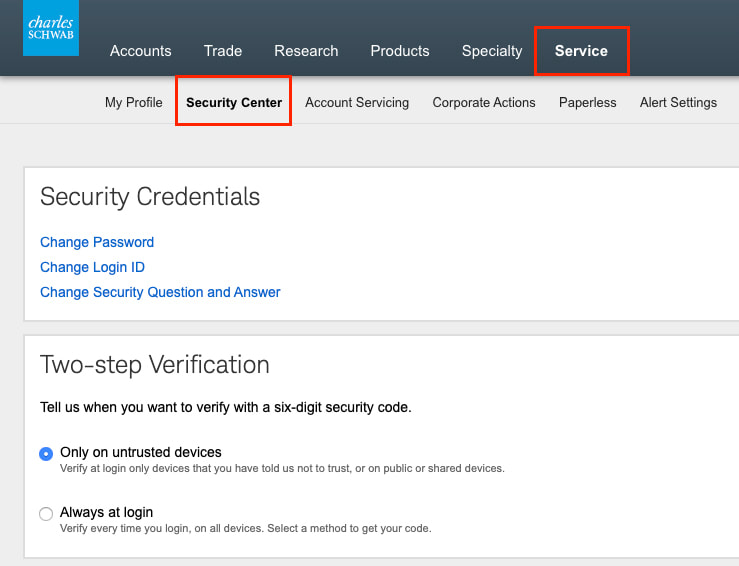

On a positive note, as Cairn searches the investment landscape for opportunities, we have continued to find quality companies to invest in that are trading at appropriate prices. Jesyca's PartAs our reliance on technology continues to advance, cybersecurity is of the utmost importance. We are always keeping an eye out for suspicious activity in your accounts and will call to verify as soon as we see any changes made. Cairn has your back. If you access your accounts online through Schwab Alliance, here are a few helpful tips to improve the security of your accounts:

Thank you, Patrick and Jesyca.

Come on by and let’s review your equity exposure and/or two-factor authorization. We’ll make sure the coffee is fresh. Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed