|

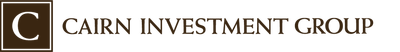

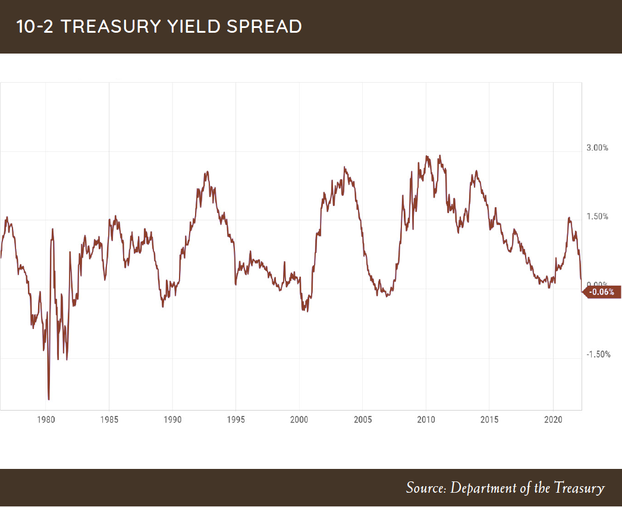

To say that there have been a lot of moving parts, in capital markets and economy, would be an understatement. Though equity and fixed income markets both finished down for the quarter, March provided some reprieve. Having both stocks and treasury bonds decline at the same time is a rare phenomenon. Over the last 100 years, it has happened four times during a calendar year. I guess we will see how the next nine months go. Many of the headlines being written, and market pundits’ comments, have been blaming the volatility that we have been witnessing in stocks on geopolitical concerns. While we are appalled at the conflict in Ukraine, we continue to believe the main drivers of equity and fixed income price movements are inflation, interest rates, and monetary policy. We have written about these topics many times over the last couple of years, and our opinion, based on data, has not changed. Inflation is here, and it is not going away anytime soon. Interest rates, and the Fed’s reaction to inflation, have been behind the curve; so now monetary policy makers are forced to play catch-up by raising rates into a slowing economy. A term that you might start to hear more over the next few quarters will most likely be “Stagflation.” Stagflation is the ugly combination of high inflation and declining economic activity, which the US has not witnessed since the 1970s. As I spoke about last quarter, rising inflation has affected consumer expectations about their future and that continues to show up in the data. The bond market has also started to take notice as the US treasury bond yield curve is the most inverted since the financial crisis. The yield curve has a strong track record of predicting a slowdown in economic activity. There will be plenty of talk about how “this time is different.” We would take those arguments with a huge grain of salt. We are not predicting, just observing the conditions and responding appropriately. If the environment changes, we will change our mind. On a positive note, there have been arguments over the last couple of years justifying the strong performance in equity markets as being driven by having no other alternative (TINA) due to interest rates being at historic lows. With the recent jump in treasury bond yields, this is no longer the case. Investors now have some options to earn income in relatively safe investments, which should impact decision-making at some point. This positive development will allow investors options for investing and provide competition for capital, which is beneficial to determine fair prices for many different asset classes. Overall, we have been pleased how portfolios have reacted during this shift in market behavior. Having a value bias during this rising interest rate environment has been helpful, as we have talked about previously. We continue to focus our equity allocation on companies and asset classes that generate consistent free cash flow, have resilient operating performance, and returns on capital that trade at attractive valuations. The main detractor to performance has been our allocation to international stocks. We continue to view international equities to be much more attractively valued than US stocks, so we are willing to be patient. Bonds have not been spared the volatility in capital markets. We manage your fixed income to be short-term in maturity and with lower credit risk than the broader bond market. Our focus on risk management, the willingness to hold cash, and be patient provides your portfolio flexibilities that are well positioned to navigate this challenging market environment. Thank you again for your continued trust. I have had many great talks with you over the last few months and continue to invite a conversation on anything you find needs further discussion. —Patrick Mason Comments are closed.

|

RSS Feed

RSS Feed