|

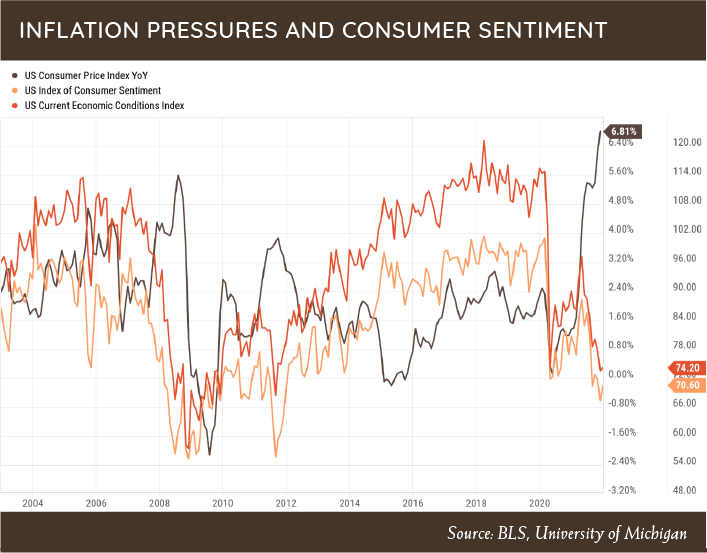

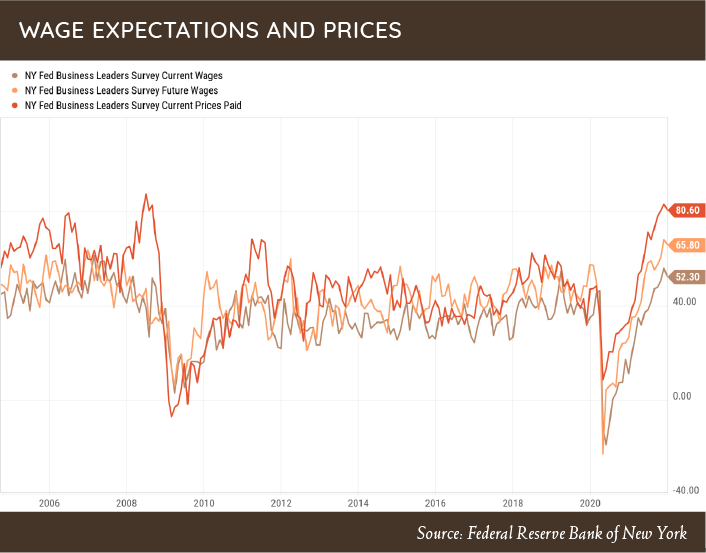

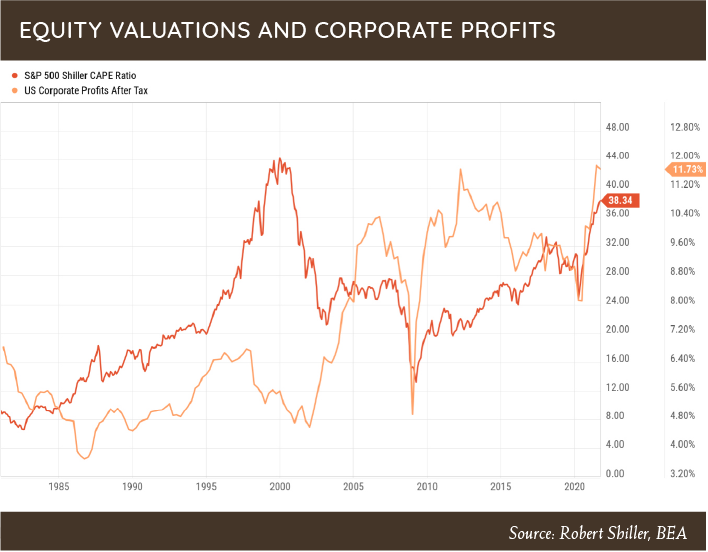

Greetings from the Northwest. Wasn’t that a nice bonus, getting a fresh blanket of snow between Christmas and New Year’s? I hope the kids all enjoyed it during their time off, as you never know around here if you’ll see any more snow this winter. I’d be just as happy if it stayed in the mountains. So, we have a new year, and we say farewell to 2021; it was quite the ride! How best should we remember it? I’m sure each of us has our own, unique take on it, but we all dealt with the same long parade of often painful global, national, and local events. Heck, we didn’t even get through the first week of the year before it started! So, again, how should we remember you, 2021? I’ll remember a year when the US equity markets provided one of the best ways on earth that one could grow their wealth, a year that saw real-estate values leap, even in areas experiencing net outflows, and one in which consumer prices rose undeniably higher. The supply of money was high, the cost of it low, and the desire of people to do something besides sit quietly in quarantine created a potent brew. The people reading this newsletter assuredly had their net worth increase this last year, providing welcome contrast to the other frustrations they may have experienced. We also got a welcome, if only temporary, reprieve from the virus in time for some early summer fun, and apparently it was easy to find a job if you wanted one. So, thank you, 2021, for what you did provide. Looking forward is both a necessary and imperfect part of our job here at Cairn. For over a year, Patrick has provided a consistent message highlighting the coming inflation and its possible effects, many of which have already been realized. This changing landscape, combined with the continued high stock valuations, is a formula for volatility. Let’s hear what Patrick has to say about this. Patrick's PartThanks, Tim. Over the last few quarters, we have discussed inflation and equity valuations from many different angles, so I apologize if I’m starting to sound like a broken record (Q2.2021 and Q3.2021). However, the changing market dynamic, moving from a long-term deflationary environment to a rising inflationary environment, will continue to have profound effects on capital markets. Prior to last quarter, we discussed that inflation might be on its way, but it was too soon to have a strong conviction one way or another. As the data continued to evolve, so did our opinion, when last quarter we echoed that inflation is here and will most likely be something we are going to have to live with for the foreseeable future. Nothing has changed over the subsequent three months to alter our opinion. In fact, more data points are emerging confirming inflation is here to stay, and that consumers are starting to believe in the same narrative. The chart below shows the year-over-year change in the Consumer Price Index with corresponding survey data on consumer sentiment. As you can see, the continued rise in inflation is starting to put a dent in consumer sentiment and their feelings about current economic conditions. Combined with survey data taken from business leaders (below) pointing to higher prices paid along with higher wage expectations, it paints an interesting picture of where future profit growth and margins could be heading Again, our concerns about inflationary pressures and the effects on capital markets would not be so strong if profit margins and valuations were more reasonable than they are today. But with profit margins and U.S. equity valuations close to record highs (below), the coming inflationary dynamic poses greater risk of loss. As we have spoken about previously, we do have a playbook and process for managing through these difficult market environments. The good news is that excessive valuations are not broadly based. Currently we are finding opportunities in international equities, and US value stocks. We were rewarded by having a value bias in 2021 as US value stocks performed well. However, international equities lagged as investors continue to blindly pile money into what “has” worked instead of what is “most likely” to work going forward. For reasons we have spoken about before, we continue to view international equities attractively, due to more compelling valuations combined with greater inflationary pressures in the US than abroad. Even as we are finding pockets of opportunity, risks are higher than normal, so our focus on risk management and capital preservation remains paramount. Thank you again for your continued trust, and please feel free to reach out to me to discuss this topic or any other concern. —Patrick Mason Thank you, Patrick, and wishing everyone a successful and happy 2022.

Tim Mosier, President Cairn Investment Group, Inc Comments are closed.

|

RSS Feed

RSS Feed