|

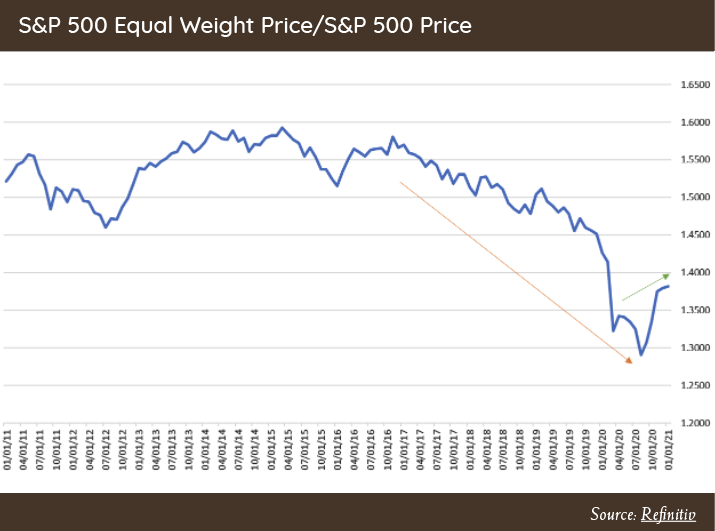

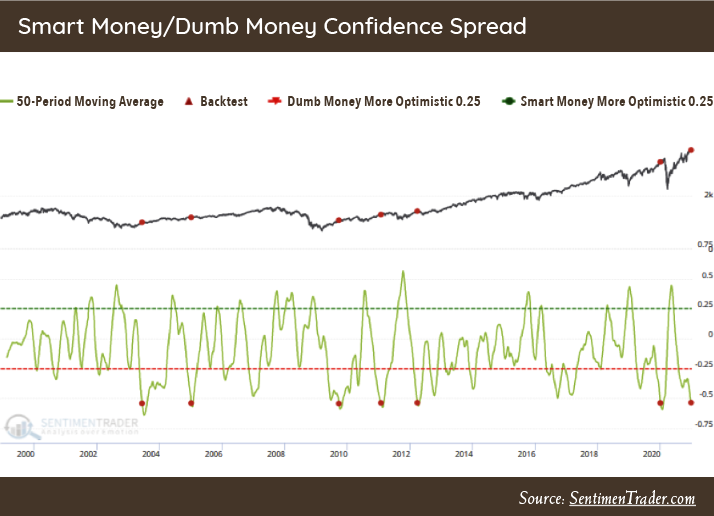

Greetings from the Northwest. Was that a Mack Truck or a herd of reindeer that knocked us off our feet? I didn’t catch a glimpse of the perpetrator, but it sure was nice of him to pick us back up and dust off our coats before he left. I’m talking, of course, about last year. Done with that, let’s move on to better days, and I do believe that better days are ahead. On a global scale, private enterprise has figured out how to operate while hampered by the confusing regulations and ever-present risks. Consumers are consuming, homebuyers are buying, etc. People and companies everywhere have pulled forward their use of technology for communicating, shopping, and more, by several years; yet it seems like we all still want to visit Costco and Fred Meyer between our Zoom meetings. As the health crisis eases with the coming vaccines, we’ll find out just how much pent-up demand exists. My sense is that it’s high. When we get the green light, we’ll be eating out, shopping, and traveling in vast numbers. Continuing in a more positive vein, I am so impressed by the people iour community who have, throughout the crisis, kept on task, helping those in need, whether that be financially, emotionally, medically, or all the above. We’ve seen strong giving from our clients and can see the good this spreads in the community. Similarly, I’ve observed an unabated commitment to important environmental projects in our state and elsewhere, with people giving their time and money trying to make a positive impact. Thank you. There will be challenges; we’ll all learn the tax impacts of the election in coming months, and we’ll all adapt. The stock market itself has already celebrated some of this success, so its performance may not be so rosy. I’ll leave it to Patrick to explain our thoughts on that in more detail. Speaking of Patrick and a brighter future, I want you all to know that as of January 1, Patrick is officially on the ownership team at Cairn. This is an important step for him, for your relationship with Cairn, and our ongoing growth, health, and continuity. Welcome, Patrick! Patrick's PartEquities posted a strong finish to 2020 with most indices up low double digits for the quarter. Investors continued to focus primarily on positive vaccine news versus a still muddling economy with lofty equity valuations. Small-Cap stocks were the biggest winner, rising 31.37% during Q4, while bonds posted a modest 0.67% gain. During our Q3 letter and our mid-quarter update we discussed where we are finding opportunity based on the large mis-pricing in small cap and value stocks, and though the first quarter of the year did not meet our expectations, portfolios have benefited from the change in market participation we are currently witnessing. One of our favorite indicators to track market participation (breadth), is the S&P 500 Equal Weight Index over the S&P 500 Cap Weight Index. When this indicator is moving down, market participation is narrow and being driven by a few large companies (like FAANG stocks). When it is moving up, the smaller companies are carrying more of the load and participating in a meaningful way, which is the current trend as you can see in the chart below. We have written quite a bit about high valuations and risk over the last few years. Though our concerns about valuation have not receded, observing more broad participation in the equity markets is a positive. With the rebound in equities that took place in April, we are now witnessing sentiment indicators at optimistic levels. One of our favorite sentiment indicators is the Smart Money vs. Dumb Money Spread released by our friends at SentimenTrader.com. This indicator measures money flows based on large option trading versus small speculative option trading. This is a contrarian indicator based on the logic that large institutional hedgers and participants have more knowledge and therefore are the “Smart Money.” As you can see from the chart below, when “Dumb Money” is at extremes, this tends to be a warning sign for the coming months. We are witnessing a tale of two markets summarized by: better participation across asset classes, and companies that will benefit from further economic improvement. Countered by equity markets that exhibit excessive valuation and frothy sentiment dampening future return potential. We have positioned portfolios accordingly, to take advantage of markets that are rewarding attractively valued companies and asset classes, while maintaining some extra cash and fixed income to act as a ballast in case more turbulent times arrive. Thank you for your continued trust. I always enjoy conversations with clients regarding any of these notes or the data we analyze, so please drop me a line if you care to discuss in greater detail. Thanks, Patrick!

Here’s to a happier 2021. Tim Mosier, President Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed