|

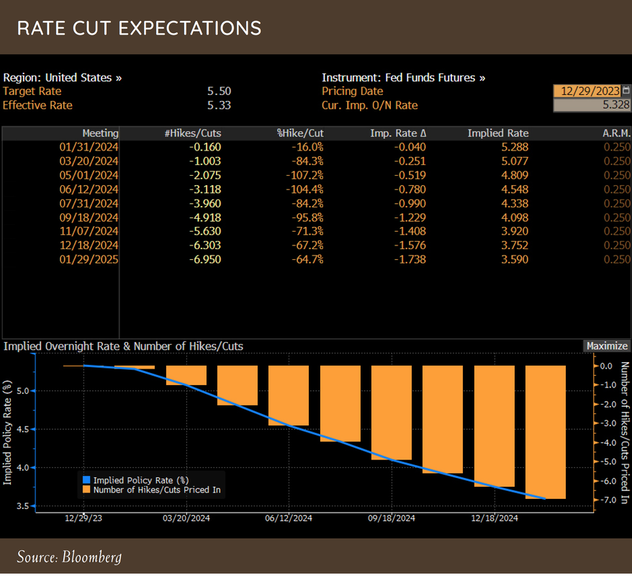

Greetings from the Northwest! As we welcome the new year, let’s briefly consider how exceptional 2023 has been. Thanks to strong El Niño conditions in the Pacific, the drought in California has been quenched, Washington has a state new record Mahimahi (a tropical fish often associated with Hawaii), and at this point no snow so far in the western Oregon or Washington valleys. It’s been warm and wet. Things were equally warm with securities markets, leaving many well-known economists, fund managers, and writers trying to dissect exactly why the year ended so much better than most predicted. Remember that the bank crisis (yes, that was in 2023), rapidly rising rates, high security valuations, inflation, global tensions, and a slowing world economy would combine to pummel stock prices? It didn’t happen; instead, we finished a year that provided solid gains in many asset classes. Some of the showy numbers, like the NASDAQ’s 54% gain, or the S&P’s 26%, were somewhat deceptive, in that they were driven to a huge extent by a very small number of headline stocks, and the NASDAQ’s eye-popping gains came on the heels of an equally bad selloff in 2022, so it’s pretty much where it was two years ago. Can it continue? Sure, but many of the concerns about overvaluation, a slowing economy, higher rates, etc., are still valid, even more so now. Much of this stock price enthusiasm was encouraged by the belief that the Fed will begin easing rates soon. They may not. I don’t think they should. The Fed has managed to take us from zero rates to something more in line with historical averages, and in so doing regained a useful tool to help us through times of crisis. We are not in crisis and haven’t been for a couple of years, yet governments at all levels have been spending like the end was nigh: another possible cause of the flourishing markets, and something that is unlikely to continue. The world’s supply chains are mostly back up to speed and shouldn’t be a significant driver of inflation going forward. When the seemingly endless flow of unfunded government payouts and backdoor bailouts ends, things are likely to become more challenging for consumers and smaller businesses. I look forward to Patrick’s more nuanced take on some of these topics. Here at home, we were honored by a long-time client and his daughter, to be presented with a digital rendition of a cairn photo that we now have hanging in our Vancouver office. Sarah Haftorson is the amazing, upcoming, digital artist who created the picture you see below. You can find out more about her and the process she employs at sarahhaftorson.com. By the time you read this, Cairn will have two new members of the ownership team: Mark Farrelly, and Cherie King, further enhancing our stability and our ability to serve our clients into the future. Congratulations, Mark and Cherie! Now on to Patrick: Patrick's PartThe 4th quarter of the year topped off a solid 2023 for broader equity markets with the S&P 500 rising over 11% for the quarter and over 26% for the year. Small Cap and International stocks also returned a respectable 16% and 18%, respectively. Bonds started the year poorly, with interest rates continuing to rise for the majority of the year, but the drop in rates that took place in the final two months saw their return move into positive territory at 5.5%. Up until the end of October, equity market performance could be characterized by the “Magnificent 7 (Apple, Microsoft, Meta, Alphabet, Tesla, Nvidia, and Amazon)” and then everyone else. The chart on the right shows the performance of the Mag 7 versus other broad indices. We have talked a lot about the lack of participation during this bear market rally that started at the end of 2022 and how unhealthy such an environment is for markets. So, if there is one silver lining to the recent rally that started on 10.27.23, it is that it has been very broad across numerous asset classes and sectors. The reason I say “one silver lining” is that the recent exuberance in equities is being driven mostly by investors’ hope that the Fed will return to a time of extremely low interest rates and that the inflation war has been won. That exuberance is not driven by drastically improving fundamentals. When you look at the data, the S&P 500 rose 16.21% from 10.27.23-12.31.23, while the S&P 500’s Price / Sales valuation multiple rose 20.19%. Euphoria is indeed alive and well, thanks to the Fed signaling a pivot in monetary policy. To end the year, the futures market is pricing in almost seven rate cuts in 2024. As you can see in the chart below, there are only eight Fed meetings during the year, so the market is assuming one rate cut starting in March and for every meeting that follows during a time when Core CPI is double the Fed’s long term 2.0% target. Not to say that cannot happen, but equity markets had better be careful what they wish for. If the Fed is cutting rates seven times in 2024, then my bet is that something alarming happened in the economy, causing the need to stimulate growth, which would not be a good thing for equity markets. This makes the biggest risks heading into this year – outside of extremely high valuations (touched on next) – that interest rates and inflation will stay HIGHER than the market is anticipating. During times of excitement and euphoria, investors tend to forget that valuations and the price you pay for the value of an investment are the main determiners of your long-term return, not the story being pitched at the time. We wrote about Cisco Systems last quarter, as many investors remember the Tech Wreck in the late 90’s, but this type of behavior has been happening for decades. In the 1970’s a story was being told about the Nifty Fifty stocks that is quite like the story being told about the Mag 7 now. It didn’t matter what price you paid for these darlings because they were innovators and would be around for many years to come. IBM is a perfect example of the narrative being presented. Yes, IBM was changing the computing world with growth rates that would match their innovation and impact on technology. In fact, IBM’s revenues grew from $6.88 billion in 1968 to over $34 billion in 1982 (close to 500%). In 1968 Business Week wrote about the exciting growth of IBM and how it compared to other companies:

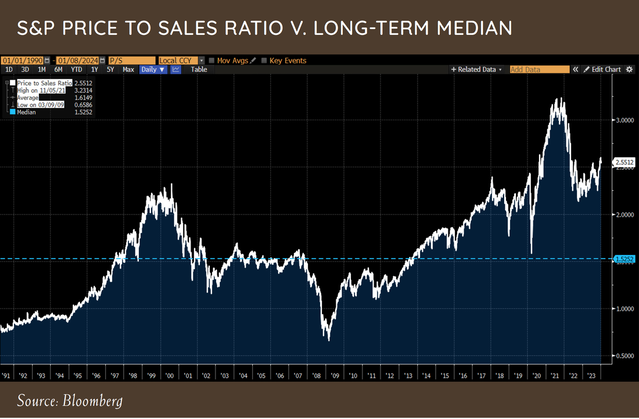

From the start of 1968, shareholders were rewarded with a price decline over 5% during the coming fourteen-year period, right in line with the S&P 500. Whether it is a company or an asset class, negative returns can be realized over a long-term investment horizon if you pay too dear a price.As Mark Twain is said to have opined, “History doesn’t repeat itself, but it often rhymes.” Currently, equity valuations are high, with the S&P 500 index price-to-revenue multiple higher than at any point in history outside of late 2021 and 70% above its long-term median. With high valuations and euphoric expectations about future growth and interest rates, risk of loss is higher than normal. A disciplined investment process with a focus on risk management will be paramount in navigating the years ahead. This is not to say there are not opportunities. Today, we still own high-quality companies that are trading at reasonable valuations; we combine those investments with asset classes we feel offer attractive valuations over the intermediate term. Fixed income is much more compelling than it was a few years ago, but we are still holding most of our allocation in short maturity debt based on the risks we discussed above. We also hold a large portion of the portfolio in cash via money markets, since the interest rate is high and it provides us with the optionality to invest in other long-term investments when prices are attractive. Our conservative positioning will not last forever. Market environments will change, and we will be ready to deploy our higher cash balances when valuations are lower or euphoria in the market has dissipated. Thank you for your continued trust and please do not hesitate to contact me directly if you have any questions or want to discuss any topics in more detail. —Patrick Mason Thanks, Patrick. As always, we’re open to discussing any and all of these topics, and would enjoy having you in the office to discuss your investments and plans. The coffee is always hot and free.

Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed