|

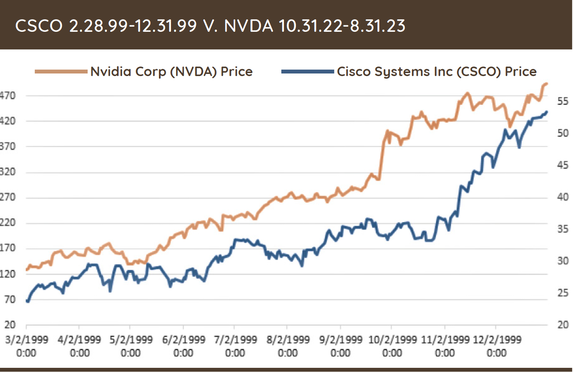

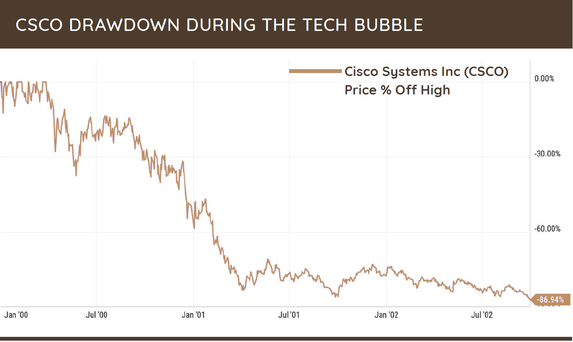

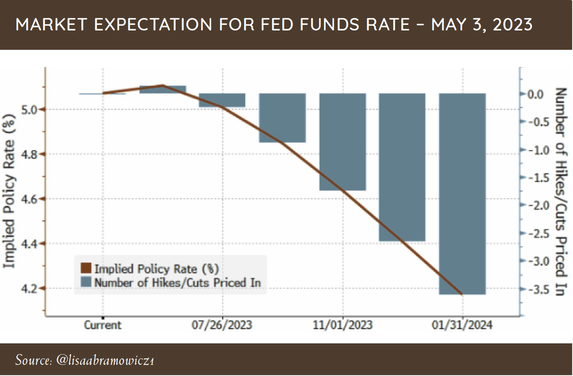

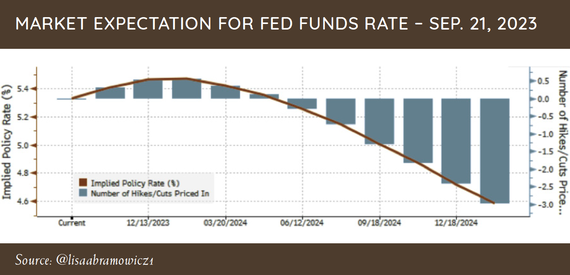

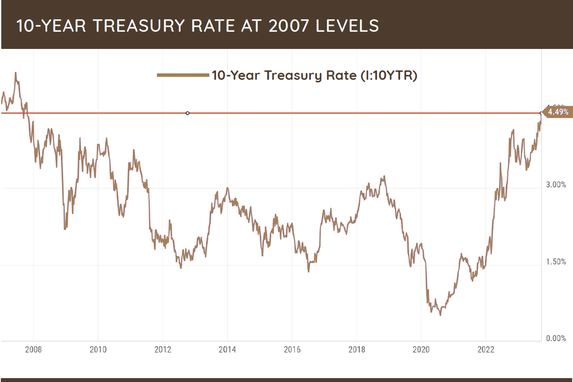

Greetings from the Northwest! How quickly things get back to normal; the weather, I mean, not the economy. As I begin writing this it’s a blustery and wet fall day that serves to remind me that all things, good or bad, must eventually come to an end. Of interest to us all is where our economy is headed, something that will be determined by our collective adaptations to the higher interest rates and just how badly the embedded cost increases of the past years will affect the spending power of the middle class. While employment seems to be hanging on, many effects of the higher rates are just now being felt and are already sending out warning signals. Credit card delinquencies and defaults have risen to levels not seen since the “Great Recession,” and that can only be interpreted as a sign of consumer stress. If employment weakens, expect things to get even worse. Much of this stress is the result of the sticky inflation that has already happened. According to Mark Zandi, Chief Economist at Moody’s Analytics: “To be sure, the high inflation of the past 2+ years has done lots of economic damage. Due to the high inflation, the typical household spent $202 more in a July than they did a year ago to buy the same goods and services. And they spent $709 more than they did 2 years ago.” As employers are forced to increase wages, it’s likely that earnings will suffer. Another effect of the higher rates, not well understood by the general public, is the relationship between interest rates and growth expectations of stocks. Patrick has hit on this in the past, and it’s now being manifested in the price of the high growth stocks that drive the Nasdaq. I’ll leave it to Patrick to take a deeper dive into some of these topics. Let’s see what Patrick has to say: Patrick's PartThe third quarter saw the return of volatility across capital markets, with most asset classes posting negative returns. Large cap stocks, measured by the S&P 500, were down 3.7%, with bonds not fairing much better, falling 1.99%. The first half of the year, investor enthusiasm was rivaling periods we saw during market highs of 2021, as pundits pushed the narrative that inflation was being controlled and the Fed could soon start cutting interest rates. Growth and big cap tech stocks were the biggest beneficiaries of this, since the artificial intelligence (AI) story has become a popular investment theme. The excitement surrounding AI is reminiscent of the 1999-2000 time frame when any company attached to the internet was being awarded a very lofty multiple. I have written about the disconnect between a good story and a good investment, most recently in March of 2021. As with any good story, there are some partial truths that make the excitement surrounding the growth in a new technology sound compelling, which then awards select companies lofty valuations. In 1999, the partial truth and narrative focused on how impactful and beneficial the internet would be to society, and to company profits. Companies like Cisco were set to profit greatly from the internet’s increasing importance since they developed networking hardware and software. In fact, from fiscal years 1999-2001, Cisco’s revenue grew at a very impressive 83%. Now, one might think that the high growth in revenue would have equated to a soaring stock price to match that growth. In truth, during that same period, Cisco’s stock went on to lose over 80% of its value as even the company’s high growth rate could not match the even higher expectations that investors had placed on the company. Witnessing investors bid up a company like Nvidia to over 30x revenues shows that investors have very short memories about market history and the effects that high valuations can have on future returns. In fact, looking at Cisco’s share price movement during the last 10 months of 1999 is very similar to what we have seen with the share price of Nvidia over the previous 10 months. This is not a prediction of what is going to happen with the share price of Nvidia. They could very well grow into the high valuation the market has placed on them. However, a good company or story does not always equal a good investment, as Cisco and many other wonderful technology companies showed investors during the tech bubble. The last three months have seen investor sentiment shift from euphoric levels to a more cautious outlook for capital markets. The primary drivers of the market’s performance over the last three months have been the bond market and monetary policy. Market participants are coming to the realization that interest rates are more than likely to remain higher for a prolonged period, which can affect many different asset classes and investments. The chart below shows as recently as May 3rd, futures markets were pricing in rate cuts for the September Fed meeting that just took place, with rate cuts continuing until the Fed Funds rate was at 4.25% in January. Fast forward to September 21st: the futures market is now pricing in an additional rate hike this year with rate cuts not taking place until June of 2024. This has also corresponded with the rate on the 10-year treasury jumping to 4.49%, a level not seen since 2007 before the financial crisis. What I find interesting about the positive performance in stocks for this year is that many pundits were justifying rising stock prices on the belief that the Fed will change course and start to cut interest rates during the year. With the market now anticipating higher interest rates for longer, and rates might not be lowered until the middle of next year, the types of equities and bonds that will generate attractive risk adjusted returns could shift. The effects of higher interest rates on fixed income instruments, all things being equal, is straightforward. As interest rates rise, the value of a bond goes down to compensate for the new higher level of interest rates. To combat that interest rate risk in fixed income portfolios, we focus on short maturity, high quality bonds which exhibit less price movement during rising interest rate environments. The effects on equities are not as intuitive. In our March 2021 letter, I wrote about how different companies can be affected by higher inflation which generally leads to higher interest rates: If inflationary pressures and concerns become a reality, the tool kit used over that last cycle (investing in high revenue growth, low current earnings U.S. companies, combined with long dated bonds), will not have the same level of success that investors have become accustomed to. The bullet points below explain the intuition:

One could almost replace the word inflation with interest rates, and come to the same conclusion, so the bullet points above hold up well during the environment we find ourselves in now – of high interest rates and sticky inflation – for the simple reason of how to value a future stream of earnings. So, the one bullet point I would add now is:

Our approach has always been to buy companies and asset classes that are being offered at a low valuation, which helps combat the risk that higher interest rates can have on the present value of a company. Most equity markets remain quite expensive historically, so building a portfolio that can weather higher interest rates and valuation risk is paramount to being successful in the years ahead. The benefit of managing risk in the current environment, versus environments during the last 16 years, is that cash rates remain high. This allows us to earn a competitive return in money markets and treasury bills while we patiently wait for a more compelling investment environment that properly compensates investors for taking an elevated level of equity risk. As always, we will change our outlook and positioning, based on what the data and facts tell us. Thank you for your continued trust and support, and please don’t hesitate to reach out to me with any questions. —Patrick Mason

Hoping everyone is well, and that this new season brings new and exciting adventures.

Tim Mosier, President, Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed