|

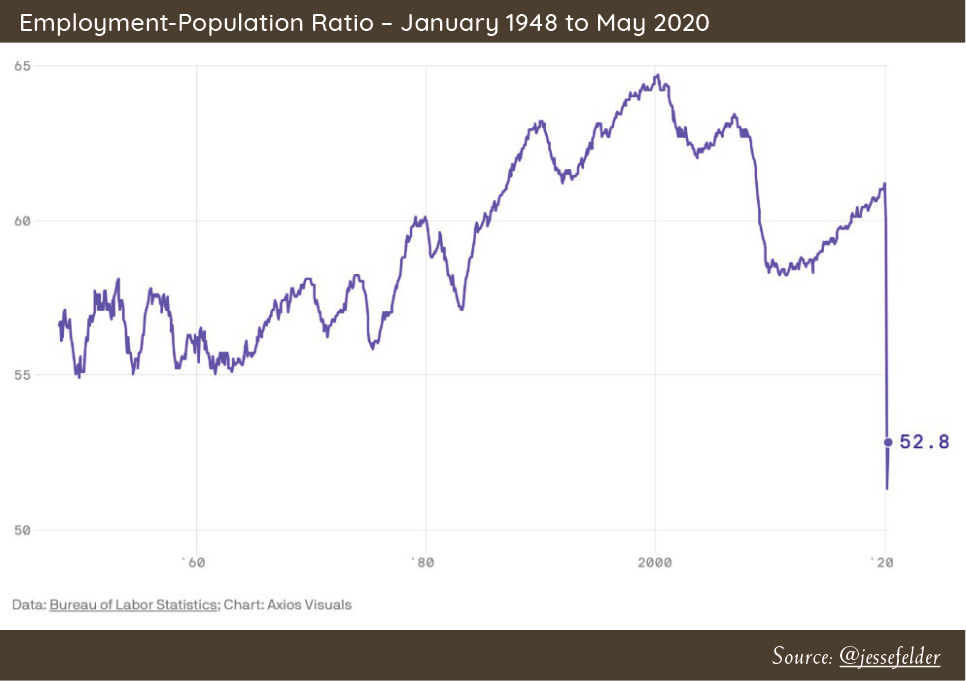

Greetings from the Northwest. Or should I say… Sweden? After all of the care we took to contain the virus and after all of the disruption to our lives, businesses and, yes, investments, we apparently will be moving forward by adapting and learning to live with the killer. While our bodies are no better prepared to fight the virus than they were in February, the medical and political systems have had time to react and strengthen their responses. We now have masks aplenty, and, apparently, an adequate number of ventilators. There’s been a noticeable lack of noise lately about vaccines and treatments, but I trust that, quietly and efficiently, the medical community is honing their response. Human nature is revealing itself, in that people are bursting their seams to get out of the house and back to work, school, play or protest, and so it shall be. So, what does this have to do with investing? Everything, I say! It has everything to do with how vibrant the economy will be, who the winners and losers will be, and how much confidence, or lack thereof, will be floating the stock market. As I write this, the market indices are again near their historic highs. Does this indicate a ground swell of confidence, or opportunistic speculation that the Fed will keep injecting funds into the system? It’s probably a little of the former and a lot of the latter. Life and the economy are always complex, with forces coming from many directions, some opposing, some reinforcing, some just confusing; but in our lives this is probably one of the most complex. With the headlines focused on major social and health issues, it’s easy to forget that many millions of hard working people are out there every day, trying to make a living and better their situation. Rush hour traffic is packed with folk headed to work. Heads down, full steam ahead. It’s this that makes what we do possible. There is no upside to the stock market or juicy dividend payouts without it. We hope and have confidence that this will always be so. While the market indices are at high points and their measurable valuations are near extremes, many investable securities have not participated fully, and we are finding a few opportunities. Keeping cash and fixed income productive is a challenge as well, with yields being extremely low. I’ll let Patrick dive a little deeper into what’s dragging the markets around. A Quick Office UpdateWe’re still closing early at 4pm each day, with Patricia and me onsite. Patrick and Jesyca join us each Tuesday so we can push forward on a number of projects we’ve undertaken. Jim and Lara check in multiple times a week and have lately been in at mid-week. Speaking of projects, the most important is our conversion from Envestnet’s “Portfolio Center” to their more advanced “Tamarac” reporting system. Your quarterly report, attached, looks very different from what we’ve produced in the past, and we believe this will enable an enhanced understanding of your investments. We look forward to your feedback. Another improvement is the ability of this system to open a private client portal to securely deliver documents, and to allow you to view your investment progress at your convenience. Our plan is to begin distributing Quarterly Reports through this secure client portal in October. Patrick's PartThese are truly unique times we are experiencing. The volatility of equity markets so far this year is something that has not been seen since the Great Depression. In the last 3 months, global equity markets went from fear of an economic collapse to trading at the same lofty valuation levels that were seen in January, before the pandemic took hold. On June 8, the National Bureau of Economic Research officially declared the US to be in a recession that had started in February. It seems like with the recent surge in stocks, markets have priced in a swift V-shaped recovery in economic growth and corporate earnings. We are not going to pretend to know how this will play out. However, we find the view of a return to economic and earnings prosperity in the near term to be Pollyannaish, as the majority of “Main Street” are still suffering from lost jobs and lack of consumer confidence in the safety of going out and living a normal life without getting sick. The Fed is a primary catalyst to the stock market’s newfound enthusiasm. On March 23, Fed Chairman Jerome Powell announced unprecedented (some would argue illegal) financial liquidity to the fixed income markets. Never before has the Fed embarked on directly buying individual corporate bonds. In our opinion, this direct backing of individual company debt is blurring the lines of free markets and creating a large moral hazard in corporate America. The Fed is now a top 5 holder of the 54 billion-dollar iShares iBoxx Investment Grade Corporate Bond ETF that holds individual bonds issued by companies such as Microsoft, GE, Anheuser-Busch, Berkshire Hathaway, and CVS Health. This means the Fed is now investing in and supporting individual company debt, having the potential ramification of choosing which type of company could succeed and fail, instead of the capital markets making that determination. The backing the Fed has provided to the bond market has spilled over to the equity markets in the hope that monetary intervention will be the panacea for the current downturn in company profits. The chart below from Charles Schwab Chief Strategist, Liz Ann Sonders, shows the growth in the Fed’s balance sheet and the price of the S&P 500 index. The Fed’s intervention corresponded with stocks moving higher: Meanwhile in the real economy close to 50% of the population is not working: Many market pundits argue that the stock market is not the economy and that stock markets can look forward to an eventual economic and earnings recovery. This is true, but significant price recovery usually takes place when market valuations are much lower than where they currently stand, at close to 30 times normalized earnings. It is not hard to argue that the disconnect between stock prices and the real economy is quite large. Our job is recognizing the environment we are investing in, managing risk, and finding opportunities. On May 11 we sent out our mid-quarter update, discussing where we are finding opportunities, and said:

Our thoughts have remained the same and we continue to find opportunities that fit that criteria. We would not be surprised to see continued volatility in financial markets, as states react to the virus and open and close communities accordingly. We will continue to act prudently and manage your wealth based on data and analysis, not on headlines and emotions. Thank you again for your continued trust, and please feel free to reach out to me to discuss any topic in greater detail. Wishing you health, happiness, safety, and enjoyment as we head into another Pacific Northwest summer.

Tim Mosier, President Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed