|

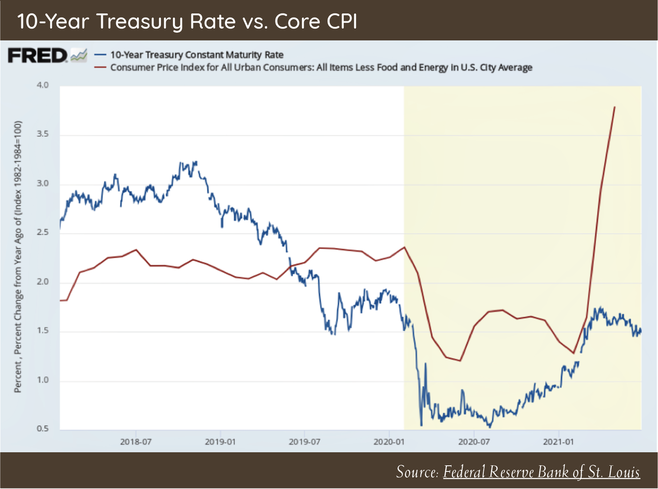

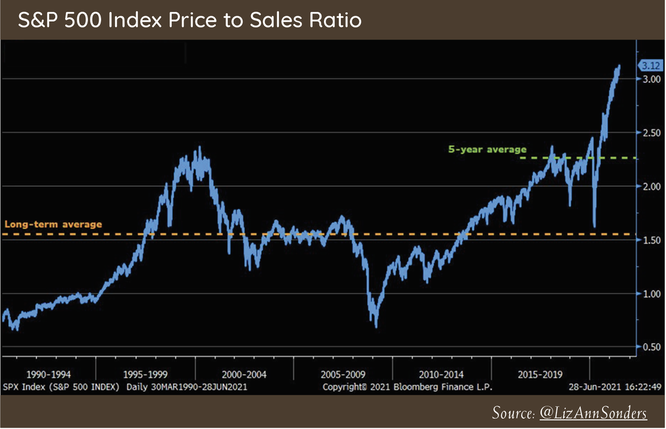

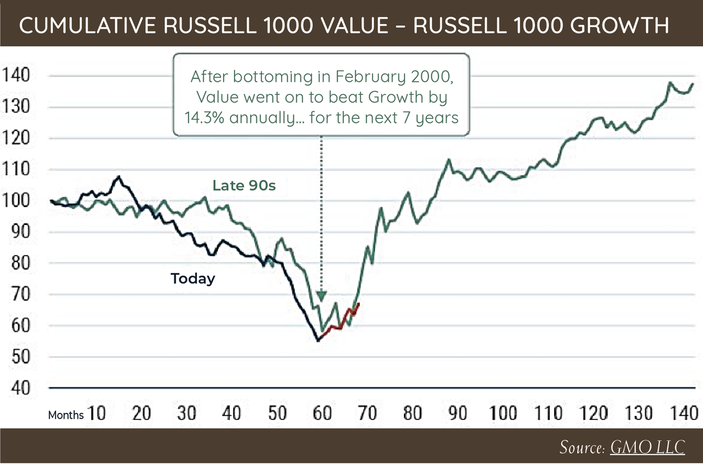

Greetings from the Northwest. Wasn’t that hot spell unpleasant! Who needs temps in the 110s? We’ve already had our first local wildfire prior to the heat kicking in, getting a good whiff of smoke in our neighborhood from a blaze just over the mountains. I’m hoping we don’t have a repeat of that thick, unpleasant smoke last September. Please, be careful out there! Now and then a new word seeps into our daily discourse; not new in the sense of its creation, but new in the sense of its prevalence and meaning. Often it’s a way to get our attention and describe something that was previously vaguely understood. Remember the word sustainable becoming part of our common language some years ago? It was novel at first, and eventually over-used, but we all came to terms with it in our own way. It now has a certain shared meaning that allows us to better communicate an important concept that’s used for a broad swath of topics. The word that I want to talk about today is narrative. You know what I mean… it seems that everybody, and every cause, has a narrative. The word “spin” may have been used in the past for some things meant by narrative, but spin sounds too negative to use in most cases. Narrative can be used for topics without sounding negative or dishonest. But let’s be clear: A narrative is a story, and these stories are all told to create reactions to the benefit of the storyteller. Because of this, they cannot be the whole truth, just a subset of the truth that works for the storyteller. In its ugliest form a narrative includes untruths as well. Unfortunately, today, narratives are even masquerading as news in our hyper-informed world. So why am I bringing up this potentially over-broad and serious topic? Well, first of all, we are being engulfed by narratives daily. Pick a topic and there are competing narratives, and our investing world is not immune. We need to remain alert to this and not let ourselves be too quickly or easily swayed before we have a chance to weigh the facts and draw our own conclusions. Our job here at Cairn is to parse through a barrage of narratives, real news, raw data, and opinion to come up with reasonable actions and advice for our investors. We can’t let ourselves get swept up in a narrative that presents a distorted view of the future and entices us to act in a way that is out of step with reality. These are momentous times as we come out from under the shadow of the virus; it’s equally possible to miss the opportunities that this presents, or to fall into a trap of our own creation. I want to emphasize that at Cairn we are working hard to remain rational and pragmatic in our vision and actions. Please read carefully though Patrick’s part as he again explains our beliefs and processes to care for your money. Patrick's PartLast quarter we wrote at length regarding the potential for higher inflation, how equities might react to it, and how our disciplined process would manage through it. As Tim correctly points out, we are being bombarded by narratives surrounding the investment and economic landscape on a daily basis. The dominant narrative to start the second quarter said something along the lines of, “inflation is coming, and you better get prepared for it!” While we still see many headlines regarding the topic, financial markets do not seem to be overly concerned. The chart below shows the year-over-year change in Core CPI (Inflation) and the yield on the US 10-year treasury bond. What is interesting is that the data shows a spike in inflation (partly due to lower-than-normal levels a year ago), but the bond market does not seem to be worried about it. If there was a large concern about persistently higher inflation, the yield on long-dated treasury bonds would be moving HIGHER, not lower as we are witnessing now. This speaks to what Tim discussed; our job is to parse through the noise being created by these numerous narratives to see what the data is actually suggesting. Currently, many data points indicate that inflation is moving higher but could be temporary. We will take the evidence as it comes and act appropriately. Another popular narrative that we hear these days revolves around valuation. With equity markets continuing to outpace underlying fundamentals, many pundits have started to whisper opinions that valuations are not as important and that elevated valuations are justified, due to higher economic growth, combined with the larger representation of disruptive technology companies. As with any good story, there are some partial truths that make these arguments sound compelling. Yes, technology companies have become more dominant in equity markets and trade at higher valuations due to their disruptive qualities. But the skeptics in us always like to take a look at the actual data to see what that tells us. Below is a chart of the S&P 500 index Price to Sales Ratio. A couple of thoughts enter my mind when I look at this chart. First, current valuations are roughly 20% higher than they were during the height of the technology bubble when the same arguments were being made about disruptive tech companies. Second, with S&P 500 revenues growing on average in the mid single digits over the last couple of decades and valuations trading at 2x long-term averages, the disconnect between price and underlying fundamentals is not solely explained by disruptive stocks trading at high valuations. So, while the financial media try to spin the narrative that today’s high valuations are justified by the dominance of select companies, when you look underneath the hood at the actual data, high valuations are present in many different sizes of companies, which is how you get valuations so much higher than average. Our process is built around understanding the price we are paying for an asset and then paying a price we believe is below what the asset is worth, whether that be a specific company, or asset class. We feel that is the best way to deliver consistent long-term results while avoiding the overvaluation we are witnessing in many areas of the equity markets. The last chart below shows the return of value vs. growth during the late 90s and what we are witnessing today. Just as in the late 90s, value just went through a period of underperformance versus its growth counterpart up until the fall of last year. Since then, value has been staging a comeback, and if history is any guide (it usually is), then this short period of value outperformance since the fall is just getting started. With relative valuations being much more attractive for value companies versus growth, we feel our investment philosophy acts as another layer of safety if market volatility rises, and opportunity if markets continue their march higher in the months ahead. Thank you for your continued trust and support. Please reach out to me if you want to discuss any of the above topics in greater detail. Thanks, Patrick!

Wishing you all a wonderful summer with lots of freedom to gather and travel. Tim Mosier, President Cairn Investment Group, Inc Comments are closed.

|

RSS Feed

RSS Feed