|

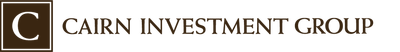

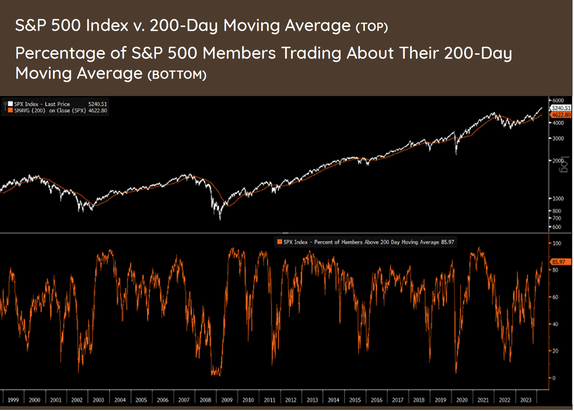

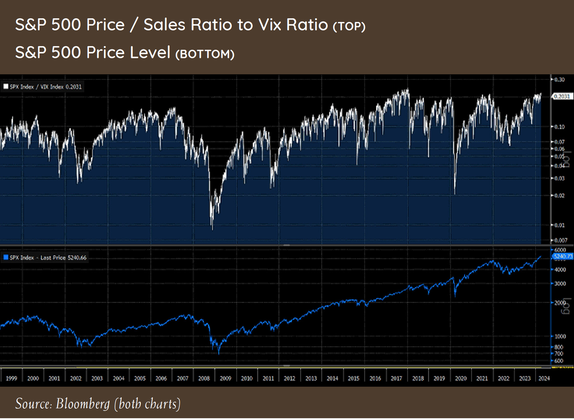

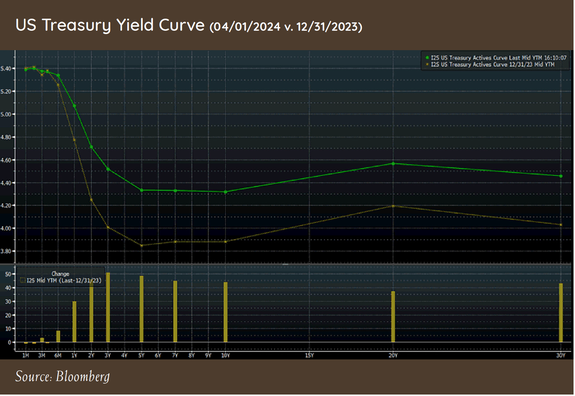

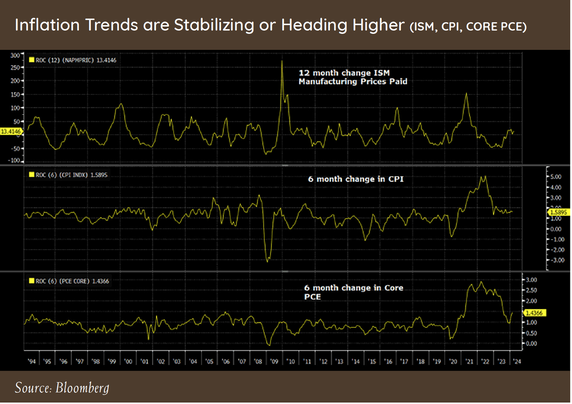

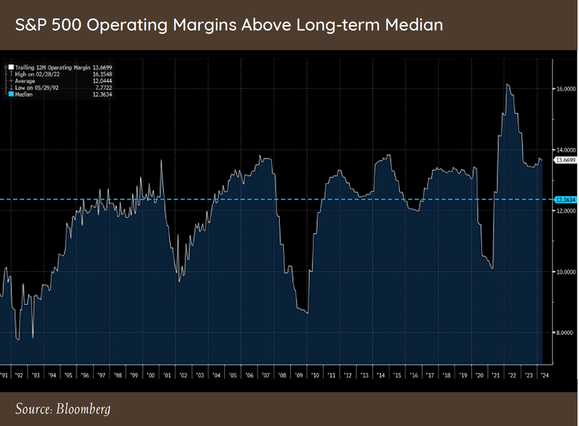

Greetings from the Northwest! Well, it’s been quite a first quarter for 2024! Against a backdrop of multi-faceted turmoil, the US economy has been strong enough to avoid a recession, despite last year’s spike in interest rates and enduring inflation. Apparently, consumers are still spending, even if it means getting deeper into debt, which may indicate a sense of optimism about their prospects, or it could be a house of cards ready to fall. We’ll see. Stock market indexes outperformed most expectations, but still, we saw that the broader market was not as enthusiastic as the few market leaders, although this last month saw that broader market catch up a bit; a healthy move. The “Magnificent Seven” is now the “Fab Four,” with Apple and Tesla in particular underperforming of late. A much-desired outcome for the Fed and most investors is the elusive “soft landing” whereby a major economic shift occurs (in this case, raising the Fed rates), without driving the economy into recession. I think it’s arguable that they’ve achieved that goal, recognizing that we never actually land anywhere; the merry-go-round never stops, and someday, due to some set of circumstances, we will experience a recession. Inflation is not yet in the bag either. We can’t yet predict the combined effect of having the Suez Canal route compromised and the upper Chesapeake out of service at the same time. I’ve heard it argued that we’ve been experiencing a “rolling” recession, with economic sectors taking their turn getting hit, then recovering, with the net result that overall, we never dip below the line. I can believe that. We’ve moved past the bank scare we were talking about last year at this time, but it may not all be over, especially for regional banks that have lent heavily into the commercial real estate market. I probably don’t have to tell you much about the state of that market for you to understand the risk presented. We have little to no exposure there, so hopefully whatever transpires won’t spread much beyond that sector. We’re happy to welcome Spring, and with the better weather, more of you are wanting to come in for an in-person meeting! I highly encourage it. Just give us a week or two’s notice and we can be prepared. Before moving on to Patrick’s well thought out dissection of the financial world, I’ll mention that we now have the ability to actively manage your 401(k)s and similar assets that cannot be brought into Schwab at this time. We’re utilizing a software service by Pontera that allows us access to almost any employer retirement plan. The advantages to you are our ability to coordinate those investments with your overall strategy and relieve you of the need to stay on top of rebalancing and allocation changes. Dan, Mark, or Patrick can explain how to set this up if it makes sense for you. With that, here’s Patrick: Patrick's PartEquity markets continued the upward trend that started in November last year, with most stock indexes posting mid to upper single digit gains for the quarter. The combination of better than anticipated economic data and the continued hope that the Fed will lower interest rates at some point this year added fuel to already overheated equity market prices. Last quarter, I wrote at length about the expensiveness of most US stocks and the effects on future returns. Suffice to say, with the performance of most markets being positive so far this year, our concerns surrounding high valuations have not changed. The current rally we are witnessing in the S&P 500 has created the following conditions: the price is more than 13% above its 200-day moving average, with more than 85% of members trading about their own 200-day moving average, the Price / Sales ratio (valuation) to the VIX (complacency) at multi-year highs (h/t John Hussman), and household allocations to stocks and their feelings about future prospects at extreme levels. The charts on the right show these conditions going back to 1998. As you can see, this does not always signal a market correction, but it has been a precursor to some of the larger drawdowns we have seen over the last 25 years. So, if there is one word I could use to describe the environment in the short term it would be “Exhausted.” One silver lining during the quarter is that participation improved in February and March, meaning that the market was not being driven by just a small group of stocks, as we witnessed over much of 2023. It is too early to tell if this is a change in trend, but it would be a much healthier environment in which to take more risk if participation wasn’t as ragged, even when considering current high valuations. Inflation and Interest RatesTo start the year, capital markets were pricing in close to seven rate cuts from the Fed, based on belief that inflation has been controlled, so restrictive monetary policy was not needed. I mentioned that I thought that was overly optimistic, based on what the inflation data was signaling. Over the last three months, inflation data has come in higher than what markets were estimating. This has changed expectations for rate cuts to come down to under three this year, with cuts not anticipated to begin until later in the year. The bond market has taken notice, as the long end of the US treasury curve has moved higher in anticipation of interest rates staying higher for longer. The current trend in inflation data being released might make even three cuts overly optimistic. The trend in CPI, Core PCE (Personal Consumption), and the prices paid component of the ISM manufacturing survey, all point to inflation being stickier and more permanent than what the market was anticipating starting the year. If inflation does become more embedded in the economy, the effects would be widespread across capital markets. Operating margins for the S&P 500 have maintained a high level, despite higher inflation, on the belief that inflation would moderate, and input costs and end prices would come back down. Inflation remaining sticky is going to test companies’ ability to continue to suppress wages and push higher prices down to the consumer. If the consumer is unable or unwilling to absorb continuously higher prices, margins will compress to more normal levels. Our job is to navigate this challenging environment and build portfolios that protect against the risks we observe, while earning a return to meet long term goals. To help protect our portfolios against margin compression and inflation risk, our analysis of companies looks at the ability of a company to maintain pricing power and the ability to adjust cost structures based on changing market dynamics. We also run scenario analysis on the operating performance of a company to make sure the price we are paying has a wide margin of safety built in. When looking at other asset classes to complement the portfolio companies we own, our understanding of market history and valuations provides the framework to take advantage of opportunities and avoid unnecessary risks when prices do not reflect economic reality. I look forward to the day when we talk about the breadth of opportunities and how the cash positions in the portfolio are being deployed to take advantage of them. In the meantime, we continue to have a neutral stance, and hold more cash than normal due to high valuations, euphoric sentiment, and ragged market participation. When the data changes, we will change our mind. Thank you for your continued trust and please do not hesitate to reach out to me to discuss any topic in greater detail. —Patrick Mason Thanks, Patrick!

Have a safe and happy spring! Tim Mosier, President Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed