|

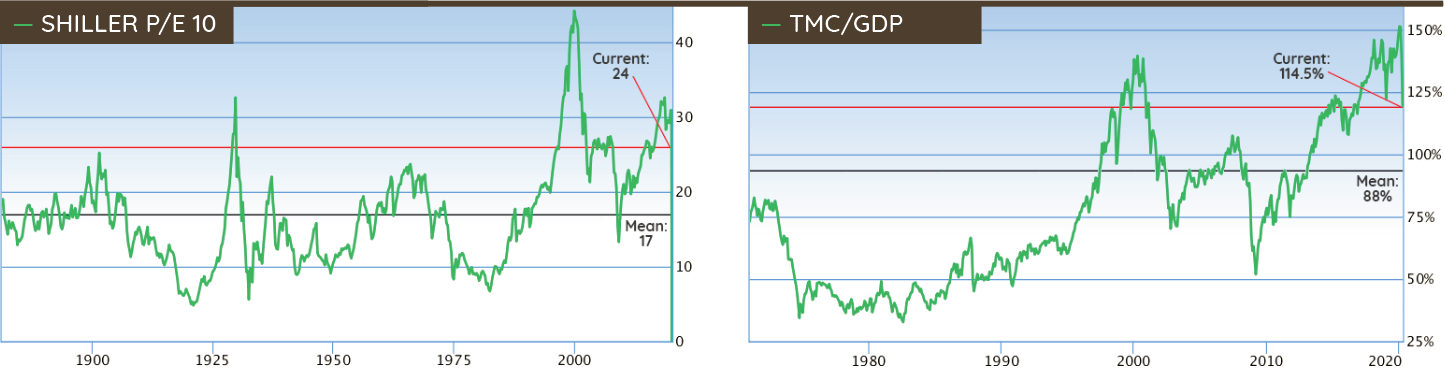

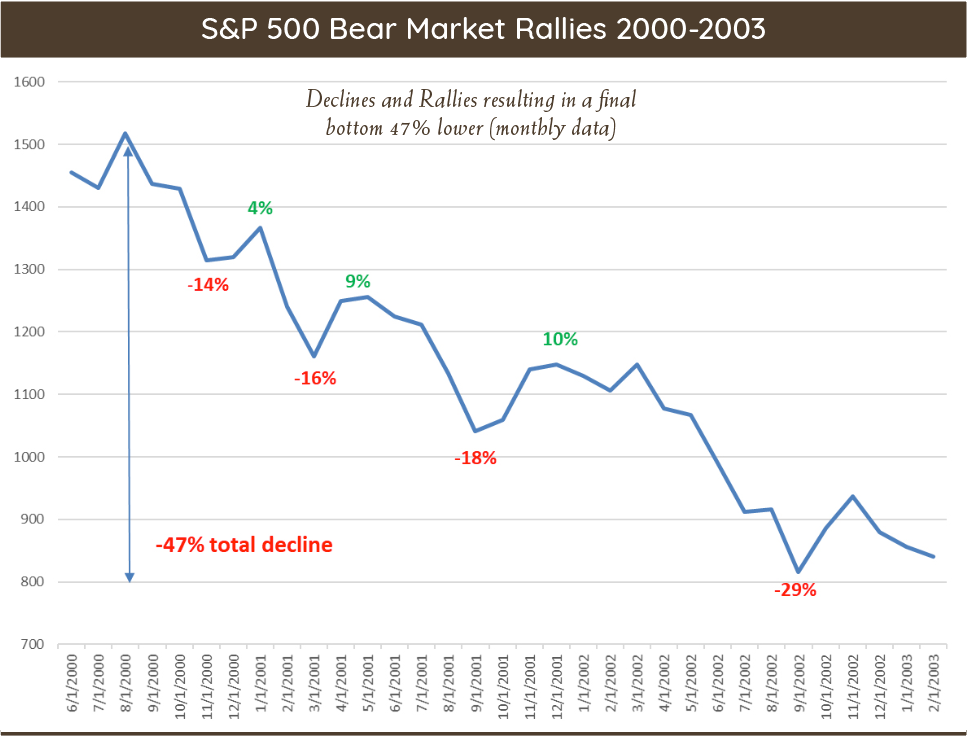

Greetings from the Northwest. In this unprecedented, historic, and frightening framework I struggled with writing that simple, well-used phrase. Is it too light and cheery for the circumstances we find ourselves in? Will this arrive at a home stricken by the virus? I can’t know, but I sincerely hope that this finds you and your loved ones healthy, and happy to be enjoying more time together at home. This is such an exceptional time. We’re all in the same boat, and that phrase works so well here, yet the way it plays out for each of us will be unique. I have few worries for myself, but my paramedic daughter is deployed with FEMA at a hot spot, and I worry for her every day. My son is currently submerged somewhere in the Pacific on board a submarine, and I last heard from him in late January. Does he even know about what’s happening? Many of you have stories and concerns of your own, I’m sure. Dealing with the health and safety is and should be the overarching priority. Through all of this, Cairn’s job is to care for your money, and give you confidence that this will work out for you financially. We’re all fine here, and we are functional. We are adapting. I write this sitting in an otherwise empty office, just having gotten off a teleconference with the staff, most of whom are working from home. For the first time ever, this newsletter and attached reports are being generated and distributed electronically. Patrick has all of his Cairn tools at home, as does Jesyca. Patricia works her normal shift in the office, fielding the incoming calls and mail. Jim and Lara remain ready to help at the push of a button, so rest assured that we are here, and will be here through it all. Investments have taken a hit. Considering the backdrop and the potential economic harm that’s being inflicted, it’s heartening to see that it’s not been worse. This might be a recognition that all stops will be pulled out to get the nation through this. I do think that more rough times are ahead, but at this point we are beginning to look for opportunities as much as we are looking to reduce risk. Patrick will go into details about the process and economics, but I will say here that if you have enough cash and fixed income to support your plans for the next year or so, it’s likely that your equities will have recovered nicely by the time you’ll need to tap into them. Let us work the process and position things for the eventual rebound. I’ll end with a quote from Warren Buffet that Jim shared with me recently: “The stock market is a device for transferring money from the impatient to the patient.” We are patient. On to Patrick… Patrick's Part It’s hard to believe that most stocks were trading at a record high only 6 weeks ago. The rate of this recent downturn was the fastest in history. US large cap stocks fared the best, being down 19.6%. US small cap stocks, developed international stocks, and emerging market stocks were down more, with returns of -30.65%, -23.01%, and -23.94% respectively. The bond market was also quite volatile during the quarter, with the broad market returning 3.10%, high yield bonds down -11.61%, and municipal bonds returning -0.61%. Needless to say, outside of cash and Treasury bonds, there were few safe havens. The response to COVID-19 has inflicted significant damage on the global economy to date, with little clarity on when the economic data will start to take a turn for the better. We have talked in great length in previous letters regarding our thoughts on the economy, high market valuations (Oct 7 2017 :: Jan 11 2019 :: Oct 8 2019), and interest rates (April 12 2019), but I don’t think anyone could have foreseen the rapid impact this virus is having. The US is most likely in recession at this point, which prompts the questions: How long will this contraction last, and what impact on consumer behavior and spending will it have on the rate of recovery? Unfortunately, nobody knows the answers to these questions. Recently, we’ve communicated how we are managing the portfolios during this difficult environment and our process for uncovering new opportunities (July 11 2019), so I won’t spend a lot of time on that here. My focus is primarily on the broader US market and where we stand from a valuation perspective after the recent price declines. For comparison we will look at price behavior during a recent bear market. With lots of noise in the short-term, I find it helpful to focus on a long-term perspective to provide some clarity on expectations of future market returns and experiences. The prevailing viewpoint amongst market pundits since the last week of March is that the low was reached on March 23rd when the S&P 500 closed at 2,237.40. This combined with the narrative that prices will be choppy, but higher prices are to be expected in short order. It’s a nice story and feels good to hear that the worst could be behind us. And (while it is possible that the pundits are correct) after examining the data and comparing previous bear market experiences, it could prove to be wishful thinking. We do not invest on hopes and wishful thinking, though, and prefer to look at hard data instead. The charts below show two different metrics that are very useful in understanding long-term valuations. I have discussed these previously and reviewed them with many of you individually. The Shiller CAPE P/E ratio and Total Market cap to GDP both peaked at the end of January. As the charts show, both indicators are down from their highs set earlier in the year. However, even with the recent improvement in valuations, these metrics are still only 20% below levels that were matched only during the Great Depression and the tech wreck. I don’t bring this up to say the market has to head lower, as investing is not an exercise in absolutes, but to give context to where current valuations stand versus history. Even after recent price decline, valuations are still elevated. The month of March was extremely volatile. Not since the Great Depression have equity markets seen this level of volatility. From March 1st to March 23rd the S&P 500 was down 24.16%. Then from March 23rd to March 31st the S&P 500 rallied 17.4%. The rally from March 23rd has caused many pundits to declare that the “bottom” has been set and the next bull market is underway. Nobody knows when the bottom happens. It is only known well after the fact when prices are higher over the long-term. The chart below shows the price experience of the S&P 500 during the bear market that took place from 2000-2003. As the chart shows, the decline that took place was filled with many short-term rallies that ultimately failed as prices moved lower. Again, this is not to say that the current market behavior will mirror the above experience, but to give a longer-term perspective on how markets can behave. They do not continuously go down during bear markets, nor do they continuously rise. We follow price trend data very closely as part of our analysis and the data still suggests a new bull market hasn’t begun. The combination of valuations and price trends leads us to believe that caution is still warranted at the broader market level. However, during bear market environments there are individual stocks, sectors and asset classes that perform much better than broad indices. On a positive note, with the recent market decline, we are starting to find many more suitable investments that didn’t exist a few months back. Many stocks have seen declines of 30-50% this year, compared to 20% for the S&P500. This is creating opportunities and we are taking advantage as prices dictate. During this period of stress, we continue to emphasize attractively valued companies, with durable cash flows and strong balance sheets that can weather this economic storm. We will continue to invest based on our disciplined process, and let facts and data tell us when we should change our mind on when taking more risk is necessary. Thank you again for your continued trust and especially your kind words during these trying times. Please drop me an email or phone call if you want to discuss any topic in greater detail. Thanks, Patrick. With that I’ll leave you all with the sincere hope that you remain safe through this perilous time.

Tim Mosier, President Cairn Investment Group, Inc. Comments are closed.

|

RSS Feed

RSS Feed