|

It’s hard to believe we’re on the precipice of yet another new year but, here we are. Temperatures are dropping, family get-togethers are being organized and, pretty soon, coffee shops will be filled with the familiar echoes of holiday music. Before the hustle and bustle of the holiday season takes over entirely, it’s important to take a moment and make several year-end planning items a priority. Below is a checklist of eleven items you should examine, which can help secure your financial plan as we transition into the new year:

The U.S. tax system is complicated. Understanding the intricacies of the tax code and how different sources of income – including social security and capital gains – interact with one another can be intimidating, especially when transitioning into retirement. Our “Taxes in Retirement” webinar will address these topics and more while providing information on the tools available to help you proactively create tax-efficient strategies and avoid common tax pitfalls.

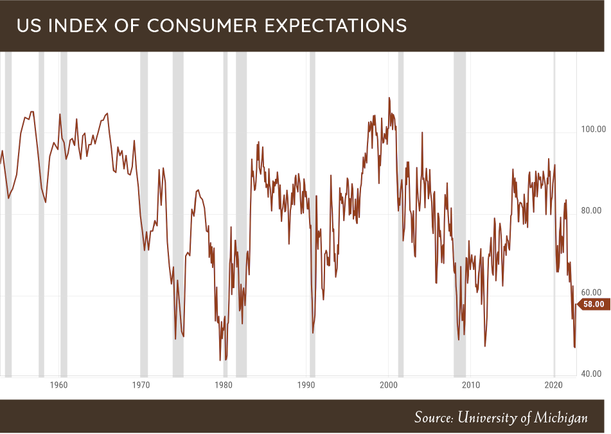

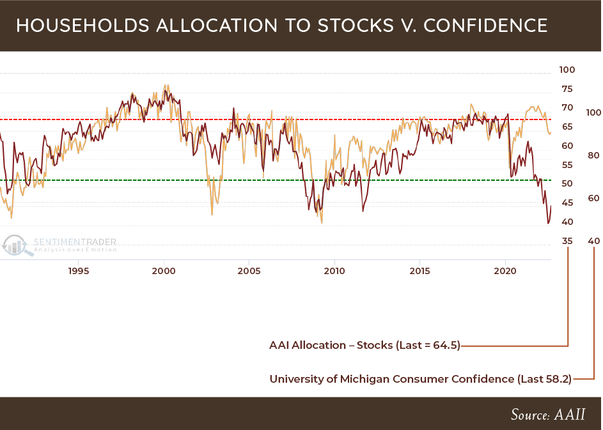

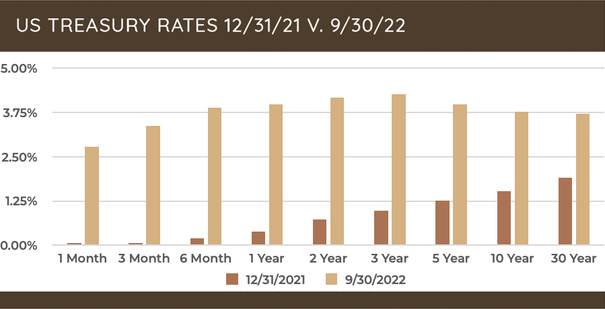

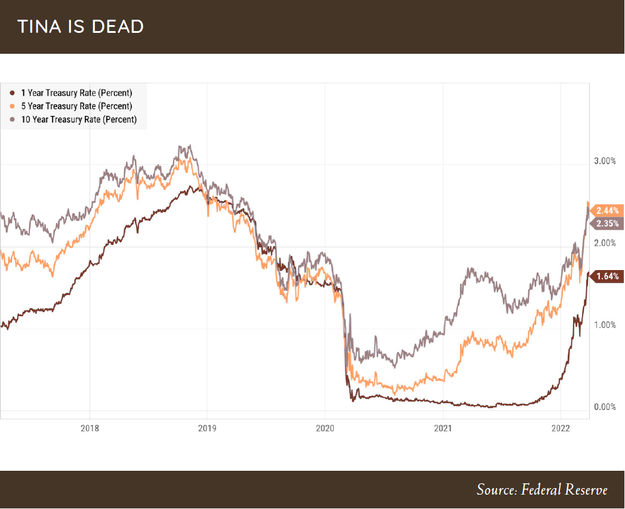

View the webinar here. Greetings from the Northwest. I can hardly believe that it’s been a year since I wrote of frosty mornings and fall colors! This year it’s summerlike temperatures, sunglasses, and tinder dry vegetation. I’m afraid that the eventual but certain surrender to Autumn may be more abrupt than usual. It’s been a rough investing season so far. I’m not sure I know why the stock market likes to pick the fall to make its most dramatic downside moves, but if September is a gauge, we’re probably in for some more pain before the bargain shopping kicks into gear to turn things around. We’ve done much to protect your assets from the most painful moves, as Patrick will point out, and we’ll continue to look for opportunities to reduce risk or pick up a bargain when we can. For most of you, staying the course will yield the best result, but if your needs and circumstances have changed, please let us know so that we can re-evaluate our plan. Here’s a topic that we’ve never really touched on before, and it has nothing to do with making you more money: In times like this it’s common to allow negative sentiment to seep into our decision making and knock us out of our normal patterns in many unexpected ways. While we’re all experiencing what’s likely a temporary reduction in our wealth, many of the organizations that provide for those in need, protect the environment, or otherwise do the hard work that most of us cannot do ourselves, still need our help, and they often find that getting the funds to do so is a bit tougher in times like this. I suggest that we continue to remember the causes that are dear to us, even when our own fortunes may be somewhat less. With that, I’ll hand things over to Patrick, who will again school us on the numerical realities of investing. Patrick's PartIt is understandable to hear investors’ comments about never having seen a market environment like the one we are living through now, having never witnessed both US stocks and bonds decline for 3 quarters in a row (h/t Liz Ann Sonders). High inflation, and the Fed’s response by raising interest rates at an unprecedented pace, have caused a shift in investor sentiment and risk-taking behavior across numerous asset classes. We have observed a quick reversal in how households and investors are feeling about their future, with the consumer expectations index hovering in recessionary territory. Though households are feeling pessimistic about the future, it seems like most investors have been conditioned over the years to expect that the Fed will always have their back, so even though pessimism is high, it seems like a fake pessimism. Although we are still in a bear market, and households are as pessimistic about the current economic environment as they have been in 30 years, very few are acting like it. The chart below shows household allocations to stocks still sitting at close to 65%, which is much higher than previous bear market lows where consumer confidence currently sits. So even though valuations have come down from their extremes (though still not cheap) and sentiment is low, the fact is that household allocations to stocks remain elevated, and we haven’t seen the signs of capitulation that signal that this bear market is over. In our first quarter letter we suggested that TINA (There is No Alternative) might be a thing of the past, as interest rates were starting to move higher. I think market pundits are going to have to come up with a new acronym, now that interest rates have risen substantially this year. The chart below shows US treasury bond rates at the start of the year and what the corresponding rates are now. Needless to say, there are now compelling opportunities to earn interest in more conservative assets, which we have not seen since 2007. Another observation looking at this chart that has been caused by aggressive Fed policy is this: I don’t know how something doesn’t break with rates rising as quickly as they have across the entire yield curve. Treasury rates are the starting place for the pricing of many other financial products across capital markets (just look at the current 30-year mortgage rate of 6.70%). Time will tell if the Fed will/can remain so vigilant in fighting inflation if higher rates start to have more broad consequences across the economy and capital markets. We have spoken many times over the years about the risks that have been present in markets due to high valuation combined with overly optimistic sentiment. We are not seeing those risks become a reality. We have preached risk management and protecting against the full brunt of market losses when bull market cycles inevitably turn. Though portfolios are down this year, holding extra cash and focusing on attractively valued companies and asset classes have helped us not participate in the full brunt of equity market losses. In our fixed income portfolios, we have focused on high quality, shorter maturity bonds which have also held up well compared to the broader fixed income market. Even though we are still cautious in thinking that the worst is behind us, we are now finding opportunities in companies and asset classes that were not present a year ago. Having extra cash in portfolios accomplishes two important goals during this period. First, it helps protect the portfolio when both stocks and bonds are not performing well. Second, it allows us to take advantage of opportunities without having to sell other assets that might be at depressed prices. So even though we still view risk as being elevated, we have the flexibility to shift gears when the time comes. We appreciate your continued trust and are always open to discuss any topic or concern in more detail if needed. —Patrick Mason Thanks, Patrick. If any of this feels like it needs a better explanation, please give us a call.

Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. It looks like this year’s take on summer has arrived, and we’re seeing a noticeable surge in the number of people mingling, dining out, shopping, and pursuing their outdoor passions, despite the higher costs that have been lightening wallets. The basic human need to live our lives and move beyond the virus is driving this burst of social activity. We’ll see how long this can survive in the face of the higher prices we’re experiencing. I’m sure glad I don’t have air travel planned any time soon, as that appears to be an unpredictable and expensive mess. So here we are, officially in a bear market, having just completed the worst first half experienced in our stock markets since the 1970s, with more clouds in the distance, as historically, the second half is the rougher. We’re probably in a recession, but a strange one. The economy is trying to burst forth from our COVID-induced lull, while at the same time the Fed is dousing the flames of the stimulus bonfire; and there’s a war and a lingering virus. The stock market has been overpriced for some time, so it’s not surprising to see a pull back, and Patrick will point out that overall, it’s still not cheap, despite some huge drawdowns in the more speculative asset classes. Housing is due for a correction of sorts, and it’s probably in the early stages of one. Depending on who you talk to and where you get your news, you could get the impression that the sky is falling and that we’re in a complete and total market meltdown. To be sure, it has been tough to find shelter in this storm, but I find comfort in our process, imperfect as it may be, believing that we’ll come out of this better than the broader markets, and well prepped for whatever’s next. Your actual experiences will vary, but I believe that what you have seen so far with your investments is distinctly less frightening than the shrill alarms being heard on many media outlets. On another, somewhat related note, I’m proud and excited to share with you that Cairn Investment Group was honored this last month as one of Oregon’s fastest growing private companies by the Portland Business Journal, the result of much hard work by the entire team. With that, on to Patrick and some specific and useful thoughts: Patrick's PartEquity and fixed income markets continued their march lower during the 2nd quarter, as investors continued to absorb rising inflation, tighter monetary policy, corporate profit margin pressures, and still high equity valuations. There were very few places for investors to hide during the first half of the year as large cap stocks, measured by the S&P 500, are down -19.96% and the Bloomberg US Aggregate Bond Index down -10.35%. I pointed to this as a risk in our Q1 2021 letter:

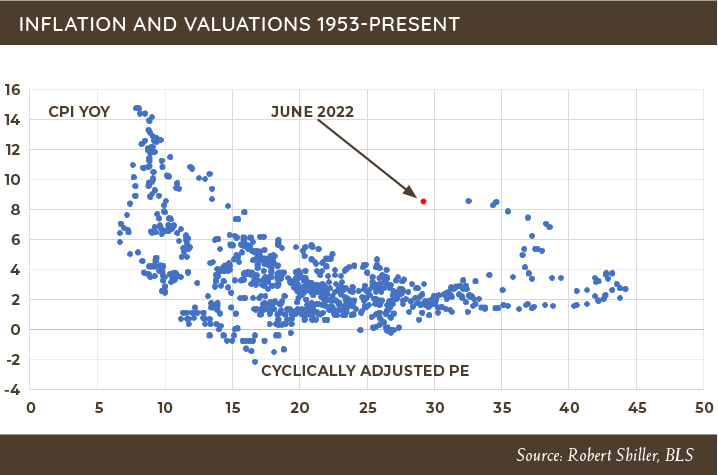

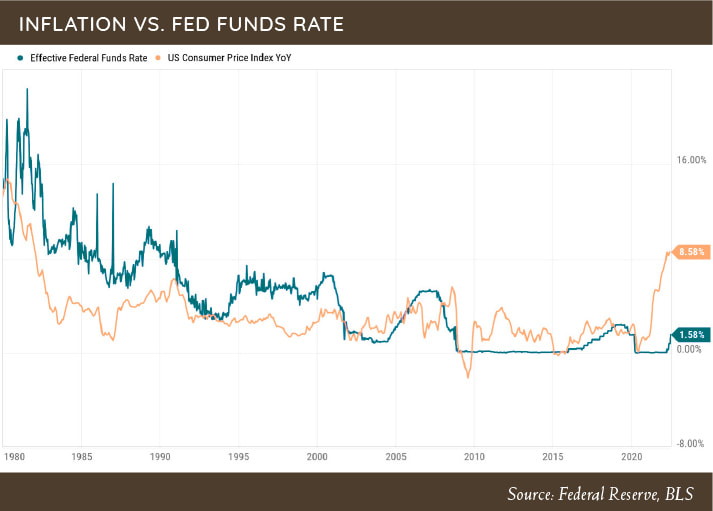

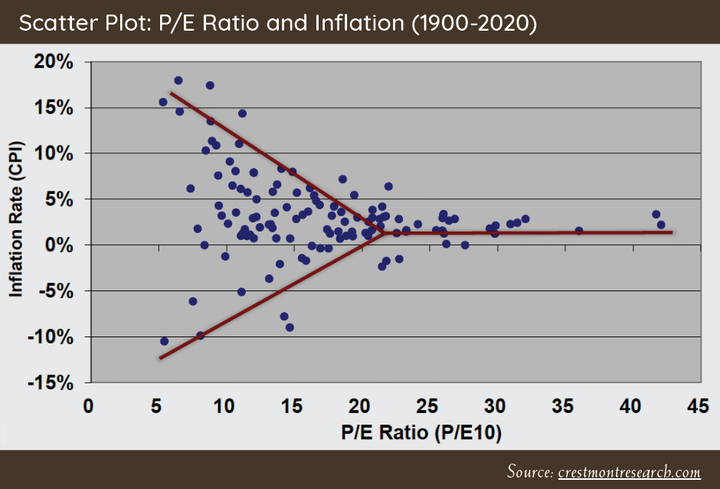

As we’ve discussed with many of you during meetings and reviews, stocks are not a very good inflation hedge when they are combined with high valuations. It’s only after valuations return to a more reasonable level that stocks offer a good hedge against inflation. The actual best hedge (short-term) against inflation is cash, which is why we have been holding a higher-than-normal cash allocation in portfolios for the last 18 months. The chart below shows inflation (vertical scale) and valuations (horizontal scale). As it illustrates, generally when you have 8.5% inflation, valuations are much lower than where they currently stand. So even though valuations have fallen from their historical extremes that investors were witnessing to start the year, they are still well above normal given the current inflationary backdrop. To combat the steady rise in inflationary pressures the economy has been experiencing, the Fed has become more aggressive in raising interest rates and tightening financial conditions. During their June meeting they raised the fed funds rate by 0.75% and have been hinting that another 0.75% hike might take place in July. As the chart below indicates, historically, when inflation is over 8% the fed funds rate is higher, not lower, than the inflation rate. So, if inflation stays high, then the fed has a way to go in raising rates. The biggest argument that we hear about why the Fed should slow their pace of interest rate hikes is the problem with the toolkit the Fed has to cool inflation. The options available are useful in decreasing the demand side of the inflation, not the supply side. Lyn Alden, of Alden Investment Strategy, said it best in her most recent monthly newsletter:

By raising interest rates, the Fed is in essence trying to raise unemployment and cool consumer demand. These actions could slow inflation for a period of time but, unfortunately, the price paid might be an economy that goes into recession. We are not in the business of predicting recessions, but we do have to be aware of the environment we are in and manage through it appropriately. With that said, we have a hard time believing that if the Fed continues down its current path, a soft landing they are hoping for is the most likely outcome. Through all the negativity there are some silver linings. Though the S&P 500 is down over 20% from its highs, many companies and asset classes have fared far worse. Many of the high-flying growth stocks that helped fuel the market bubble we were in, are now trading like beaten up value stocks. Overall, portfolios continue to hold higher than normal cash positions and are defensively positioned based on what the data is showing us. This provides us plenty of flexibility to change course when opportunities present themselves across the investment landscape. Combined with our cash allocation, we continue to hold a portfolio consisting of high quality, value-oriented stocks and bonds across asset classes that can weather market turbulence and provide the ability for capital appreciation, once the market environment eventually changes course. Thank you again for your continued trust and feel free to reach out to me to discuss any topics in greater detail. —Patrick Mason Thanks Patrick.

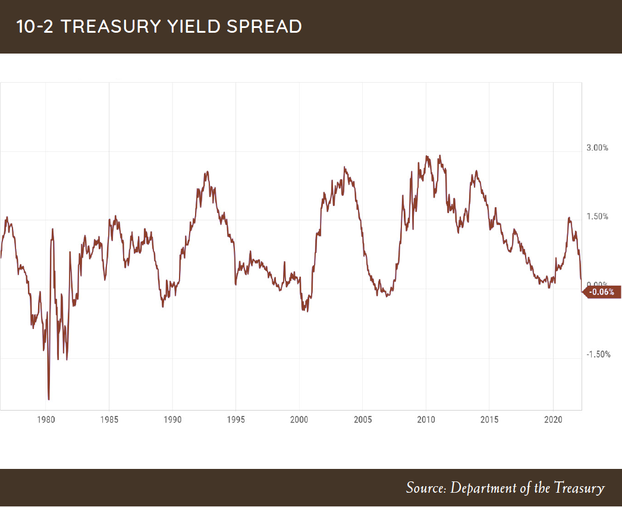

Here’s a reminder that the office is open, the coffee is fresh and hot, so please, don’t be shy about requesting an appointment or giving us a ring. Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. To say that there have been a lot of moving parts, in capital markets and economy, would be an understatement. Though equity and fixed income markets both finished down for the quarter, March provided some reprieve. Having both stocks and treasury bonds decline at the same time is a rare phenomenon. Over the last 100 years, it has happened four times during a calendar year. I guess we will see how the next nine months go. Many of the headlines being written, and market pundits’ comments, have been blaming the volatility that we have been witnessing in stocks on geopolitical concerns. While we are appalled at the conflict in Ukraine, we continue to believe the main drivers of equity and fixed income price movements are inflation, interest rates, and monetary policy. We have written about these topics many times over the last couple of years, and our opinion, based on data, has not changed. Inflation is here, and it is not going away anytime soon. Interest rates, and the Fed’s reaction to inflation, have been behind the curve; so now monetary policy makers are forced to play catch-up by raising rates into a slowing economy. A term that you might start to hear more over the next few quarters will most likely be “Stagflation.” Stagflation is the ugly combination of high inflation and declining economic activity, which the US has not witnessed since the 1970s. As I spoke about last quarter, rising inflation has affected consumer expectations about their future and that continues to show up in the data. The bond market has also started to take notice as the US treasury bond yield curve is the most inverted since the financial crisis. The yield curve has a strong track record of predicting a slowdown in economic activity. There will be plenty of talk about how “this time is different.” We would take those arguments with a huge grain of salt. We are not predicting, just observing the conditions and responding appropriately. If the environment changes, we will change our mind. On a positive note, there have been arguments over the last couple of years justifying the strong performance in equity markets as being driven by having no other alternative (TINA) due to interest rates being at historic lows. With the recent jump in treasury bond yields, this is no longer the case. Investors now have some options to earn income in relatively safe investments, which should impact decision-making at some point. This positive development will allow investors options for investing and provide competition for capital, which is beneficial to determine fair prices for many different asset classes. Overall, we have been pleased how portfolios have reacted during this shift in market behavior. Having a value bias during this rising interest rate environment has been helpful, as we have talked about previously. We continue to focus our equity allocation on companies and asset classes that generate consistent free cash flow, have resilient operating performance, and returns on capital that trade at attractive valuations. The main detractor to performance has been our allocation to international stocks. We continue to view international equities to be much more attractively valued than US stocks, so we are willing to be patient. Bonds have not been spared the volatility in capital markets. We manage your fixed income to be short-term in maturity and with lower credit risk than the broader bond market. Our focus on risk management, the willingness to hold cash, and be patient provides your portfolio flexibilities that are well positioned to navigate this challenging market environment. Thank you again for your continued trust. I have had many great talks with you over the last few months and continue to invite a conversation on anything you find needs further discussion. —Patrick Mason Greetings,

With the situation in Ukraine now overlaying other risks already present in our financial systems, I’d like to give our perspective on possible outcomes for our clients and what we are doing to work our way through this. An outright war was almost unthinkable just a few months ago, and yet here we are. I won’t comment much on the war itself, as you are all able to read the reports as well as I can. My gut aches thinking about the fear, misery, and death that’s being inflicted on such large urban populations, and for their sake, I hope that this can end sooner than later. Much like my comments on COVID back in early 2020, I suggest that the actions that our government and its allies take will be the major driver in how our investments fare through this. That’s not to suggest that a wider conflict would not have impacts that transcend all that we’re dealing with, but for now, the choice to impose economic sanctions, likened to economic warfare by Putin, is what will drive the numbers we read in the following weeks and months. A quick list of the top risks to your investments:

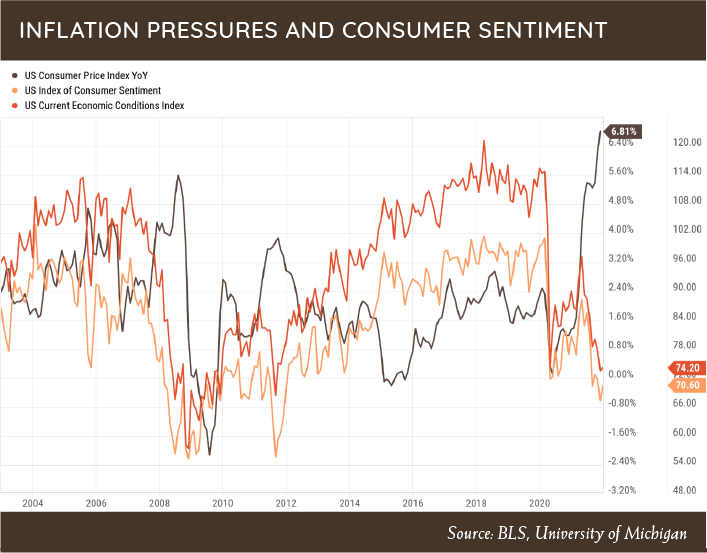

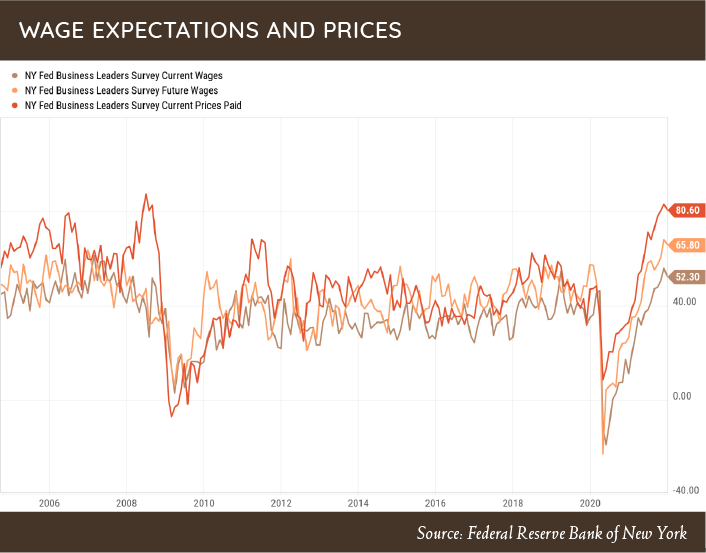

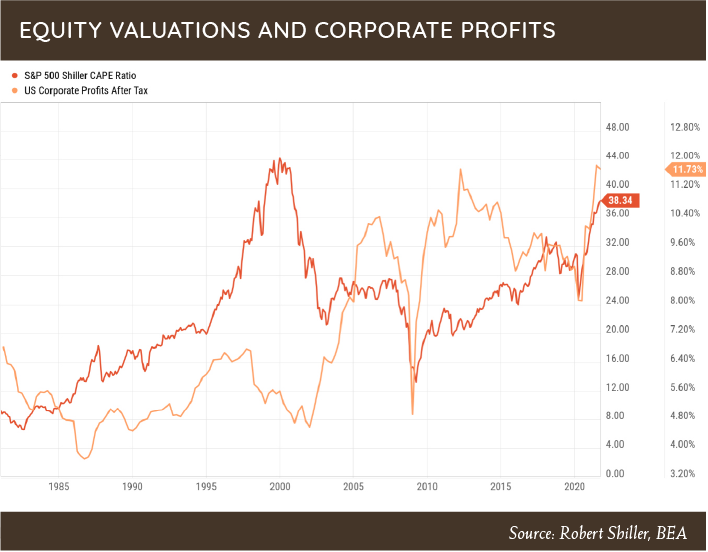

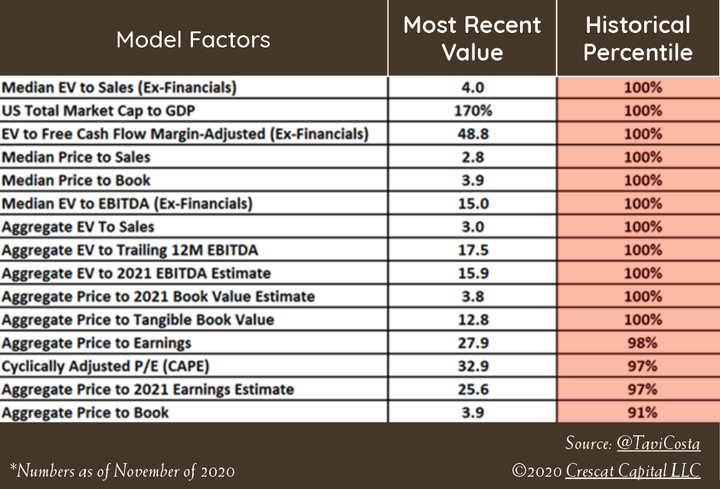

I’m sure that I missed a few, but any of these is by itself a cause for caution. On the bright side, American companies are still pushing forward out of COVID; many have aggressive hiring and expansion plans, and lots of government stimulus money remains to be spent. The dollar is strong, and the USA looks like a beacon of stability that continues to attract foreign interest and investment. Believing all of that, what are we doing differently? We have a process that focuses on risk management, and in general it’s a good form to stick with a process until there’s evidence that it’s not working. The good news is that it seems to be. It’s led us to own companies and asset classes with solid fundamentals and good prospects, and to buy them when they’re a good deal, sell them when they’re not, and hold them when they are working. Some experience hiccups, but most don’t, and we find that in these tough times it’s a successful strategy to protect and grow. Our bond holdings align with our thoughts on the rate markets and are characterized by low-duration, high-quality offerings. If you read Patrick’s part in recent newsletters (Q2:2021 and Q3:2021), you can get an in-depth review of our approach. I hope this provides a little clarity. Of course, I welcome any of your calls to discuss this and any other topic on your mind. Best Regards, Tim Mosier Greetings from the Northwest. Wasn’t that a nice bonus, getting a fresh blanket of snow between Christmas and New Year’s? I hope the kids all enjoyed it during their time off, as you never know around here if you’ll see any more snow this winter. I’d be just as happy if it stayed in the mountains. So, we have a new year, and we say farewell to 2021; it was quite the ride! How best should we remember it? I’m sure each of us has our own, unique take on it, but we all dealt with the same long parade of often painful global, national, and local events. Heck, we didn’t even get through the first week of the year before it started! So, again, how should we remember you, 2021? I’ll remember a year when the US equity markets provided one of the best ways on earth that one could grow their wealth, a year that saw real-estate values leap, even in areas experiencing net outflows, and one in which consumer prices rose undeniably higher. The supply of money was high, the cost of it low, and the desire of people to do something besides sit quietly in quarantine created a potent brew. The people reading this newsletter assuredly had their net worth increase this last year, providing welcome contrast to the other frustrations they may have experienced. We also got a welcome, if only temporary, reprieve from the virus in time for some early summer fun, and apparently it was easy to find a job if you wanted one. So, thank you, 2021, for what you did provide. Looking forward is both a necessary and imperfect part of our job here at Cairn. For over a year, Patrick has provided a consistent message highlighting the coming inflation and its possible effects, many of which have already been realized. This changing landscape, combined with the continued high stock valuations, is a formula for volatility. Let’s hear what Patrick has to say about this. Patrick's PartThanks, Tim. Over the last few quarters, we have discussed inflation and equity valuations from many different angles, so I apologize if I’m starting to sound like a broken record (Q2.2021 and Q3.2021). However, the changing market dynamic, moving from a long-term deflationary environment to a rising inflationary environment, will continue to have profound effects on capital markets. Prior to last quarter, we discussed that inflation might be on its way, but it was too soon to have a strong conviction one way or another. As the data continued to evolve, so did our opinion, when last quarter we echoed that inflation is here and will most likely be something we are going to have to live with for the foreseeable future. Nothing has changed over the subsequent three months to alter our opinion. In fact, more data points are emerging confirming inflation is here to stay, and that consumers are starting to believe in the same narrative. The chart below shows the year-over-year change in the Consumer Price Index with corresponding survey data on consumer sentiment. As you can see, the continued rise in inflation is starting to put a dent in consumer sentiment and their feelings about current economic conditions. Combined with survey data taken from business leaders (below) pointing to higher prices paid along with higher wage expectations, it paints an interesting picture of where future profit growth and margins could be heading Again, our concerns about inflationary pressures and the effects on capital markets would not be so strong if profit margins and valuations were more reasonable than they are today. But with profit margins and U.S. equity valuations close to record highs (below), the coming inflationary dynamic poses greater risk of loss. As we have spoken about previously, we do have a playbook and process for managing through these difficult market environments. The good news is that excessive valuations are not broadly based. Currently we are finding opportunities in international equities, and US value stocks. We were rewarded by having a value bias in 2021 as US value stocks performed well. However, international equities lagged as investors continue to blindly pile money into what “has” worked instead of what is “most likely” to work going forward. For reasons we have spoken about before, we continue to view international equities attractively, due to more compelling valuations combined with greater inflationary pressures in the US than abroad. Even as we are finding pockets of opportunity, risks are higher than normal, so our focus on risk management and capital preservation remains paramount. Thank you again for your continued trust, and please feel free to reach out to me to discuss this topic or any other concern. —Patrick Mason Thank you, Patrick, and wishing everyone a successful and happy 2022.

Tim Mosier, President Cairn Investment Group, Inc Greetings from the Northwest. I love this time of the year, and I know many of you do too. The welcome relief from the heat, with a cool fresh breeze, soaking rain and magical, mystical fog coming to the rescue of flora baked and broiled through this hot dry summer. Trees turn brilliant colors, salmon leap at the falls, waterfowl get ready for their annual migrations; here and there someone lights a fire in their hearth and shares a warm drink with a friend. All is wonderful, and for now, new and exciting. It’s fall. On many counts it’s another normal fall. Kids are in school, the stock market is getting choppy, and politicians are back at work doing whatever politicians do. I do hope they choose to continue funding the government. There is that COVID thing, though. I don’t think that last year I thought I’d still be asked to wear a mask at this point, but unfortunately here we are. Whether it’s exhaustion or unwillingness to continue with extreme shutdown measures, or wisdom gained through hard-won experience, we do seem to be weathering this better economically than we did last year, despite the surging infection rates. There are some economic oddities that we can blame on the pandemic, and one that many of you are experiencing is related to a damaged global supply chain. Try buying new furniture or finding a replacement part for your car. You might be waiting weeks if not months. Aside from the obvious inconvenience and irritation this may cause, it’s also a symptom of supply and demand that are out of sync; probably and hopefully temporarily, since this was caused by a shock event. However, we all know that more demand than supply leads to higher prices. Patrick will again dice and slice this in his section, with some new and intriguing angles. Another, not unrelated, economic oddity we’re experiencing is the surge in home prices, not just in the predictable core urban areas, but in the far suburbs or “exurbs” as people seek a bit more space between themselves and others or flee urban crime and blight. Freed for now from commuting constraints, high-paid professionals are even driving up prices in cities far from their employers; Bozeman, Montana comes to mind. With that I’ll hand things over to Patrick: Patrick's PartFinancial markets showed more volatility during the third quarter. Large cap stocks were the best performers, rising a modest 0.58%, driven by the biggest cap stocks. Peeling back the skin, performance of equities showed mixed results with large value stocks declining -0.78%, small cap stocks returning -4.36%, and international stocks returning –0.45%. Bonds did their job, showing low volatility and modest returns of 0.05%. In the past two quarters we have written about the effects of inflation on equity markets, the current high valuations of large cap stocks, and how we would manage through a period of higher inflation. In recent months the hard data surrounding inflation, and the commentary from company management, have made it clear that inflation is here, and how quickly it will subside is anyone’s guess. Though The Fed has been adamant that inflation will be transitory due to the pandemic, in their September policy meeting they admitted that inflation has lasted longer at a higher rate than anticipated. I indicated last quarter that the bond market has not been a believer in the inflation narrative. However, the bond market can only turn a blind eye for so long. The prolonged inflation picture could have effects on the following: consumer behavior, how profitable companies will be going forward, and how the equity markets will behave. First, on the effects of consumer behavior. Here is just one example of the headlines investors and consumers were reading from the Wall Street Journal on September 26th:

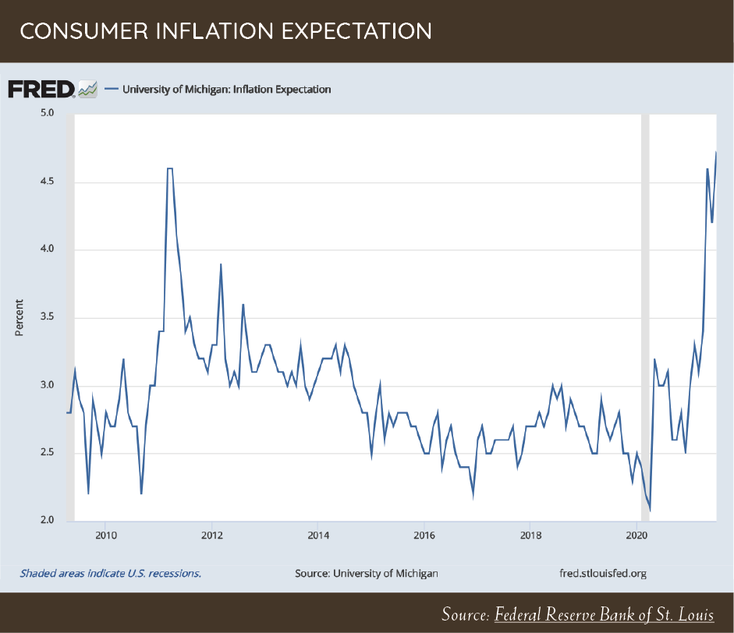

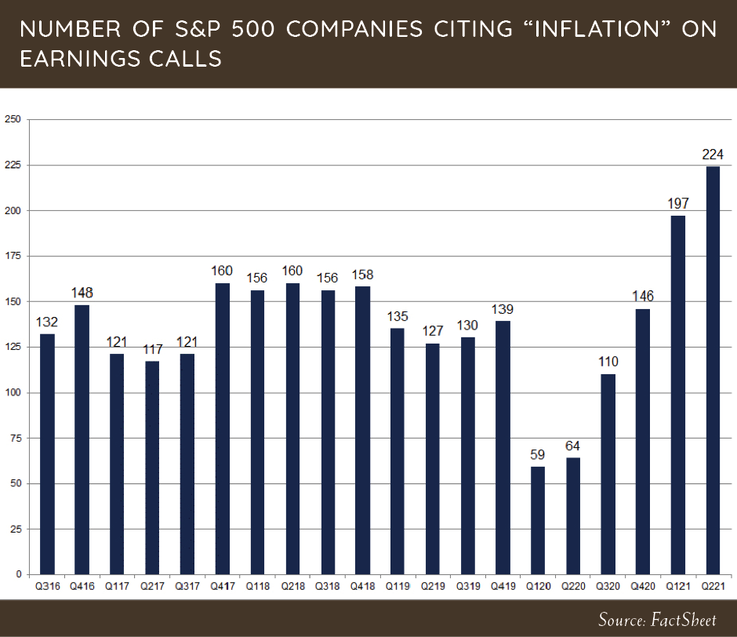

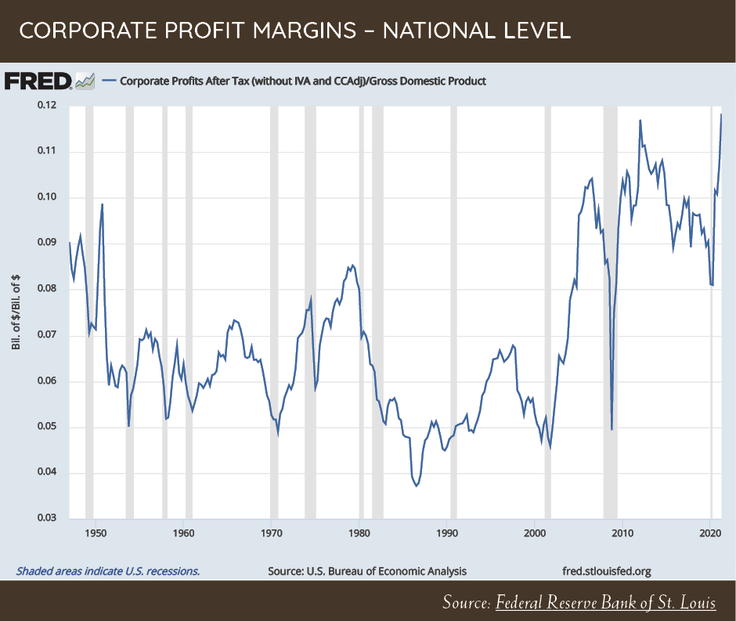

I have discussed the inflation topic with many of you over the last 12 months, and one thing I have said is that inflation can take hold because people believe it will take hold, like a self-fulfilling prophecy. As demand for goods continues to be high, while supply of goods is low due to supply chain issues, consumer behavior could change based on the expectation of higher prices, causing the very thing that everyone fears the most, inflation. The chart below is a survey measuring inflation expectations from consumers. As you can see, it is the highest since 2011. Inflation’s effect on corporate profit margins will be highly dependent on a company’s ability to pass higher input costs to the end consumers. In our analysis of each company we own, we stress test their cash flows, considering negative effects of inflation and profitability when we determine a fair value. One thing is for sure: company executives are talking about inflation. Below is a chart showing the number of S&P 500 companies that are mentioning inflation in their earnings calls. With nearly 50% of companies mentioning inflation in earnings calls, there seems to be a real concern about inflation amongst companies. Executives are going to have to make some tough decisions about how to allocate capital going forward if costs continue to rise and profits start to come under pressure. This is one of the many reasons why being disciplined in the price you are willing to pay for a company is so important. Paying too high a price during a period of eroding profits is a dangerous recipe. Over the last few quarters, we have talked about what the effects of inflation would be on equity markets, so I will be brief. The chart below shows corporate profit margins at a national level. As you can see, profit margins are at an all-time high. The combination of record high equity valuations with record high profit margins could prove to be a challenge for equity market performance if inflation starts to erode profits. Though we view many large cap stocks as being expensive, we are still finding opportunities in select individual companies and certain asset classes. Over the last year, portfolios have been rewarded by having a value and small cap bias. The main detractor to performance has been our allocation to emerging market equities. Though the underperformance of emerging market equities has been disappointing, we believe we will be rewarded in the long term as valuations are much more attractive compared to the United States. Our portfolios continue to have a conservative bias and hold slightly more cash than normal, due to the risks that are present in equities combined with the low opportunity set available. Thank you for your continued trust and support. The topic of inflation and the effects it will have on capital markets is complex, so feel free to reach out to me with any question. —Patrick Mason Thank you, Patrick. We’re all curious to see how this plays out.

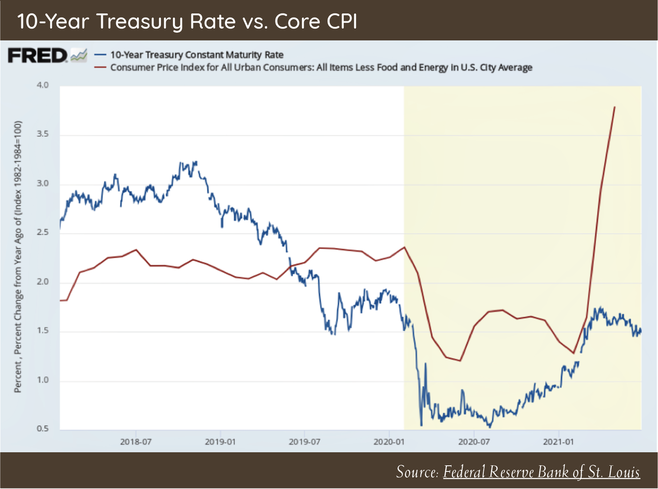

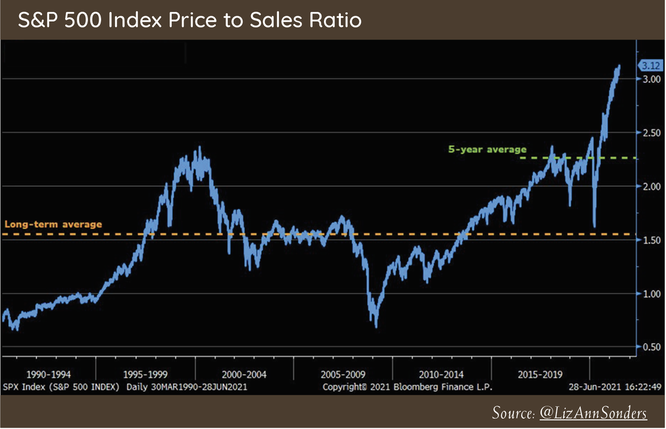

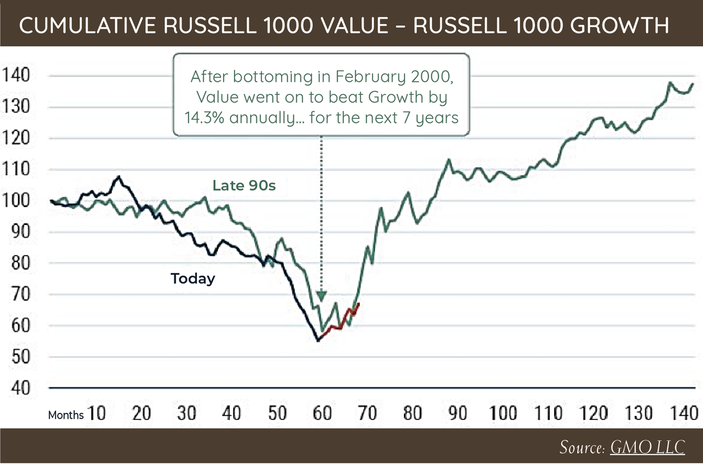

Goodbye for now and Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. Wasn’t that hot spell unpleasant! Who needs temps in the 110s? We’ve already had our first local wildfire prior to the heat kicking in, getting a good whiff of smoke in our neighborhood from a blaze just over the mountains. I’m hoping we don’t have a repeat of that thick, unpleasant smoke last September. Please, be careful out there! Now and then a new word seeps into our daily discourse; not new in the sense of its creation, but new in the sense of its prevalence and meaning. Often it’s a way to get our attention and describe something that was previously vaguely understood. Remember the word sustainable becoming part of our common language some years ago? It was novel at first, and eventually over-used, but we all came to terms with it in our own way. It now has a certain shared meaning that allows us to better communicate an important concept that’s used for a broad swath of topics. The word that I want to talk about today is narrative. You know what I mean… it seems that everybody, and every cause, has a narrative. The word “spin” may have been used in the past for some things meant by narrative, but spin sounds too negative to use in most cases. Narrative can be used for topics without sounding negative or dishonest. But let’s be clear: A narrative is a story, and these stories are all told to create reactions to the benefit of the storyteller. Because of this, they cannot be the whole truth, just a subset of the truth that works for the storyteller. In its ugliest form a narrative includes untruths as well. Unfortunately, today, narratives are even masquerading as news in our hyper-informed world. So why am I bringing up this potentially over-broad and serious topic? Well, first of all, we are being engulfed by narratives daily. Pick a topic and there are competing narratives, and our investing world is not immune. We need to remain alert to this and not let ourselves be too quickly or easily swayed before we have a chance to weigh the facts and draw our own conclusions. Our job here at Cairn is to parse through a barrage of narratives, real news, raw data, and opinion to come up with reasonable actions and advice for our investors. We can’t let ourselves get swept up in a narrative that presents a distorted view of the future and entices us to act in a way that is out of step with reality. These are momentous times as we come out from under the shadow of the virus; it’s equally possible to miss the opportunities that this presents, or to fall into a trap of our own creation. I want to emphasize that at Cairn we are working hard to remain rational and pragmatic in our vision and actions. Please read carefully though Patrick’s part as he again explains our beliefs and processes to care for your money. Patrick's PartLast quarter we wrote at length regarding the potential for higher inflation, how equities might react to it, and how our disciplined process would manage through it. As Tim correctly points out, we are being bombarded by narratives surrounding the investment and economic landscape on a daily basis. The dominant narrative to start the second quarter said something along the lines of, “inflation is coming, and you better get prepared for it!” While we still see many headlines regarding the topic, financial markets do not seem to be overly concerned. The chart below shows the year-over-year change in Core CPI (Inflation) and the yield on the US 10-year treasury bond. What is interesting is that the data shows a spike in inflation (partly due to lower-than-normal levels a year ago), but the bond market does not seem to be worried about it. If there was a large concern about persistently higher inflation, the yield on long-dated treasury bonds would be moving HIGHER, not lower as we are witnessing now. This speaks to what Tim discussed; our job is to parse through the noise being created by these numerous narratives to see what the data is actually suggesting. Currently, many data points indicate that inflation is moving higher but could be temporary. We will take the evidence as it comes and act appropriately. Another popular narrative that we hear these days revolves around valuation. With equity markets continuing to outpace underlying fundamentals, many pundits have started to whisper opinions that valuations are not as important and that elevated valuations are justified, due to higher economic growth, combined with the larger representation of disruptive technology companies. As with any good story, there are some partial truths that make these arguments sound compelling. Yes, technology companies have become more dominant in equity markets and trade at higher valuations due to their disruptive qualities. But the skeptics in us always like to take a look at the actual data to see what that tells us. Below is a chart of the S&P 500 index Price to Sales Ratio. A couple of thoughts enter my mind when I look at this chart. First, current valuations are roughly 20% higher than they were during the height of the technology bubble when the same arguments were being made about disruptive tech companies. Second, with S&P 500 revenues growing on average in the mid single digits over the last couple of decades and valuations trading at 2x long-term averages, the disconnect between price and underlying fundamentals is not solely explained by disruptive stocks trading at high valuations. So, while the financial media try to spin the narrative that today’s high valuations are justified by the dominance of select companies, when you look underneath the hood at the actual data, high valuations are present in many different sizes of companies, which is how you get valuations so much higher than average. Our process is built around understanding the price we are paying for an asset and then paying a price we believe is below what the asset is worth, whether that be a specific company, or asset class. We feel that is the best way to deliver consistent long-term results while avoiding the overvaluation we are witnessing in many areas of the equity markets. The last chart below shows the return of value vs. growth during the late 90s and what we are witnessing today. Just as in the late 90s, value just went through a period of underperformance versus its growth counterpart up until the fall of last year. Since then, value has been staging a comeback, and if history is any guide (it usually is), then this short period of value outperformance since the fall is just getting started. With relative valuations being much more attractive for value companies versus growth, we feel our investment philosophy acts as another layer of safety if market volatility rises, and opportunity if markets continue their march higher in the months ahead. Thank you for your continued trust and support. Please reach out to me if you want to discuss any of the above topics in greater detail. Thanks, Patrick!

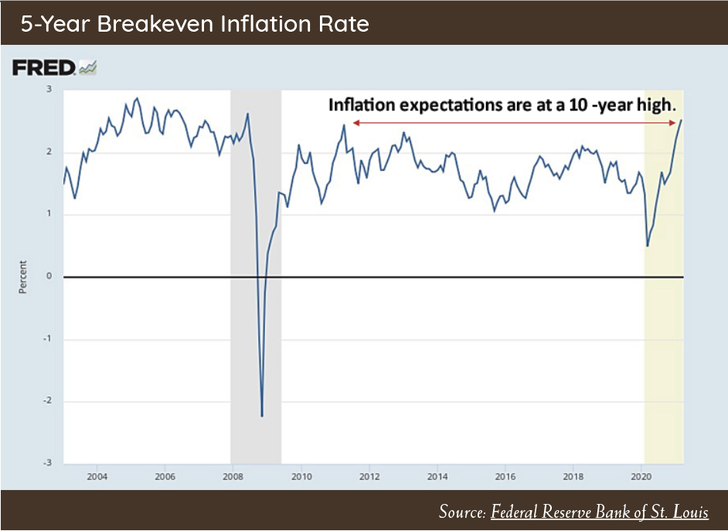

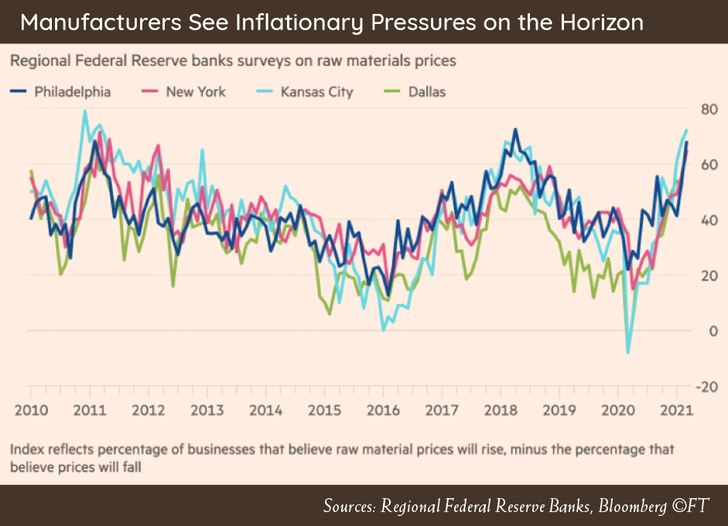

Wishing you all a wonderful summer with lots of freedom to gather and travel. Tim Mosier, President Cairn Investment Group, Inc Greetings from the Northwest. Can you believe that it’s been over a year living with this pandemic, and no clear end in sight? And yet, here we are with financial markets and home prices at all-time highs, leading to a large divergence in fortunes between those who own assets, and those who don’t. We all know that it’s been particularly hard on those whose livelihood depends upon up-close and personal interactions with other humans. Let’s all hope that the stimulus and a well-managed re-opening of the economy relieve much of this burden for them. I believe that almost everyone reading this falls into the category of “those who own assets,” and have seen their personal worth increase during one of the most disruptive events in modern history. What has happened and what is happening globally should be considered as seminal, an inflection point in history heading towards something new and unknown. One can sense that big changes are afoot, and on many fronts. Indications are that after decades hiding in his bottle, the inflation genie is likely to reappear, fueled by massive government spending, and rising wealth from gains on many types of assets. Interest rates, on a downward path for the better part of 40 years and an entire career for most financial professionals, are very likely to rise in concert with inflation. Both of these have direct implications for asset prices and your investments. In his part, Patrick will give you our thoughts on this and what we plan to do about it. On the positive side are the emergence of medical and vaccine technologies that promise to improve our response to future outbreaks. One hopes that governments, too, will have learned and adapted to better handle them. Companies globally are adapting to the idea of more worker autonomy and a more dispersed and mobile workforce. What implications can we imagine for urban centers and commercial real estate? How far will or can this administration go in changing the direction of U.S. policy and practice on a broad array of American interests? It’s working with a clear mandate to pull us through the current crisis, but without such a clear mandate on many of the other issues that we face. How much further in debt will we go, and what will be the impact on our taxes? Will the world see a separation of supply chains and economies divided between the U.S. and China? How far will China’s economic and political rise take it? Will Russia’s global meddling (while its home economy is in shambles) lead to something worse or get checked in the future? Will the European Union come out of the crisis stronger or weaker after its chaotic response to COVID? The way that these and many other issues play out will have lasting effects on our investments and our personal lives. They don’t come with a playbook or a probable outcome, so we’ll adapt as we see them evolve. With that, here’s Patrick with some practical, measurable observations and what we are doing about them. Patrick's PartThrough small bouts of volatility, equity markets continued their forward march during the first quarter. Stocks, measured by the S&P 500, returned 6.17%, while the real drag on capital markets during the quarter took place in fixed income, with Long Dated Treasury bonds dropping 13.92%. The recent negative returns generated in bonds due to rising interest rates have caused a lot of chatter across the investment community. This is a topic we find of high importance as we manage your wealth moving forward. Some might say, “Wait, Patrick; interest rates rose a couple years ago, and bonds did okay.” Or “I don’t own many bonds in my portfolio, so what will this have to do with equity markets?” My simple response: “A lot!” The source of rising rates will have a profound effect on equity markets and returns realized across different investment styles over the coming market cycle. The source is very important, because, unlike 2018 when rates were rising due to the Fed reversing QE, the current narrative and concern of rising rates are not being driven by the Fed tightening monetary policy. Fed officials have been clear that they have no intention of reversing their current course for at least a couple of years. As the two charts below indicate, we are seeing interest rates rise today because market participants, investors, and business managers are becoming concerned that inflation is starting to heat up. This could be for a myriad of reasons, but the most likely culprits are large government spending, combined with strong economic growth, and extremely accommodative monetary policy. If inflationary pressures and concerns become a reality, the tool kit used over that last cycle (investing in high revenue growth, low current earnings U.S. companies, combined with long dated bonds), will not have the same level of success that investors have become accustomed to. The bullet points below explain the intuition:

As with most things in financial markets, not everything is black and white, so there will be certain areas of the marketplace we will continue to focus on, to find opportunities to combat the threat of higher inflation. First, as we have written about many times in the past, value stocks vs. growth stocks still trade at a large historical discount. The benefit of value stocks over their growth counterpart in a rising inflationary environment is that many of the cash flows and earnings of traditional value companies are realized in the present (think of Costco). So even if inflation is rising, the future value of earnings is not as impaired as in growth companies that realize their earnings many years into the future. Second, companies that have a strong competitive advantage with the ability to pass rising costs on to their customers and consumers should weather inflationary periods with less disruption to profits. Lastly, having exposure to equity markets outside the U.S. will be essential, as the relative value of international stocks is much more attractive, and higher inflation domestically generally comes with a lower value for the U.S. dollar. A lower value of the U.S. dollar versus other currencies is historically a positive to foreign equity markets. The benefit of our process is that it is built around understanding the value of what we are paying for something, while comparing that to the risks that could be present. Our disciplined approach will only act as another layer of safety during this potentially changing investment landscape. When risks are high, and opportunity is low, we will remain flexible but defensive for when the pendulum eventually swings in the other direction. Currently, we view risks as being high but not so high that defense is the only strategy. This positions our portfolios to hold slightly more cash than normal, while we are actively taking advantage of investments we feel offer compelling return potential during this challenging market environment. As always, thank you for your continued trust, and please reach out if you would like to discuss any topic in greater detail.

Thanks, Patrick!

In case you’ve missed the website and LinkedIn updates, Cairn has added a key member to the team in the last month. Mark Farrelly CFP®, CDFA® has joined us as Senior Advisor and Director of Financial Planning. It’s exciting to bring on someone as experienced and talented as Mark, who’s been in the business for almost 20 years, specializing in providing detailed and comprehensive financial advice. Mark and Patrick have worked together earlier in their careers, and already have a deep level of trust and respect for the other’s skill set and work ethic, setting up a promising integration of Mark and Cairn. Mark operates out of Northern California and will continue to work remotely. Over time Mark will help us in improving and codifying our financial planning practices, providing a better experience for all of our clients. Welcome, Mark! As restrictions ease, I hope to see many of you back in the office. In the meantime, we’re happy to provide help by any means that works for you, including Zoom or WebEx meetings. Tim Mosier, President Cairn Investment Group, Inc. |

RSS Feed

RSS Feed