|

Greetings from the Northwest. I love this time of the year, and I know many of you do too. The welcome relief from the heat, with a cool fresh breeze, soaking rain and magical, mystical fog coming to the rescue of flora baked and broiled through this hot dry summer. Trees turn brilliant colors, salmon leap at the falls, waterfowl get ready for their annual migrations; here and there someone lights a fire in their hearth and shares a warm drink with a friend. All is wonderful, and for now, new and exciting. It’s fall. On many counts it’s another normal fall. Kids are in school, the stock market is getting choppy, and politicians are back at work doing whatever politicians do. I do hope they choose to continue funding the government. There is that COVID thing, though. I don’t think that last year I thought I’d still be asked to wear a mask at this point, but unfortunately here we are. Whether it’s exhaustion or unwillingness to continue with extreme shutdown measures, or wisdom gained through hard-won experience, we do seem to be weathering this better economically than we did last year, despite the surging infection rates. There are some economic oddities that we can blame on the pandemic, and one that many of you are experiencing is related to a damaged global supply chain. Try buying new furniture or finding a replacement part for your car. You might be waiting weeks if not months. Aside from the obvious inconvenience and irritation this may cause, it’s also a symptom of supply and demand that are out of sync; probably and hopefully temporarily, since this was caused by a shock event. However, we all know that more demand than supply leads to higher prices. Patrick will again dice and slice this in his section, with some new and intriguing angles. Another, not unrelated, economic oddity we’re experiencing is the surge in home prices, not just in the predictable core urban areas, but in the far suburbs or “exurbs” as people seek a bit more space between themselves and others or flee urban crime and blight. Freed for now from commuting constraints, high-paid professionals are even driving up prices in cities far from their employers; Bozeman, Montana comes to mind. With that I’ll hand things over to Patrick: Patrick's PartFinancial markets showed more volatility during the third quarter. Large cap stocks were the best performers, rising a modest 0.58%, driven by the biggest cap stocks. Peeling back the skin, performance of equities showed mixed results with large value stocks declining -0.78%, small cap stocks returning -4.36%, and international stocks returning –0.45%. Bonds did their job, showing low volatility and modest returns of 0.05%. In the past two quarters we have written about the effects of inflation on equity markets, the current high valuations of large cap stocks, and how we would manage through a period of higher inflation. In recent months the hard data surrounding inflation, and the commentary from company management, have made it clear that inflation is here, and how quickly it will subside is anyone’s guess. Though The Fed has been adamant that inflation will be transitory due to the pandemic, in their September policy meeting they admitted that inflation has lasted longer at a higher rate than anticipated. I indicated last quarter that the bond market has not been a believer in the inflation narrative. However, the bond market can only turn a blind eye for so long. The prolonged inflation picture could have effects on the following: consumer behavior, how profitable companies will be going forward, and how the equity markets will behave. First, on the effects of consumer behavior. Here is just one example of the headlines investors and consumers were reading from the Wall Street Journal on September 26th:

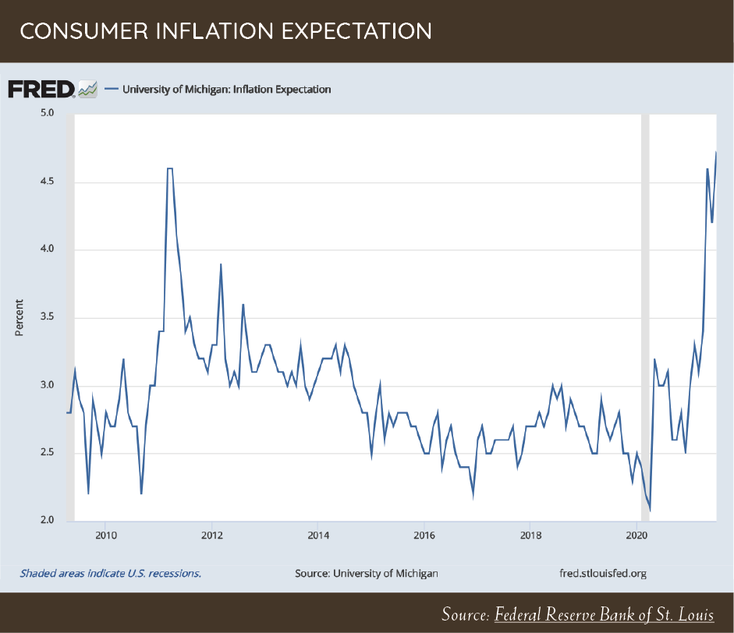

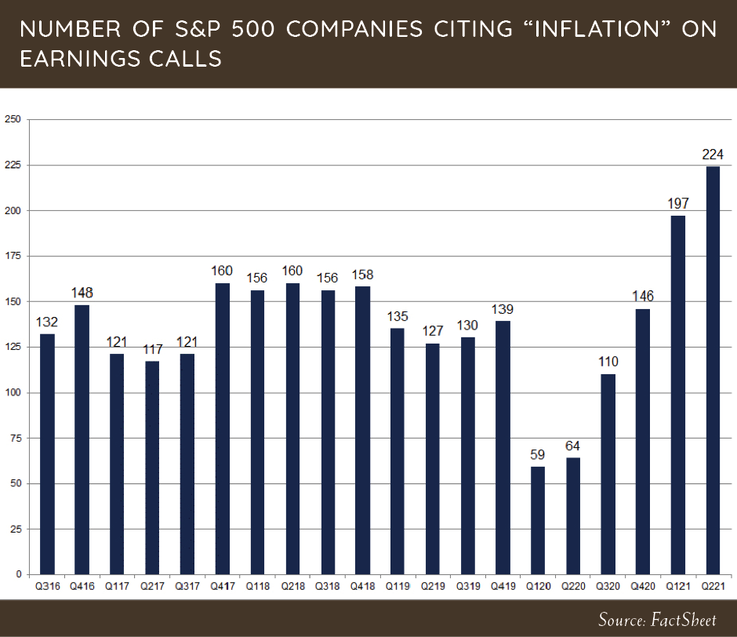

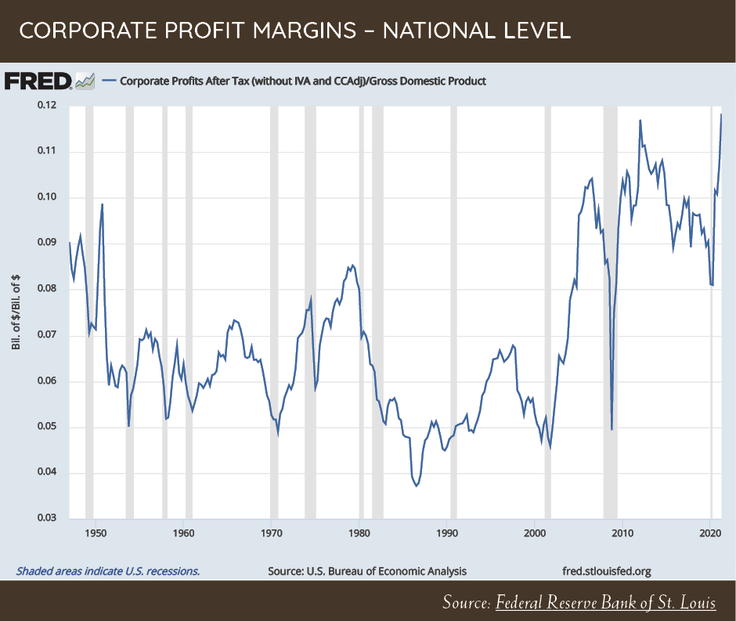

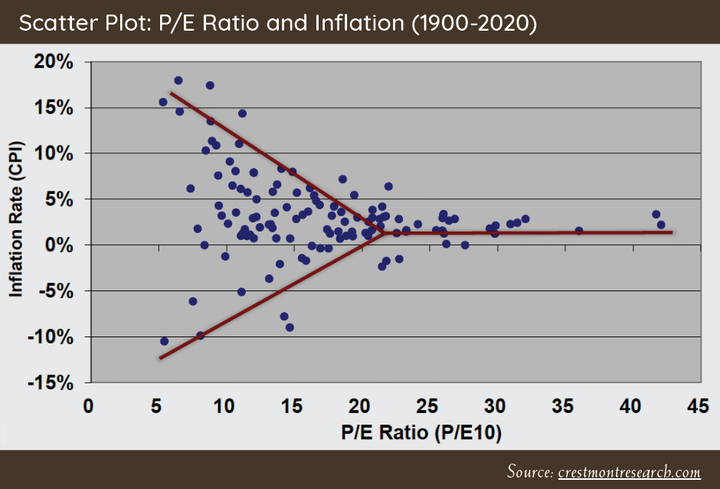

I have discussed the inflation topic with many of you over the last 12 months, and one thing I have said is that inflation can take hold because people believe it will take hold, like a self-fulfilling prophecy. As demand for goods continues to be high, while supply of goods is low due to supply chain issues, consumer behavior could change based on the expectation of higher prices, causing the very thing that everyone fears the most, inflation. The chart below is a survey measuring inflation expectations from consumers. As you can see, it is the highest since 2011. Inflation’s effect on corporate profit margins will be highly dependent on a company’s ability to pass higher input costs to the end consumers. In our analysis of each company we own, we stress test their cash flows, considering negative effects of inflation and profitability when we determine a fair value. One thing is for sure: company executives are talking about inflation. Below is a chart showing the number of S&P 500 companies that are mentioning inflation in their earnings calls. With nearly 50% of companies mentioning inflation in earnings calls, there seems to be a real concern about inflation amongst companies. Executives are going to have to make some tough decisions about how to allocate capital going forward if costs continue to rise and profits start to come under pressure. This is one of the many reasons why being disciplined in the price you are willing to pay for a company is so important. Paying too high a price during a period of eroding profits is a dangerous recipe. Over the last few quarters, we have talked about what the effects of inflation would be on equity markets, so I will be brief. The chart below shows corporate profit margins at a national level. As you can see, profit margins are at an all-time high. The combination of record high equity valuations with record high profit margins could prove to be a challenge for equity market performance if inflation starts to erode profits. Though we view many large cap stocks as being expensive, we are still finding opportunities in select individual companies and certain asset classes. Over the last year, portfolios have been rewarded by having a value and small cap bias. The main detractor to performance has been our allocation to emerging market equities. Though the underperformance of emerging market equities has been disappointing, we believe we will be rewarded in the long term as valuations are much more attractive compared to the United States. Our portfolios continue to have a conservative bias and hold slightly more cash than normal, due to the risks that are present in equities combined with the low opportunity set available. Thank you for your continued trust and support. The topic of inflation and the effects it will have on capital markets is complex, so feel free to reach out to me with any question. —Patrick Mason Thank you, Patrick. We’re all curious to see how this plays out.

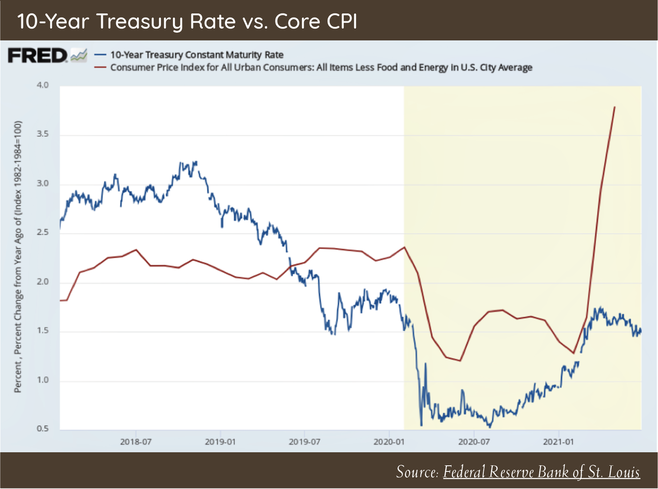

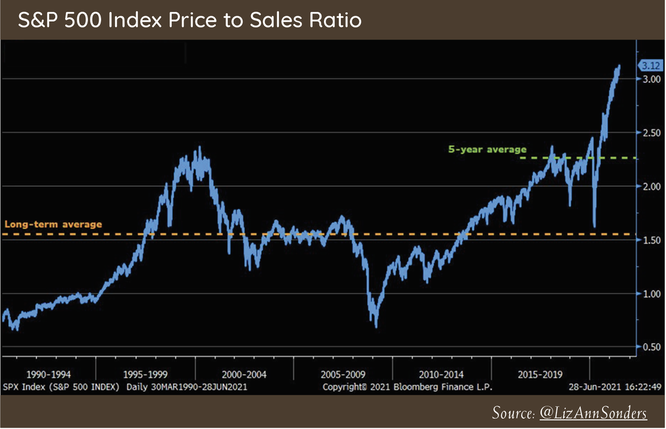

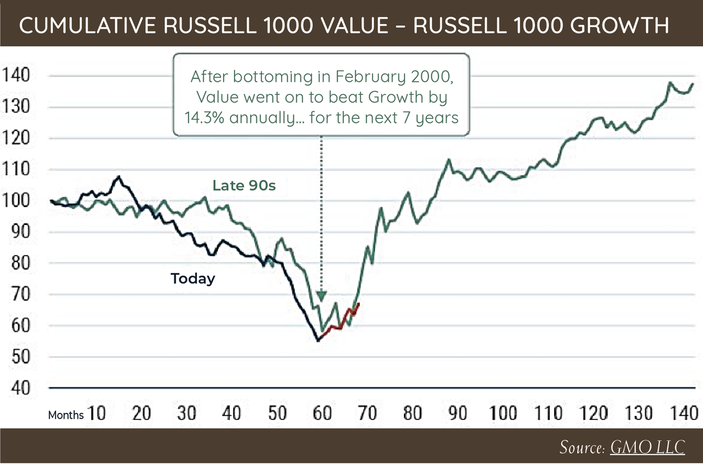

Goodbye for now and Happy Trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. Wasn’t that hot spell unpleasant! Who needs temps in the 110s? We’ve already had our first local wildfire prior to the heat kicking in, getting a good whiff of smoke in our neighborhood from a blaze just over the mountains. I’m hoping we don’t have a repeat of that thick, unpleasant smoke last September. Please, be careful out there! Now and then a new word seeps into our daily discourse; not new in the sense of its creation, but new in the sense of its prevalence and meaning. Often it’s a way to get our attention and describe something that was previously vaguely understood. Remember the word sustainable becoming part of our common language some years ago? It was novel at first, and eventually over-used, but we all came to terms with it in our own way. It now has a certain shared meaning that allows us to better communicate an important concept that’s used for a broad swath of topics. The word that I want to talk about today is narrative. You know what I mean… it seems that everybody, and every cause, has a narrative. The word “spin” may have been used in the past for some things meant by narrative, but spin sounds too negative to use in most cases. Narrative can be used for topics without sounding negative or dishonest. But let’s be clear: A narrative is a story, and these stories are all told to create reactions to the benefit of the storyteller. Because of this, they cannot be the whole truth, just a subset of the truth that works for the storyteller. In its ugliest form a narrative includes untruths as well. Unfortunately, today, narratives are even masquerading as news in our hyper-informed world. So why am I bringing up this potentially over-broad and serious topic? Well, first of all, we are being engulfed by narratives daily. Pick a topic and there are competing narratives, and our investing world is not immune. We need to remain alert to this and not let ourselves be too quickly or easily swayed before we have a chance to weigh the facts and draw our own conclusions. Our job here at Cairn is to parse through a barrage of narratives, real news, raw data, and opinion to come up with reasonable actions and advice for our investors. We can’t let ourselves get swept up in a narrative that presents a distorted view of the future and entices us to act in a way that is out of step with reality. These are momentous times as we come out from under the shadow of the virus; it’s equally possible to miss the opportunities that this presents, or to fall into a trap of our own creation. I want to emphasize that at Cairn we are working hard to remain rational and pragmatic in our vision and actions. Please read carefully though Patrick’s part as he again explains our beliefs and processes to care for your money. Patrick's PartLast quarter we wrote at length regarding the potential for higher inflation, how equities might react to it, and how our disciplined process would manage through it. As Tim correctly points out, we are being bombarded by narratives surrounding the investment and economic landscape on a daily basis. The dominant narrative to start the second quarter said something along the lines of, “inflation is coming, and you better get prepared for it!” While we still see many headlines regarding the topic, financial markets do not seem to be overly concerned. The chart below shows the year-over-year change in Core CPI (Inflation) and the yield on the US 10-year treasury bond. What is interesting is that the data shows a spike in inflation (partly due to lower-than-normal levels a year ago), but the bond market does not seem to be worried about it. If there was a large concern about persistently higher inflation, the yield on long-dated treasury bonds would be moving HIGHER, not lower as we are witnessing now. This speaks to what Tim discussed; our job is to parse through the noise being created by these numerous narratives to see what the data is actually suggesting. Currently, many data points indicate that inflation is moving higher but could be temporary. We will take the evidence as it comes and act appropriately. Another popular narrative that we hear these days revolves around valuation. With equity markets continuing to outpace underlying fundamentals, many pundits have started to whisper opinions that valuations are not as important and that elevated valuations are justified, due to higher economic growth, combined with the larger representation of disruptive technology companies. As with any good story, there are some partial truths that make these arguments sound compelling. Yes, technology companies have become more dominant in equity markets and trade at higher valuations due to their disruptive qualities. But the skeptics in us always like to take a look at the actual data to see what that tells us. Below is a chart of the S&P 500 index Price to Sales Ratio. A couple of thoughts enter my mind when I look at this chart. First, current valuations are roughly 20% higher than they were during the height of the technology bubble when the same arguments were being made about disruptive tech companies. Second, with S&P 500 revenues growing on average in the mid single digits over the last couple of decades and valuations trading at 2x long-term averages, the disconnect between price and underlying fundamentals is not solely explained by disruptive stocks trading at high valuations. So, while the financial media try to spin the narrative that today’s high valuations are justified by the dominance of select companies, when you look underneath the hood at the actual data, high valuations are present in many different sizes of companies, which is how you get valuations so much higher than average. Our process is built around understanding the price we are paying for an asset and then paying a price we believe is below what the asset is worth, whether that be a specific company, or asset class. We feel that is the best way to deliver consistent long-term results while avoiding the overvaluation we are witnessing in many areas of the equity markets. The last chart below shows the return of value vs. growth during the late 90s and what we are witnessing today. Just as in the late 90s, value just went through a period of underperformance versus its growth counterpart up until the fall of last year. Since then, value has been staging a comeback, and if history is any guide (it usually is), then this short period of value outperformance since the fall is just getting started. With relative valuations being much more attractive for value companies versus growth, we feel our investment philosophy acts as another layer of safety if market volatility rises, and opportunity if markets continue their march higher in the months ahead. Thank you for your continued trust and support. Please reach out to me if you want to discuss any of the above topics in greater detail. Thanks, Patrick!

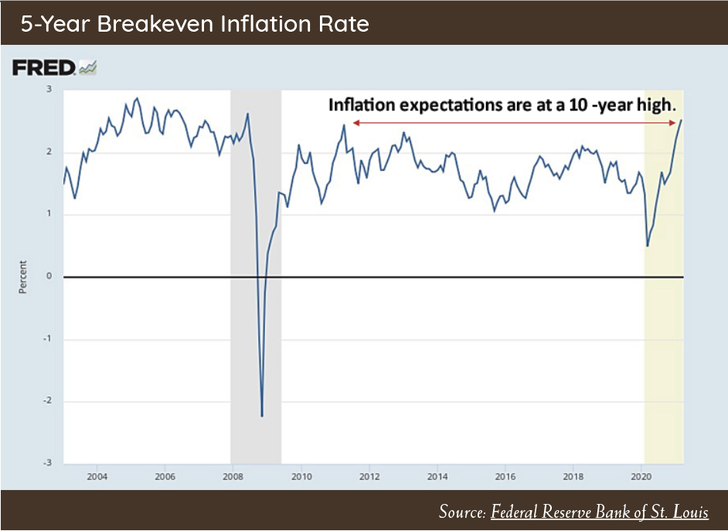

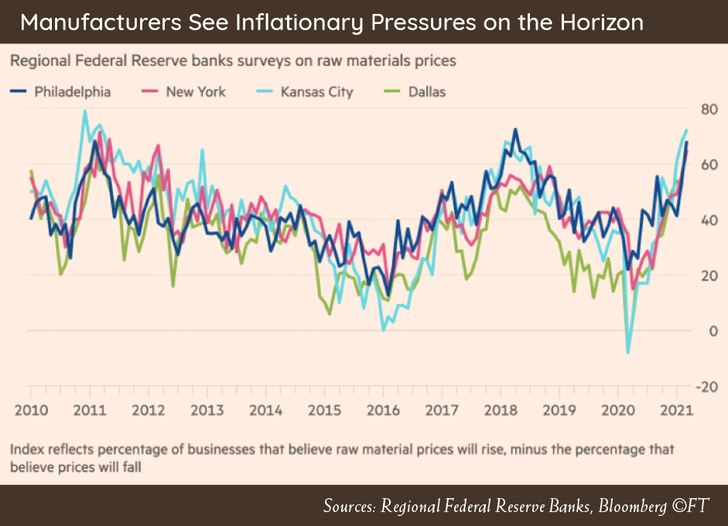

Wishing you all a wonderful summer with lots of freedom to gather and travel. Tim Mosier, President Cairn Investment Group, Inc Greetings from the Northwest. Can you believe that it’s been over a year living with this pandemic, and no clear end in sight? And yet, here we are with financial markets and home prices at all-time highs, leading to a large divergence in fortunes between those who own assets, and those who don’t. We all know that it’s been particularly hard on those whose livelihood depends upon up-close and personal interactions with other humans. Let’s all hope that the stimulus and a well-managed re-opening of the economy relieve much of this burden for them. I believe that almost everyone reading this falls into the category of “those who own assets,” and have seen their personal worth increase during one of the most disruptive events in modern history. What has happened and what is happening globally should be considered as seminal, an inflection point in history heading towards something new and unknown. One can sense that big changes are afoot, and on many fronts. Indications are that after decades hiding in his bottle, the inflation genie is likely to reappear, fueled by massive government spending, and rising wealth from gains on many types of assets. Interest rates, on a downward path for the better part of 40 years and an entire career for most financial professionals, are very likely to rise in concert with inflation. Both of these have direct implications for asset prices and your investments. In his part, Patrick will give you our thoughts on this and what we plan to do about it. On the positive side are the emergence of medical and vaccine technologies that promise to improve our response to future outbreaks. One hopes that governments, too, will have learned and adapted to better handle them. Companies globally are adapting to the idea of more worker autonomy and a more dispersed and mobile workforce. What implications can we imagine for urban centers and commercial real estate? How far will or can this administration go in changing the direction of U.S. policy and practice on a broad array of American interests? It’s working with a clear mandate to pull us through the current crisis, but without such a clear mandate on many of the other issues that we face. How much further in debt will we go, and what will be the impact on our taxes? Will the world see a separation of supply chains and economies divided between the U.S. and China? How far will China’s economic and political rise take it? Will Russia’s global meddling (while its home economy is in shambles) lead to something worse or get checked in the future? Will the European Union come out of the crisis stronger or weaker after its chaotic response to COVID? The way that these and many other issues play out will have lasting effects on our investments and our personal lives. They don’t come with a playbook or a probable outcome, so we’ll adapt as we see them evolve. With that, here’s Patrick with some practical, measurable observations and what we are doing about them. Patrick's PartThrough small bouts of volatility, equity markets continued their forward march during the first quarter. Stocks, measured by the S&P 500, returned 6.17%, while the real drag on capital markets during the quarter took place in fixed income, with Long Dated Treasury bonds dropping 13.92%. The recent negative returns generated in bonds due to rising interest rates have caused a lot of chatter across the investment community. This is a topic we find of high importance as we manage your wealth moving forward. Some might say, “Wait, Patrick; interest rates rose a couple years ago, and bonds did okay.” Or “I don’t own many bonds in my portfolio, so what will this have to do with equity markets?” My simple response: “A lot!” The source of rising rates will have a profound effect on equity markets and returns realized across different investment styles over the coming market cycle. The source is very important, because, unlike 2018 when rates were rising due to the Fed reversing QE, the current narrative and concern of rising rates are not being driven by the Fed tightening monetary policy. Fed officials have been clear that they have no intention of reversing their current course for at least a couple of years. As the two charts below indicate, we are seeing interest rates rise today because market participants, investors, and business managers are becoming concerned that inflation is starting to heat up. This could be for a myriad of reasons, but the most likely culprits are large government spending, combined with strong economic growth, and extremely accommodative monetary policy. If inflationary pressures and concerns become a reality, the tool kit used over that last cycle (investing in high revenue growth, low current earnings U.S. companies, combined with long dated bonds), will not have the same level of success that investors have become accustomed to. The bullet points below explain the intuition:

As with most things in financial markets, not everything is black and white, so there will be certain areas of the marketplace we will continue to focus on, to find opportunities to combat the threat of higher inflation. First, as we have written about many times in the past, value stocks vs. growth stocks still trade at a large historical discount. The benefit of value stocks over their growth counterpart in a rising inflationary environment is that many of the cash flows and earnings of traditional value companies are realized in the present (think of Costco). So even if inflation is rising, the future value of earnings is not as impaired as in growth companies that realize their earnings many years into the future. Second, companies that have a strong competitive advantage with the ability to pass rising costs on to their customers and consumers should weather inflationary periods with less disruption to profits. Lastly, having exposure to equity markets outside the U.S. will be essential, as the relative value of international stocks is much more attractive, and higher inflation domestically generally comes with a lower value for the U.S. dollar. A lower value of the U.S. dollar versus other currencies is historically a positive to foreign equity markets. The benefit of our process is that it is built around understanding the value of what we are paying for something, while comparing that to the risks that could be present. Our disciplined approach will only act as another layer of safety during this potentially changing investment landscape. When risks are high, and opportunity is low, we will remain flexible but defensive for when the pendulum eventually swings in the other direction. Currently, we view risks as being high but not so high that defense is the only strategy. This positions our portfolios to hold slightly more cash than normal, while we are actively taking advantage of investments we feel offer compelling return potential during this challenging market environment. As always, thank you for your continued trust, and please reach out if you would like to discuss any topic in greater detail.

Thanks, Patrick!

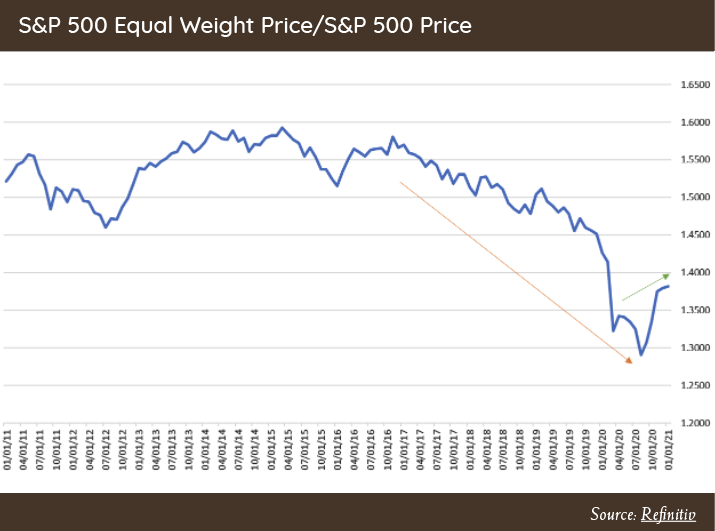

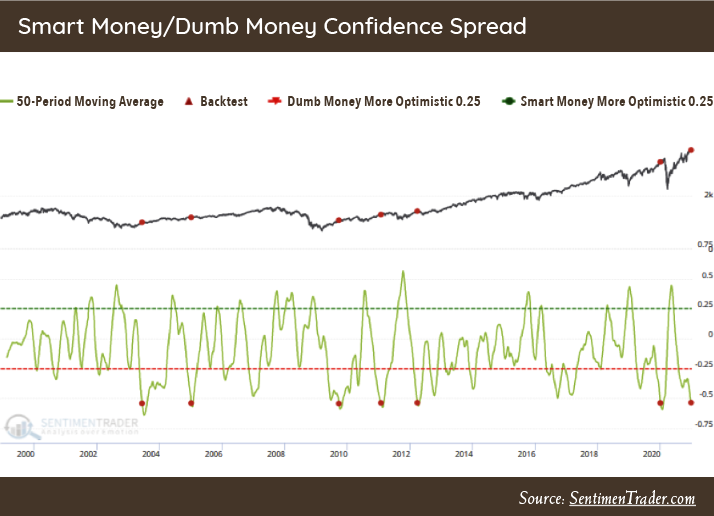

In case you’ve missed the website and LinkedIn updates, Cairn has added a key member to the team in the last month. Mark Farrelly CFP®, CDFA® has joined us as Senior Advisor and Director of Financial Planning. It’s exciting to bring on someone as experienced and talented as Mark, who’s been in the business for almost 20 years, specializing in providing detailed and comprehensive financial advice. Mark and Patrick have worked together earlier in their careers, and already have a deep level of trust and respect for the other’s skill set and work ethic, setting up a promising integration of Mark and Cairn. Mark operates out of Northern California and will continue to work remotely. Over time Mark will help us in improving and codifying our financial planning practices, providing a better experience for all of our clients. Welcome, Mark! As restrictions ease, I hope to see many of you back in the office. In the meantime, we’re happy to provide help by any means that works for you, including Zoom or WebEx meetings. Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. Was that a Mack Truck or a herd of reindeer that knocked us off our feet? I didn’t catch a glimpse of the perpetrator, but it sure was nice of him to pick us back up and dust off our coats before he left. I’m talking, of course, about last year. Done with that, let’s move on to better days, and I do believe that better days are ahead. On a global scale, private enterprise has figured out how to operate while hampered by the confusing regulations and ever-present risks. Consumers are consuming, homebuyers are buying, etc. People and companies everywhere have pulled forward their use of technology for communicating, shopping, and more, by several years; yet it seems like we all still want to visit Costco and Fred Meyer between our Zoom meetings. As the health crisis eases with the coming vaccines, we’ll find out just how much pent-up demand exists. My sense is that it’s high. When we get the green light, we’ll be eating out, shopping, and traveling in vast numbers. Continuing in a more positive vein, I am so impressed by the people iour community who have, throughout the crisis, kept on task, helping those in need, whether that be financially, emotionally, medically, or all the above. We’ve seen strong giving from our clients and can see the good this spreads in the community. Similarly, I’ve observed an unabated commitment to important environmental projects in our state and elsewhere, with people giving their time and money trying to make a positive impact. Thank you. There will be challenges; we’ll all learn the tax impacts of the election in coming months, and we’ll all adapt. The stock market itself has already celebrated some of this success, so its performance may not be so rosy. I’ll leave it to Patrick to explain our thoughts on that in more detail. Speaking of Patrick and a brighter future, I want you all to know that as of January 1, Patrick is officially on the ownership team at Cairn. This is an important step for him, for your relationship with Cairn, and our ongoing growth, health, and continuity. Welcome, Patrick! Patrick's PartEquities posted a strong finish to 2020 with most indices up low double digits for the quarter. Investors continued to focus primarily on positive vaccine news versus a still muddling economy with lofty equity valuations. Small-Cap stocks were the biggest winner, rising 31.37% during Q4, while bonds posted a modest 0.67% gain. During our Q3 letter and our mid-quarter update we discussed where we are finding opportunity based on the large mis-pricing in small cap and value stocks, and though the first quarter of the year did not meet our expectations, portfolios have benefited from the change in market participation we are currently witnessing. One of our favorite indicators to track market participation (breadth), is the S&P 500 Equal Weight Index over the S&P 500 Cap Weight Index. When this indicator is moving down, market participation is narrow and being driven by a few large companies (like FAANG stocks). When it is moving up, the smaller companies are carrying more of the load and participating in a meaningful way, which is the current trend as you can see in the chart below. We have written quite a bit about high valuations and risk over the last few years. Though our concerns about valuation have not receded, observing more broad participation in the equity markets is a positive. With the rebound in equities that took place in April, we are now witnessing sentiment indicators at optimistic levels. One of our favorite sentiment indicators is the Smart Money vs. Dumb Money Spread released by our friends at SentimenTrader.com. This indicator measures money flows based on large option trading versus small speculative option trading. This is a contrarian indicator based on the logic that large institutional hedgers and participants have more knowledge and therefore are the “Smart Money.” As you can see from the chart below, when “Dumb Money” is at extremes, this tends to be a warning sign for the coming months. We are witnessing a tale of two markets summarized by: better participation across asset classes, and companies that will benefit from further economic improvement. Countered by equity markets that exhibit excessive valuation and frothy sentiment dampening future return potential. We have positioned portfolios accordingly, to take advantage of markets that are rewarding attractively valued companies and asset classes, while maintaining some extra cash and fixed income to act as a ballast in case more turbulent times arrive. Thank you for your continued trust. I always enjoy conversations with clients regarding any of these notes or the data we analyze, so please drop me a line if you care to discuss in greater detail. Thanks, Patrick!

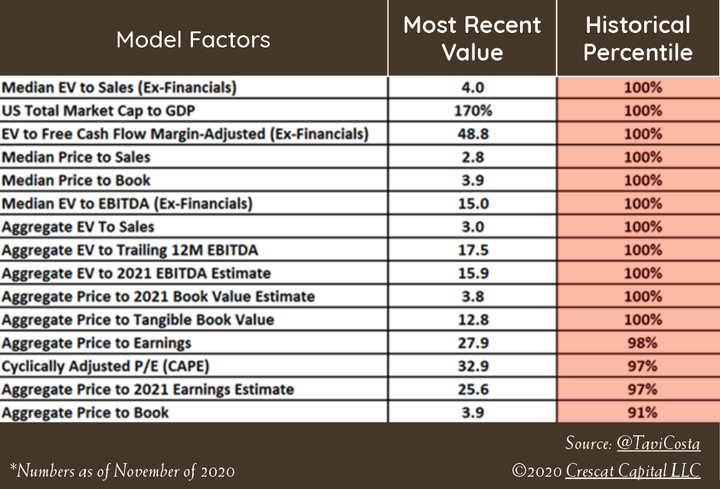

Here’s to a happier 2021. Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. Well, it’s Fall at last and it’s beginning to cool off a bit, although more slowly than usual, as it’s still been in the 80s when the smoke’s not too thick. We did kick off October with the first foggy mornings of the season and that seems to make a cup of coffee just a little more enjoyable. I look forward to the wonderful, natural changes that happen this time of the year, in stark contrast to some of our human constructs. Below, I’ll dig into some of my thoughts about our man-made world, but first I’ll share a moving personal experience with you. Some weeks ago, I woke up along the banks of the Madison River in Montana, having spent a few days fishing and revisiting one of the favorite memories from my youth. Wow, had it changed! Trophy homes are perched on every hill and a very active tourist/fishing racket drags paying customers down the river in small armadas, slapping the water continuously with their bright strands of fly line, all hoping to catch the same fish that had successfully ignored the prior dozens of presentations. Having had enough of that, I packed up camp early and headed east to Wyoming, through Yellowstone Park. I always enjoy Yellowstone, but unless one can stay awhile and explore, it’s just a slow drive through some pretty country, albeit a bit smoky this time. Midway through the drive, along the banks of the Yellowstone River, I found myself coming to a halt behind a line of stopped cars and a scene straight out of an apocalyptic movie, with drivers abandoning cars mid-road, grabbing cameras and optics, while lunging towards the river with much excitement. What I witnessed was one of nature’s greatest and most brutal spectacles. A very large grizzly had chased a mature bull elk into the river and was dispatching him as I arrived. Despite the elk’s long powerful legs and massive pointed antlers, he was no match for the bear’s practiced approach and agility. By entering the river, he had unwittingly sealed his fate. I watched as the bear finished this task, essential to his survival, and then slowly, working with the current, brought the elk to shore. Having assured survival for another week or so, he sat on his haunches, resting and considering his victory. This entire episode, from well before I arrived on the scene and for days thereafter, has been photographed and recorded by many, and you can easily find this on YouTube if you’re interested. While this is a cool story and a great memory for me, I think it also has some instructional value when it comes to our lives, our decisions and our investing behavior. The outcome of this event was not preordained. Why did the elk give up its advantage and play into the strengths of the bear? My theory is that in this case the bear was much more experienced at killing than the elk was at not getting killed. The elk lived in a predator-rich environment, being on guard at all times and occasionally experiencing the loss of a herd member, but it probably had not been in such close proximity to death and had an exaggerated sense of his ability to escape. He was the amateur in this fight. Seeking safety was his undoing. By contrast, the bear, evidenced by his mere existence, was a professional. Each and every meal not scavenged, was preceded by a successful hunt. He is an expert at the end game. I draw a parallel from this to our own behavior: what we think and do when we’re afraid, and again when we’re confident. Our current human environment is unprecedented. To some extent we are all amateurs today. Who could imagine a year when the impeachment of the President of the United States is page three news? I cannot claim that we here at Cairn have some special insight into the future, or that we’re even smarter than the average bear, but I can tell you that we have a process and that process works much better than running into the river for safety. Please take a moment and consider what Patrick has to say about what we do and what we plan to do to keep your money in a good place. Patrick's PartIt was only a few short months ago that we were writing about the deep recession and corresponding market correction. Contrast that to today where we’re witnessing exuberance in parts of the equity markets that resembles the tech bubble that took place 20 years ago. The US stock market, not to mention Robinhood traders, must be fans of the late musician Prince because it is partying like it is 1999. My apologies if that song is now stuck in your head. The difference being, in 1999 you had stock tips on AOL message boards and discount brokerage firms that would take your trades 24 hours a day. Today, you have a slew of new traders with Twitter and a phone app that lets you trade stocks like a video game. We have written in previous quarters on some of the reasons investor enthusiasm is at its peak (Fed intervention, low interest rates, etc.). This optimistic behavior has driven valuation metrics across the board to historic highs. One of our favorite valuation metrics is the Price to Revenues (P/S) ratio. It gives a clear picture of what investors are willing to pay for a stream of revenues before costs and other accounting factors. It has been observed that there are now more companies in the S&P 500 trading at 10 times revenues (37) than there were in March of 2000 (30). This data point reminds me of a quote from former Sun Microsystems Founder and CEO, Scott McNeely, when he discussed the investor euphoria that was taking place prior to the tech bubble bursting:

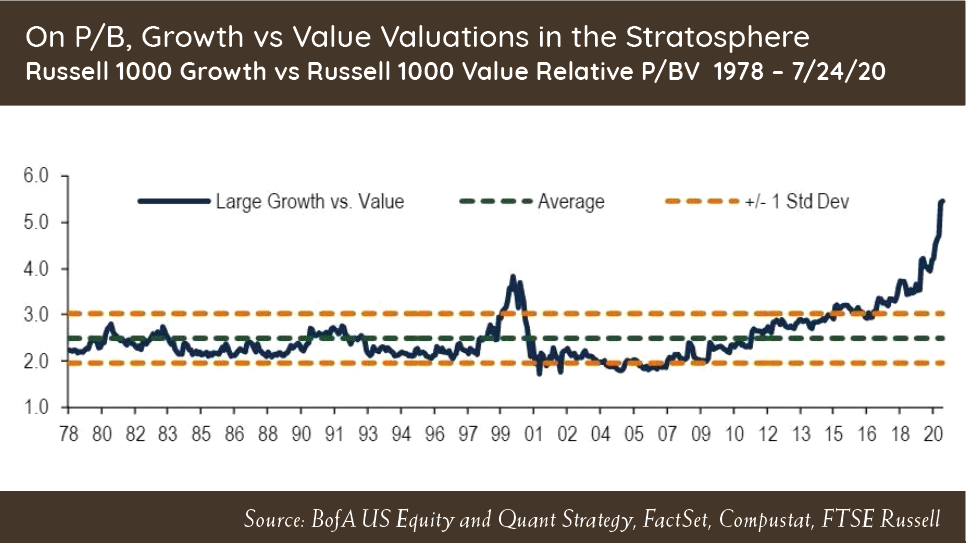

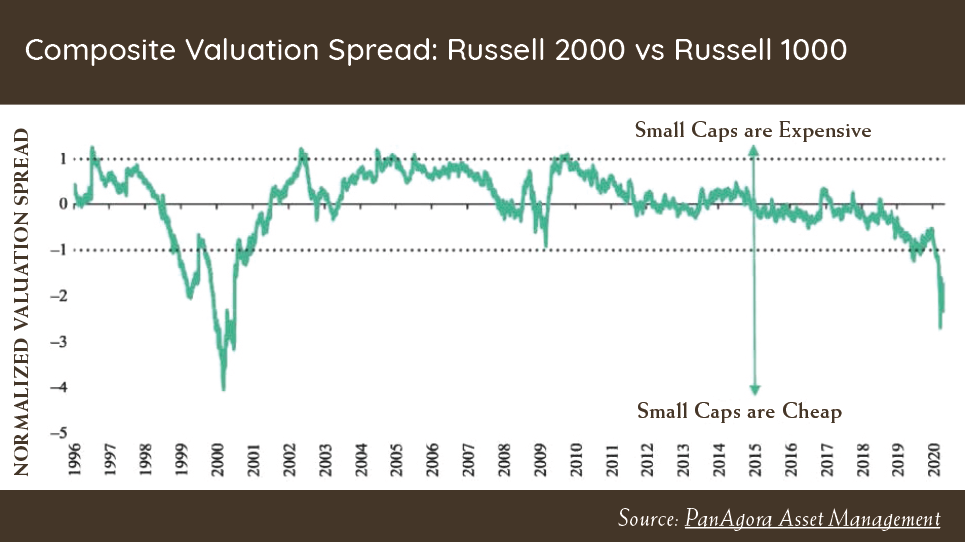

The recent price performance of Tesla showcases a current example of investor euphoria when their share rose 50% after the company announced a stock split on August 11th. A stock being split may sound like a good thing, but there is no economic value created with a stock split! The market value, earnings, revenues, and cash flows of the company remain the same. There are simply more shares outstanding being offset by a lower price. Tesla’s 50% increase in market cap in the two short weeks following their split announcement generated more wealth for investors during that period of time than any of their car designs have ever done. Wonderful companies (many of which we own) that create essential products and services have seen their share prices shoot past the fair value of the underlying business. However, this means that the prospects of these companies have been accounted for in the high share price. This potentially leaves little room for growth and heightens risks if the prospects fail to materialize. Down the road many investors may be looking back on this period asking themselves, “What was I thinking?” With the levitation in growth stocks, investors have ignored other well-run businesses and asset classes. This is where we are finding opportunities for new investments. As value investors, our primary focus is not looking for new investments based on what has previously done well, but rather we look for companies and markets that are under appreciated that will do well in the future. The current divergence in price returns has been shown to reward some companies too much while punishing others too harshly. Mean reversion is a powerful phenomenon and the evidence suggests that such anomalies tend to reverse. Below are charts showing the relative valuation of value stocks vs growth stocks, and small company stocks vs large company stocks. Looking at these charts together tells a strong message. While focusing on risk, the opportunity for investors to earn returns is found by looking at value over growth and smaller companies over larger companies. The companies and asset classes we are investing in fit this criterion as investor enthusiasm has swung the pendulum to extreme levels in both instances. Unfortunately, no one can predict precisely when the pendulum will lose momentum and swing back in the other direction. We continue to focus on what we can control: being disciplined, patient, having a historical perspective, and straying away from the herd when opportunities or excessive risks are present. Thank you for your continued trust and please reach out if you would like to discuss any topic in greater detail. Stay safe and healthy. Thanks, Patrick.

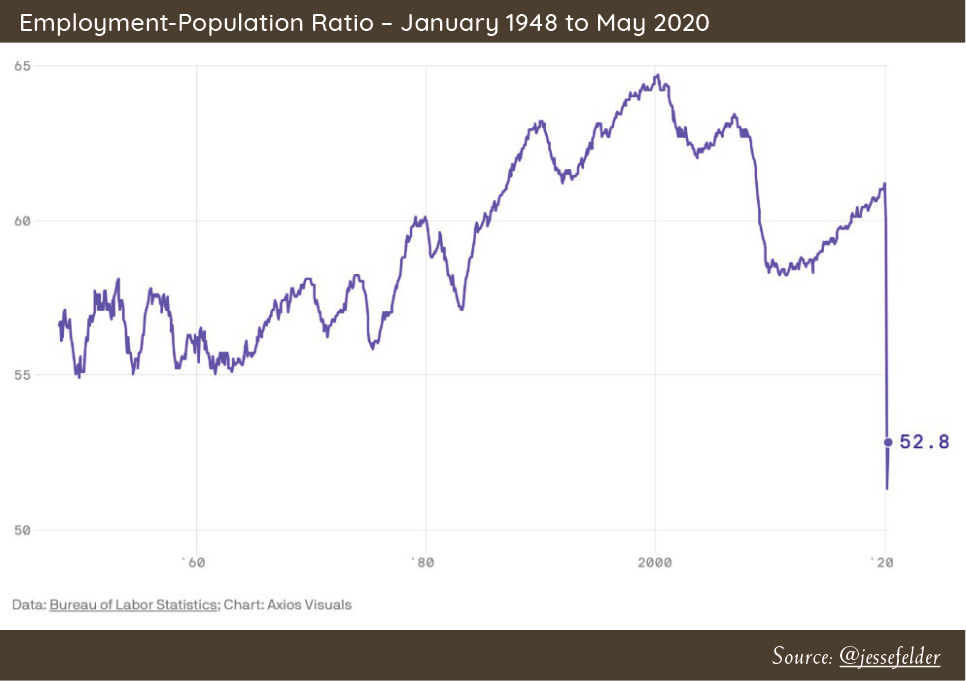

Wishing you all good health and dry feet as the Autumn soaks in. Happy trails, Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. Or should I say… Sweden? After all of the care we took to contain the virus and after all of the disruption to our lives, businesses and, yes, investments, we apparently will be moving forward by adapting and learning to live with the killer. While our bodies are no better prepared to fight the virus than they were in February, the medical and political systems have had time to react and strengthen their responses. We now have masks aplenty, and, apparently, an adequate number of ventilators. There’s been a noticeable lack of noise lately about vaccines and treatments, but I trust that, quietly and efficiently, the medical community is honing their response. Human nature is revealing itself, in that people are bursting their seams to get out of the house and back to work, school, play or protest, and so it shall be. So, what does this have to do with investing? Everything, I say! It has everything to do with how vibrant the economy will be, who the winners and losers will be, and how much confidence, or lack thereof, will be floating the stock market. As I write this, the market indices are again near their historic highs. Does this indicate a ground swell of confidence, or opportunistic speculation that the Fed will keep injecting funds into the system? It’s probably a little of the former and a lot of the latter. Life and the economy are always complex, with forces coming from many directions, some opposing, some reinforcing, some just confusing; but in our lives this is probably one of the most complex. With the headlines focused on major social and health issues, it’s easy to forget that many millions of hard working people are out there every day, trying to make a living and better their situation. Rush hour traffic is packed with folk headed to work. Heads down, full steam ahead. It’s this that makes what we do possible. There is no upside to the stock market or juicy dividend payouts without it. We hope and have confidence that this will always be so. While the market indices are at high points and their measurable valuations are near extremes, many investable securities have not participated fully, and we are finding a few opportunities. Keeping cash and fixed income productive is a challenge as well, with yields being extremely low. I’ll let Patrick dive a little deeper into what’s dragging the markets around. A Quick Office UpdateWe’re still closing early at 4pm each day, with Patricia and me onsite. Patrick and Jesyca join us each Tuesday so we can push forward on a number of projects we’ve undertaken. Jim and Lara check in multiple times a week and have lately been in at mid-week. Speaking of projects, the most important is our conversion from Envestnet’s “Portfolio Center” to their more advanced “Tamarac” reporting system. Your quarterly report, attached, looks very different from what we’ve produced in the past, and we believe this will enable an enhanced understanding of your investments. We look forward to your feedback. Another improvement is the ability of this system to open a private client portal to securely deliver documents, and to allow you to view your investment progress at your convenience. Our plan is to begin distributing Quarterly Reports through this secure client portal in October. Patrick's PartThese are truly unique times we are experiencing. The volatility of equity markets so far this year is something that has not been seen since the Great Depression. In the last 3 months, global equity markets went from fear of an economic collapse to trading at the same lofty valuation levels that were seen in January, before the pandemic took hold. On June 8, the National Bureau of Economic Research officially declared the US to be in a recession that had started in February. It seems like with the recent surge in stocks, markets have priced in a swift V-shaped recovery in economic growth and corporate earnings. We are not going to pretend to know how this will play out. However, we find the view of a return to economic and earnings prosperity in the near term to be Pollyannaish, as the majority of “Main Street” are still suffering from lost jobs and lack of consumer confidence in the safety of going out and living a normal life without getting sick. The Fed is a primary catalyst to the stock market’s newfound enthusiasm. On March 23, Fed Chairman Jerome Powell announced unprecedented (some would argue illegal) financial liquidity to the fixed income markets. Never before has the Fed embarked on directly buying individual corporate bonds. In our opinion, this direct backing of individual company debt is blurring the lines of free markets and creating a large moral hazard in corporate America. The Fed is now a top 5 holder of the 54 billion-dollar iShares iBoxx Investment Grade Corporate Bond ETF that holds individual bonds issued by companies such as Microsoft, GE, Anheuser-Busch, Berkshire Hathaway, and CVS Health. This means the Fed is now investing in and supporting individual company debt, having the potential ramification of choosing which type of company could succeed and fail, instead of the capital markets making that determination. The backing the Fed has provided to the bond market has spilled over to the equity markets in the hope that monetary intervention will be the panacea for the current downturn in company profits. The chart below from Charles Schwab Chief Strategist, Liz Ann Sonders, shows the growth in the Fed’s balance sheet and the price of the S&P 500 index. The Fed’s intervention corresponded with stocks moving higher: Meanwhile in the real economy close to 50% of the population is not working: Many market pundits argue that the stock market is not the economy and that stock markets can look forward to an eventual economic and earnings recovery. This is true, but significant price recovery usually takes place when market valuations are much lower than where they currently stand, at close to 30 times normalized earnings. It is not hard to argue that the disconnect between stock prices and the real economy is quite large. Our job is recognizing the environment we are investing in, managing risk, and finding opportunities. On May 11 we sent out our mid-quarter update, discussing where we are finding opportunities, and said:

Our thoughts have remained the same and we continue to find opportunities that fit that criteria. We would not be surprised to see continued volatility in financial markets, as states react to the virus and open and close communities accordingly. We will continue to act prudently and manage your wealth based on data and analysis, not on headlines and emotions. Thank you again for your continued trust, and please feel free to reach out to me to discuss any topic in greater detail. Wishing you health, happiness, safety, and enjoyment as we head into another Pacific Northwest summer.

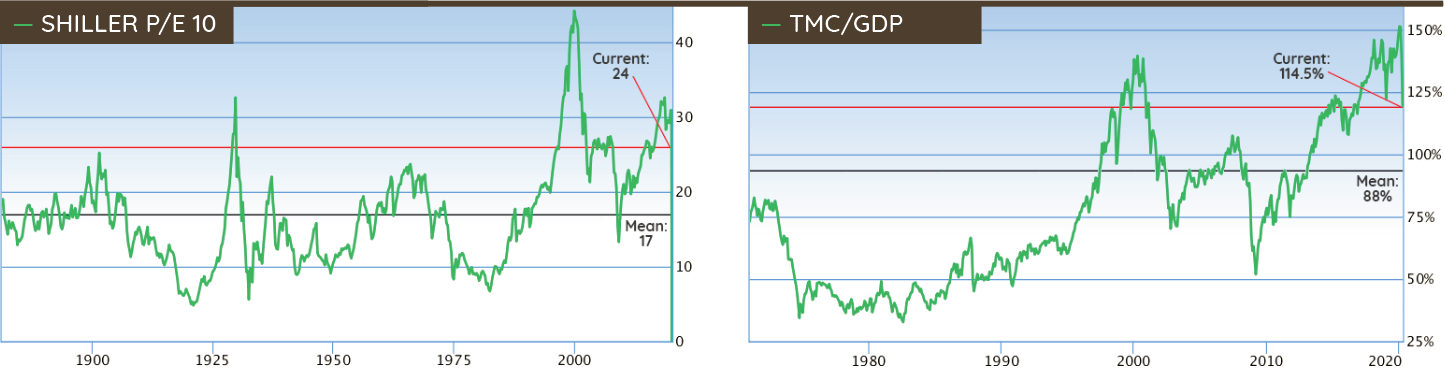

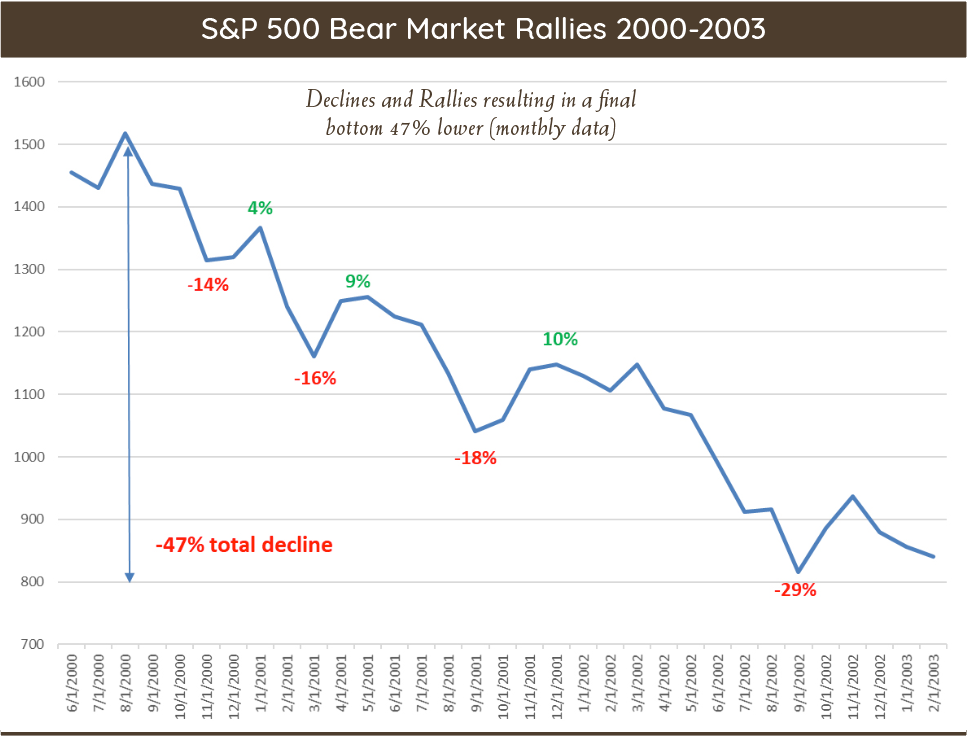

Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest. In this unprecedented, historic, and frightening framework I struggled with writing that simple, well-used phrase. Is it too light and cheery for the circumstances we find ourselves in? Will this arrive at a home stricken by the virus? I can’t know, but I sincerely hope that this finds you and your loved ones healthy, and happy to be enjoying more time together at home. This is such an exceptional time. We’re all in the same boat, and that phrase works so well here, yet the way it plays out for each of us will be unique. I have few worries for myself, but my paramedic daughter is deployed with FEMA at a hot spot, and I worry for her every day. My son is currently submerged somewhere in the Pacific on board a submarine, and I last heard from him in late January. Does he even know about what’s happening? Many of you have stories and concerns of your own, I’m sure. Dealing with the health and safety is and should be the overarching priority. Through all of this, Cairn’s job is to care for your money, and give you confidence that this will work out for you financially. We’re all fine here, and we are functional. We are adapting. I write this sitting in an otherwise empty office, just having gotten off a teleconference with the staff, most of whom are working from home. For the first time ever, this newsletter and attached reports are being generated and distributed electronically. Patrick has all of his Cairn tools at home, as does Jesyca. Patricia works her normal shift in the office, fielding the incoming calls and mail. Jim and Lara remain ready to help at the push of a button, so rest assured that we are here, and will be here through it all. Investments have taken a hit. Considering the backdrop and the potential economic harm that’s being inflicted, it’s heartening to see that it’s not been worse. This might be a recognition that all stops will be pulled out to get the nation through this. I do think that more rough times are ahead, but at this point we are beginning to look for opportunities as much as we are looking to reduce risk. Patrick will go into details about the process and economics, but I will say here that if you have enough cash and fixed income to support your plans for the next year or so, it’s likely that your equities will have recovered nicely by the time you’ll need to tap into them. Let us work the process and position things for the eventual rebound. I’ll end with a quote from Warren Buffet that Jim shared with me recently: “The stock market is a device for transferring money from the impatient to the patient.” We are patient. On to Patrick… Patrick's Part It’s hard to believe that most stocks were trading at a record high only 6 weeks ago. The rate of this recent downturn was the fastest in history. US large cap stocks fared the best, being down 19.6%. US small cap stocks, developed international stocks, and emerging market stocks were down more, with returns of -30.65%, -23.01%, and -23.94% respectively. The bond market was also quite volatile during the quarter, with the broad market returning 3.10%, high yield bonds down -11.61%, and municipal bonds returning -0.61%. Needless to say, outside of cash and Treasury bonds, there were few safe havens. The response to COVID-19 has inflicted significant damage on the global economy to date, with little clarity on when the economic data will start to take a turn for the better. We have talked in great length in previous letters regarding our thoughts on the economy, high market valuations (Oct 7 2017 :: Jan 11 2019 :: Oct 8 2019), and interest rates (April 12 2019), but I don’t think anyone could have foreseen the rapid impact this virus is having. The US is most likely in recession at this point, which prompts the questions: How long will this contraction last, and what impact on consumer behavior and spending will it have on the rate of recovery? Unfortunately, nobody knows the answers to these questions. Recently, we’ve communicated how we are managing the portfolios during this difficult environment and our process for uncovering new opportunities (July 11 2019), so I won’t spend a lot of time on that here. My focus is primarily on the broader US market and where we stand from a valuation perspective after the recent price declines. For comparison we will look at price behavior during a recent bear market. With lots of noise in the short-term, I find it helpful to focus on a long-term perspective to provide some clarity on expectations of future market returns and experiences. The prevailing viewpoint amongst market pundits since the last week of March is that the low was reached on March 23rd when the S&P 500 closed at 2,237.40. This combined with the narrative that prices will be choppy, but higher prices are to be expected in short order. It’s a nice story and feels good to hear that the worst could be behind us. And (while it is possible that the pundits are correct) after examining the data and comparing previous bear market experiences, it could prove to be wishful thinking. We do not invest on hopes and wishful thinking, though, and prefer to look at hard data instead. The charts below show two different metrics that are very useful in understanding long-term valuations. I have discussed these previously and reviewed them with many of you individually. The Shiller CAPE P/E ratio and Total Market cap to GDP both peaked at the end of January. As the charts show, both indicators are down from their highs set earlier in the year. However, even with the recent improvement in valuations, these metrics are still only 20% below levels that were matched only during the Great Depression and the tech wreck. I don’t bring this up to say the market has to head lower, as investing is not an exercise in absolutes, but to give context to where current valuations stand versus history. Even after recent price decline, valuations are still elevated. The month of March was extremely volatile. Not since the Great Depression have equity markets seen this level of volatility. From March 1st to March 23rd the S&P 500 was down 24.16%. Then from March 23rd to March 31st the S&P 500 rallied 17.4%. The rally from March 23rd has caused many pundits to declare that the “bottom” has been set and the next bull market is underway. Nobody knows when the bottom happens. It is only known well after the fact when prices are higher over the long-term. The chart below shows the price experience of the S&P 500 during the bear market that took place from 2000-2003. As the chart shows, the decline that took place was filled with many short-term rallies that ultimately failed as prices moved lower. Again, this is not to say that the current market behavior will mirror the above experience, but to give a longer-term perspective on how markets can behave. They do not continuously go down during bear markets, nor do they continuously rise. We follow price trend data very closely as part of our analysis and the data still suggests a new bull market hasn’t begun. The combination of valuations and price trends leads us to believe that caution is still warranted at the broader market level. However, during bear market environments there are individual stocks, sectors and asset classes that perform much better than broad indices. On a positive note, with the recent market decline, we are starting to find many more suitable investments that didn’t exist a few months back. Many stocks have seen declines of 30-50% this year, compared to 20% for the S&P500. This is creating opportunities and we are taking advantage as prices dictate. During this period of stress, we continue to emphasize attractively valued companies, with durable cash flows and strong balance sheets that can weather this economic storm. We will continue to invest based on our disciplined process, and let facts and data tell us when we should change our mind on when taking more risk is necessary. Thank you again for your continued trust and especially your kind words during these trying times. Please drop me an email or phone call if you want to discuss any topic in greater detail. Thanks, Patrick. With that I’ll leave you all with the sincere hope that you remain safe through this perilous time.

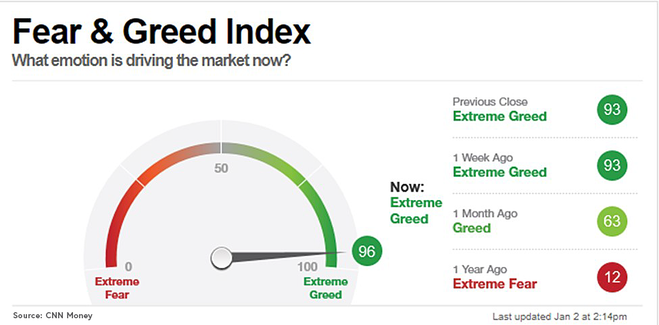

Tim Mosier, President Cairn Investment Group, Inc. Greetings from the Northwest! Those familiar words have been a hallmark of our quarterly newsletters for many years and are likely to remain our first words for years to come, gently easing our readers into whatever more serious topic that is bound to follow. Working shoulder to shoulder with Jim Parr over the better part of two decades, I’ve learned that people enjoy, and get comfort from, the familiar. When Jim and I founded Cairn “way back” in 2007 we made a sincere effort to create a place where our investors, our people, could feel at home; a place where they were known, valued and thought about on a regular basis. It’s my desire to continue on this same path, putting you above all other goals, and you should expect no less than this. Inevitably there will be change, but change intended only to improve our service, improve our investing and improve our overall effectiveness. If we can do this and have you, our investor, feel like nothing has changed, only improved, then we will have succeeded. We have a great team today, I think the strongest in our 12 years here. As Jim mentioned in a prior note, Patrick Mason will be joining the ownership this year, adding a comforting layer of assurance that our methods and our mission can continue seamlessly in support of your goals. Read his message that follows, take it to heart, understand the choices that we are faced with in this complex economic and political environment, and know that you are being well served. Jesyca and Patricia put a smile on my face every day when I observe and hear the way they deal with our investors’ needs, simple and complex. Of course, Lara continues to provide a solid backstop to everyone’s efforts, and Jim cheers us on from his new and slightly different perspective. In the next few weeks I’ll be announcing another exciting addition to our team, but more on that later! I’ll leave the serious stuff to Patrick this time around, but I do want to sincerely thank all of you for being a part of the Cairn family, and in particular those of you who give us honest feedback on your experience, as it only serves to make us better. It’s my goal to revitalize our communications in 2020 to see and talk with as many of you as I can. Between the changes here, the upcoming election, and inevitable twists of the economic cycle, we should have plenty to talk about. Patrick's PartEquities finished the year in a celebratory mood, with U.S. large cap and small cap stocks posting fourth quarter gains of over 9%. Developed international stocks and emerging market stocks also fared quite well, with gains of 7% and 12% respectively. Fixed income, which had been a strong performer earlier in the year, posted flat returns as interest rates moved higher on longer dated bonds. Global markets were strong in 2019 after coming under pressure the year before. Concerns about trade and economic growth were pushed aside as investors cheered the Federal Reserve’s change in interest rate policy last January. As you can see by the Fear & Greed Index chart below, the majority of investors have now embraced equity market risk with little thought of the actual risk being taken. In fact, the 2019 S&P 500 performance can be attributed to roughly 4% earnings growth, 2% dividend yield, with the remaining 25% attributed to multiple expansion (P/E ratio moving higher). In other words, over 80% of the S&P 500 Index return was generated by investors’ willingness to pay more for many years of future earnings, in the present. I think that fits the definition of greed pretty well. When valuations are already stretched, paying an even higher premium for future earnings can open investors up to experience larger losses or underwhelming gains in the future. Even with the strong performance of 2019, it would only take an 11% drop in the S&P 500 to get prices back to where they were in January of 2018. As we noted last quarter, we continue to observe softness in the current economic expansion, combined with generally high equity valuations. However, the data does not point to imminent recession and there are still opportunities for us to invest wisely. We continue to look for fundamentally sound investments selling at attractive prices, while balancing both risk and reward. As famed investor and writer Howard Marks likes to say, “Move forward with caution.” We think that is pretty sound thinking in the later stages of this cycle. Another topic of discussion this year revolves around the Secure Act and IRA distribution changes that passed into law recently. There are some major changes taking place, and we find the following two will impact the greatest number of our investors. The first involves the age at which a person must start taking their required minimum distribution. The second discusses the new parameters for beneficiaries that inherit a retirement account.

Estate planning issues may arise from these changes. The primary one we see is the naming of a trust as a beneficiary of an IRA. Attorneys will occasionally recommend this so that the assets are still under control of a trust while allowing the stretch provision for the RMD. Under the new law, all assets in the inherited IRA have to be distributed by the 10th year. Since there is no annual withdrawal required, the new provision could cause a large taxable distribution to the beneficiaries of the trust in the 10th year. As we meet with you over the coming year, reviewing IRA beneficiary designations will be an action item. My last topic involves cash management within your portfolios. As interest rates have done a U-turn over the last 12 months, interest paid on cash and money market funds has continued to fall. To make sure we are earning the highest interest on your cash while we either construct a portfolio, or wait for a new opportunity, we have implemented new cash management tools. To efficiently manage your cash, we are using liquid and safe securities consisting of CDs, T-Bills, position traded money markets, and short-term Treasury Bond ETFs that earn a higher interest rate than cash. We don’t want a lot of idle dollars earning very little in this challenging environment, and feel it is our job to manage your cash as effectively as possible. Thank you for your continued trust and please drop me a line if you have any questions or additional topics you wish to discuss. As always, our doors are open, the coffee is hot, and the parking is free, so please make a point to visit when you can.

Happy New Year, Tim Mosier, Principal Cairn Investment Group, Inc. There is no Frigate like a Book :: To take us Lands away Nor any Coursers like a Page :: Of prancing Poetry —Emily Dickinson Greetings from the Northwest. During past market cycles I had a chance to read company reports, newspapers, and periodicals. Visit with company executives and their business to business trading partners. Reflect on business and industry segments and then pin it all up on my “wall of worry” and look at it. The process was a little like adding a new chapter to an ongoing story each quarter. Everything must continue to evolve. Well, welcome to the crazy-fast times. It is not as common as it once was to read a book. The tales of far-off lands now arrive as fast as the next news cycle, which is terrifying. It’s hard to find time to reflect on the good or the generous and the joy of a poem. And why would we when we can be entertained and amazed at the silly, greedy, and stupid behavior of so many prancing world leaders? Let’s take a moment of our precious time and focus on the real monster in the room. Uncertainty. It has often been said that the “market” likes good news, dislikes bad news and absolutely hates uncertainty. We should add that investors don’t like volatility. Uncertainty creates volatility, which causes investors to become restless. Restless about what? Patrick has been doing some thought-provoking work looking into the comings and goings of recessions. Yes, I’ve said it. Recession. We will have them. Patrick’s work is helping shed light on the recession monster and what we should be doing now… or not. Patrick's PartEquity returns during the quarter were mixed, with large-cap U.S. stocks posting a slight gain of 1.7%, while small-cap U.S. stocks, international developed stocks, and emerging market stocks posted slight losses of -2.3%, -0.79%, -4.75% respectively. Volatility has started to pick back up again, as markets grapple with a combination of trade tensions, changes in monetary policy, and slowing global growth. During the year we spend a lot of time with our clients discussing what is going on in their lives, the ongoing management of their wealth, and how we view this ever-changing market environment. We learn a great deal from these discussions. Though the economy has been strong over the last few years, in recent months we have observed recessionary fears rising amongst the public and the folks we talk with. It’s easy to see why, as the news chatters regularly about when the next recession will happen. This has largely been driven by the consistent yield curve inversion. As of August 31, 2019, the New York Federal Reserve Bank’s Recession Probability Indicator, based on the yield curve, has moved to a 37% chance of recession within the next 12 months, up from 14.5% a year ago. In April, I wrote about the lag times after the yield curve inverts and the inconsistent message that an inversion sends (read about it here). However, there are more data points in recent months revealing that the economic recovery is showing signs of stalling. We take evidence as it comes and do not attempt to predict the likelihood of when the next recession will start. At this time, the data we analyze does not point to immediate recession. Where we have been focusing our efforts is in analyzing what the most likely market experience would be if we entered a recession in the near term. Our conclusions are as follows:

On a positive note, as Cairn searches the investment landscape for opportunities, we have continued to find quality companies to invest in that are trading at appropriate prices. Jesyca's PartAs our reliance on technology continues to advance, cybersecurity is of the utmost importance. We are always keeping an eye out for suspicious activity in your accounts and will call to verify as soon as we see any changes made. Cairn has your back. If you access your accounts online through Schwab Alliance, here are a few helpful tips to improve the security of your accounts:

Thank you, Patrick and Jesyca.

Come on by and let’s review your equity exposure and/or two-factor authorization. We’ll make sure the coffee is fresh. Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. Greetings from the Northwest. Our second quarter report is always a little chaotic to produce, since the Fourth of July holiday generally jumps right into the middle of the progress. The distraction of summer, and all that this Fourth brings with it, can cause your diligent advisors to be found yearning for the sizzling BBQ burger or the thirst-quenching relief of an ice-cold beer. This Fourth of July holiday was marked by distinctly cool weather that made the 32nd Waterfront Blues Festival, held along the bank of the Willamette River, quite tolerable in the warming afternoons all 4 days. If the afternoons were filled with blues, the morning of Sunday was exploding with excitement as the U.S. women’s national team took the soccer World Cup for the fourth time!! Being distracted from the business world for a bit was a nice relief from the growing number of global economic woes filling the airwaves recently. The most significant topic of today may be the announcement that Deutsche Bank is retreating from its global expansion and laying off 18,000 people. Oops. Closer to home, in the American oil patch, things are slowing down as well. “Hoping for a gusher, driller came up short.” It’s a common refrain heard in so many words about many business ventures these days. There are so many situations in business now that are good, but not quite great:

I’m sounding like a deflated firework and Patrick is itching to report on the current economic trends, so over to Patrick while I go squeeze our lemons into lemonade. Patrick's PartThe second quarter witnessed investors tossing tariff risks and economic growth concerns aside to focus on the possibility of the Federal Reserve cutting interest rates in the coming months. After bouts of volatility during the 4th quarter of 2018 and again in May, large company U.S. stocks closed near an all-time high. During this time, investors have experienced quite a change in economic growth expectations and monetary policy implementation. Just one year ago, the U.S. Fed was forecasting 2019 GDP growth to be 2.4% and 2020 growth to be 2.4%. When they released their most recent projections on June 19, those figures dropped to 2.1% and 2.0%, respectively. Looking at corresponding interest rate projections, previous forecasts were calling for a rise in the fed funds rate (short term interest rates) to 3.4% in 2020. The current forecast is predicting that interest rates will fall to 2.1%. What a difference a year makes. This flip-flop in policy has been a large component of falling interest rates across the bond market (prices rise) and the tailwind we have witnessed for U.S. stocks in the short term. As Danielle DiMartino Booth, former Federal Reserve Bank of Dallas Advisor and founder of Quill Intelligence, recently said, “We are having a recession party” when describing how positively the stock market is reacting to much slower growth that could result in easier monetary policy. As the S&P 500 index (large company stocks) trades close to an all-time high, while small cap and international stocks do not, we like to check underneath the hood to see what is really driving these recent returns. One question I looked at recently was, “Are all stocks carrying their weight and rising together or are just a few winners saving the day?” Examining this allows us to determine the overall health of the equity market. The breadth of participation signals how broad or shallow a market rally can be, which we find useful during the late innings of a cycle. One of the ways we analyze this is to look at the return contribution of the top names of the S&P 500. Recently, I ran comparison of the return contribution of the top 4 (largest) companies during 2013 and the contribution of the top 4 companies over the last 12 months. For the majority of 2013, we witnessed a broad based contribution and participation from U.S. stocks across the board. Which makes it a good comparison point. Here is the story the data tells: 2013:

Last 12 months:

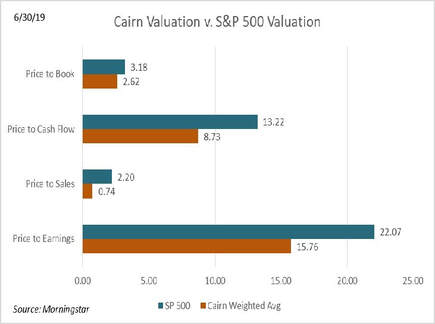

In essence, 2013 was a year where there was broad participation with many names of the index carrying the weight. Over the last 12 months you cannot say the same thing. A little more than 10% of the index is making up almost a quarter of the return. This indicates that the largest, and most popular, names have been carrying the load and the majority of companies have not been keeping up. I will leave it to you what you draw from this observation, but just a hint: It’s not sustainable in the long run. Cairn’s approach is not just following the crowd by investing more and more dollars into overly expensive companies. Our process of uncovering suitable investments is disciplined and consistent. As we stated in our September 2018 letter: “Through our quarterly letters and individual meetings we have discussed our process for uncovering successful investments, our current view of U.S. stocks, and how we are managing assets concurrent with that view. First, we are always on the lookout for industry leading companies that generate significant cash flows, with balance sheets that can provide financial flexibility. The final, and what we believe is the most important, piece is paying a price for a company that is significantly lower than what our analysis says the business is worth. We use a combination of cash flow analysis and the historical operating performance of the business to identify suitable investments, avoiding ones for which we would be paying too high a price, therefore limiting appreciation potential.” As the chart below illustrates, your portfolios trade at a significant discount to the S&P 500 by many different valuation metrics. Lastly, here is just a small subset of the companies we own across portfolios we manage. We thought it would be of interest.

As we head toward the second half of the year, we will continue to look for opportunities, realizing that risk management remains paramount as we reach the late stage of both this economic and market cycle. If you’re interested in reading more about individual companies that we’ve researched, check out the Company Spotlights or give us a call and Jim, Tim or I will be happy to provide more information. Thank you, Patrick.

As I’m fond of saying at the close of our quarterly letters, swing on by for a cup-o-joe. The coffee pot is always on. I’d like to add a personal note to all, about how thrilling it is to see our children grow. This event found me walking daughter Lindsey down the outdoor aisle in Wyoming as she accepted Aaron’s hand. Happy Trails, Jim Parr, Principal Cairn Investment Group, Inc. |

RSS Feed

RSS Feed